Renting a home or apartment is very flexible. You can move easily. You do not worry about property taxes. But what about your things, your stuff? A common myth is that if you are a tenant of an insurance firm, your insurance has you covered. It doesn’t. That is where Renters Insurance comes in. It is a crucial safety net. It is for the protection of your personal items and your financial future. Without it and you are one accident from a major loss.

This guide will help you to go through all that. We will cover what it is. We will be talking then what it protects. We’ll teach you about some cheap ways to go about it, along the way. You will see why you really can’t live without it.

Demystifying Renters Insurance

So, what is really Renters Insurance? Think of it as some type of personal protection plan. It is designed especially for tenants. It provides coverage to your personal property. Liability coverage is also included. This occurs within the realms of the space you rent out. It is a contract between you and an insurance company. You pay a low monthly or yearly fee that is called a premium. In turn, the insurer has agreed to help you out financially. This is if certain bad things happen.

The Landlord’s Insurance vs. Your Insurance

Many renters get confused on this. They assume the landlord’s policy covers them. This is a dangerous mistake. The two policies are protecting two completely different things. The first step in understanding this difference. It is key to securing your own financial safety.

What Your Landlord’s Policy Covers

Your landlord has insurance, yes. But that policy only relates to the structure of the building. It will used to protect the physical house or apartment building. This includes the walls, the roof, and floors. It also covers their own liability. For example, if someone is injured in a common place such as a lobby. Their policy includes nothing at all about personal need and your personal goods.

What Your Renters Policy Covers

Your policy is all about you. As we know – this includes your clothes, your furniture, your electronics. It keeps your kitchenware and other valuables safe. If you have had your apartment destroyed by fire, your landlord’s insurance will rebuild your walls. Your Renters Insurance will help you to replace your lost TV, sofa and wardrobe.

As you can see, both policies are vital. They just serve different people. It’s similar to how does different personal policies come into operation, for example, a comprehensive insurance of State Farm Life Insurance is insurance protecting a future of your family and in renters insurance present.

Deep Dive into Renters Insurance Coverage

Understanding what is in a policy is important. The question is what are you paying for? A typical Renters Insurance policy is divided into three major components. Each component of the renters insurance coverage insures you against a different sort of risk. Let’s learn the details of each one of them.

Personal Property Protection

This is the essence of any renters policy. It covers the cost of replacing/repairing your personal belongings. This is provided they get stolen or damaged. The damage must from a covered event also which is known as a “covered peril.”

Actual Cash Value (ACV) vs. Replacement Cost Value (RCV)

When you purchase a policy, you will be choosing between these two. This choice has a major impact on your claim payment.

- Actual Cash Value (ACV): This is a coverage that will pay for what your item was worth at the time that it was lost. It provides information about the depreciation. For example, your five year old laptop may only have a value of $200 today. ACV will pay you that $200.

- Replacement Cost Value (RCV): This is the better option. It pays the full cost to replace your item with a new-similar item. So, it would have given you the money to purchase a brand new laptop. RCV policies cost a little more, but they are much better.

What’s Typically Covered?

Most policies cover a lot of different perils. These often include:

- Fire or lightning

- Theft and vandalism

- Windstorm or hail

- Explosions

- Water damage from internal sources (such as a burst pipe)

- Falling objects

What’s Usually NOT Covered?

There are exclusions on standard policies. They normally fail to account for damage from:

- Floods (Separate flood insurance policy).

- Earthquakes (requires separate policy/ rider)

- Pest infestations

- Damage from your own pet

Liability Coverage: Protecting You from Lawsuits

This part of your policy is often overlooked. However, it may be a financial lifesaver. Liability coverage covers you if somebody gets injured in your apartment. It also covers you in case you accidentally break someone else’s property. Let’s say one of your guests trips over a rug in your living room.

They could break their arm and choose to sue you for medical bills. Your liability coverage would help pivot you to pay for their medical expenses and your legal fees. This protection is not limited to your apartment – a layer of financial security like this is available in a professional liability insurance insurance.

