We all work hard. We focus on delivering excellent results. But humans make mistakes. In most jobs, a minor mistake gets easily rectified. But What If What You Are Doing Is High-Stakes Advice? You might make a simple mistake and cost your client thousands. Or even millions. This is where Professional Liability Insurance is vital.

In fact, you may be familiar with it by other names. Many call it e&O insurance. This is short for errors and omissions insurance. It is a special shield of business of service. It insures you against your clients saying that your work was faulty. They may claim that you were negligent. Or that your advice cost them some money.

A lawsuit can be devastating. This is true if you did nothing wrong. Legal defense expenses can bankrupt a small business. This insurance covers such costs. It helps to protect your money and protect your reputation. We will discuss what is Professional Liability Insurance? We’ll see who needs it. And is going to learn why it is not just an option, but a necessity.

What Exactly is Professional Liability Insurance?

Following is a breakdown of this important coverage. Consider it as the “malpractice insurance” for professionals. Doctors and lawyers have it. But so are consultants, designers and accountants. It is for anyone who is paid for their expertise. Your legal defense is covered by this. Settlements or judgments are also paid for.

This protection is in the form of financial losses. A client cannot sue you for being sad. They will have to prove that your professional error caused them financial harm. This is a key difference. It distinguishes e&O insurance from other types of business insurance policies. It is specifically for the service that you provide.

Decoding the Jargon: E&O vs. Professional Indemnity

You will hear many terms. They have often the same meaning. In the United States the common term is e&O insurance. It draws attention to mistakes (errors) and failures to do something (omissions). This includes a wide variety of professional slip-ups.

In the UK and elsewhere, profs indemnity insurance is frequently heard to roll off people’s tongues. This is the same core product. It “indemnifies” or “makes whole” the client who suffered a loss. Do not get confused with the names. The purpose of both policies is to insure you against claims of professional negligence.

What Does E&O Insurance Actually Cover?

Your policy – it is your very specific guide. But most Professional Liability Insurance plans are for similar claims. These are the most prevalent ones. Your policy covers alleged/actual negligence. This includes mistakes in your work. It also covers about things that you did not do.

It can shield you from the mismanagement claims. Did you over-promise a result? It could have to with inaccurate advice that you gave. It can also apply to violations of good faith. This is an extremely broad and strong shield. It secures you from a lot of client related disagreements.

What is Not Covered?

This insurance is by no means a catch-all. It is highly specific. It does not include bodily injury. If you have a client that trips in your office, that’s General Liability. It does not discuss employee injuries. That is what Worker Compensation is for.

Nor will it cover intentional fraud. You can’t lie to a client and expect your insurance to pay. It does not normally include data breach costs. For it, you require Cyber Liability. Finding affordable business insurance for your startup construed that you require to be finding the right type of insurance not just a single kind.

The Big Question: Does My Business Need Professional Liability Insurance?

This is the most important question. The answer is simple. Do you offer a professional service to clients for pay? If your answer is yes, you need this insurance. Your risk is not zero. Many business owners believe they are too small. Or that their clients love them.

But disputes happen. Miscommunication is common. A simple project scope creep can lead to a lawsuit. The client can say that you didn’t deliver what was promised. Your prof liability insurance is your defence. It tells you that you are a serious professional.

The “Service vs. Product” Test

Here is an easy test. Do you need to sell physical products? You really only need Product Liability. This includes harm from your products. But do you sell advice? Do you sell designs, codes or strategies? Then it is your service that you are selling. Your risk is financial.

If your service fails, your client loses money. And they will want that money back. They will come to you for it. Professional Liability Insurance is intended for precisely this situation. It insures service providers against financial claims.

High-Risk Professions That Can’t Live Without It

Some jobs have obvious risks. Doctors and lawyers are the classic examples. But the modern economy operates using services. Many professions have high liability risks. IT consultants and techs. A bug in the code can take down an e-commerce site.

