Finding car insurance can be very stressful. And that’s even worse with a few tickets or accident on your record to show. A lot of insurances see a blemish and just say “no.” This is where The General Auto Insurance comes in. It has made its entire brand saying “yes” to drivers in need of that second chance. But is it the right choice for you.

This review separates the signal from the noise. We will cover coverage, costs, and customer service. We will also go in depth on SR-22 filings. Our point is to give you the honest look at this well-known provider. We would like you to be able to make an intelligent decision for your particular condition.

Our Expert Rating: 3.5 / 5.0 Stars

The General does an excellent job at its small business and its core mission: making insurance accessible to high-risk drivers. However, this accessibility comes with premiums and frills compared to its mainstream competitors. It is a necessary service, not a pleasure product.

Pros and Cons of The General Auto Insurance

Every insurance company has good and bad things about it. For a high risk driver understanding these is the key. You are not simply shopping for the cheapest price. You are shopping for a company that is actually going to cover you. Below is a brief summary before we get into more details.

👍 Pros

- ✅Accepts High-Risk Drivers (DUI, tickets)

- ✅Specializes in SR-22 and FR-44 Filings

- ✅Low Down Payment Options Available

- ✅Backed by American Family Insurance

- ✅Simple and fast quote process

👎 Cons

- ❌Premiums are often higher than average

- ❌Limited discounts compared to major carriers

- ❌Customer service reviews are mixed

- ❌Not ideal for drivers with clean records

- ❌Fewer coverage add-ons than competitors

Who is The General Auto Insurance Best For?

Let’s be direct. If you have a perfect driving record and some great credit, you may be able to find a cheaper policy through another company. The General Auto Insurance doesn’t have a specific price competative for preferred drivers. It competes on access.

This company is a good fit for:

- Drivers Needing an SR-22 or FR-44: If you have been ordered by a court or your state DMV to obtain an SR-22 insurance filing, The General is an expert. They deal with the whole process for you.

- Drivers with a DUI/DWI: If you are convicted of DUI or DWI, you are a very high-risk applicant. Many typical insurers will flat out deny you. The General Specialist in DUI insurance.

- Drivers with Multiple Tickets or Accidents: A series of accidents in multiplication or speeding tickets can make you uninsurable to standard carriers. The General will almost always for the policy to offer you.

- Drivers with Poor Credit: Included in many states are provisions that allow your continued driving to determined by your insurance rates, which would impacted by your credit score. The General is more lenient than others when it comes to offering bad credit car insurance.

- Young or Inexperienced Drivers: Young or Inexperienced: Statistically are riskier drivers more. A good place to start to build an insurance history may be the General.

If you have been turned down by other companies you should get a the general insurance quote. That is they are constructed for the service of the non-standard insurance market.

“After my accident, my former insurer dropped me. I thought I was out of options. The General gave me a policy the day the same. It was not cheap but at least it got me back across the legal road.” – Policyholder Review

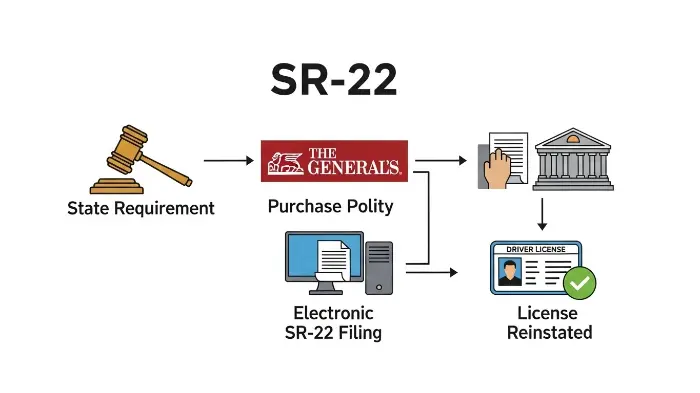

A Deep Dive into The General’s SR-22 Insurance Filings

This is one of the most important services provided by the company. Many people driving don’t get the term “SR-22.” It is important to understand it if you have been asked to file one. This is a fundamental strength of The General Auto Insurance company.

What Exactly is an SR-22?

