Tech Coverage

Protect your laptop, phone, and camera.

Table of Contents

ToggleIf you are renting your home, you need protection. The landlord’s policy only covers the building. It prevents your personal stuff from being covered. Here comes in renters insurance. It saves your laptop, furniture, clothes, etc.

But traditional insurance can be out of date. It is often one size that fits all. You could end up paying for insurance coverage that you do not need. We are living in a fast and flexible world. We need a lifestyle-focused insurance that is commensurate with our lifestyle.

This is why Toggle Insurance for Renters is getting noticed. It is a modern way of coverage. This is made specifically for you, the modern renter. It allows you to make a policy which suits you for your life. No more, no less. This guide will take a look at the way of Toggle. We will see whether it is right for you. It is breaking new ground in thinking about safety.

Traditional renters insurance is nothing new. It served a simple purpose. Your stuff was covered in the event of fire or theft. Protection of liability was also provided by it. This is good. But our lives are not so simple anymore.

Many of us work from home. We run side businesses. We have expensive tech. Treating pets like family is also something we do. The old policies were not designed for this. They are often rigid. You get a bundle, and that is it.

This model feels outdated. It is like buying a cable table with 200 channels. You only watch five. You are paying for waste. This inflexibility is a problem. It can result in you being underinsured. Or it can make you pay too much. We need a system that is flexible to meet our needs. Not the other way around. Finding affordable business insurance can be just as hard, but for renters, a new option is here.

Toggle is not exactly a brand new startup. It has the backing of Farmers Insurance. This gives it stability. But it is a modern tech company that works. Its main idea is simple, you are supposed to be in control. Toggle by Farmers puts the Power in Your Hands.

This is a big shift. In the old insurance, insurance told you what you needed. Toggle asks you what you want. This is based on a platform of choice. You can select and choose your coverage. This is ideal for the changing life of a renter.

Then you may be a student the following year. You may be a young professional the next. Your insurance should be able to change as you. That is the fundamental bet of Toggle. It is insurance that catches up with the times.

“The future of insurance is personal, digital and flexible.”

Customers don’t want a product anymore, they want an experience that is flexible with their life.

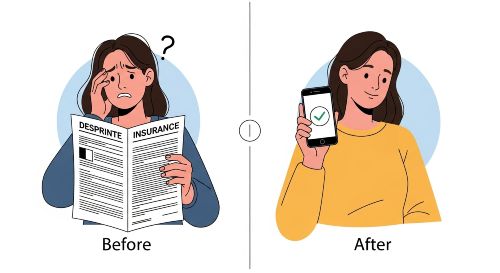

To really get aware of the Toggle Let’s see the example how it is compared. The old way of doing things is disappearing. A new more logical model is replacing this. This illustrates the difference in approach during the real world.

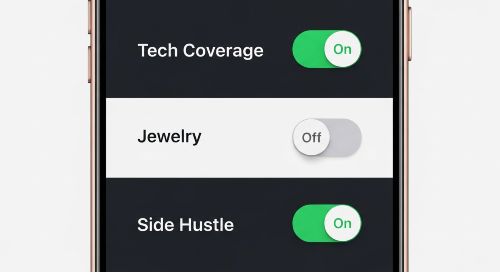

The name “Toggle” is literal. The platform gives you the option of “toggle” your coverage. You start with a base plan. Then you add what you need. And it all happens via an easy to use app or website.

You do not just purchase “renters insurance.” You build it. Do you have very expensive cameras? Kernel – You can turn up your tech coverage. Do you not own much jewelry? You can leave such coverage low.

This granular control is what is important. You can increase your individual property limits. You can modify your liability amount. It works on subscription basis. This has more the feel of Netflix than old insurance. It is monthly. It is easy to understand. And you can make some changes fast.

Toggle is designed for technological people. You will not be on the phone for hours. You go online. Answers to some simple questions are given by you. Depending on your needs, you will receive a quote in no more than a few minutes, we promise.

