Understanding Your Health Coverage

This is an important finding: Finding good health coverage is vital. It can feel very confusing. You have a number of different options. United Healthcare Insurance is a preferred option. They cover a wide range of different plans. We will help you in understanding them.

This guide will examine their PPO and HMO plans. We will look at costs. We will look at networks. Our purpose is to make yours an easier decision. Every person needs a plan that matches their life.

Who is United Healthcare?

United Healthcare is a very large health insurer. They belong to the UnitedHealth Group. Millions of Americans put their faith in them. They provide plans for individuals. They are also a service to employers and seniors. Their network is vast.

They have a long history of being in the business. This provides them a lot of experience. They strive to help people live healthier lives. They harness technology to advance better care. You probably have seen their name before.

Why Health Insurance is Not Just an Option

Health insurance is a requirement today. Medical bills can be very expensive. A simple visit to the ER can cost thousands. Your insurance covers your finances. It helps you pay for care. O you pay a monthly fee, called a premium.

This protection is crucial. It also includes preventive care as well. To think of check-ups and screening. This helps you stay healthy. It catches problems early. Good insurance is good for investing in yourself.

Decoding Key Insurance Lingo

Before we do the comparison between plans let’s learn some terms. These words are on every policy. Understanding them is key. You will, invariably, see “deductible.” This is what you pay first. This plan pays after you have met it.

“Premium” is your monthly bill. This keeps your plan active. A “copay” is a flat rate of a fee for a visit. For instance, you may pay $30 for doctor. “Coinsurance” is a percentage which you pay. The plan pays the rest. Insurance terms can end up being tricky. It’s like comparing term life insurance vs. whole life insurance; the little things.

The Core Debate: PPO vs. HMO Plans

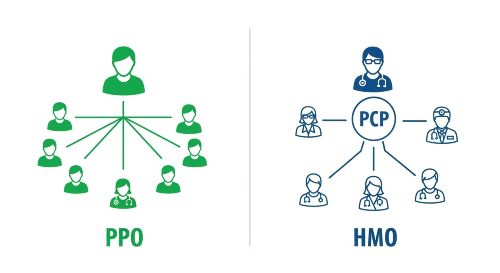

The two widely used plans are PPO and HMO. United Healthcare Insurance provides them both. They operate in extremely different ways. Your choice has an impact on your costs. It also means that it impacts where you get care. Let’s get to the bottom of each of them simply.

We will observe the advantage and disadvantage. think about your lifestyle. Do you need flexibility? Or do you want lower costs? This is the main question.

What is an HMO Plan?

HMO is an abbreviation for Health Maintenance Organization. This plan is based on a network. The doctors in the network must be used. Care outside of the network is not covered. There is this one big exception: emergencies.

You also need to pick a Primary Care Physician (PCP). Your PCP is your main doctor. Every facet of your healthcare is managed by them. If you do need a specialist then you have to go for a referral. This means first it needs to be approved by your pc of primary care services (PCP).

Pros of a United Healthcare HMO

The biggest advantage of an HMO is cost. Premiums are generally a lot lower. Copays and deductibles are often less expensive as well. This results in your budget being predictable. There is less paperwork for the patients.

Your PCP coordinates all your care. This can be very helpful. One doctor knows all about your health history. This results in better and more connected care. It is a very managed approach.

Cons of a United Healthcare HMO

The chief disadvantage is lack of flexibility. You must stay in the network. If you go to the doctor out-of-network you pay 100%. This is a major restriction. This can be difficult if you are a frequent traveler.

The referral rule is another matter. You cannot make an appointment just like that. You must see your PCP first. This can be slow. It adds an extra step. Some people feel that this is frustrating.

What is a PPO Plan?

PPO is an acronym for Preferred Provider Organization. This plan has much greater flexibility. You still got a network of “preferred” doc(s). Using them saves you money. But you can go out-of-network.

A portion of the plan will still pay. You do not need a PCP. Referrals are also not required. You can see a specialist personally. This freedom is the selling point.

Pros of a United Healthcare PPO

Flexibility is the number one pro in the benefits. And you have a whole list of choices out there. You can see just about any doctor you want. You are not constrained in your network to just one type. This is great for traveling people.

