There are many of us who are called to the open road. It promises freedom, adventure and new horizons. Your Recreational Vehicle (RV) is more than just an actual vehicle. It’s your home away from home. That’s why insuring it with the appropriate RV Insurance is so important. This policy isn’t a suggestion; which is a vital shield to your investment as well as to your mind. It preserves your travel on a smooth road and not end up on the road.

We know sometimes it is difficult to understand insurance. But you may be wondering about some ways you can receive a good deal on coverage. Sometimes it is even a struggle to find affordable business insurance. But, with the right information, you can make sure choices. So, let us get into the world of RV insurance. We will be going into detail on what it covers, why you need it and how you can be well protected for your adventures.

What is RV Insurance and Why Do You Need It?

You might consider that your standard auto policy should cover you. However, an RV is a peculiar combination of a car and a house. This means that it has risks that are unique. RV insurance is made specifically to cover these hybrid waters. It gives you the protection that you need either you are on the highway or sitting in one of the nice campsites.

More Than Just Car Insurance

Your car insurance can insure you on the road. But, what happens when you are stopped on a parking are? When an RV becomes your living space, it is your personal space. Accidents may occur at a campsite. Someone may slip and fall around your rig. A fire could do some damage to your possessions within. Regular auto insurance will not cover these situations.

RV insurance fills that gap. It partakes features of both auto and home insurance. Think of it like a policy for your car, and a mini-policy for a house, as one. For a different type of vehicle, you may want to look into everything you need to know about classic car insurance, but for your RV, a special type of policy is important.

State Requirements for RV Insurance

Virtually all states will require you to have a liability insurance for your RV. This is if your RV is a motorhome (drivable). The rules are comparable to those for a regular car. You must have coverage for any damages that you may cause or injuries that you may cause.

For towable RVs, such as fifth wagons or travel trailers, the rules change. Your trailer tend to be liable for auto insurance; it is often also there on something while it is towing. However, this doesn’t get the trailer itself from damage. Nor is it going to cover you when it is unhitched and parked. That’s why a separate RV insurance policy is highly recommended nevertheless.

“The greatest adventure one can experience is to live the life of your dreams.”

– Oprah Winfrey

Types of RV Insurance Coverage

When you begin to look for an rv insurance quote, there are a lot of coverage options which you will see. Answering these options is the first step. It helps you to build the policy suiting your lifestyle. Let’s break down the most common insurances that are available.

Standard Coverage Options

These are the foundational pieces of any great RV insurance policy. Most are similar to the type of secular overnight insurance you would have in a traditional auto policy, but modified to fit the specific needs of an RV.

Liability Coverage (Bodily Injury & Property Damage)

This is the cornerstone of the policy of your policy. If you are responsible for an accident, then liability coverage covers the cost of the medical bills and property damage to the other person. Laws within the states require minimum liability limits. However, due to the size and weight of an RV, to be better protected often, experts will recommend higher limits. It’s a little bit like you need professional liability insurance for your career; this is liability protection for your travels.

Collision Coverage

Collision coverage is helpful in case of an accident involving your RV and another vehicle or object, compensates for repairing your RV. It does not matter who is at fault. Whether you back into a post or are in a multiple car pile-up, this coverage covers the costs of repairing your rig. You will first have to pay a deductible.

Comprehensive Coverage

This is for the purpose of protecting your RV from non-collision events. Consider that the “everything else” coverage. This includes things such as theft, vandalism, fire and falling objects. It also includes damage caused by weather related events such as hail or floods. For an expensive asset such as an RV, comprehensive coverage is very important.

Uninsured/Underinsured Motorist Coverage

What happens if someone hits you, but they don’t have insurance? Or they don’t have the insurance to pay for your repairs and medical bills? This is where uninsured/underinsured motorist coverage benefit coverage comes in. It insures you against the financial consequences of an accident involving an irresponsible driver. This coverage is similar to what you would find upon looking at motorcycle insurance.

Specialized RV Coverage You Should Consider

This is where the RV insurance really brightens up. These add-ons offer up that protection that standard auto policies simply can’t offer. They deal with RV lifestyle unique risks.

Full-Timer Liability

If you live in your RV for six months or more each year you are considered to battle a full-timer. Full-timer liability offers protection similar to a homeowner’s policy. It has you covered for accidents that occur in and around your RV when parked. This is of utmost importance to anyone using their RV as a permanent residence.

Personal Effects Replacement

Your RV is stuffed with personal possessions. One example could be your clothes, your laptops, kitchen supplies, and outdoor gear. Personal effects replacement coverage helps you to replace these items if they are stolen or damaged. Standard auto policies cover very little when it comes to personal items. This add-on is a must.

Vacation Liability

This coverage covers you once you are using your RV for recreational purposes. If someone is injured at your campsite the vacation liability can cover their medical expenses. It normally offers a certain limit of coverage such as $10,000 and is very affordable.