Additional Living Expenses (ALE)

What if fire renders your apartment un livable? Where will you go? Additional Living Expenses (ALE) coverage is useful for this. It covers the costs that you bear “in addition” to those expenses while rooted out. This can include hotel bills, as well as meals in restaurants and laundry services. It covers the difference between what you normally spend within living and what you spend temporarily. ALE makes it possible for you to maintain your ordinary standard of living during the repair of your home.

Personal Property

Covers your belongings like furniture, clothes, and electronics from theft or damage.

Liability Protection

Protects you financially if someone is injured in your home or you damage their property.

Additional Living Expenses

Pays for temporary housing and other costs if your rental becomes uninhabitable.

Understanding the Renters Insurance Cost

One of the best things about renters insurance is that it is very affordable. Many people overestimate the price. And so what they are often surprised at is how low it can be. The national average renters insurance cost is only about $15 to $20 per month. In the United States, that translates to less than a few cups of coffee. The final price that you pay depends on a number of key factors.

“An ounce of prevention cuts a pound of cure.”

– Benjamin Franklin

This old saying perfectly sums up the worth of insurance. A little cash each month will help avoid a huge financial headache down the road.

Factors That Influence Your Premium

Insurance companies are all about risk. They consider a variety of factors in order to determine your specific premium.

Your Location

Where you live matters a lot. A neighborhood with a large crime rate will have higher premiums. Areas that are likely to experience certain weather events could also experience higher costs. Your ZIP code is a major driving pricing force.

Your Coverage Amount

How much stuff do you have? The more personal property coverage you need, the higher your premium will be. Someone with $50,000 worth of content will be paying more than someone with $15,000.

Your Deductible

Deductible is the money that you pay out-of-pocket on a claim. A higher deductible involves you having a higher initial risk. This results in a lower monthly premium. A common deductible is $500 or $1,000.

Your Claims History

If you’ve made a number of claims in the past, everyone from the insurance companies might view you as a higher risk. This can result in a higher premium. A clean claims history helps you to keep your rates down.

Safety and Security Features

Box-walking risk reduction: Insurers love it. When you reduce a risk, insurance companies love it. Having safety features such as smoke detectors, fire extinguishers and deadbolt locks can earn you a discount. A security system can also reduce your costs.

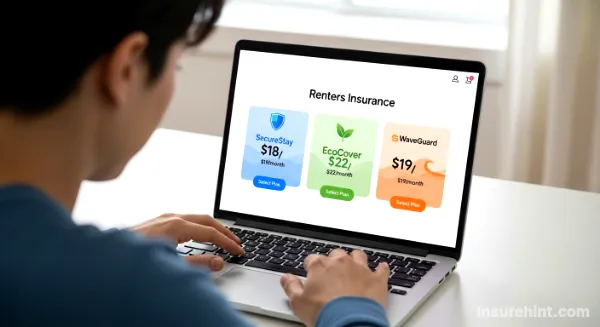

How to Find Cheap Renters Insurance

Even with its low average cost, you can still save money. Finding cheap renters insurance comes all about being smart when you shop. You have a number of different strategies to use at your disposal.

Bundle Your Policies

This is one of the simplest ways of saving. If you have auto insurance, ask the company for renters insurance prices. As a rule, most insurers offer significant “multi-policy” discount for bundling. This same logic can applied to other policies, making it a smart first step when looking for ways of lowering your car insurance cost.

Increase Your Deductible

If you are in a position to pay more in the beginning after a loss, consider increasing your deductible from $500 to $1,000. This simple change will reduce your monthly premium. Just make sure that you have that deductible amount saved.

Ask About Discounts

Don’t be shy. Ask your insurance agent for discounts for which you’re eligible. Perhaps you’ll get a discount for being claim free, being a non-smoker, or if you have auto pay set up. Every little bit helps.

Shop Around and Compare Quotes

This would be the most important tip. Don’t accept the first offer you make. Prices may vary significantly from company to company for identical coverage. Get at least you 3 to 5 renters insurance quotes to compare. This is true with all insurance, including health plans with providers such as United Healthcare Insurance, where it is important to compare PPO and HMO insurance.

