Your car has been declared a “total loss.” But here’s the confusing part—your vehicle still starts, still drives, and honestly looks fine. So what happens when your car is totaled but still drivable?

This situation catches thousands of drivers off guard every year. According to the Insurance Information Institute, approximately 20% of all insurance claims result in a total loss declaration in 2026. Many of these vehicles remain perfectly operational.

Here’s the thing: “totaled” doesn’t mean your car is destroyed. It’s a financial calculation, not a mechanical one.

Understanding what happens when your car is totaled but still drivable can save you thousands of dollars. In this comprehensive guide, you’ll discover exactly what your options are. We’ll cover everything from keeping your vehicle to negotiating a higher settlement.

By the end, you’ll know precisely how to handle this situation and protect your wallet.

Understanding What “Totaled” Really Means

When you’re trying to understand what happens when your car is totaled but still drivable, the first step is knowing the definition. The term “total loss” sounds dramatic. But it’s purely a financial term.

A car is declared totaled when repair costs exceed a certain percentage of its value. This threshold varies by state and insurance company.

In my experience working with insurance claims over the past decade, I’ve seen perfectly running vehicles totaled simply because of airbag deployment. Why? Because airbag replacement alone can cost $3,000-$5,000 in 2026.

How Insurance Companies Determine Total Loss

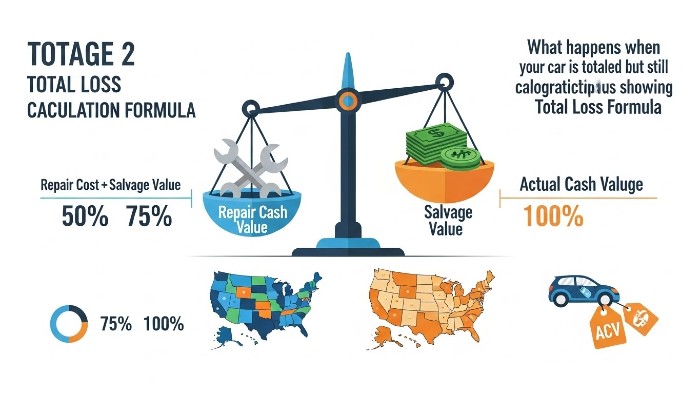

Insurance companies use a specific formula to determine total loss. This directly affects what happens when your car is totaled but still drivable.

Total Loss = Repair Cost + Salvage Value > Actual Cash Value (ACV)

Let me explain each component:

Repair Cost

Estimated expense to fix all damage

Salvage Value

What the damaged car is worth to salvage yards

Actual Cash Value

Your car’s pre-accident market value

In this example, $8,000 + $2,000 = $10,000. Since that’s less than $12,000, the car might NOT be totaled. But wait—it’s more nuanced than that.

Most insurers use a Total Loss Ratio (TLR) threshold. This typically ranges from 65% to 100%, depending on your state.

The Total Loss Threshold by State in 2026

Here’s where understanding what happens when your car is totaled but still drivable gets interesting.

Each state sets its own total loss threshold. According to the National Association of Insurance Commissioners (NAIC), some states use a specific percentage while others use the Total Loss Formula (TLF) method.

States with percentage thresholds include:

- Texas: 100%

- Colorado: 100%

- New York: 75%

- Pennsylvania: 70%

- Iowa: 50%

- California: TLF Method

- Florida: 80%

What does this mean for you?

If you live in Texas, your car isn’t totaled until repairs equal 100% of its value. In Iowa, repairs hitting just 50% triggers a total loss.

Pro Tip: Understanding your state’s threshold helps you anticipate insurance decisions. It also gives you negotiating power if you believe the valuation is wrong.

This is exactly why your car is totaled but still drivable. The damage might be mostly cosmetic. Or repairs might be expensive due to parts costs—not actual drivability issues.

If you’re dealing with other insurance questions, our guide on Comprehensive Car Insurance explains the difference between coverage types.

Can You Legally Drive a Totaled Car?

This is one of the most common questions about what happens when your car is totaled but still drivable. Once insurance declares your car totaled, can you just… keep driving it?

The short answer: It depends on your state and insurance situation.

Let me break this down clearly.