And also an SR-22 is not a type of insurance. It is a certificate of financial responsibility. Think of it as something special and unique your insurance company files with the department of Motor Vehicle (DMV) of your state. This form is proof that you are carrying the state-required minimum liability coverage. It basically communicates to the state, “We are insuring this driver and we will draw to your attention if this driver cancels his policy.”

You could need to do a SR-22 for several reasons:

- Conviction for a DUI or DWI.

- Driving without insurance or driving without a valid license.

- Multiple traffic offences in a brief period of time.

- Being in an accident at fault when uninsured.

- Being subjected to the mark of being a “habitual traffic offender.”

How The General Handles the SR-22 Process

And this is where The General excels. While big, standard carriers may be slow or reluctant to one file an SR-22, The General has simplified the procedure.

- Get a Quote: A SR-22 filing can obtained when you request a quote, you can expect to be asked if you need an SR-22 filing. Be honest here. This is critical to getting the right policy as well as making sure the paperwork is filed correctly.

- Purchase the Policy: Once you purchase your policy The General will start you off with the insurance filing process. They charge a small fee for this service, one time only, usually it costs around $25, but this may vary from state to state.

- Electronic Filing: The General takes the SR-22 and electronically files it to the state’s DMV. This is much faster than mail. In many cases the filing can done the same day that you purchase your policy. This is a huge benefit in case your license is suspended and you need to get it reinstated quickly.

- Maintaining Coverage: The No.1 part of an SR-22 will be to keep your insurance. However, if you cancel your policy or fail to pay on time, The General is legally bound to file something known as an SR-26 form. This form will notify the DMV that you are no longer insured (which will likely result in your license being suspended one again).

The requirement for an SR-22 usually applies for three years but this can vary. Throughout this time, The General Auto Insurance gets you compliance and on the road.

The General Auto Insurance Coverage Options

While known for basic policies, The General offers a decent variety of coverages to protect you and your vehicle. They focus on getting you legal and connected the driving essentials to get you driving safely.

Standard Coverage Types:

- Bodily Injury Liability: This covers injuries to other people that you cause an accident. It is required by almost every state.

- Property Damage Liability: This consists of the damage of another’s property (such as their car or fence) in an at-fault accident. It is also required.

- Collision Coverage: This is to pay to have your own car repaired or replaced for an accident that occurs regardless of who was at fault. It is used only if you have a car loan.

- Comprehensive Coverage: This is coverage for damage to your car due to non-disaster events such as theft, vandalism, fire or hitting an animal. It is also an optional one if you do not have a loan.

- Uninsured/Underinsured Motorist: This is to cover you if you are hit by a driver that has no insurance or not enough insurance to cover your medical bills.

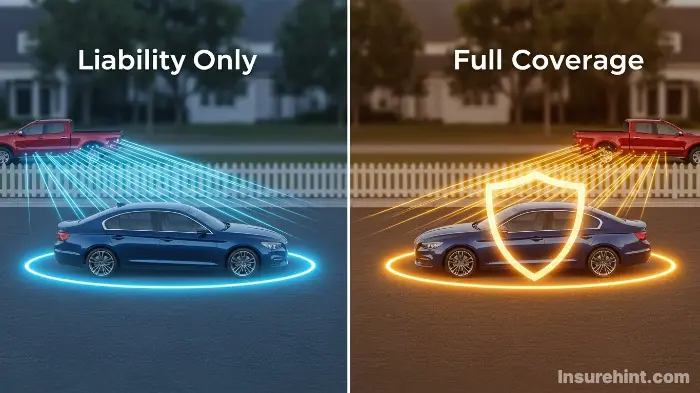

Many high-risk drivers try to get away with getting minimum coverage to keep costs down. This means in most cases simply purchasing the state-required Bodily Injury and Property Damage liability. While this makes you legal, it does not provide you with any protection of your own vehicle. Carefully weigh that this is enough according to your financial status. Getting quotes for various levels of coverage can help you to make a decision. If you are going after some ways to cut on expenditures, taking a look at some tips on how to reduce your car insurance cost would be great sources of strategies.

Optional Add-Ons:

The General also has a couple of key features as add-ons:

- Roadside Assistance: Provides roadside assistance in case of lockouts, flat tires or dead batteries.

- Rental Reimbursement: Used to help pay for rent for a rental car when your vehicle is being repaired for some covered claim.