You also manage your own care. No referrals are needed. If you are experiencing pain in your back visit a specialist. You do not need permission. This is to be faster and more direct. Many people like this type of control better.

Cons of a United Healthcare PPO

Such flexibility creates a cost to the PPO plans cost more. Your monthly premiums are going to be higher if you do. Deductibles and copays are higher too, however. You pay more for your freedom.

You also have more paperwork. If you take the services out of network, you may pay upfront. Then you must file a claim. This is more work for you. You must track your own bills.

PPO vs. HMO: At-a-Glance Comparison

To help you make up your mind, here follows some creative breakdown. This indicates the major differences between the two primary united healthcare plans.

HMO Plan (The Fortress)

- Cost: Lower premiums and copays.

- Network: Must stay in-network.

- PCP: Required.

- Referrals: Needed for specialists.

- Best For: Budget-conscious people.

PPO Plan (The Explorer)

- Cost: Higher premiums and deductibles.

- Network: Can go out-of-network.

- PCP: Not required.

- Referrals: Self-referral allowed.

- Best For: People seeking flexibility.

A Deeper Look at United Healthcare PPO Plans

Let’s make some headway into PPO plans. Many people select them because of the control that they provide. You are the one in charge. You choose your doctors – that’s up to you. This is a big responsibility.

You must be a good consumer. This means checking costs. It entails an understanding of your benefits. But, the worth of the freedom is caring to a large amount of people.

How United’s PPO Works for You

Suppose that you awaken in pain in your knees. With a PPO, however, you are able to call an orthopedist. You can book a visit directly. You do not need to be seen first by your family doctor first. This saves you time.

Before calling you must check the network. And if the specialist is “preferred,” it costs you less. If they are not on your network, you must pay more. You have the choice. This is the core of a PPO.

Finding united healthcare providers in a PPO Network

United Healthcare has massive PPO network This is in contract to millions of doctors. They also have partnerships with thousands of hospitals. This makes it easy to access care. You can use their website.

Their online tool enables you to search for united healthcare providers. You can search by specialty. You can search by location. This is helpful to you to find the right doctor. Always check this list first.

The True Cost of Flexibility

The extra cost of a PPO is real. Your monthly premium comprises the first part. Then that leaves you with your deductible. This can be high. It may end up being thousands of dollars. You have to pay this and then the plan will pay.

You also have coinsurance. This is a percentage. For in-network care, you may have to pay 20%. For out-of-network, it could be 40%. These numbers add up quickly. You are paying the consequences for your choices. This is comparable to managing your monthly premium. It is important to know this, if you want to lowering your car insurance cost as well; you are trading off cost against coverage.

Exploring United Healthcare HMO Plans

Now let’s focus on HMO plans. These are great for people in the budget. They are also good for those who like simple. The plan has more rules. But it holds your hand.

Your PCP is the “gatekeeper.” This person is your health partner in your health. They guide your decisions. This can result in very efficient care.

The Central Role of Your Primary Care Physician (PCP)

When you join an HMO, you choose your PCP. This doctor is in the plan’s network. This is your first call when you have any issue. They handle your check-ups. They cure your everyday ills.

This creates a strong relationship. Your PCP knows you well. They know the history of your health. They can spot problems early. This relationship forms the basis of the HMO model.

Navigating Referrals and Specialists

What if you need a specialist? You need to speak to your PCP first though. Your PCP will examine you. They will determine whether or not a specialist is necessary. If they do, they will provide a referral for you.

This referral is to a specialist in the HMO network. You cannot see just anyone. Your pc is where you will be recommended to a person. This system controls costs. It means you can receive health care you only really need. This is very different from other forms of health coverage. You also may want to check out Humana dental insurance to see how their HMOs stands.

Are HMOs a Good Choice for Families?

HMOs can be great for families. The expenses are not high and predictable. Young children see the doctor frequently. Those are some small copays that are easy to budget. This is better than we have unknown big bills.

The care and coordination is also a plus. Each family member has a PCP. Vaccines can be managed by the doctor. They can chart milestones of development. This makes parenting a little less stressful. The network is the only limit.

“An ounce of prevention is worth a pound of cure.”

This quote summarises the HMO spirit perfectly. By focusing on preventive care through a PCP, HMOs strive to keep you healthy. This would save money in the long run.

