Are you looking for a way to accumulate great wealth, provide for your family and have a source of tax-free income in retirement? The concept of a Maximum Funded Indexed Universal Life policy often comes up in such conversations. It sounds complicated but it’s a great financial tool that combines a death benefit with a unique investment-like cash value component.

This is not your grandfather’s old life insurance act of the past. It’s an advanced game plan with a very specific goal and that goal is cash value accumulation. But is it right for you? As a hippo scholar for more than 10 years and my days as a financial content specialist I’ve observed these policies in action and have seen them work wonders for some, and become a burden for others;

The language of this complete guide we shall omit. We will discuss the advantages, disadvantages and realistic returns of this strategy. You will receive a un-biased clear look to help you make your final decision on whether it is something that you could fit in your financial plan.

What is Indexed Universal Life (IUL) Insurance? A Quick Refresher

Before we go down to the “maximum funded” part, let’s complete the basics. An indexed universal life insurance (IUL) policy is a kind of permanent life insurance. This means it’s designed to remain with you for life and you will never have to pay the term insurance premiums.

An IUL has three major elements:

- Death Benefit: A tax free lump sum that is paid to your beneficiaries upon your death.

- Cash Value: A separate account within the policy which increases with time.

- Premiums: The payments that you need to make in order to keep the policy running.

What is unique about an IUL is the way the cash value increases. It doesn’t pay a fixed rate of interest on it. Instead, its growth is based on a stock market index, such as the S&P 500.

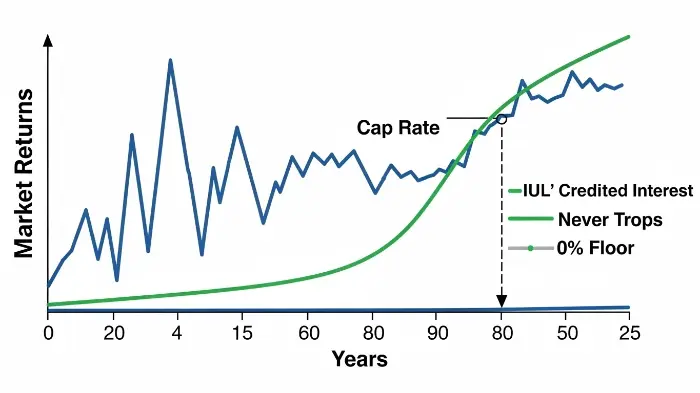

This is the relevant point- your money is not put directly in the stock market. You get to take part in the gains of the market but you are protected from the losses. This is done by a couple of key features:

- The Floor: Well this is your safety net. The floor is typically 0% or 1%. This means that if the market index crashes, your cash value will not lose money because of the result of the market.

- The Cap: This is the maximum return your cash value can credited during a particular year. If the cap is 10% and the index would have increased 25%, your interest that is charged to you is trapped at 10%.

- The Participation Rate: This is the percentage of the gain of the index you “participate” in. But if the rate of participation is 100% and you increase the index by 8% (then your cap is 10%), you earn monies equal to 100*8%, i.e. full gain of 8%. If it’s 50%, you’d get 4%.

Imagine one walking up an escalator. You get a boost when it is going up (it’s the market), but you can’t get higher than the ceiling (the cap). If the escalator stops or moves down then you simply don’t move off your step (the floor). You don’t go backward. This combination of the growth element with the protection is the heart of the appeal of an IUL policy.

The “Maximum Funded” Strategy: What Does It Really Mean?

Now, let’s get to the main event which is the Maximum Funded Indexed Universal Life strategy. This approach is all things turboPhone it being cash Value

Normally, you would pay a premium to pay for the insurance and add some to the cash value. With a Maximum Funded Indexed Universal Life plan, you want to overfund the policy. You pay absolutely as high a premium as the IRS will allow without altering the tax treatment of the policy. The theory is to minimize what goes to the death benefit and maximize what will go into your cash value account.