How to Get the Best Renters Insurance Quotes

Shopping for insurance can be an intimidating process. But it’s not difficult as one would imagine to follow a set procedure. Getting the best renters insurance quotes has seconds everything – prepare get comparison on time. A little bit of home work goes a very long way.

Step-by-Step Guide to Buying a Policy

To be sure you have the right coverage at the best price do the following: This process will make a confident and informed buyer.

Your Path to Protection

Create a Home Inventory

List all your belongings and estimate their value. This is vital for choosing coverage and filing claims.

Determine Your Needs

Decide on your coverage limits for property and liability, and choose between ACV and RCV.

Gather Quotes

Contact multiple insurance companies or use an online comparison tool to get several quotes.

Review and Purchase

Compare the quotes side-by-side, read the policy details carefully, and then make your final choice.

Step 1: Create a Home Inventory

This is the most crucial step. You have to learn what you own to be able to insure it properly. Go through each room of your rental property. Make a list of what things you own. For costly items, record the brand, model number and dates of purchase. The easiest way to do this is with your smartphone.

Take a video as you are walking throughout your house, talking about what you see. You can even take pictures and store them in a cloud. For further instruction, the Insurance Information Institution has some great tips, tools and resources for free.

Step 2: Determine Your Coverage Needs

Using your inventory, calculate the total of all of your things. This provides you with a target for your personal property cover. Most experts suggest at least $100,000 in liability coverage. It is not very costly to bump this up to $300,000 or even $500,000. The peace of mind that is supplied is well worth it. This is also the time when you’ll make the decision of ACV vs. RCV coverage. We strongly recommend RCV.

Step 3: Gather Your Information

When you are asking for quotes, you will need some basic information. This includes your address; what type of building is there (apartment, house) and are there any safety features? You’ll also give your desired amounts of coverage and your desired deductible.

Step 4: Compare Renters Insurance Quotes

Now it’s time to shop. You have the option of calling agents directly; or you can use some helpful tools online and compare quotes from many companies at once. Be sure you are comparing apples to apples. On all quotes you’ll have to make sure the coverage limitations, deductibles and types of coverage (RCV/ACV) are not different. Just like you would compare different health or Humana dental insurance plans, you need to look at the details, not just the price.

Step 5: Read the Fine Print and Finalize

After you have selected a provider, read the policy documents carefully before signing them. Understand the exclusions as well as the process of filing a claim. If all of the above appears to be in order, you can complete your purchase. Often you can instantly get your policy documents by email.

Special Considerations for Your Renters Insurance Policy

Standard policies are solid but not comprehensive. Sometimes you may have some special circumstance that requires a bit more attention or special coverage. I think it is important to be aware of these situations.

“The time to fix the roof is when the sun is shining.”

– John F. Kennedy

This quote is a reminder to get your insurance needs taken care of before a problem becomes problematic. Attacking special cases now will prevent major gaping holes in your coverage later on.

Do You Need Extra Coverage for Valuables?

A standard renters policy has sub-limits for some high value items. For example, a policy may only cover you up to $1,500 for all your jewellery. So, if you have a $5,000 engagement ring there is a major coverage gap. To correct this, you can “schedule” your worthwhile items. This is done with a policy add on known as a rider or floater. You can schedule items like:

- Expensive jewelry

- Fine art or collectibles

- High supremacy electronics or cameras

- Firearms

- Musical instruments

Scheduling an item insures it for full appraised value. It is often more expansive in regard to providing protection against accidental loss. This one is similar to how the owner of unique vehicles get specialized from the classic car insurance, to protect their specific investment.

Roommates and Renters Insurance

This is a common question. Would you be able to share a policy with your roommate? Sometimes, yes. Some companies have roommate sharing policy. However, it just may complicated. If you have had a claim filed against you by your roommate, that would go on your claims history, too.

Also, limits in the coverage are shared. If the policy has $30,000 in coverage you have to share that much. In most cases, it is easier and safer for each roommate to have his or her own individual policy. It makes it certain that your coverage is your own.