Beyond PPO and HMO: Other United Healthcare Plans

PPO and HMO are not the only choices. United Healthcare Insurance offers other plans. These can be a middle ground. They combine characteristics of both models. Let’s look at a few.

You could hopefully find a plan that will work perfectly for you. EPO and POS plans are common. High Deductible plans are also popular. They deal with health savings accounts.

What About EPO and POS Plans?

EPO is an abbreviation for Exclusive Provider Organization. It is like an HMO. You must stay in the network. But, you just do not usually need a PCP. You also do not require referrals. It is a little more flexible than an HMO.

POS is the abbreviation for Point of Service. This plan is a hybrid. It is similar to an HMO, thus you have a PCP. You require referrals for in network care. But, you can go out-of-network. It works like a PPO if you do. You will just pay much more.

High Deductible Health Plans (HDHPs) and HSAs

An HDHP has a very high deductible. This means that you pay a lot of money upfront. Your monthly premium is very inexpensive. The following is a plan for healthy people. They do not think they will use so much care.

HDHPs are often coupled with an HSA. The HSA stands for Health Savings Account. This is a special kind of bank account. Money that you put in is tax-free. You can use it to pay your medical bills.

Using an HSA for Your Future

An HSA is a powerful tool. The money you save is yours for ever. It does not expire. This account can earn interest. The balance also rolls over year after year. Many people use it as a retirement account.

You can use it to pay your deductible payment. It can also be used for copays. Even buying glasses is possible with it. This is where you have your health dollars under control. It is a smart financial move.

The Medicare Puzzle: United Healthcare Medicare Advantage

As you age, you have new health needs. Medicare is the federal health plan. It is for people 65 and older. United Healthcare Insurance is a huge player here. They provide plans that work with Medicare.

And this is a really important subject. Many seniors get confused. We will make it simple.

What is Original Medicare?

Original Medicare is administered by the government. It has two parts. Part A is for hospitals. It covers stays in a hospital. Part B is for doctors. It includes visits and tests to a doctor or a visit to the doctor.

Original Medicare has gaps. It does not cover everything. This does not cover prescriptions. It also has no cap on the amount that you can spend. This is where private plans come into picture.

How united healthcare medicare Steps In

Private companies such as United Healthcare step in. They offer two types of plans. They provide Medicare Supplement plans (Medigap). These plans help pay the gaps. They pay for your deductibles and coinsurance.

The other one is united healthcare medicare advantage. This is a very popular choice. It is another way of getting your benefits.

The Rise of united healthcare medicare advantage (Part C)

Medicare Advantage is also referred to as Part C. This is an all-in-one plan. You get Part A and Part B. You get Part D (prescriptions) also. These plans are offered by private insurers.

These united healthcare medicare advantage plans bundle it all up. This makes it very simple. You have one card. You have one company to call. This convenience is one of the major benefits.

What Do Medicare Advantage Plans Cover?

These plans must include all that Original Medicare includes. But they add extra benefits. This is the best part. Most plans contain prescription drug coverage.

They also include dental coverage. They have vision coverage for glasses added. Many incorporate the addition of heard aid benefits. Some even include gym memberships. These extras are very valuable. They are not covered by Original Medicare. This is part of planning your senior years. Many like a State Farm life insurance review for final expenses but health in retirement is just as vital.

PPO vs. HMO in the Medicare Context

Medicare Advantage plans also use networks. They come as HMOs or PPOs. A united healthcare medicare advantage HMO, is common. It will be the one with the lowest premium. It may even have a $0 premium. But you must use its network.

A Medicare PPO plan is a flexible plan. One can be able to see doctors out of network. This is good for seniors that travels. This is referred to as a “snowbird” option. There is a slight extra cost for this freedom.

Special Coverage Options

Your health does not end with a visit to the doctor. What about your teeth? What about your eyes? These are often bundled together by United Healthcare Insurance. Or, you can purchase them), you can buy them for separate. Let’s consider this additional coverage.

And you also need to have an idea about mental health. This is a very important aspect of your health. Good plans cover this.

Does United Healthcare Offer Dental and Vision?

Yes, they do. Many of their plans feature it. This is particularly true with Medicare Advantage. This is equally true for employer plans. You can also purchase stand-alone dental plans.