Roadside Assistance

Getting breakdown in a car is a hassle. It is a major issue to break down in a 40 foot motorhome. Specialized RV roadside assistance covers towing for a large vehicle, repairs at the side of the road, changing a tire, and for even trip interruption costs. You can’t count on having normal auto club plans for an RV.

Total Loss Replacement

If you have a new RV, this coverage is a lifesaver in case your new RV is totaled in the first few years. Instead of giving you the depreciated cash value, it will pay for the replacement of your RV with a brand new similar model. This is a powerful feature that is offered by many top rv insurance companies.

Pest Damage Protection

Believe it or not, overheating by pests can cause great damages on an RV. Mice, squirrels and other critters can chew through electricity wires and destroy insulation. Some specialized RV insurance policies provide coverage for this unique and expensive problem.

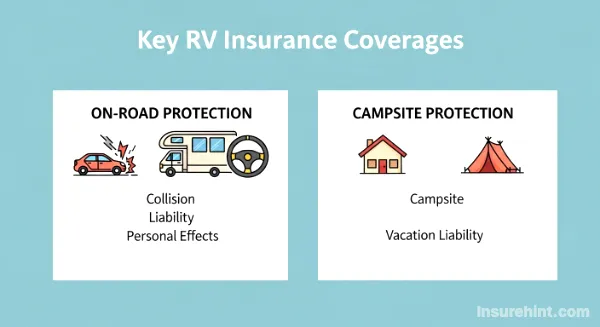

Essential RV Coverage Types

On-Road Protection

- Liability Coverage

- Collision Coverage

- Comprehensive (Theft, Fire)

- Uninsured Motorist

At-Campsite Protection

- Full-Timer Liability

- Personal Effects Replacement

- Vacation Liability

- Roadside & Pest Assistance

How Much Does RV Insurance Cost?

This is the big question of every RV owner. The cost can vary widely. An rv insurance quote can range in the hundreds or thousands of dollars per year. The final price is dependent upon an enormous number of factors. Understanding them can help you figure out ways in which you can save money. If you are also a driver, you may be interested in learning our top 10 tips on how to lower your car insurance cost.

Factors That Influence Your RV Insurance Quote

RV Insurance companies consider a lot of information in determining your premium. The following are the most significant:

- RV Type and Class: A large and luxurious Class A motorhome will cost more to insure than a small pop-up camper. Its value and potential cost of repair are much higher. The RV Industry Association (RVIA) offers great information on these different classes and market trends.

- Age and Value of the RV: Newer, more expensive RVs cost more to insure. A good practice is to check your vehicle’s history for any recalls on the National Highway Traffic Safety Administration (NHTSA) website, as this can affect its value.

- Usage: How You Use Your RV Sounds like a silly question, but it is true. A full-time RVer will pay more than someone going on a few weekend trips a year. The longer you are on the road, the more risk you are exposed to.

- Driving Record: Just as is the case with car insurance, having a clean driving record without any accidents or tickets will result in lower premiums.

- Location: Where you live and store your RV makes a difference with respect to your rates. Areas with higher rates of theft, vandalism or weather will have higher insurance costs.

- Coverage and Deductibles: The more you choose to cover against the losses the higher your premium. Selecting a higher level of deductible (the amount that you have to pay yourself out-of-pocket on a claim) can result in a lower premium.

Finding the Best Rates

You do not have to be powerless when it comes to you RV insurance premium. You can take a number of steps to get a better rate. The most important thing is to shop around. Get an rv insurance quote from a number of different companies.

Don’t Forget to Ask For Discounts. Many companies will offer some type of discount for bundling your RV policy with your auto or home insurance. You may also receive a discount for being a safe driver, a member of an RV club or having safety features on your rig. Much like it would with the health plans available from providers like Humana Dental Insurance, bundling and loyalty can result in savings.

Choosing from the Top RV Insurance Companies

So many options, how do you choose the right company? The cheapest in the world is not necessarily the best. You need a company that you can trust and one that is known for having a very good reputation. You want one of the best rv insurance companies that will be at your side when you don’t need them most. Look for people who specialize in RV insurance as they have a good idea of the lifestyle.

When comparing rv insurance companies, look at what their customer service reviews are. How do they handle claims? Are their representatives knowledgeable in RV? Also, check their financial stability ratings from financial rating agencies such as A.M. Best. A great financial rating indicates that they possess resources to pay out claims.

Some players that are major in the RV space are Progressive, National General and Good Sam. You should be looking at your other insurance concerns too, such as reading a State Farm Life Insurance policy, to determine if there is any reason to bundle.

“To travel is to live.”

– Hans Christian Andersen

What to Look for in RV Insurance Companies

Customer Service

Look for companies with high satisfaction ratings and knowledgeable, RV-focused support staff.

