Health insurance can be very complicated. There are numerous names in the market. One name stands out a lot: Blue Cross Blue Shield. And, they are a major player in American healthcare. But what are they, really? The above guide will understand.

We will cover Blue Cross Blue Shield policies. We shall look to different plan types. You will be taught about finding doctors. We will also cover costs and special coverage. This information will help you make a well-founded choice. You are able to have confidence in your recent health decisions.

What Makes Blue Cross Blue Shield Unique?

Blue Cross Blue Shield (BCBS) is not a single company. This is most important thing to know. It is an association of 34 independent companies. These companies are on a community based, and locally operated basis. They serve specific regions.

This structure makes BCBS unique. A local company runs the plan. They understand the needs of the locality community. They liaise with local doctors and hospitals. This can be a major advantage. It provides an excellent local network.

The BCBS Association Structure

The BCBS Association is a National Federation. It is used to link all the independent companies. This link enables them to share a brand. It also provides for them national reach. Your local BCBS company has a local presence. But it has backing of a national network.

This model assists members that travel. Perhaps you have a plan with BCBS of Texas. But you do not have to endure any suffering without help in New York. The “BlueCard” program is the connection of these networks. It can ensure that you have access to care even in other parts of the country.

This is a structure utilized by other big providers. You could find a similar model when you are looking at a State Farm Life Insurance Review. Big companies make a way to serve local needs. It’s an important component of their business after all.

Local Focus, National Power

The local focus is an important advantage. Your local BCBS company understands your state. They are aware of the health plight there. They establish networks of blue cross blue shield providers around them. This can result in improved, more relevant care.

This local first approach applies to business plans as well. Local support that small businesses need. It can be easier to find affordable business insurance. A local insurer has an understanding of the local market. They can design plan for local companies.

Decoding Blue Cross Blue Shield Insurance Plans

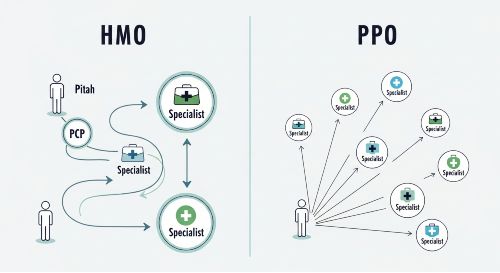

When you go shopping for blue cross health insurance, you will find a lot of letters. HMO, PPO, EPO, and POS. These are the major types of plans. Each one works differently. They educate in balance with cost and flexibility. Understanding them is key.

You have to select the right plan. It depends on your budget. It is also dependent on your health needs. Do you want flexibility? Or do you care about having lower costs each month? Let’s look at each one.

Health Maintenance Organization (HMO)

HMO $ plans often are the most affordable. They have monthly premiums that are lower. They also have lower out-of-pocket costs. But they come with more rules. You have to choose a Primary Care Physician (PCP).

Your PCP treats everything to do with your care. Referral from a specialist is required to visit a chronic kidney disease specialist. An HMO plan only covers in network care. You will pay 100% for out of the network care. This is a good option so long as you are healthy.

Preferred Provider Organization (PPO)

PPO Plan – PPO plans are far more flexible. This is the primary selling point of them. There is no need for a Primary Care Physician. As far as physicists are concerned, you may visit them without any referral munitions. This freedom is very popular.

PPOs have a network of providers that is extensive. You pay less for an in-network care. But they also include out-of-network care. You will only be paying a higher share. This flexibility costs more. PPO premiums are generally more expensive than HMOs.

This HMO vs. PPO vs. is common. It will be visible with other plans where. This is on par with comparing Humana dental insurance options. Or even looking at United Healthcare insurance plans. The basic principle is always cost vs. freedom.

Exclusive Provider Organization (EPO)

An EPO plan is a hybrid. It is a combination of an HMO and PPOs. Like a PPO, you do not need a PCP. You also do not require referrals for specialists. This makes it flexible and simple in its use.

However, it does have a major HMO rule. It covers only in network care. It will not pay for out of network providers. This is the main drawback. EPOs are a middle ground. They are flexible to a certain extent at a reasonable cost.