- Custom Equipment Coverage: Covers items of aftermarket equipment such as custom wheels or stereo systems.

It is worth to note that The General does not offer some specialty coverings. For example, they are not the best option when it comes to insuring a high value collector’s vehicle; for that type of vehicle, you would want a specialized Classic Car Insurance. Similarly, personal auto is their interest so, if you use your vehicle for work purposes then you will require a separate Commercial Auto Insurance policy. However, they do provide coverage for two-wheel vehicles, making them a viable option for Motorcycle Insurance.

Non-Owner Car Insurance from The General

Another offering that is important is non-owner insurance. This is a liability policy for people who drive frequently but do not own a car. You will find it perfect solution if you:

- Often borrow cars from friends/family.

- Use car-sharing services on a regular basis.

- Need to file an SR-22 to get your license back, but do not own a vehicle.

A non-owners policy from The General Insurance includes liability coverage which is a secondary level of protection. If you cause an accident while driving a borrowed car, you begin by paying through the auto insurance of the car owner. Your non-owner policy then helps to cover whichever damages are left over up to your policy limits. It is an intelligent and economical means to be secure, and to fulfill state requirements without owning a car. For people who merely require protection for a very brief while browsing the web for Temporary Car Insurance might likewise come in handy.

How Much Does The General Insurance Cost?

This is the big question to many shoppers. The General auto insurance usually costs more than standard carriers such as State Farm or Allstate, especially for drivers with no tickets on their records. This higher cost is not arbitrary, it reflects the higher risk of the drivers that they insure. The entire customer base of the company is statistically more likely to file a claim because the premiums need to be higher in order to pay the claims.

A number of factors will contribute towards your the general insurance quote:

- Driving Record: This is the largest factor. A recent DUI or at-fault accident will cause your premium to increase quite considerably.

- Location: Rates are very variable by state, and even by ZIP code.

- Vehicle Type: The type, model, and age of your car have a different impact on how expensive it will be to repair or replace it.

- Credit History: In states where this is permitted, a poor credit score often results in more expensive insurance rates.

- Coverage Levels: A liability-only will be much cheaper than a full coverage policy with low deductibles.

The best way to know what your cost will be is to get a quote. Their online system is quick and easy, and offers you a price in minutes.

The General Auto Insurance Company: Discounts and Savings

Since their list of discounts is shorter than some of their competition, The General still have a few ways to save money. Every dollar matters though when you are already being charged a high-risk premium.

Available discounts can entail:

- Pay-in-Full Discount: Paying for your entire 6 or 12 month premium upfront may allow you to save a lot of money.

- Good Student Discount: For young drivers with “B” average school grades or better.

- Driver’s Training Discount: For young drivers who take an approved driver’s education course.

- Homeowner Discount: Sometimes you actually can reduce your auto insurance rates by having a home.

- Multi-Car Discount: When you insure more than one vehicle with The General you can receive a discount.

Always ask your agent or check at the time of quoting online to check what discounts you qualify for.

Customer Service and Claims Experience

A company’s reputation is built upon how they treat their customers especially during a claim. This is an area in which The General auto insurance is receiving mixed reviews.

The National Association of Insurance Commissioners (NAIC) monitors customer complaints. The General normally receives a higher than average number of complaints for a company of its size. Common problems reported by customers are those relating to the claim process and unexpected cancelations.

Why is it important to take this in perspective? The high-risk insurance market is necessarily more complex. Claims can more contentious and due to non-payment, policies are often canceled more frequently, which is more common in this demographic.

“While The General’s customer satisfaction scores are behind industry leaders, their chief value proposition is not white glove service. It’s market access to a market that is ignored by regular carriers. For their target customer, ‘good enough’ service that comes with a ‘yes’ is often better than a ‘no’ from a top-rated company.” – J.D. Power Automotive Analyst

The claims process itself is conventional. You are in 24 hours/7 days a week, you can move the claim online You can move the claim via their mobile application You can call their claims number. Once they are filed, an adjuster will tasked with investigating the accident, determining damages and providing payment for covered losses. For further context on what the industry as a whole is performing, you can check consumer information from various sources such as the National Association of Insurance Commissioners (NAIC).

