Have you ever had to borrow your friend’s car? Perhaps you often rent cars to take you on trips. In these moments a very important question comes to mind. Are you actually insured: This is where Non Owner Car Insurance fails in. It’s an important safety net for the driver without a car.

This guide will walk you down the whole civilized road. We are going to cover what this insurance is. We’ll take a look, further, with the main point: who needs it most. Finally, we’ll demonstrate to you how to get it.

Understanding the Core Concept of Non Owner Car Insurance

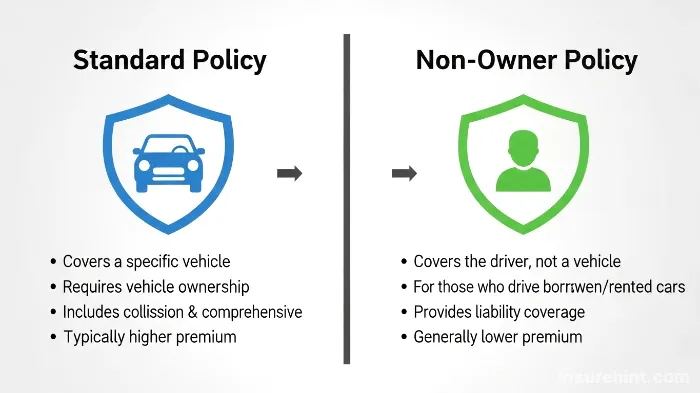

So, what is it exactly: It’s liable insurance of a kind. It covers the situation to give you coverage when you drive a vehicle not owned by you. You may think of it as personal auto liability. It follows the driver of a vehicle and not a particular car.

This policy is secondary coverage policy. This means the insurance from the car owner pays out first. For example, if you create an accident, their policy is the first one. Your non-owner policy then covers costs which are beyond their limits.

Diving Deep: What Does Non-Owner Car Insurance Cover:

It is absolutely essential to understand your coverage. You have to know what you’re paying for. A Non-Owner Auto Policy is specific. It concerned itself primarily with liability.

Therefore, it saves you from financial ruin. This is if you’re at fault in an accident. Let’s take a breakdown of the main parts.

Bodily Injury: A Key Part of Your Non-Owner Auto Policy

This is one of the pillars of your policy. It includes expenses for injuries which you cause to others. These costs can add up very quickly.

They may include medical bills. They could also include lost wages. In the worst possible cases, it can cover legal fees. This defends your personal assets from lawsuits.

Property Damage Liability with Non Owner Car Insurance

The other major portion is property damage. This pays for damages if you damage somebody else’s property. Most of the time this is the car of the other person.

However, it may be applicable to other property. For example, you may have damaged a fence or a mailbox. Such coverage covers those repair or replacement expenses. It saves you from paying from your pocket.

Potential Add-Ons for Your Non-Driver Car Insurance Policy

Since liability is standard, there are some add-ons offered by some insurers. These can be used to gain more robust protection.

You may be able to include Medical Payments (MedPay). This is helpful in paying for your or your passengers medical bills. It is regardless of who was at fault with the accident.

Another alternative may be Uninsured/Underinsured Motorist (UM/UIM) coverage. This protects you against getting hit by a driver with no insurance. Or, it assists them if they have too little insurance. It’s a really good addition that you have to think about.

“The time to take counsel is before you make a start.”

– M. T. Cicero

What Is Not Covered by a Non-Owner Policy:

Knowing the exclusions are they equally as important. A Non Owner Car Insurance policy is not a one-size-fits-all policy. It has very specific limitations which you need to know.

First, it does not cover damage to the car that you are driving. If you borrowed a car and wrecked it, this policy would not pay for the repairs. That drops down to the owner’s collision coverage.

Secondly, usually your own personal injuries are not covered. For that you would need MedPay or your personal health insurance. There are some states that have Personal Injury Protection (PIP) that could also be used.

Well, in addition to that, it doesn’t cover vehicles in your household. If you live with someone who has a car, you should be included on his policy. A non owner’s policy won’t protect you by driving their vehicle. The same does not apply to a car you have regular access to.

Lastly, services such as towing or rental reimbursement are not included. These are characteristics of an average, good auto insurance policy. Speaking of comprehensive, if you are looking towards buying coverage for a unique vehicle, then you may want to learn about classic car insurance.