Point of Service (POS)

A POS plan is another hybrid. It is similar to an HMO with some PPO elements. You will need to pick a Primary Care Physician. Your care will be managed by your PCP. You will need some referrals to get to special specialists.

The PPO feature is the feature of out of network care. A POS plan will include doctors who are not in the network. But you will pay much more. It’s less flexible than a PPO. But, it is more flexible than a regular HMO.

How to Find Blue Cross Blue Shield Providers

Your plan is nothing better than your network. Finding blue cross blue shield providers is very important. This includes doctors, hospitals and specialists. You need to investigate the network before making a purchase.

Using in-network doctor saves you money. A lot of money. Using a doctor who is not in the network can be very costly. Your plan might pay nothing. Always check first.

“The greatest wealth is health.”

– VirgilThis old saying is true. Protecting your health means protecting your wealth. That choice in terms of ‘the right providers’ is a big part of that. Don’t risk a huge bill.

Using the BCBS Provider Directory

Each local Blue Cross Blue Shield company has a Web site. This website has a provider directory. This is your most important tool that you can use. You can search for the name of doctors. You can search by specialty. There are also searches by location.

The official directory must always be used. Do not trust a doctor’s office. They may tell you that they “take” your insurance. That is not also the same as being in-network. You have to make sure on the BCBS website.

In-Network vs. Out-of-Network

Let’s be very clear about this. “In-network” means that the doctor has a contract. They agreed to BCBS’s prices. Your plan will generate a big payment. You only pay part of all health behavior costs; your copay or coinsurance.

“Out-of-network” is a euphemism for no contract. The doctor does not have to just charge a certain price. Your plan may pay a small part. Or it may pay nothing. You will be the responsible for the rest. This can result in “surprise billing.” This is the simplest step however, like finding tips for lowering your car insurance cost. A little check out could save thousands to you.

Understanding Your Blue Cross Health Insurance Coverage

You have your plan. You found a doctor. Now you need to know what your costs are. Each blue cross health insurance plan has its key terms. These terms are the definition of what you pay. You have to acquire this new vocabulary.

These are the terms found on your “Summary of Benefits.” This document is your road map. It tells you how much exactly you need to pay for the services. Read it carefully. Keep it in a safe place.

Key Terms You Must Know

There are four main terms. Deductible, Copay, Coinsurance, Out-of-Pocket Max. Knowing these will make you a smart patient. You will know what to expect.

Here is a basic breakdown of these terms of importance:

Your 4 Key Insurance Costs Explained

-

Deductible

This is the amount you pay first. You pay 100% of your medical bills until you reach this number. Then, your insurance starts to help pay.

-

Copay

This is a flat fee. You pay it for certain services (e.g., $30 for a doctor visit). You pay this even after meeting your deductible.

-

Coinsurance

This is a percentage that starts *after* you meet your deductible. The plan might pay 80% while you pay the other 20%.

-

Out-of-Pocket Maximum

This is your safety net. It’s the most you will pay in a year. Once you hit this, the plan pays 100% for you.

Reading Your Summary of Benefits

All insurance companies must offer a “Summary of Benefits and Coverage” (SBC). This is a standard document. It makes the comparison between plans easy. And it’s a list of the deductible, the copay, and the coinsurance.

It also provides coverages examples. You can see how much it might cost to you. For example, “having a baby.” Or “managing type 2 diabetes.” This document is best friend of yours. You can learn more about this summary required by the government from official government resources.

Special Coverage Options: Blue Cross Travel Insurance

What happens when you travel? Your regular blue cross health insurance may not be working. The same applies especially to overseas. Your site in the US will probably not have any coverage. Or it may only cover extreme emergencies.

This is a major gap. An accident abroad can be an expensive one. This is where blue cross travel insurance is useful. BCBS has international plans. They are designed for those who travel.

Does My Regular Plan Cover Travel?

Inside the USA, yes. The BlueCard program helps. You will be able to find in-network providers. Care can be obtained in any state. You are fairly well covered in general.