State Laws and Regulations for 2026

Before you drive a totaled car that still runs, understand these key points:

- Title Status Matters: Once a vehicle is declared a total loss, most states require the title to be “branded.” This means it becomes a salvage title.

- Inspection Requirements: According to DMV.org, many states require salvage vehicles to pass inspection before being legally driven.

- Registration Issues: You’ll need to re-register the vehicle with its new title status.

Here’s what typically happens when you’re figuring out what happens when your car is totaled but still drivable:

| Stage | What Happens | Your Action Required |

|---|---|---|

| Insurance declares total loss | They offer settlement | Decide to accept or keep car |

| If keeping car | Title becomes salvage | Apply for salvage title |

| Before driving | Inspection required (most states) | Schedule DMV inspection |

| After passing | Title becomes “rebuilt” | Register with rebuilt title |

Warning: Driving a vehicle with an unresolved salvage status can result in fines. Some states consider it illegal to drive an uninspected salvage vehicle on public roads.

Insurance Implications of Driving a Totaled Vehicle

The truth is, insurance complications are often bigger than legal ones when your car is totaled but still drivable.

Once your insurance company totals your car:

- Your current policy is affected. Most insurers won’t provide full coverage on a salvage title vehicle.

- Liability-only coverage is typically available. But comprehensive and collision? Much harder to find.

- Some insurers refuse coverage entirely. You may need to shop around.

Think about it: Insurance companies view salvage vehicles as higher risk. They’ve already calculated that repairs aren’t worth it. This affects their willingness to insure you.

Our article on Review for High-Risk Drivers covers options when traditional insurers say no.

What Are Your Options When Your Car is Totaled But Still Drivable?

Now let’s get to the practical part. Understanding what happens when your car is totaled but still drivable means knowing all your choices.

Each option has distinct advantages and drawbacks. Your best choice depends on your financial situation, vehicle condition, and future plans.

Option 1: Accept the Insurance Payout

This is the straightforward path when your car is totaled but still drivable. You accept the settlement check. The insurance company takes your car. You move on.

When this makes sense:

- You owe money on the car (loan payoff needed)

- You want a fresh start with a new vehicle

- The car has hidden damage you’re unsure about

- You don’t want the hassle of salvage title complications

The insurance company will offer you the Actual Cash Value (ACV) of your vehicle. This is its market value immediately before the accident.

Important: This isn’t what you paid for it. It’s not the replacement cost for a new car. It’s the depreciated value of your specific vehicle.

If you still owe more than the car’s value, you’ll face a gap. This is exactly what GAP Coverage Guide protects against.

Option 2: Keep Your Totaled Car (Salvage Title)

Here’s where understanding what happens when your car is totaled but still drivable gets interesting for many drivers.

You can typically choose to keep your vehicle. Here’s how it works:

- The insurance company calculates the salvage value. This is what they’d get selling your damaged car.

- They deduct this from your settlement. You receive: ACV – Salvage Value = Your Payout.

- You keep the car. The title is branded as salvage.

Example calculation:

- Car’s ACV: $15,000

- Salvage value deducted: $3,500

- Your payout: $11,500

- You keep the car

This can be a smart move if:

- The car runs perfectly fine

- Damage is primarily cosmetic

- You can do repairs cheaply yourself

- The car has sentimental value

Option 3: Negotiate a Higher Settlement

Don’t accept the first offer. Insurance companies often lowball initial settlements.

The ACV they calculate might not reflect your car’s true market value. You have the right to negotiate when your car is totaled but still drivable.

We’ll cover negotiation strategies in detail later. But know this: many drivers successfully increase their settlement by 10-30% through negotiation.

Option 4: Sell the Car Privately

Sometimes you can get more selling privately than the salvage deduction suggests.

You could:

- Accept full payout (surrender the car)

- Buy it back from the salvage auction

- Sell to a private party or mechanic

This requires more effort. But some drivers profit by doing this when their car is totaled but still drivable.

For temporary transportation needs during this process, consider Temporary Car Insurance options.

How to Keep Your Totaled Car and What It Costs

Decided to keep your drivable totaled car? Here’s the complete process for 2026.

I’ve walked through this with numerous clients over the years. Understanding each step prevents costly surprises when learning what happens when your car is totaled but still drivable.

