Finding great dental insurance is so important. Your smile is one of your best assets. However, keeping it healthy is costly. Major dental work commonly costs thousands. This is where a good insurance plan comes in handy. It is not only good for your health, but also your wallet. We will discuss the appropriate plans for you.

This guide will work out everything in detail. We will look at plans of major work. This includes crown and root canals to implants. You will be shown how you can find affordable dental insurance. Let’s ensure that you have the coverage that you really need.

Why You Absolutely Need Dental Insurance Coverage

Many people question whether dental insurance is worth it or not. They may just visit them for cleanings. However, problems may arise without warning. Chipped tooth or a sudden ache will happen. With no coverage, these problems turn into financial emergencies.

Preventive care is the key to staying out of the big problems. But in case of a major procedure, the costs quickly add up. A crown that is for just one tooth can cost more than $1,500. A root canal can be even more. Therefore, having a plan in place is a smart financial move in your future.

Understanding the Basics of Dental Insurance Plans

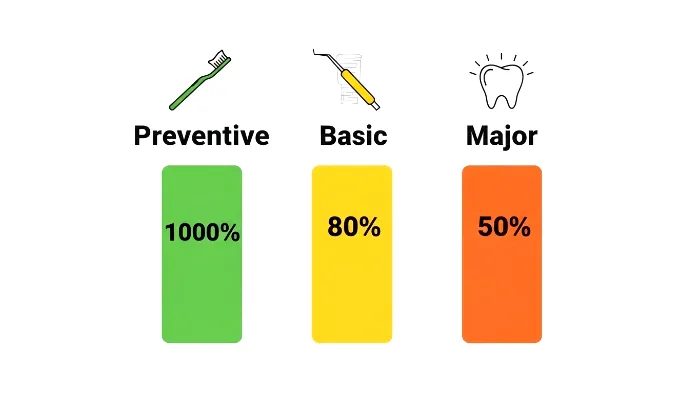

Before we get down to the Tullum hats I have some basics first. Most dental insurance plans are based on a 100-80-50 plan. This is a popular categorization of services by companies. Having an understanding of this assists you in making predictions of the cost.

What is the 100-80-50 Rule in Dental Insurance:

This rule is a simple guide. It indicates the amount to which your insurer pays. It is categorized into three divisions.

- 100% for Preventive Care: This includes cleanings, exams and x-rays. Insurers want you to be healthy. So, one often sees these fully covered.

- 80% for Basic Procedures: This is for fillings, simple extractions and a deep cleaning. You will be making a smaller part of the cost.

- 50% for Major Procedures: This is where we should be focusing. It involves crowns, bridges, dentures, and implants. It is 1/2 paid by your plan and 1/2 is to be paid from personal funds.

Key Dental Insurance Terms You Must Know

One of the requirements to navigate dental plans is possessing the correct terminology. These are the terms that are found in every policy. Knowing them is crucial.

Deductible

This is the amount which you pay initially. You must pay it before your insurance begins in order to help. For example, if your deductible is $50 then you pay the first $50 of your dental care every year.

Annual Maximum

This is the most that your plan will pay you in a year. A typical maximum is around $1,500. If your dental work is more expensive, you are responsible for the difference in cost The higher maximums can be for major work.

Co-insurance

This is a percentage of costs that you pay. After you meet your deductible of course. For major work, you will see your co-insurance frequently at 50%. The other 50% is paid by the insurance company.

Waiting Period

This is a very important point with major procedures. A waiting period is something that you must wait. When it comes to a set time, you have to have the plan for certain things before it. For major work this can be from 6 to 12 months.

Exploring Different Types of Dental Plans

Not all dental insurance is created equal to each other. There are several types of plans. Each one has its pros and cons of course, it depends on your needs to choose the right one. It is also related to your budget.

Exploring PPO Dental Plans

PPO plans are very popular. They are very flexible in their possibilities. Any dentist you would like to see is available. However, you charge less money for staying in the network. These “preferred providers” have agreed to charge reduced rates.