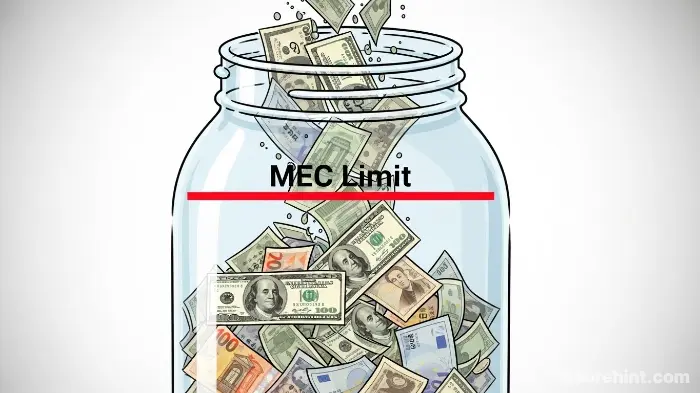

Avoiding the MEC Trap

The IRS has special regulations regarding life insurance. If you finance a policy too rapidly it becomes a Modified Endowment Contract (MEC). A policy that becomes a MEC forfeits one of its most powerful benefits – tax-free loans and withdrawals. Once a MEC, always a MEC.

The whole idea of using a Maximum Funded Indexed Universal Life strategy is to get to right up to that MEC limit but not cross it. This is so that your policy will maintain the favorable tax status while providing the maximum tax-deferred growth. This is the reason why you will sometimes hear this plans referred to as a 7702 plan, named after the part of the IRS tax code addressing life insurance.

As financial planner Ric Edelman says, “The goal is to put in as much money as the IRS allows.” This maximizes the compounding power inside the tax-sheltered environment of the policy.

Structuring this in the right way is critical. It takes an expert to determine the appropriate level of funding. When done correctly, you have a fantastic savings instrument that compounds tax free, and is tax-free in retirement. Some business owners even use this as a long-term savings independent of their need for commercial auto insurance.

The Major Pros of a Maximum Funded Indexed Universal Life Policy

When structured correctly, the following policies provide a great list of benefits. They are a favorite for high-income earners that have maxed out other retirement accounts such as 401(k)s and IRAs.

Tax-Advantaged Growth and Withdrawals

This is the number one reason that people choose a Maximum Funded Indexed Universal Life policy. The benefits are threefold:

- Tax-Deferred Growth: Your cash value continues to increase, year over year, with no taxes being required on the gains. This enables more efficient and faster compounding mechanisms.

- Tax-Free Access: You have the option of accessing your cash value by taking policy loans. Since these are loans against your death benefit, they are not treated as income, and are thus tax-free. This is the number one way that people create a tax-free retirement income stream from an IUL.

- Tax-Free Death Benefit: The amount of death benefit that is passed on to your heirs is usually free of income taxes.

This tax treatment is one of the most important benefits that life insurance has. According to the IRS itself, revenues received by a life insurance policy due to death of the insured is not usually subject to inclusion in gross income.

Potential for High Returns with Downside Protection

We touched upon this earlier but it bears repeating. An IUL is a unique value proposition. You get to participate in stock market gains by up to a cap. This provides you with superior growth potential than a savings account or CD.

The 0% of floor, however, means that your principal is safe from the downtrends of the market. In a volatile year where the market could fall 20%, cash value account gets a zero. You do not “lose a dime of your accumulated value” to market risk. This peace of mind is invaluable to the conservative investors.

Extreme Flexibility

Universal life policies are reputed to be flexible. You can often:

- Adjust Premium Payments: Once the initial period of funding is up you may be able to increase, decrease or even skip premium payments, provided that the cash value is able to cover the costs of the policy. This is far more flexible than, for instance, the rigid payment schedule of a whole life policy. It can more flexible than policy on temporary car insurance, which is fixed on the term of its time.

- Access Cash for Any Reason: It is the cash value that is your money. You may need to take out loans to fund a down payment on a house, you might need them to pay for college, start a business or to do, perhaps, their medical emergency. There are no restrictions to the ways you use it.

- Adjust the Death Benefit: You may be able to increase (with new medical underwriting) or decrease your death benefit as your life needs change.

A Built-In Death Benefit

Let’s not forget, at the most basic level this remains a life insurance policy. It is very important to have a safety net for your loved ones. This being both an investment vehicle and a protection tool is a great advantage. It solves with one product two financial needs: Many people struggle with what is best and how much insurance to get, as many are comparing Term life insurance vs whole life insurance; Insurance United Life (IUL) may be a third and more complicated choice.