Accountants and financial advisors are also at high-risk. The mistake of taxes can cost huge penalty. Architects and engineers are the subject of claims over design flaws. Real estate agents can be sued for misrepresentation. Even marketing and ad agencies need it. A failed campaign or a copyright matter might be the cause of a lawsuit.

What About Freelancers and Sole Proprietors?

Yes, absolutely. You might need it most of all. As a sole proprietor, there is no distinction in law. Your business is you. If your business is threatened with a lawsuit, your personal assets are threatened with loss. Your house, your car and your savings could all be at stake.

Professional Liability Insurance is a way to protect you as a person. It also builds trust. Many large clients won’t hire a freelancer without one. They will be asking for a “Certificate of Insurance.” Having it proves yourself to be a true professional. It makes them believe in you when you’re hiring you. Your personal life insurance is important, but E&O insures your pro-life.

“To err is human, to forgive – divine. To be sued, however, is ever so very, very expensive.”

— (Modern Business Proverb)Real-World Scenarios: When Errors and Omissions Insurance Saves the Day

Sometimes, it is difficult to see the danger. Let’s look at some examples. These illustrate how errors and omissions insurance works. These are common situations. This happens more often that you think.

The Case of the Faulty Code

An IT consultant is hired. They have to construct a new payment system. They write the code. It works in testing. But a hidden bug exists. It goes live. The system fails during a major holiday sale. The client loses $150,000 in revenue.

The client sues the IT consultant. They claim negligence. The consultant’s e&O insurance policy kicks in. It hires a lawyer to defend the consultant. It ultimately makes a settlement. Have no insurance, the consultant would be bankrupt.

The Accountant’s Miscalculation

An accountant prepares the annual taxes of a client. He makes one little mistake in a deduction. It is not noticed for 2 years. Then, the IRS audits the client. They discover the error. The client owes the client $50,000 in back taxes. They also owe $20,000 in penalties.

The client is furious. They sue the accountant for $70,000. The accountant’s prof liability insurance covers the claim. It pays for the client’s penalties. It also covers the legal fees. The accountant’s business survives the mistake.

The Marketing Campaign That Missed the Mark

A marketing agency develops a new advertisement. They use a photo they found on the Internet. They believed it to be royalty-free. It was not. The initial photographer sues the client for $100,000. The client is now in the midst of being sued because of the agency.

The client turns around. They sue the marketing agency. They say the agency was negligent. The agency’s Professional Liability Insurance covers this. It provides a legal defense. It helps settle the copyright claim. This saves the agency from a huge financial hit.

How Does Professional Liability Insurance Work?

It is important that you understand your policy. You need to know how it protects you. There are two major kinds of policies. Most E&O policies work in a specific way. It is important to be aware of the terms. This will help you to buy the right coverage.

Claims-Made vs. Occurrence Policies

Most e&O insurance policies are “claims-made.” This is very important. It means that the policy must be active at the time the claim is filed. It does not matter when the mistake occurred. You need to be covered when you get sued.

This is why you need to ensure you remain covered. You cannot cancel your policy when a project stops. The mistake you made last year can result in a lawsuit this year. If you cancelled your policy, you have no cover. This is of course unlike dental insurance plans, which are much simpler.

The Importance of the “Retroactive Date”

When you buy a claims-made policy for the first time, it has a “retroactive date.” This is normally when the policy commences. Your insurance will not cover any work you did before this date. This ensures their protection against past mistakes.

You must keep this date. If you do switch insurers, be sure that the new insurance does honor your original retroactive date. This provides “prior acts coverage.” It has the purpose of ensuring your old work is still protected. Never let this date lapse.

Understanding Your Policy Limits and Deductibles

Your policy will have limits. This is the very most it will pay. There is typically a “per claim” limit. This is the maximum for one single lawsuit. There is also an “aggregate” limit. This is the overall maximum of the whole policy year.