These plans cover cleanings. They help pay for fillings. Vision plans assist in paying for eye examinations. They give you the allowance for glasses. This coverage is just like what you’d find in Humana dental insurance.

Mental Health Coverage

Mental health is as necessary as physical one. It must be covered by all major medical plans. This includes united healthcare plans. This means therapy is covered. It means that counseling is covered.

You may have a copay. It is possible that you need to use the network. But you have access to care. This is a huge step forward. Never be afraid to utilize these advantages.

Coverage for Specific Needs

Some people have very specific needs. You may need special medical equipment that is durable. The physical therapy may become necessary. These are covered. Information about the plan will indicate to you the amount.

This is the case with any insurance. If you need professional liability insurance, you get a special policy. If you have some unique health needs, you look up your plan’s details. The same logic applies if you want to insure something special like with classic car insurance.

How to Choose the Right Plan for You

We have prepared a lot of ground. Now it is time to decide. How do you pick the one plan? So you need to think on yourself. Your health and your money are the two greatest factors.

Let us now complete the final steps. Be honest with yourself. This will lead to the best choice.

Assessing Your Personal Health Needs

The first thing you should think about is your health. Are you young and healthy? Do you rarely see a doctor? An HMO or an HDHP may be perfect. You can save a lot of money.

Do you suffer from some chronic condition? Do you see specialists often? A PPO might be better. It is the flexibility that’s worth the cost. You need easy access to care. Make a list of your doctors and the prescriptions.

Analyzing Your Budget

Next, look at your budget. How much are you willing or able to pay every month? This is your premium. A low premium (HMO) is tempting. But is the high deductible something you can afford?

Think about the total cost. This is the premium plus the out of pocket costs. A PPO has a high premium. But it may have better coinsurance. You have to balance balancing out these two numbers. Finding affordable business insurance sums up the same logic. You find equating responses between monthly cost and protection.

Which Plan Profile Fits You?

Here is a very simple way of thinking of your choice. Find the profile one that sounds like you.

Profile 1: The Budget-Saver

“I want the lowest monthly bill.” I am healthy and willing to follow rules to save money. I prefer having one main doctor coordinate my care.

Profile 2: The Freedom-Seeker

“I want full control.” I want to see any specialist I choose without referrals. I travel a lot and need coverage everywhere I go.

The Importance of the Provider Network

This is the most important of all steps. Do not skip this. Before you buy any plan check the network. This is true for PPOs and HMOs. Doctors you can see: You must know the doctors you can see.

Make a list of your doctors. Include your family doctor and all specialists. Include your favourite hospital. Go to the United Healthcare Website. Use their “Find a Doctor” tool. Check every single one.

Checking Your Doctors and Hospitals

If your doctor is not in the HMO network, don’t buy it. You will face the necessity of a doctor change. Are you willing to do that? This is a very personal choice.

If you are looking at a PPO, check if they are in-network. Your costs are lower when they are in-network. Even if they are out-of-network, you can still get to see them. You just have to budget for the increased cost.

Real-World Scenarios

Let’s apply this. We can look at a few examples. This can help you to see yourself.

Case Study: A Young Freelancer

Maria is 28. She is a freelance artist and works as a graphic designer. The income she earns can vary from month-to-month. She is very healthy. She needs covering but finding affordable business insurance and health insurance are tough to find.

An HMO or an HDHP plan is an ideal option. Her premium will be low. This helps her to manage her money budget. Since she is healthy, she probably will not have high costs. She might just need insurance for a short time, just like temporary car insurance.

Case Study: A Growing Family

David and Sarah have two young kids. Their son has asthma. He sees a specialist. They want predictable costs. They are busy and want simple healthcare.

An HMO is a strong choice. They will have low copays that never change. Great for the frequent visits of kids. The PCP can ensure that the asthma care is coordinated. Or, a PPO could work. It would allow them to have direct access to the specialist. And they have to compare the total costs. As their needs increase, they may even need commercial auto insurance one day.

Case Study: Nearing Retirement

Robert is 64. He is preparing for Medicare. He has high blood pressure. Also he has a cardiologist whom he trusts. He wants to keep this doctor.

When Robert reaches 65, he has options. A united healthcare medicare advantage PPO is a good idea. It will allow him to see his cardiologist. He can go out-of-network if necessary. An HMO would only work if his doctor is in the network. He must check.