PPO plans are great for people who want choice. If you have a dentist that you already love, find out if he or she is in the network. Many are. Even if they aren’t, a PPO plan still will cover some of the cost. This is a significant advantage for a large number of families.

Understanding HMO Dental Plans

HMO plans are often cheaper. They have lower monthly premiums. The catch is you have to use a dentist that is on their network. There is no coverage for out-of-network care, except in the case of emergencies.

You will also need the referral from your primary care dentist. This is required to visit a specialist, such as an oral surgeon. For those on a tight budget, HMO can be a great way of availing of essential coverage. You may also get excellent options with a Humana Dental Insurance Plan.

“Every time you smile at someone, it is an action of love, a gift to that person, a beautiful thing.”

– Mother Teresa

Fee-for-Service Dental Plans (Indemnity)

Indemnity plans are the most flexible. They are also referred to as traditional insurance. There are no networks. You can see any and every dentist literally. The payment plan pays a specified percentage of costs.

The bad side is usually higher premiums. You may also need to pay your dentist in advance of the payment. Then, you file a claim for repaying. These dental plans are more rare today and they provide maximum freedom.

Coverage At-a-Glance: The 100-80-50 Rule

Finding Dental Insurance That Covers Major Procedures

Now, the main event. We need to find dental insurance that are excellent on major work. This includes looking beyond the level of basic cleanings. We need plans that have good major care coverage.

What Your Dental Plan Considers a “Major” Procedure

Insurers are very specific on what counts as being “major.” This is the expensive stuff. These procedures often continue for many visits and special work. They restore their function and appearance.

Crowns and Bridges

A dental crown is a cap of a damaged tooth. It is restored as to shape, size and strength. A bridge “bridges” a gap. It’s used when the absence of one or more of the teeth is present. Both are common but costly. After your deductible, a good plan will garner you 50% of this cost.

Root Canals

The treatment of infected pulp inside a tooth is called root canal. It saves the tooth that may be lost. While some plans consider this “basic,” many consider it “major.” You have to look at the policy details carefully. This is a very important procedure.

Dentures and Implants

Dentures are items that are removable to substitute for lost teeth. Implant which is a permanent solution. A titanium post is grown in the bone of the jaw. Implants are the gold standard but are very expensive.

Many of the basic dental plans do not cover implants. You have to look for plans specifically with implant coverage so you can see plans that include implants.

The Big Problem with Dental Insurance: Waiting Periods

As we said waiting periods are a huge factor. Most insurers will not allow you to purchase a plan today and have a crown tomorrow. They have a set waiting period for major services. This is typically 6 to 12 months.

This is for the protection of the insurance company. It means that people don’t just buy insurance when they need expensive work done. If you foresee the need for major work, then you need to plan ahead.

Get dental insurance well in advance.The employer-sponsored plans might waive these. Similarly, if you are looking at another kind of coverage, such as professional liability insurance, planning is also key.

How to Find the Best Affordable Dental Insurance

You want great coverage. But, it also must be affordable. It is a case of finding the balance. Let’s take a look at the concepts of shopping smart to get affordable dental insurance.

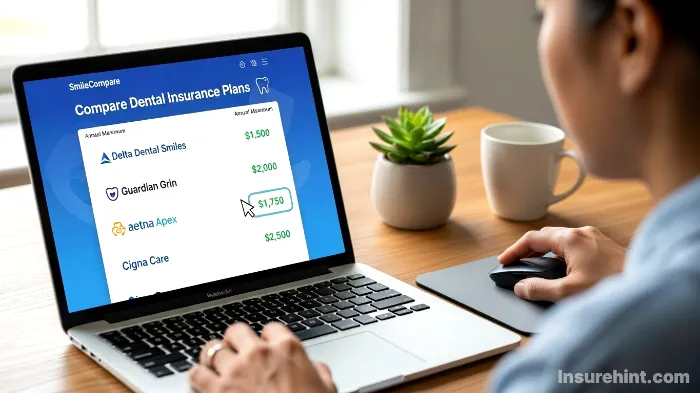

Compare Top Dental Insurance Providers

Many companies have some very good dental insurance plans. Some of the biggest names are famous for health coverage as well. They often have large networks and reliable service.