What About a Home-Based Business?

More people are working from home than ever before. And if you are operating a small business out of your rental, your renters insurance likely will not cover it. Business equipment and business-related liability are not usually covered. If you have clients visiting your home or you are storing business inventory in your home, you need a separate policy.

This is a critical distinction and for those who are running a business, looking into affordable business insurance is a necessary next step to ensure that you are fully protected. Even cars for work purposes may require commercial auto insurance rather than a personal one.

Understanding Dog Bites and Liability

We love our pets. But they do have the potential to cause liability issues. One of the most common liability claims is due to dog bites. Many insurance companies will cover up dog bites, but there are some restrictions. They may even restrain certain breeds who they think are “high-risk,” like Pit Bulls or Rottweilers. Don’t lie to your insurer about the number of pets you have.

Lying about a dog may result in them denying a future claim. If you’re struggling with getting your housing to covered, a good place to look is The Humane Society, who are fighting for non-discriminatory policies. It is always better to be upfront, whether you’re insuring a pet, any one of a kind possession, or even a specialized vehicle that needs its own motorcycle insurance.

The Final Verdict: Is Renters Insurance Worth It?

The answer to this is a resounding yes after the entire review of all the facts. Renters Insurance is not a good idea; but a basic one, as a responsible renter. It is a very potent weapon at a very low cost.

Think about the cost of a new replacement of all items you possess. Your dryclean, your washing, your furniture, your clothes, your kitchen. It is thousands, or even tens of thousands of dollars. Would you be able to change all that immediately? For most of us, the answer is no. This forms the main safeguard that is offered by renters insurance.

Next there is the liability risk. Even a mere accident might result in a time-consuming case at the expense of all. Liability insurance is your safety net, which secures your present finances and incomes. It offers a legal defense and settlements, which offer you a tremendous security. As you can consider taking term life insurance or whole life insurance to ensure the security of your family in the future, renters insurance secures your current finances.

A Small Price for Huge Peace of Mind

You can protect yourself against fire, theft and lawsuits all at the price of a streaming product or a couple of coffees every week. In case your home is destroyed, you get the money to move on. You have an option of recovering, without borrowing a loan.

It is among the best deals in the insurance world. It is even demanded by some of the landlords and with reason. They are aware of the fact that it secures their tenants and minimizes the confrontation post an incident. Even the temporary car insurance is something one can buy to cover short-term needs but renters insurance it is something you will always need as the protection of your home environment is very much steady.

Peace of mind does not come as a luxury it is a necessity.

This final thought says it all. Renters Insurance is not a regular bill. It is an investment into yourself and your state of being. In the case of a company that provides such protection, one may consider such providers as Progressive. Waiting to learn its lesson, don’t wait until a disaster has struck you. Protect yourself today.

Frequently Asked Questions (FAQs) about Renters Insurance

It is not legally obligatory in the majority of places. Nevertheless, it is a condition of the lease in a large number of property management companies and landlords. They do this to make sure that their tenants are able to restore their lives following the onset of a disaster.

No, surely you are not covered. A policy only includes the individual that is mentioned on the policy and in certain cases, resident family members. To have a coverage, you must purchase a separate policy.

The first step is to make a home inventory to estimate the value of your goods- this is your level of personal property cover. Liability should be at least $100,000, however we suggest $300,000 or more as there is greater protection.

Not at all! It is between $15- $20 dollars or so per month at the national average level. It is one of the cheapest kinds of covers yet the ultimate price varies depending on your place of residence, the level of coverage including the deductible.

Contact your insurance company after the occurrence of an incident. They will put an adjuster of claims on the case. To document the loss, you will be required to give your home inventory list and any police report or photographs. You are then going to be taken through the process by the adjuster.

![Compliant Drivers Program: Is It Legit for Driver Safety? [2025]](https://propinfo.site/wp-content/uploads/2025/12/Compliant-Drivers-Program-150x150.jpg)

Leave a Reply