You will also have a deductible. This is the amount you pay first. The insurer pays the rest, up to the limit. An increase in the deductible amount can decrease your premium. But, be sure that you can afford to pay for it. It is a balance, the same as with healthcare insurance plans.

Claims-Made Policy

Retroactive Date

Policy Limit

Tail Coverage (or ERP)

Finding the Right E&O Insurance Policy

Not all policies are equal. You have to find a coverage that suits your specific industry. A policy for the graphic designer looks different. It is different than a policy for a financial advisor. You must shop smart.

How Much Coverage Do You Need?

This is a common question. The answer depends on your risk. How much could your mistake cost a client? A million dollar contract requires more coverage. Less is required for a small freelance project.

Also, see your client contracts. Many clients will require that you carry a certain minimum. This is often $1 million per claim. This is a common place from which to begin. But that may not be all your industry requires. This is different than buying classic car insurance, where value is more obvious.

Shopping for Your Prof Liability Insurance

You always need to compare quotes. Get quotes from the minimum of three different insurers. But do not just look at the price. Look for specialists in your field for insurance. They know your risks that no one else knows.

Read the policy exclusions carefully. What is not covered? This is just as important. Ask questions. Make sure that you understand the deductible. And confirm the retroactive date. For good general advice, you can check on resources like the Small Business Administration (SBA) on insurance.

Common Misconceptions About Errors and Omissions Insurance

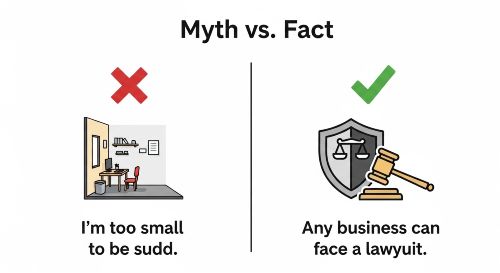

Many business owners have the wrong idea. They accept myths about this coverage. These myths are dangerous. They leave businesses vulnerable to massive risks. Let’s clear up a few.

“My General Liability Policy Covers Me.”

This is the most common and dangerous myth. No, it does not. General Liability (GL) is for bodily injury and property damage. If a client slips and falls, GL pays. Errors and omissions insurance is for financial injury.

If your advice hurts a client’s bank account, GL will not pay. You need a separate Professional Liability Insurance policy. It is crucial to have both. They cover totally different risks. This is as basic as knowing commercial auto insurance is separate from personal auto.

“I’m Too Small to Be Sued.”

This is wishful thinking. In fact, small businesses can be easy targets. A large company can afford a lengthy legal battle. A small freelancer is often not able to. An angry client knows this. They could sue just to get a quickie settlement.

The cost of a lawyer is alone enough to be debilitating. E&O insurance covers for that lawyer. It defends you even if the lawsuit is baseless. This protection is important for small businesses.

“I’ve Never Made a Mistake.”

That is great. But it does not matter. You do not need to be guilty to be sued. A client may sue you for anything. They could have mis understood the contract. They could be simply unsatisfied with the result.

The lawsuit is still filed. You still have to respond. You still need to hire a lawyer. Your errors and omissions insurance pays for this defense. It insures you against extraneous claims. It insures you against claims that are not your fault.

In the world of professional services, your reputation is your currency. E&O insurance is the vault which protects it.

Insurance ExpertHow to Reduce Your Risk (And Lower Your Premiums)

Insurance is your last line of defense. Your first line is doing good work. There are things that you can do to prevent putting yourself at risk. Insurers like to see this. It can even help lower your insurance cost.

The Power of a Strong Contract

Your contract is your best friend. It should be clear. It should outline the exact work that needs to be done. What will you deliver? When will you deliver it? What is not included?

There should be key clauses in your contract as well. A “limitation of liability” clause can cap your financial risk. Have a lawyer look over your standard contract. This little money can save you millions.