“The greatest wealth is health.”

– Virgil

This is true for all stages of life. Selecting the appropriate insurance plan is the way you can insure that wealth. It gives you peace of mind.

Enrolling in United Healthcare Plans

You have done your research. You have made a choice. Now it is time to enroll. Enrollment is only available to join at certain times. This is important to know.

You can sign up with the help of your job. Or you can buy a plan yourself. You can also obtain a Medicare plan.

When is Open Enrollment?

For the majority of the plans, there is what is called an “Open Enrollment” period. This is once per year. It is usually in the fall. This is when anyone can purchase a plan. This is for plans on the HealthCare.gov marketplace.

Medicare has its own period. This is from October 15 to December 7. This is when seniors are able to change their Advantage plans.

Special Enrollment Periods (Life Events)

What if you have a need any plan outside this window? You might be able to get into Special Enrollment Period. This is the case if you have some life situation. Did you lose your job? Did you get married? and Did you have a baby?

These occurrences “unlock” a 60-day window. You can buy a new plan. This is to ensure you will never be uninsured.

The Step-by-Step Enrollment Process

The process is simple. You can visit the website of United Healthcare. So you can further go to the government market place. You will enter your zip code. So you will be presented with all the plans that are available.

You can compare them on a side-by-side basis. Also you can see the premiums. You can see the deductibles. After you select, you complete an application. Then, you are making your first payment.

Smart Tips for Managing Your Plan

Your Job is not Done after you Enroll You need to be an active user. You have to have an understanding among your plan. This will save you money. It will also reduce stress.

Know your benefits. Know how to use them.

Using the United Healthcare Member Portal

United Healthcare has an awesome portal online. It is also an app. You should sign up right away. Here it’s possible to see your benefits. You can find doctors. On them you may even check the status of a claim.

This is your mission control. You can see your deductible. Also you can know how much you have paid. You can also print your ID card. It is a very powerful tool.

Understanding Your Explanation of Benefits (EOB)

Following a doctor visit comes an EOB. This is an explanation of benefits. This is not a bill. It is a summary. There it reads what kind of charge the doctor put forward. It displays what United Healthcare paid.

It also shows what you owe. You should read this. Check it for mistakes. It helps you to understand your costs It is like managing your policy for motorcycle insurance; you need to read the documents.

How to File a Claim or Appeal

With an HMO, you hardly ever file claims. The doctor does it all. With a PPO, you might. If you go out-of-network, you are permitted to pay. Then you send the bill to United Healthcare.

What if they deny a claim? You have the right to appeal. This is to request that they look it over. The instructions for the EOB will be included. Do not be afraid to do this.

Conclusion: Making a Confident Choice

Making a decision about health insurance is a big one. United Healthcare Insurance offers excellent. The decision to choose between a PPO and an HMO is personal. It is a balance between money on one side and freedom on the other.

An HMO saves you money. It has rules. A PPO gives you flexibility. It costs more. There is no single “best” plan. There is not more than the best plan for you.

Think about your health. Think about your budget. Check the network. If you do these things, you will make a great choice. You will have peace of mind. And you will have protection. We hope this guide to United Healthcare has been helpful.

Frequently Asked Questions (FAQs)

Yes, you can. But you have to wait for the Open Enrollment period. You are not changing in the middle of the year. The only exception is if you have a Special Enrollment Period.

Yes, they are one of the biggest providers. They provide numerous united healthcare medicare advantage plans. These plans will often have $0 premiums with other benefits. They are a very popular choice.

With a PPO, you are covered. You can visit a doctor outside of your circle. With an HMO you are only covered for emergencies. For routine care, you will have to wait until you are home.

Go to the UHC website. They have a provider directory. You can search according your plan type. You are also able to search by location and specialty. This should always be checked prior to a visit.

Yes. Most plans cover prescription drug coverage. This is known as Medicare Part D for seniors. Your plan will have a list of drugs that are on the plan with the costs covered. This is called a “formulary.”

![Compliant Drivers Program: Is It Legit for Driver Safety? [2025]](https://propinfo.site/wp-content/uploads/2025/12/Compliant-Drivers-Program-150x150.jpg)

Leave a Reply