What’s Covered

- Bodily injuries to other people

- Property damage to other vehicles/property

- Legal defense fees if you are sued

- Can be expanded with UM/UIM coverage

What’s Not Covered

- Damage to the car you are driving

- Your own personal injuries (without MedPay)

- Vehicles owned by people in your household

- Towing or roadside assistance services

Top Reasons to Get a Non-Driver Car Insurance Policy

Who really benefits from this coverage is anyone: Several lot of people find this policy indispensable. It offers peace of mind and very important financial protection. Lets have a look at the most common of these scenarios.

Frequent Renters: Why Rental Car Insurance for Non-Owners Matters

Do you frequently rent cars on business or pleasure? The insurance available in the rental counter is sometimes very expensive. Day after day, those costs amount to a great deal.

A non-owner car insurance may be a smarter choice. It offers uniform liability insurance. This is often cheaper in the long run than purchasing the rental company’s policy every time. You will enjoy in-rental car the non-owner’s insurance for built right in.

Borrowing Cars: How a Non-Owner Policy Protects You

You just may borrow your friend’s car to do an errand. Or maybe, you have a family member’s truck that you use for moving? You assume that their insurance will cover you. It usually does, by means of “permissive use.”

However, what if their policy limits are not good? If you cause a major accident their costs could be over their coverage. Your non-owner policy then becomes your safety net. It pays the balance of the score which insure you against you and the car owner.

Car-Sharing Users and the Need for Liability Coverage for Non-Owners

Services such as Zipcar or Turo are incredibly popular. They provide some insurance but not necessarily amounts of insurance. It is very important to read the fine print.

Often their included coverage is only the state minimum. A serious accident could readily exceed these limits. You in turn your own liability coverage for non-owners is in place to make sure you are adequately protected. This gives you the confidence of use with these convenient services.

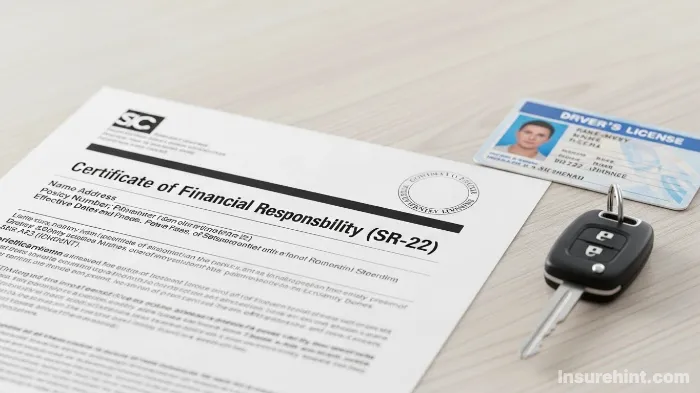

Filing an SR-22 with SR-22 Non-Owner Insurance

At times, the state demands you prove financial responsibility. This is often done as a result of a major traffic violation. For example, a DUI, or driving without insurance.

The court can order you to fill an SR-22 or FR-44 form. If you do not own an automobile, an SR-22 non-owner policy is the answer. It’s a cost-effective way of fulfilling the requirements of the law. It enables you to get your license reinstated and get back on the road in a legal way.

Between Cars? Maintain Coverage with Non Owner Car Insurance

Do you have a car that has recently been sold? Are you planning on purchasing a new one in the near future? Going without insurance in this gap of time can be a mistake.

Insurance companies reward full coverage. If you had a lapse in your insurance history, you might have to pay more. The next time you buy your car, you could be faced with a penalty. A low cost non-owner policy will keep your policy active. This can save you a lot of money in the long-run. In case you’re searching for a type of coverage for short-term use, then you might also study temporary car insurance.

How to Get Cheap Non-Owner Insurance

It doesn’t have to be a difficult matter finding the right policy. Understanding the right approach, you can have cheap coverage. The most important thing is to be a smart shopper.

And you have to compare your options. You also need to know what kind of questions to ask. Here is a step by step guide to help you get the best deal.

“Risk comes from not knowing what you’re doing.”

– Warren Buffett

Step 1: Info Needed for a Non Owner Car Insurance Quote

Before you start calling for quotes, get your details in order. Insurers will need to some basic information in order to check your risk.

Have available driver’s license number. You’ll also need the use of your full name as well as your current address. Finally, be ready to answer questions on your driving history. This includes tickets and accidents.