You can be able to explore the options provided by different carriers. For example, many people look at United Healthcare insurance for their extensive PPO as well as HMO plans. Comparing providers, you will be able to compare who is a better value when it comes to providing you with the best value for the major procedure in your area.

Read the Fine Print of Your Dental Plan

The secret to a good plan is in the nitty-gritty. Do not just look at the monthly premium. You must dig deeper. Look for the annual maximum. Is it $1,000 or $2,500? For major work you may have you may find a higher maximum is much better.

Also, see what the percentage of coverage is for major services. Is it 50%? Or is it lower? Check for exclusions. Does the plan or not cover implants? Taking the time to read the policy summary 30 minutes can save you thousands of dollars in the future. This is as much true with dental as it is with classic car insurance.

“Insurance is a promise of reimbursement in the case of loss; paid to people who are smart enough to buy it.”

– Anonymous

Special Focus: Dental Insurance for Seniors

Seniors have often have unique dental needs. Years of wear and tear can result in more major processes. Unfortunately, Original Medicare does not cover most dental care. This is a gaping coverage for millions.

This makes private dental insurance for seniors a necessity. Look for plans which are designed for older people. These may have better plans for things like dentures, bridges and implants. Some Medicare Advantage (Part C) plans have dental benefits. These are worth exploring.

PPO vs. HMO Plans

- More Flexibility & Choice

- Out-of-Network Coverage

- Higher Monthly Premiums

- More Complex Billing

- Lower Monthly Premiums

- Simpler Cost Structure

- Restricted to a Network

- Referrals Needed for Specialists

Tips for Maximizing Your Dental Insurance Benefits

Once you have chosen a plan, you would like to make the most of it. It is important to use your dental insurance wisely, as it is equally important to pick it. Here are some pro tips.

Use Your Dental Plan’s Preventive Care Benefits

This is the simplest method for you to maximize your plan. Your cleanings and exams are normally 100% covered. Use them. Schedule your appointments every six months. This helps give your dentist enough time to help spot problem areas in time.

An early-stage cavity is simply a filling (basic care). Left to become treated like a root canal & crown (major care). Preventive care will save you pain and time; and a lot of money. It also helps you to save your annual maximum for actual emergencies.

It’s a proactive way to think of things – very much the same way you go through your State Farm life insurance policy to make sure that it continues to be the right one for your life.

Coordinating Your Dental Plan with Your Dentist

Personnel in your dentist’s office are insurance wizzes. These are plans that they deal with every single day. Discuss it with them before they agree to a major procedure. Ask them to submit an estimate of pre-treatment.

This amount is forwarded at estimate to your insurer. The insurer will respond with an answer as to what exactly they will be covering. It will display your estimated out of pocket cost. This avoids nasty surprises

It allows you to be able to budget for the procedure without hesitation. Being prepared is always a good strategy, whether it is for dental work or comprehension of commercial auto insurance.

Strategically Planning Treatments with Your Dental Insurance

If you are going to have high annual maximum, use it wisely. If you have to have several major operations you might hit your cap. For instance, let’s say that one year you need to have two crowns and your max for the year $2,000. Each crown costs $1,800.

Your plan pays 50% therefore their share is $900 per crown Two crowns would cost the insurer $1,800. This clearly is well in your maximum. However, if you need a third one, you is on your own. It is sometimes wise to put one major procedure late in the year.

Then, capable to schedule the next one early in the new year. This allows you to use two years’ worth of annual maximums. This type of planning may also prove helpful when comparing term life vs. whole life insurance.

Don’t Forget About Dental Discount Plans

Sometimes, good old-fashioned insurance simply won’t work. If you need major work right away, waiting periods are an issue. In this case, a dental discount plan can be a life saver. It is not insurance. Instead, you pay an annual fee.