Asset Protection

For business owners and high-net-worth people, this is an enormous advantage. In many states, the cash value stored in the life insurance policy is safe from creditors and lawsuits. If your business is sued, or if you are personally sued, this pool of money is protected. This makes it an attractive tool for people that also invest in things such as professional liability insurance for more sides of the tripod in their assets.

The Critical Cons and Risks of a Maximum Funded Indexed Universal Life Policy

Financial product is no panacea. It would be an injustice to overlook the great risk and downside to an IUL. You have to know these before you even consider one. A Maximum Funded Indexed Universal Life policy, although very powerful, is also very complex.

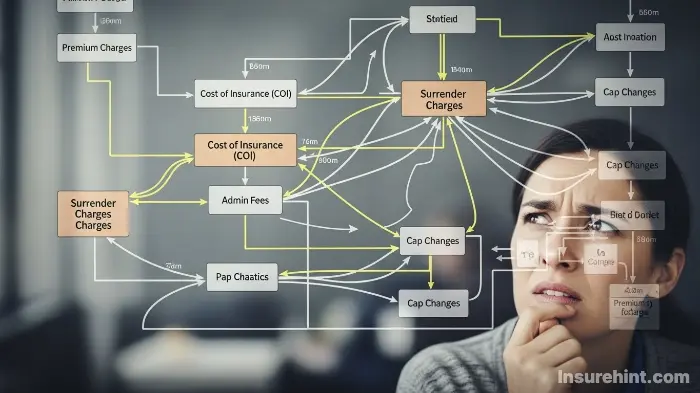

Complexity and Misunderstanding

IUL policies are not simple. The moving parts – caps, participation rates, fees and crediting methods are confusing. Unfortunately, sometimes these policies are marketed by agents who either don’t fully understand these policies or over-promise in terms of what they can do for you in regard to your policy.

According to a consumer alert by FINRA (the Financial Industry Regulatory Authority), “The way that IUL policy interest is calculated is complicated, and the policies themselves are complex. Unrealistic expectations are likely to cause disappointment.”

It’s so important to work with an advisor that will take time with you to educate you completely. Don’t be afraid to ask hard questions until you have understood each and every detail. A policy, such as a typical State Farm life insurance policy, is much simpler by comparison; this is an indication of both the complexity in IULs, and the fact that the market for life insurance products is fluid.

High Fees and Costs

IULs have huge internal costs attached to them. These fees can be a big drag to the returns you get, particularly in the early years.

Common fees include:

- Premium Expense Charges: A percentage collected from the top of all of your premiums.

- Cost of Insurance (COI): The amount of the cost of issuing the insurance to cover this death benefit each month. This increases as you grow older.

- Administrative Fees: Fix monthly or annual charges to administer the policy.

- Surrender Charges: Very large penalty if you have to cancel the policy during the initial 10-15 years.

A Maximum Funded Indexed Universal Life strategy help in combating this. By pumping so much cash into the policy early on, the cash value has got a bigger pool of base value to grow from, which will help it overcome the drag of fees faster than a minimally funded policy. Still, you will have to be conscious of costs, as you would when it comes to finding ways of lowering your car insurance cost.

Capped Growth Potential

The safety of the 0 percent floor comes at a price, the cap. While you are protected from losses, you have also forfeited the explosive gains of a huge bull market. If the S&P 500 rose by 30% in a year, you will not get this return. Your gain will limited by the cap which could be 9%, 10% or 11%. If your main objective is to maximize the return on your investment on the market, then investing directly in an index fund at a low-cost rate may be more suitable.

Illustrations Are Not Guarantees

This is the one single most important risk to understand. When an agent has an IUL, he or she will show you an illustration — which is a projection of what the policy might do over decades.

These illustrations are a hypothetical and is not bound to happen.

These are based on assumptions about future costs, cap rates and market performance. The insurance company can reduce cap rates or increase internal costs in the future. If they do, your policy will not do what it is illustrated in. Swimming on the rosy illustration is a recipe for later disappointment.

The Risk of Lapsation

If the policy doesn’t performance equally with the illustration and the internal costs (particularly the ever-increasing costs of insurance) chew up the cash value, your policy could be in trouble. It may mean that you have to pay much higher premiums than planned just to have it from lapsing. But if you can’t, you will terminate the policy. You would lose your death benefit and all the cash value and could even faced with a huge tax bill on the gains you took as loans.