The General’s Mobile App & Website Experience

In the current world, digital tools are a must. The General has made an investment in a good mobile app and a usable website. This is a big plus for customers who do not want to let others manage their policies and manage on their own time.

The app allows you to:

- Check the policy documents as well as your ID cards.

- Make payments & set up auto-pay payments.

- Or get a new the general insurance quote.

- Start the claims process.

The experience is meant to simple and no-frills, and this fits with their overall brand. You won’t get high tech telematics or complicated safe driving programs like Progressive’s Snapshot. Instead, you get a working tool that takes care of the essentials, which exactly is what their target customer needs.

How The General Compares to Competitors

The General Insurance is a space in which the competition operates. Its main rivals are also focusing in the non-standard or high-risk market. The big competitors are SafeAuto and to some extent, Progressive, which has a big division of high risk.

Here’s a quick comparison:

Analysis:

- The General vs. SafeAuto: Both are experts in the high-risk business. The General has the advantage of having the financial backing of American Family Insurance, thus giving it better financial strength. SafeAuto will often compete by serving the absolute minimum coverage required by law, and at a very low price point.

- The General vs. Progressive: Progressive is a giant that serves all the risk levels. They are often willing to take on high-risk drivers and their pricing is sometimes competitive with The General. Progressive offers much more discounts as well as a better digital experience. It is always worth getting a quote from both to compare.

A Look at The General’s Parent Company: American Family Insurance

In 2012 American Family Insurance took over The General. This was a private great move that gave so much stability. American Family is huge and financially sound, insurance company with a long history and excellent ratings.

What does this mean to you as a customer?

It means that The General auto insurance has deep pockets financial wise. You can be assured of the company’s ability to have money to pay out claims, even large claims. Financial strength is an important consideration when selecting an insurer. The credit rating agency AM Best, a leading credit rating agency in the insurance industry, rates American Family and its subsidiaries, including The General, “A” (Excellent).

You can confirm these ratings on our AM Best website. This backing ensures removal of the concern about the long-term viability of the company. This financial strength can be a determining factor when it comes to insurance, much like when it comes to other financial products that require comparison like Term Life Insurance or even health plans like the ones from United Healthcare Insurance.

The Verdict: Is The General Auto Insurance Right for You?

After thoroughly reading we come to a clear verdict. The General Auto Insurance has a point and vital purpose in the market.

You’ll, therefore, want to think hard and give a strong consideration to The General if:

- You have had a DUI, more than one accident or have a bad driving record.

- You Have been Ordered by the State to File an SR-22 or FR-44.

- You haven’t been offered cover by several standard insurance companies.

- You need insurance as soon as possible and you want the fast and hassle-free process.

You expect to look, and look elsewhere if:

- You have a good driving record and good credit.

- You are looking for the lowest price for the standard coverage.

- You want a wide range of discounts and policy features.

- Excellence in customer service is your most important priority.

Ultimately, The General auto insurance company is a lifeline. It creates a route to legal driving for previously shut up the standard market. While you may have to pay more for basic service, the benefit of being able to get to the road legally and responsibly is immeasurable.

For people who can’t avail coverage anywhere, it’s not only a good option, it’s often the only option. If you fall in the high-risk box however, getting a quote is a necessary process in your search for insurance. The best policy is one that actually accepts you and for many drivers, that policy comes from The General Auto Insurance.

Frequently Asked Questions (FAQ)

Yes. The General was purchased by American Family insurance in 2012. This provides it with high financial support and stability in the insurance market.

Most policies have some sort of down payment, however, The General is known for offering low down payment options to make it easier for customers to get started.

The General has a specialization in SR-22s and is able to electronically file the certificate with your individual state’s DMV the same day you buy your policy, ensuring you are able to get your license back faster.

Yes, The General auto insurance is a fully-licensed and legitimate insurance provider that offers state-required liability coverage as well as optional physical damage coverage. It is not merely a marketing agency.

For most drivers, especially good records drivers, The General will be more expensive than GEICO. This is because of the fact that The General is specialized in the high-risk market, which inherently has higher costs.

![Compliant Drivers Program: Is It Legit for Driver Safety? [2025]](https://propinfo.site/wp-content/uploads/2025/12/Compliant-Drivers-Program-150x150.jpg)

Leave a Reply