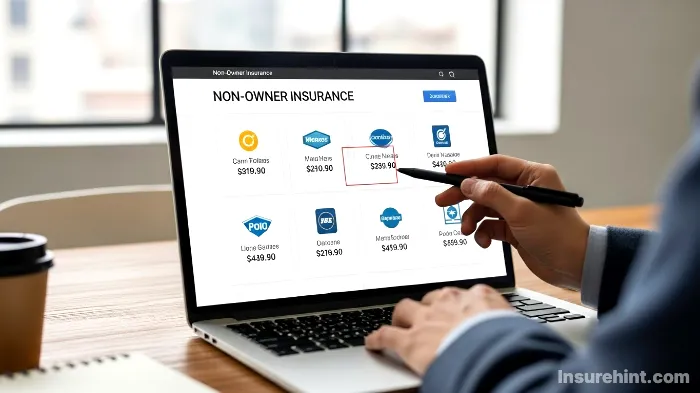

Step 2: Find Companies Offering Non-Owner Auto Policies

This type of policy is not offered by every insurance company. Many major carriers do, as you may have to ask to find out specifically. Some smaller local insurers may also be a good source.

Companies such as Geico, Progressive and State Farm are known to offer it. You may end up having to call an agent directly. It’s not available through online quote tools a lot of the time. Speaking of big providers, if you’re looking at other forms of insurance, a State Farm life insurance review may be useful.

Step 3: Comparing Quotes for Insurance for Drivers Without a Car

This is the most important stage. Don’t accept the first quote that is provided to you. It is important to get at least three to five different quotes.

When comparing, make sure that you are comparing the same coverages limits. Another cheaper quote may afford less protection. Make an apples-to-apples comparison to get the true best value.

Step 4: Finding Discounts on Your Non-Owner Policy

Even with this specially designed policy, discounts may be available. You should always ask your agent what you qualify for.

For example, you may receive a discount for being a good student. Or, they could save by bundling it with a renters or homeowners policy. Some professions as well, such as teachers or engineers, may also qualify for savings. Thinking of your professional needs, you might also be interested in professional liability insurance.

Your 4-Step Guide to Getting a Quote

Gather your driver’s license and driving history.

Find insurers who offer non-owner policies.

Compare at least 3-5 quotes for the same coverage.

Ask every agent about available discounts.

Breaking Down the Cost of Non-Owner Car Insurance

One of the biggest question people have is for price. How much will Non Owner Car Insurance cost: The good news is, however, it’s generally rather affordable.

Because the one doesn’t cover a specific car, the risk is less. The policy doesn’t have to take into account the year, make or model. It also does not cover costly collision or comprehensive coverage. This makes it a cheaper alternative.

Is Non Owner Car Insurance Cheaper Than a Standard Policy?

Yes, almost always. A non-owner policy can be much cheaper than a conventional auto insurance policy. The premium is solely determined by your risk as a driver.

For some people, it is as low as $20 to $50 a month. In contrast, a standard automobile insurance can easily be several hundreds of dollars per month. This difference in cost makes it very attractive. You can look into other ways of saving with these tips on how to lower your car insurance cost.

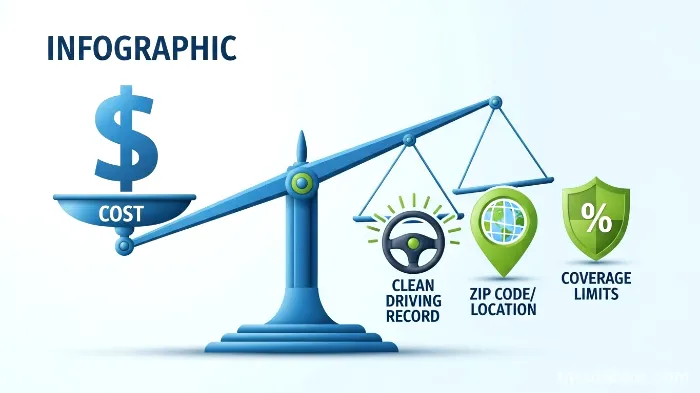

Key Factors Influencing Your Non Owner Car Insurance Premium

Even though it’s cheaper, it doesn’t cost all people the same price. A number of factors will determine your final premium. Insurers use these to try and work out your personal risk.

Your Driving Record

This is the most important factor. A clean driving record with no accidents/tickets will get you the best rates. On the other hand, a history of violations will result in a higher premium. An SR-22 requirement will also force your policy to be costlier.

Your Location and ZIP Code

Where you live matters a lot. Urban areas with higher level of traffic and more accidents tend to have higher insurance costs. Rural areas tend to have lower rates for premiums. Crime rates in your ZIP code also can be a factor.

How Often You Plan to Drive

The insurer will enquire about your driving habits. If you are only going to drive a couple of times a month, your rate will be lower. If you tell them you’ll be driving several times a week the cost will go up. Be honest in regards to the quantity you will be using.