Document Everything

Keep detailed records. Save your emails with clients. Send follow up notes to follow up on meeting. Get client sign offs at major milestones. If a dispute arises, these records are your proof.

If a client comes to you telling you you did something wrong, you can show them the email. You can show where they had approved the design. Good documentation may prevent a lawsuit before it begins. It tells me that you were diligent and professional.

Your Business Shield: E&O vs. GL vs. Cyber

Professional Liability (E&O)

What it covers:Financial losses to a client caused by your professional mistakes, negligence, or bad advice.

Example Scenario:An accountant’s tax error forces a client to pay penalties. E&O covers the claim.

General Liability (GL)

What it covers:Physical injuries to people (non-employees) or damage to their property.

Example Scenario:A client visits your office, trips over a cord, and breaks their wrist. GL covers the medical bills.

Cyber Liability

What it covers:Costs from a data breach or cyber-attack, like client notification, credit monitoring, and fines.

Example Scenario:Your server is hacked, leaking client credit card numbers. Cyber Liability covers the fallout.

What Happens When a Claim is Filed?

Let’s say the worst happens. You receive a scary letter from a client’s lawyer. What do you do? Even if you have insurance the process is pretty easy.

First, do not panic. Do not admit fault. And do not ignore it. Call your insurance provider immediately. This is crucial. Most policies call for “prompt notification.” Waiting too long could cost yourself your coverage. This is no like temporary car insurance where the term is short.

Your insurer will appoint you a claims adjuster. This person would review the case. They will ask for a contract with you. They will want every bit of documentation from you. Then, they will hire a law firm for you. This lawyer is paid for by the insurer.

All communication will be taken care of by the lawyer. They will make a legal response. They will defend you in court if necessary. This defense will be paid for by your insurer. They will also pay for any settlement. Or they will pay the final judgment, up to your policy limit.

Your Best Investment: Peace of Mind

Professional Liability Insurance is not merely an expense. It is an essential component of conducting business. Consider it an investment into your own survival. This also gives you peace of mind. It enables you to concentrate on your work. You can undertake larger clients. This allows you to work without fear.

You cannot predict when a client will not be happy. Controlling anything and everything is impossible. But there is one thing that you can control – your preparedness. E&O insurance is the preparation. It protects your finances. Your reputation is also defended. This is responsible for the future of your business.

Don’t wait for a lawsuit. Assess your risk today. Review your E&O needs and other policies. Consider all your assets, from motorcycle insurance to term life insurance. A little extra now will save you from a later devastating loss. For more on professional negligence, some legal resources, such as Nolo, can be very informative.

Frequently Asked Questions (FAQs)

General Liability (GL) covers physical risks. This includes bodily injury to a person or damage to property. Professional Liability Insurance (E&O) covers financial risks. It covers a client’s financial loss as a result of your professional mistakes, negligence, or bad advice.

In the vast majority of cases, it is not mandated by law. However, it tends to be required by clients. Many large companies will not sign a contract with you unless you have proof that you have e&O insurance. Some professions such as doctors and lawyers may be required by their licensing boards.

The cost varies widely. It depends on the industry you are in (a tech consultant pays more than a writer). It also depends upon your revenue and where you are located as well as the coverage limits you select. A freelancer may have to spend a few hundred dollars. A larger firm may be able to pay thousands.

Tail coverage is a supplemental feature for claims-made policies. If you retire or close down your business, you cancel your policy. Tail coverage extends your reporting period. This opens the possibility to report claims after your policy is canceled, for work you did while it was active.

Yes, absolutely. Many insurance companies have policies specifically available for freelancers and sole proprietors. It is highly recommended. As a freelancer, your personal assets are personally at risk. This insurance is your first-line financial protection.

![Compliant Drivers Program: Is It Legit for Driver Safety? [2025]](https://propinfo.site/wp-content/uploads/2025/12/Compliant-Drivers-Program-150x150.jpg)

Leave a Reply