Outside the USA, it is otherwise. Most plans provide for “emergent” care. This translates into a life-threatening problem. A broken leg might not count. You would pay the full bill. You need just an exclusive traveling plan.

What Blue Cross Travel Insurance Offers

Blue Cross Blue Shield Plans are available through GeoBlue. These schemes are for international travel. They include doctor visits, hospital stays and prescriptions abroad. They also provide for medical evacuation.

This is crucial. Medical evacuation can cost $100,000. A travel plan covers this. If you are going travelling, look at this. It’s like temporary car insurance. It offers a short term protection. It’s for a particular important need.

Beyond Health: Other BCBS Offerings

Blue Cross Blue Shield is associated with health. But a number of local companies do more. They offer other types of coverage. This allows you to bundle your plans. It can simplify your life.

These plans are usually sold on an individual basis. With this you can add them to your health plan. This includes Dental and vision. They also work in cooperation with government programs.

Dental and Vision Plans

Your health plan probably doesn’t cover dental. As well, it may not include routine eye exams. You need to have separate plans for these. They are available from many BCBS companies. You can get a dental PPO. Or a vision plan for glasses.

These are important for an overall good health. Poor Dental Health has an impact on your heart. Poor vision has an effect on quality of life. Don’t skip these. They are a component of a fully developed wellness plan.

Medicare and Medicaid Plans

BCBS is a humongous partner of government plans. They provide Medicare Advantage plans (Part C). These plans combine the coverage of the hospital, doctor, and drugs. They are very popular with the elderly.

They are also responsible for managing Medicaid plans. Working with the state governments is part of their function. Taking care of families with low income is their responsibility. Their large network makes them a good option. They also provide specialty plans. These are like classic car insurance. Or motorcycle insurance. These are constructed for a specific need.

The Cost of Blue Cross Blue Shield Policies

The question always is cost. How much does Blue Cross Blue Shield cost? There is no single answer. The price is dependant on a lot of factors. Your premium is unique to you.

The cost depends upon your local BCBS company. Since remember they are all independent. A plan in florida costs more or less than Ne But there are some factors that are universal.

What Factors Influence Your Premium?

Age

Older individuals typically pay higher premiums.

Location

Your zip code has a big impact on the cost.

Plan Type

A PPO plan will generally cost more than an HMO.

Tobacco Use

Smokers can pay up to 50% more for coverage.

Family Size

Individual plans cost less than family plans.

Are There Ways to Get Financial Help?

Yes. Many people receive assistance in paying for plans. This help comes from the government. It is known as premium tax credit. Or a subsidy. This can help to reduce your monthly premium.

You receive this help through the ACA Marketplace. This is HealthCare.gov. Or your state’s own exchange. Blue Cross Blue Shield sells many plans there. You can see if you qualify. Independent resources such as the Kaiser Family Foundation have calculators. They can help you to estimate your savings.

Filing a Claim and Appeals

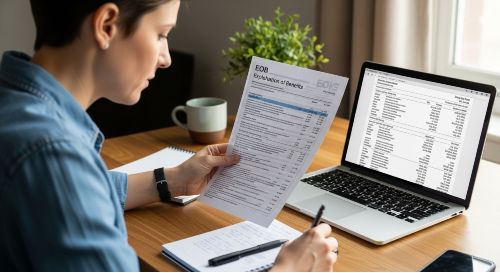

You have your plan. You visited the doctor. What happens next? In most cases, nothing. If you use in-network blue cross blue shield providers they file the claim. They send the bill directly to BCBS.

An “Explanation of Benefits” or EOB will come home to you. This is not a bill. It shows what BCBS paid. It shows what you owe. You will have another bill from the doctor. This bill should be the same as your EOB.

“It is health that is real wealth and not pieces of gold and silver.”

This is true, but bills are physical. Always check your EOB. Compare it with the bill of the doctor. Mistakes can happen. You must be your own advocate.

The Process of Filing a Claim

At times, you need to file the claim. This occurs with out-of-network care. Or if you are using blue cross travel insurance. You will pay the doctor first. Then you get BCBS to pay you back.