The entire process is digital in nature. From the quote to filing a claim. This eliminates a great deal of friction. It is ideal for those who love time. This ease of use is a large selling point. It is distinct from complex State Farm Life Insurance review, which implies strategy for a longer period of time. Toggle is the here and now about the here and now.

Toggle is not just flexible. It provides unique types of coverage. These are things the traditional plans miss most of the time. They are designed to the modern way of life.

This is the main feature. You pay only for what you need. Let’s say you have a $500 laptop. And a $3,000 bicycle. Old plans may include ten grand total. You are paying for $6,500 of air.

With Toggle, it is possible to set certain limits. This is a smarter way of insuring. SimplifyingSeptember 14, 2012 You get the protection you need. You do not pay too much for things that you do not own. It is a truly customizable renters insurance policy. It’s not that the set packages that you see in Humana dental insurance plans.

This is a huge benefit. Millions of people have a gig on the side. Maybe you sell things online. Or you are doing graphic design on a freelance basis. Or you work with a delivery service driving.

Traditional renters insurance will not cover this. It stops where your business starts. Toggle has a “Side Hustle” add-on. This allows the protection of your business gear. It can cover income loss. This is a game-changer to gig economy workers.

Do you have a dog or cat? Toggle has an add-on for them. This is no pet insurance for vet bills. Instead, it protects you. It covers what damage that your pet might do.

If your dog manages to destroy the carpet of your apartment, Toggle may be your ally. If your pet caused the harm to another person, the added protection is necessary. This is an up-to-date solution for the pet owners. It offers great peace of mind.

We live our lives online. This creates risks. Toggle has a feature for identity protection. It can monitor your credit. It allows you to recover from identity theft. This is a very useful and modern luxury. It indicates they know about the dangers of the digital age.

Let’s dissect the major components of a Toggle policy. You can make these pieces adjustable to construct your plan. This helps you to know what you are buying.

This is the most basic part. It covers your “stuff.” This includes your furniture, clothes and electronics. This is also extended to your kitchenware. You pick out the total value you would like to insure.

This is a major component of any renters insurance policy. As explained here by this helpful guide on what renters insurance covers from Investopedia, what renters insurance covers from Investopedia, this ensures that your belongings are protected against perils such as fire and theft. Often you can either opt for replacement cost (buys you a new one) or actual cash value (pays what it was worth).

This is crucial. Do not skip this. Liability will cover you in case you are sued. What if somebody’s hurt in your apartment? Or what if by accident, you start a fire? This coverage is for legal fees. Also, it pays for damages that you owe.

This is not a place to cut corners on money. A lawsuit can be financially disastrous. Toggle provides the capability to choose your liability limit. Choose a high enough amount. This is as vital as other types of PPO and HMO plans such as the United Healthcare insurance.

What happens if your apartment burns down? Where will you live? ALE coverage pays for this. It covers your hotel bills. It pays for food. This covers other costs when your home is being repaired.

Renter insurance of this type is a standard part of while insuring contracts. It is a true lifesaver. Toggle includes this. It makes sure that you have a safe place to stay in. You are not going to be left scrambling around.

“Your house is supposed to be an anchor, a port in a storm… renters insurance is the line that holds the anchor down.”

– Jim Agnew

Toggle’s Interface is all about building. It becomes more small insurance than big insurance, like the customization of a painting. You run into the same problem: You are the architect of your own policy.

Protect your laptop, phone, and camera.

Cover your high-value items, like bikes or art.

Add protection for pet-caused damage.

Get coverage for your gig work gear.

Protect yourself from lawsuits if someone gets hurt.

Get help if your identity is ever stolen.

This is a common question. Does it cost less to have a-la-carte that is flexible? The answer is: it can be. Since we are not charging you any extras. You only buy what you need.

This translates to low premiums to many renters. When you are a minimalist, your price will be low. High coverage can be obtained in case you possess numerous valuables. But you only will pay that high coverage. Not for things you do not have.