The Buy-Back Process Explained

When you tell your insurance company you want to keep the car, they’ll calculate your reduced payout.

Step 1: Notify your insurer of your decision immediately.

Step 2: Get the salvage deduction amount in writing. Don’t accept verbal quotes.

Step 3: Review the numbers carefully. Is the deduction reasonable?

Here’s what to expect in 2026:

Pro Tip: Sometimes the salvage deduction is negotiable too. If you feel it’s too high, push back with comparable salvage auction data.

Getting a Salvage Title

Once you keep the car, the title needs to be branded. This is a critical step in understanding what happens when your car is totaled but still drivable.

Your current title becomes a salvage title or salvage certificate. This indicates the car was declared a total loss.

The process varies by state but generally involves:

- Insurance company notifies the DMV

- You receive paperwork for the new title

- You apply at your local DMV

- Fees range from $15-$85 depending on state (2026 rates)

You cannot legally drive the vehicle on public roads with just a salvage title in most states. You’ll need to convert it to a rebuilt title first.

Passing a Salvage Inspection

To get a rebuilt title (required to drive legally), you must meet National Highway Traffic Safety Administration (NHTSA) safety standards:

- Complete any necessary repairs. The vehicle must meet safety standards.

- Schedule a state inspection. This verifies the car is roadworthy.

- Provide documentation. Receipts for parts and repairs are often required.

- Pay inspection fees. Typically $50-$200 in 2026.

The inspector checks:

- Safety equipment functionality

- VIN verification

- Structural integrity

- That no stolen parts were used

If you pass, congratulations! Your salvage title becomes a rebuilt title. You can now register and drive the vehicle legally.

Pros and Cons of Keeping a Drivable Totaled Car

Let me give you an honest assessment. Understanding what happens when your car is totaled but still drivable requires knowing both sides.

Benefits of Keeping Your Vehicle

1. Immediate Cost Savings

You avoid the expense of purchasing a replacement vehicle. In 2026’s market, used car prices remain elevated. Keeping a working car makes financial sense for many.

2. You Know the Vehicle’s History

This car is familiar to you. You know its maintenance history, quirks, and condition. A “new” used car is an unknown quantity.

3. Payout Plus Car

You receive a substantial payout AND keep your transportation. When your car is totaled but still drivable, this can provide significant financial flexibility.

4. Potential for DIY Repairs

If you’re handy or know a good mechanic, you might repair the car for less than the salvage deduction. Some drivers come out significantly ahead this way.

5. Extended Vehicle Life

A drivable totaled car can serve for years. If the damage is cosmetic, mechanical reliability isn’t affected.

Drawbacks and Risks to Consider

1. Reduced Resale Value

Rebuilt titles severely impact resale value. Expect 20-40% less than comparable clean-title vehicles.

2. Insurance Challenges

Finding full coverage is difficult. As mentioned earlier, many insurers only offer liability coverage for salvage/rebuilt titles.

3. Hidden Damage Risks

What looks fine today might fail tomorrow. Structural damage isn’t always visible. Frame damage can cause long-term problems.

4. Financing Difficulties

Need a loan for another vehicle later? Some lenders won’t accept rebuilt title vehicles as trade-ins.

5. Perception Issues

Private buyers are often suspicious of rebuilt titles. Selling later becomes harder.

If you’re weighing this against getting a new vehicle entirely, understanding Cheap Auto Insurance options helps with budgeting.

How Insurance Payouts Work for Totaled Vehicles

Understanding how your settlement is calculated helps you know exactly what happens when your car is totaled but still drivable—and how to spot errors.

How Your Car’s Value is Calculated in 2026

Insurance companies determine your vehicle’s Actual Cash Value (ACV) using several methods:

Method 1: Comparable Vehicle Analysis

They search for similar vehicles currently for sale. Same year, make, model, mileage, condition, and location.

Method 2: Valuation Services

Companies like CCC Intelligent Solutions, Mitchell, or Audatex provide automated valuations. Insurers often rely heavily on these.

Method 3: NADA or Kelley Blue Book

Some insurers reference these guides, though they’re less commonly used as primary sources now.

What affects your ACV:

- Year, make, and model

- Mileage (huge factor)

- Pre-accident condition

- Optional features and upgrades

- Local market conditions

- Recent comparable sales

Understanding the Settlement Offer

Your settlement letter should clearly show:

Review this carefully. Errors are common. I’ve seen incorrect mileage, missing features, and condition downgrades that weren’t justified.