Claims Process

A smooth, fast, and fair claims process is critical when you need help the most. Read reviews!

Valuable Discounts

Seek out insurers offering multi-policy bundles, safe driver rewards, and RV club member discounts.

The Process of Getting an RV Insurance Quote

It is easier than ever to get an rv insurance quote. You can do it online, over the phone and with the local agent. What is important is to have all your information handy. This will make the process smooth and to ensure that you get an accurate quote. If you have a business based in your RV, you may also need commercial auto insurance too.

Information You’ll Need

To get a precise rv insurance quote, you will need to provide some details. Be prepared to share:

- The VIN Vehicle Identification Number of the RV.

- The year, make and model of the RV.

- Your driver’s license number.

- Your house address and where the RV will be stored.

- Ways that you plan to use it (recreational vs. full-time)

- Your driving history and any claims.

Online vs. Agent

It is fast and convenient to get a quote online. Allows you to individualize multiple rv insurance companies in minutes. However, having an independent insurance agent to work with may also be very beneficial. An expert in RV insurance can provide expert advice.

They will be able to help you navigate through complex coverage options and make sure that you are not missing out on any important protection. This is similar to how an agent can assist you to grasp the subtleties of a United Healthcare Insurance plan.

Tips for Full-Time RVers

If you live in your RV though, your insurance needs are quite different. You are not insuring a vehicle; you are insuring your home. Make sure that it is included in your policy.

Full-Timers Liability is not an option; it is a necessity. It provides the same type of liability protection as you would have in a homeowner’s policy. You should also greatly increase your Personal Effects coverage. You have way more possessions than a casual camper. It’s also a good idea to invest in thinking about what type of life insurance you have or what’s better, term life vs whole life. Finally you’ll have to establish a “domicile” state, for legal and insuring purposes.

Common Mistakes to Avoid When Buying RV Insurance

It can be a tricky world when it comes to navigating the customer insurance world. Here are a few pitfalls you should be looking for when you buy RV Insurance.

- Underinsuring Your RV: The cheapest insurance policy may sound like a way to save money in the short run, but it may cost you a great deal in the long run. Make sure that your coverage limits are high enough to really protect your investment.

- Forgetting Personal Belongings: Don’t think their contents on your RV is covered. P policies: Always add in Personal effects Replacement coverage to your policy.

- Ignoring Specialized Coverage: Vacation Liability and Roadside Assistance are cheap and they can save you from any major headaches and expenses. Don’t short-change on them in the name of saving a couple of dollars.

- Not Shopping Around: Only sticking to the first quote you get has you make a mistake. Compare rate/coverage from at least 3 different rv insurance companies. I’d be sure you could find the same protection for a lot less money.

- Failing to Update Your Policy: If you are going to add a solar panel system or make a major renovation, make your insurance company aware of it. You need to update your coverage to tout to these fresh investments. You may not need temporary car insurance, however, you do need current coverage.

“Home is where you park it.”

– Unknown

Your Adventure Awaits

Your RV is your ticket to freedom and indescribable memories. Protecting that investment with the necessary RV insurance is one of the most important decisions that you will need to make. It’s the safety net to allow you to explore with confidence.

Take the time to get to understand your needs. Assess whether you are a weekend warrior or are a full-time nomad. Get a detailed rv insurance quote from some reputed companies. By a smart policy, you can be sure that your home on wheels is protected whitenever the turn of the road carries you. And now go out there and create some memories.

Don’ts

- Assume auto insurance is enough.

- Underinsure to save money.

- Forget to cover personal items.

- Ignore customer service reviews.

Do’s

- Shop around for quotes.

- Ask about available discounts.

- Choose specialized RV coverage.

- Update your policy after upgrades.

Frequently Asked Questions about RV Insurance

For drivable motorhomes, yes. Nearly every state mandates that you have at least liability insurance. For towable trailers the Liability from your auto policy may extend for while towing, but you need to have another policy for damage to the trailer itself.

RV insurance has both auto insurance elements (such as collision and liability) and homeowners insurance elements (such as personal property and vacation liability). It is designed for the sake of protection both for the vehicle and your living space.

This is a special policy for individuals living in their RV for more than six months a year. It includes increased liability and personal property coverage, and it is more of a homeowner’s type policy for your rig.

Yes! Most rv insurance companies offer discounts for bundling policies, having a clean driving record, belonging to an RV club and installing safety devices on your RV. Always ask your provider what bargains are available.

Yes, you should have “Personal Effects Replacement” cover in your policy. Standard cover for belongings is very limited. This add-on guarantees that your clothes and your electronics and other things are safe from being stolen or damaged.

![Compliant Drivers Program: Is It Legit for Driver Safety? [2025]](https://propinfo.site/wp-content/uploads/2025/12/Compliant-Drivers-Program-150x150.jpg)

Leave a Reply