This renders Toggle quite a pocket-friendly renters insurance company. It leaves your budget at your mercy. The price change is also displayed in real time. You adjust your toggles. You follow the premium up and down. This transparency is rare. It is very refreshing. It is another globe compared to the search of a good commercial auto insurance.

No product is perfect. Toggle by Farmers is a company with numerous strengths. However, it also is not without its vices. Let’s look at both sides.

This moderated opinion is significant. These advantages and disadvantages are validated through the closer examination of Toggle by Forbes Advisor, review of Toggle by Forbes Advisor. They glorify its customization and observe the restrictions in availability. These are aspects that you should consider.

Let’s do a final comparison. Rigid plan can be considered as a set it and forget it tool. You buy it. Auto-pay is set up by you. You hope you never use it. It is passive. You may search about tips for lowering car insurance but not the renters policy.

Toggle Insurance for Renters is not a passive product. It beckons you to participate with it. Did you buy a new TV? Only open the app and switch on the coverage. Are you starting a side gig? Add that feature. It is made to evolve so are you.

This is the key difference. It is a lifestyle choice. Do you want a passive bundle? Or custom-made, on the go policy? For many, the choice is clear. It is not the temporary car insurance during a weekend. This is about your daily life.

This new model is exciting. But it is not for everyone. Why do you tell whether it suits your way of life? Here is a quick way to check.

“Security can not mean the lack of danger, it is having a plan. It is even better to have a flexible plan.”

In case, you consider Toggle to be sound, then there is nothing difficult about it. You can get a quote online. It takes about two minutes. You are not obligated to buy.

Do, however, take inventory, before you do. Walk through your apartment. Make a list of your valuables. Estimate what they are worth. This is an intelligent move of any insurance. It is a more complicated insurance than professional liability insurance, but a necessity.

This knowledge is power. It translates to not being an over-insured person. And you will not under-insure. You will get it just right. Nationally, the National Association of Insurance Commissioners (NAIC) provides a guide, National Association of Insurance Commissioners (NAIC) guide on this. They emphasize on being aware of what you possess. This will be the beginning of smart coverage. It assists you in making your choice among the term life vs. whole life insurance and renters policies.

The insurance world is evolving. It is now quicker, smarter and more individual. Toggle Insurance Company is a pioneer of this change. It is a product that is developed this decade.

It is not for everyone. This is not one of those hands-off, old-fashioned agents that you want. However, as a contemporary renter, it is an effective instrument. It gives you control. It secures your own individual way of life. Your side hustle is also covered by it. It protects your pet.

This is an intelligent and personalized customizable renters insurance. In it, you find yourself in the driver. You get to make the policy you require. Toggle belongs to a world of choice perfectly. It is just particular to you just like motorcycle insurance is to a rider.

Toggle is a Farmers product of renters insurance. It is a digital first and up-to-date platform. It gives you the ability to tailor your policy. The coverage levels can be switched. You only pay for what you need.

Yes, it is very legitimate. Toggle is a company that works under Farmers Insurance. One of the oldest and big insurers is farmers. The implication of this is that Toggle is well-supported financially and stable.

Not exactly. You have to keep fundamental coverages. This is the case of liability and partial personal property. You “toggle” the amounts. You are also able to add or get rid of optional coverage. As a case in point, you can add “Side Hustle” cover. You may take it off later in case you quit your gig.

No. This is a key difference. pet insurance is paid in vet bills in case your pet falls ill. The add-on offered by Toggle is named the “Pet Parent”, and it is a liability coverage. It assists in covering costs incurred in injuries that are caused by your pet. As an example, when it destroys your apartment.

The whole process is computerized. You can file a claim. You can track its status. This is all done via the Toggle application or web site. It is designed to be fast. It avoids long phone calls.

🎉 Secret Code: O1N5RSBGF8XI

Emma Henao is the driving force behind InsureHint. With years of experience in the financial services sector, she founded the site to demystify complex insurance terms. Her mission is simple: to provide the clear, practical Hints you need to make confident financial decisions. She covers everything from life and auto policies to business security, always focusing on clear, actionable advice.

Leave a Reply