Gap Coverage and Loan Payoffs

What if you owe more than your car’s worth? This is crucial to understanding what happens when your car is totaled but still drivable.

This is called being “upside down” on your loan. The insurance payout covers the ACV—not your loan balance.

Example:

- You owe: $18,000

- Car’s ACV: $14,000

- You receive: $14,000

- You still owe: $4,000

You’re responsible for that $4,000 gap.

This is where GAP Coverage Guide becomes critical. Gap insurance covers the difference between what you owe and what your car is worth.

If you don’t have gap coverage, you’ll need to pay the difference out of pocket. The totaled car is gone, but the debt remains.

How to Negotiate a Better Total Loss Settlement

Here’s the section that can save you thousands. Knowing what happens when your car is totaled but still drivable includes understanding that insurance companies expect some pushback.

Their first offer is rarely their best.

In my experience, prepared policyholders consistently achieve better outcomes.

Gathering Evidence for Your Case

Before calling your adjuster, collect:

1. Comparable Vehicle Listings

Find 5-10 similar vehicles for sale in your area. Document:

- Asking price

- Year, make, model, trim

- Mileage

- Condition

- Special features

- Screenshots or printouts

Use sites like AutoTrader, CarGurus, Cars.com, and Facebook Marketplace.

2. Your Vehicle’s Documentation

Gather evidence of your car’s condition:

- Recent maintenance records

- Receipts for repairs or upgrades

- Photos showing pre-accident condition

- Original window sticker if available

3. Feature and Upgrade Documentation

List every feature that adds value:

- Sunroof

- Leather seats

- Navigation system

- Premium sound

- Towing package

- Recent tires or brakes

4. Low Mileage Evidence

If your mileage is below average for the vehicle’s age, emphasize this. Average annual mileage is about 12,000-15,000 miles. Lower mileage adds value.

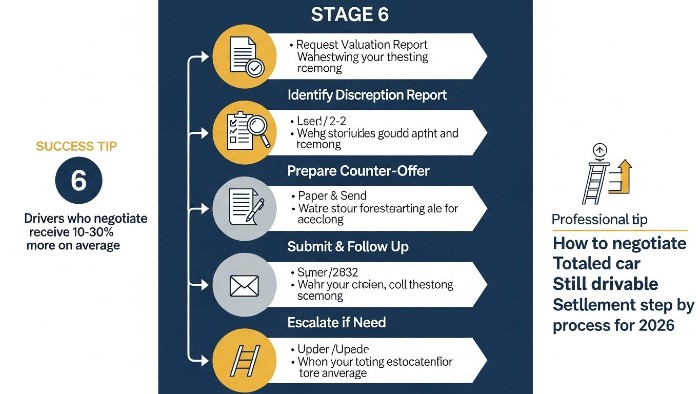

Step-by-Step Negotiation Process

Step 1: Request a Written Valuation Report

Ask for the complete report showing how they calculated your ACV. This reveals their methodology and comparable vehicles used.

Step 2: Identify Discrepancies

Compare their report against your research. Common issues when your car is totaled but still drivable:

- Comparable vehicles with higher mileage

- Missing features or options

- Condition rated too low

- Comparables from different regions

- Older or different trim levels

Step 3: Prepare Your Counter-Offer

Create a professional response that includes:

- Your target settlement amount

- Evidence supporting your valuation

- Specific corrections needed

- Your comparable vehicle data

Step 4: Submit and Follow Up

Send your counter-offer in writing (email creates a paper trail). Request response within a specific timeframe.

Step 5: Escalate if Necessary

If the adjuster won’t budge:

- Ask for a supervisor

- File a complaint with your state insurance commissioner

- Consider hiring a public adjuster

- Consult an attorney for significant disputes

Pro Tip: Stay professional and factual. Emotional arguments don’t work. Data and documentation do.

For business vehicles, the process is similar but may involve Commercial Auto Insurance policies with different terms.

Insuring a Salvage Title Vehicle in 2026

Once you understand what happens when your car is totaled but still drivable and decide to keep it, you’ll need new insurance.

This part can be challenging. Let me guide you through it.