You will have to fill out a claim form. This form is available on the BCBS websites. You need to attach an itemized bill. Make copies of everything. This process can be slow. Be patient and persistent.

What to Do If Your Claim is Denied

Sometimes, BCBS refuses to give a claim. They will say that a service was not covered. Or it was not “medically necessary.” Do not panic. You have the right to appeal.

The first step for a claim’s appeal is an internal appeal. You appeal to BCBS to go over the decision. But there is more to tell in the An alternative is that your doctor determines a letter he or she could write. This is similar to what it is like to appeal the finding in professional liability insurance. You are arguing your case.

If they don’t again it’s up to you. You can request that you have an external review. A third party, which is independent, examines the case. Their decision is final. This process is your right.

Comparing BCBS to Other Insurers

Is Blue Cross Blue Shield the best? It depends. A strong and stable choice would be. They have huge networks. But then again, they are not your only option. You should always compare.

You can compare them to the national chains. Companies such as UnitedHealthcare or Aetna. You can also compare them to plans which are local/regional. Each has pros and cons.

“An ounce of prevention is worth a pound of cure.”

— Benjamin FranklinThis applies to shopping, too. An hour of comparison of plans is prevention. It can save a year’s worth of high costs. This is true when comparing term life vs. whole life insurance. It is true with health plans as well.

Blue Cross Blue Shield vs. National Chains

Blue Cross Blue Shield has local structure. This can be a pro or a con. Your local BCBS company goes deep. They may have access to the best local network. But customer service varies from state to state.

There is one brand for a national chain. The experience across the board is identical. Their national network may be better. This is good for people that move a lot. It is like comparing commercial auto insurance. Do you want a local or a national giant?

The Future of Blue Cross Health Insurance

The world is changing. Changing with it is health insurance. Blue Cross health insurance plans are catching up. They are adding new features. They are focusing technology. And caring for prevention, they are working.

This is good news for members. Plans are also becoming more user-friendly. They are offering more tools. This helps you to manage your health. It also helps you to manage your costs.

Technology and Telehealth

Telehealth is a huge change. You can see a doctor online. You make use of your phone or computer. This has been embraced by BCBS plans. Many plans also have low cost or free telehealth visits.

This is very convenient. You can get care from home. It is ideal for small problems. A cold, a rash or a refill of a prescription. The World Health Organization considers this to be an integral component of modern healthcare. It has the benefit of improving access for all.

Focus on Preventative Care

Insurance used just to pay for sickness. Now, it has an attempt to make you healthy. This is preventative care. BCBS plans are concentrative on this. They include check-ups and screenings.

Your annual physical is likely to be free of charge. Vaccines are free. Mammograms are free. They want to catch the problem early. This is better for you. It is also cheaper for them. It is a win-win.

Your Partner in Health

For Blue Cross Blue Shield is big name. It is a federation of local companies. They offer all types of plans. HMOs for savings. PPOs for flexibility. They have large networks.

Choosing a plan is a big deal. You must read the details. Understand the deductible. Check the provider network. Your health and your cheques are dependent upon it.

A blue cross blue shield insurance plan can be great company. It insures you against hugely expensive costs. It gives you access to care. Use this guide in order to make a smart choice. Be an informed customer.

Frequently Asked Questions (FAQs)

No. It is a national association comprised of 34 independent locally-operated companies. The local company you would be with is one of these companies.

HMO has lower costs, and more rules. You need a PCP and referrals. A PPO is more flexible. You don’t need referrals. But it has more monthly premiums.

Always use the directory of official providers on the website of your local BCBS company. Do not call up the doctor’s office to see if it’s still OK.

Your coverage plan most likely only includes true emergencies. For complete coverage, you must purchase a separate blue cross travel insurance plan, for example, those from GeoBlue.

You may be eligible for government subsidy. This is based on your income. You can apply using the HealthCare.gov marketplace.

![Compliant Drivers Program: Is It Legit for Driver Safety? [2025]](https://propinfo.site/wp-content/uploads/2025/12/Compliant-Drivers-Program-150x150.jpg)

Leave a Reply