The Coverage Limits You Choose

You have control of your liability limits. It will be the cheapest to choose state minimum. However, it is also the one that provides the least protection. Choosing higher levels, such as 100/300/50 will be more costly. But, it offers much better financial security.

Affordable liability coverage balances affordable. You want to save your money but well-protected, too. It’s often a good idea to opt to select limits that are above the state minimum. For those customers who run a company, commercial auto insurance has its own list of cost factors.

Non-Owner Insurance vs. Other Options

It helps when making this kind of policy choice to compare it to other choices. This allows you to has the ideal opportunity to see where in which it fits and if it’s proper for you. You have a couple of possible options, but they both have drawbacks.

Comparing to a Standard Auto Policy

If you have a car, then you need a normal policy. Simple as that. A non-ownership policy is not an option to vehicle owners. The biggest difference lies in the scope of the coverage. A standard policy covers your car, liability, etc. A non-owner policy only covers your liability if you are driving other people’s car.

How it Differs from Rental Agency Insurance

You can always purchase some insurance at the rental counter. This is convenient but is usually very expensive. Their liability and damage waivers can increase your options of daily rental costs by two-fold.

A non-owner’s policy gives you your liability coverage. Then, you can rely on your credit card often times for the collision damage waiver (CDW). This form of combination is often much cheaper than purchasing a rental company’s complete package. The use of various insurance types, like Humana dental insurance, must have a similar cost and benefits analysis.

The Risks of Relying Only on the Owner’s Policy

This is the riskiest option. While “permissive use” for the most part does cover you, there are some limitations. The policy of the car owner may exhausted for major accident if you are in a major accident.

The rest would be up personally to you. This would result in wage garnishing or loss of assets. Furthermore, the car owner’s premiums will increase enormously. This can put a strain on personal relationships. The non-owner policy keeps one away from these serious problems. Many people also compare various plans such as those of United Healthcare insurance in order to supplement their coverage.

“It is better to have insurance and not need it than to need it and not have it.”

– Unknown

What’s Protected

- Very affordable compared to standard policies.

- Maintains continuous insurance coverage.

- Fulfills SR-22/FR-44 legal requirements.

- Provides liability protection for rentals/borrowing.

What’s Excluded

- No collision or comprehensive coverage.

- Doesn’t cover damage to the car you drive.

- Not available if you own a car.

- Can’t be used for cars in your household.

Is Non-Owner Car Insurance the Right Move for You?

We’ve covered a lot of ground. By now, you should be able to have a clear picture. A Non Owner Car Insurance policy is a strong tool for a particular type of driver.

It’s for the person who drives and doesn’t have the money to buy. It’s for the savvy renter, the good borrower, and the driver getting on his/her feet. This is a cheap insurance layer and one that can save you from financial disaster. For other significant financial decisions, such as term life vs. whole life insurance, similar thought and consideration is required.

If you do not own a car but drive on a regular basis, the answer is probably yes. There is an invaluable peace of mind that comes with it. The cost is negligible compared to how risky it can to drive without insurance. For those that drive, there is a similar logic when it comes to motorcycle insurance.

It is up to you to make the final decision. Assess your driving habits. Take into consideration your financial position. If you are in the process of starting a new venture, you may need to consider also business insurance for your startup. Talk to an insurance agent to get some options. It is always a safe bet to protect yourself.

You can get more information about state requirements and laws about financial responsibility from sources such as the Insurance Information Institute (III). There are regulations that can be found on official sites such as the NHTSA. For specific state rules checking your local DMV website is always a good idea.

Frequently Asked Questions (FAQs)

Yes, you can. However, your premiums will be more expensive. This policy is also often the only way for drivers who have a history of violations to get the SR-22 filing they need to begin driving legally again.

Generally, no. If you are driving for work – for deliveries or ridesharing, for example – you will usually need a commercial insurance policy. Personal non-owner will not cover business use.

In most cases, you can have them to get a policy activated on the same day you apply. The process is quick, especially if you have all your information in hand when you call an agent.

It’s rare. Non Owner Car Insurance policies are something that most major insurance companies require you to call an agent to purchase. Their online systems are designed for the ordinary auto policies which are attached to a precise vehicle.

If you purchase a car, you must contact your insurance company as soon as possible. You will have to convert your non-owner policy into an ordinary owner auto policy. Your non-owner coverage will no longer be valid after you own a vehicle.

![Compliant Drivers Program: Is It Legit for Driver Safety? [2025]](https://propinfo.site/wp-content/uploads/2025/12/Compliant-Drivers-Program-150x150.jpg)

Leave a Reply