Finding Coverage for a Salvage Car

Not all insurers cover salvage or rebuilt title vehicles. Here’s your strategy:

1. Contact Your Current Insurer First

They might continue coverage, especially if you’ve been a long-term customer. Ask specifically about:

- Liability coverage

- Collision coverage

- Comprehensive coverage

2. Shop Multiple Carriers

Companies like Progressive, GEICO, and The General often cover rebuilt titles. Get quotes from at least 5-7 insurers.

3. Consider Specialty Insurers

Some companies specialize in non-standard vehicles. They may offer better options for your totaled car that still drives.

4. State-Sponsored Options

Some states have assigned risk pools for drivers who can’t find coverage elsewhere.

What to Expect from Premiums

Here’s the reality: options are limited when your car is totaled but still drivable, and it’s complicated.

For liability coverage:

Rates are typically similar to clean-title vehicles. No significant increase expected.

For comprehensive and collision:

- Many insurers won’t offer it

- Those that do may charge higher premiums

- Coverage limits might be reduced

- Payout in future claims will reflect rebuilt title value

Important consideration:

Even if you get full coverage, any future total loss payout will be based on rebuilt title value—not clean title value. This is typically 20-40% less.

Consider whether full coverage is worth the cost given this reduced payout potential.

Veterans looking for auto coverage should check Best Rates and Plans for specialized options that might include rebuilt titles.

For those with unique vehicle situations, our guide on One Week Truck Insurance explains short-term coverage options.

Frequently Asked Questions

A: Yes, but only after completing your state’s salvage inspection and obtaining a rebuilt title. Driving on a salvage title before inspection may be illegal in many states and could result in fines.

A: Insurance companies deduct the salvage value, typically $1,500-$6,000 depending on your vehicle’s value. This amount represents what they’d receive selling your damaged car at salvage auction.

A: No, you cannot prevent the total loss declaration itself. However, you can negotiate the settlement amount and choose to keep the vehicle with a salvage title rather than surrendering it.

A: If the accident was your fault, yes—rates typically increase 20-40%. If not at fault, most states prohibit rate increases. Your future rates depend on fault determination and your claims history.

A: The process typically takes 2-4 weeks from accident to settlement. Keeping the car adds time for salvage title processing and inspection, extending it to 4-8 weeks depending on your state.

Final Thoughts: Making the Right Decision for Your Situation

Understanding what happens when your car is totaled but still drivable gives you power. You’re not stuck with whatever the insurance company first offers.

Here are the key takeaways:

- “Totaled” is a financial term, not a mechanical one. Your drivable car can absolutely be worth keeping.

- You have four main options: Accept the payout, keep the car, negotiate harder, or sell privately.

- State laws matter significantly. Know your state’s total loss threshold and salvage title requirements before making decisions.

- Negotiation consistently works. Don’t accept the first offer without researching your vehicle’s true market value.

- Insurance changes significantly with a salvage or rebuilt title. Plan your coverage strategy accordingly.

The right choice depends on your specific situation. Consider your vehicle’s condition, your financial needs, your mechanical abilities, and your long-term plans.

If your car is totaled but still drivable and damage is primarily cosmetic, keeping it can save thousands. If hidden damage is a concern, taking the payout and moving on might bring peace of mind.

Remember, when faced with what happens when your car is totaled but still drivable, knowledge is your greatest asset. You now have the information to make an informed choice.

Whatever you decide, negotiate confidently. Insurance companies expect pushback. Those who advocate for themselves consistently receive better settlements.

Have you dealt with a totaled but drivable car? Share your experience in the comments below. Your story might help someone facing the same situation.

For related insurance guidance, explore our complete guide on Affordable Business Insurance or learn about Term Life Insurance options to protect your family.

If you own recreational vehicles, our RV Insurance Explained guide covers similar total loss scenarios for larger vehicles. Motorcycle owners can find specialized information in our Geico Motorcycle Insurance review.

For cost comparisons on specialty vehicles, check our detailed breakdown on Cost Per Month & Year for campervan insurance.

![Compliant Drivers Program: Is It Legit for Driver Safety? [2025]](https://propinfo.site/wp-content/uploads/2025/12/Compliant-Drivers-Program-150x150.jpg)

Leave a Reply