In return, you receive a discount for services from participating dentists. The discounts are sometimes significant, 15% to 50%. There are no waiting periods, deductibles or annual maximums. It can be a great suspension to insurance or an independent item. It’s another tool, just like knowing when you need temporary car insurance.

Alternatives to Dental Insurance for Paying for Major Work

Even with good dental insurance, the 50% that you owe can be a lot. What if you require some work that costs $5,000? Your share is $2,500. Not everyone has that on hand. Let’s look at other options.

Health Savings Accounts (HSA)

If you have a high deductible health plan, you may have an HSA. This is a fantastic tool. You can contribute your pre-tax money in this account. You can then use it to glorified medical expenses and dental expenses.

It is a smart move to use an HSA to pay for crowns or implants. You are paying with tax-free money. This is equivalent to getting a discount equal to your tax rate. It’s a powerful tool for the healthcare cost. Just like finding affordable business insurance is a smart move for a startup.

Third-Party Financing

Companies such as CareCredit provide healthcare expenses financing. They act like a credit card for medical and dental charges. Many have promotional periods at 0% interest.

If you are able to pay off the balance in that time it is a great way to spread the cost out. However, be careful. If you fail to pay it off in time, the interest rates can be really high. Read through the terms and conditions very carefully. It’s as important as finding ways on how to get your car insurance cost lower.

“The groundwork for all happiness is good health.”

– Leigh Hunt

In-House Payment Plans

Talk to the manager of your dentist’s office. Most dental practices know that costs are high. They may have their own in-house payment plans. They may allow you to make payments for the balance over several months.

This can often be a no interest lien option. Dentists are interested in having you obtain the care you need. They are more often than not willing to work with you. It never hurts to ask. This can be more flexible that external financing. It’s a bit like getting the right motorcycle insurance; it is in your best interest sometimes to deal directly.

Conclusion: Why Dental Insurance is an Investment in Your Health

Your dental health goes directly in relation to your overall health. Problems in your mouth can affect your heart, diabetes, etc. Seeing dental insurance as an investment is a change of perspective. It’s not another one of those monthly bills.

It’s a tool to having a well being. A good plan that provides coverage for major procedures would provide peace of mind. You know that if some dental emergency arises, you are safe from crippling costs. You can focus on getting better, and not the bill.

Take the time to research. Compare PPO, HMO and other dental plans. Read up on the information regarding deductibles, maximums and waiting periods. Find the best affordable dental insurance for you. You will thank yourself in the future that you did it. A healthy smile is truly priceless.

For more information related to dental health and finding the right providers, the American Dental Association is a quality resource. You can also compare different health and dental plans on the government’s official market place at HealthCare.gov. For financial strength ratings of insurance companies, there are resources you can use to do that such as AM Best.

Frequently Asked Questions (FAQs)

It’s rare but possible. Some employer-sponsored group plans waive the waiting periods. Some individual plans may as well but they often have higher premiums or other restrictions.

Generally, no. Most dental insurance plans are focused on procedures that are focused on restoring health and function. Purely cosmetic work such as whitening or veneers will normally not be covered.

It depends. If you know that you will require a great deal of care, a plan with a higher premium and a lower deductible may cost you less in the big picture. You may be able to save money if you are healthy because a lower premium and higher deductible could be offered to you.

Not necessarily. While PPO’s provide flexibility, a good HMO plan with a good network and high co-insurance for high cost work can be very cost-effective especially if your favorite dentist is in-network.

Costs also vary greatly depending on the location and level of coverage. A basic plan could be $20-$30 per month and a comprehensive plan with high maximums and coverage for implants could be $50-$90 per month or more.

![Compliant Drivers Program: Is It Legit for Driver Safety? [2025]](https://propinfo.site/wp-content/uploads/2025/12/Compliant-Drivers-Program-150x150.jpg)

Leave a Reply