Understanding IUL Returns: What Can You Realistically Expect?

So, what are the sorts of returns you can expect from a Maximum Funded Indexed Universal Life policy, after all? It’s important to have a healthy realism. You won’t enjoy the return of the S&P 500.

After controlling for caps, participation rates, and years that have a 0% return, a properly structured, low cost IUL has had long-term returns on average in the 5% to 7.5% range historically.

This return is not guaranteed, though. However, keep in mind that this is a tax-advantaged return. A 6% tax-free return on an IUL may be the same as an 8% or 9% taxable return to someone in a high tax bracket. The cash value accumulation is the main objective, and the manner in which these returns are taxed makes this very attractive. It’s a niche financial product, similar to the way that classic car insurance is a specific type of insurance policy for a specific asset.

To put this in perspectives lets compare a Maximum Funded Indexed Universal Life plan with other popular retirement vehicles.

Comparison Table: IUL vs. Roth IRA vs. 401(k)

📊 Investment Options Comparison

| Feature | Maximum Funded IUL | Roth IRA | 401(k) (Traditional) |

|---|---|---|---|

| Contribution Limits | Very High (MEC Limit) | $7,000 (2024, under 50) | $23,000 (2024, under 50) |

| Tax on Growth | Tax-Deferred | Tax-Free | Tax-Deferred |

| Tax on Withdrawals | Tax-Free (via loans) | Tax-Free | Taxable as Income |

| Market Risk | Floor protects principal | Full market risk | Full market risk |

| Upside Potential | Capped | Unlimited | Unlimited |

| Death Benefit | Included (Tax-Free) | None | None |

| Early Access (Pre-59.5) | Yes, via tax-free loans | Contributions only (penalty-free) | Loans available, but with limits |

This table clearly illustrates that a Maximum Funded Indexed Universal Life policy is a long term policy that has its own unique set of trade-offs.

Who is a Maximum Funded Indexed Universal Life Policy Best For?

This is not a product for everyone. It is a special tool made for a particular type of person and finances. It is generally a good fit for:

- High-Income Earners: Individuals that are currently maxing out their 401(k)s and IRAs. They need somewhere else to place in their retirement savings where they pay fewer taxes.

- Business Owners: They can use IULs to safeguard their families, to finance buy-sell agreements and to accumulate a pool of capital that is protected from business creditors. Finding affordable business insurance is one priority and building protected personal assets is another.

- Those Seeking Tax Diversification: People who are concerned about the tax rate in the future and wish to move forward in their lives with a bucket of tax-free retirement income to supplement their taxable 401(k)s and Social Security.

- Conservative Investors: People who are fond of stock market growth but are scared of losing their principal. The 0% floor offers the “sleep-at-night” factor which they crave.

This strategy is generally NOT for people with limited income, people that can’t commit to funding it for at least 10-15 years, or people looking for a absolute highest market returns. It’s also different from other specific policies, such as motorcycle insurance which has a singular and non-investment purpose.

How to Set Up and Manage a Maximum Funded Indexed Universal Life Policy

If you think that a Maximum Funded Indexed Universal Life policy is possibly right for you, going through the proper process is the key to success.

Step 1: Find a Reputable, Independent Advisor

Do not simply walk in your local insurance office. You need to work with an independent IUL design-advisor. They should able to compare policies offered by several top-rated carriers to find the one that is the lowest cost and provides you with the best features.

Step 2: Undergo Full Medical Underwriting

There is a huge impact of your health rating on the cost of insurance (COI). The healthier you are, the less money you spend and the better your cash value will perform. Be ready for a medical checkup. Your overall picture for health, like that is considered for United Healthcare insurance or Humana dental insurance is also a key factor.

Step 3: Structure the Policy for Maximum Funding

This is the most crucial step. Your advisor must set up the policy using the minimum amount of death benefit, based on the amount of premium you wish to be in the policy. This way as much of your payment as possible will go to cash value and just under that MEC limit. This is what makes a Maximum Funded Indexed Universal Life policy.

Step 4: Choose Your Indexing Strategies

Most policies have a number of index options (e.g. S&P 500, a global index, a volatility controlled index). You and your advisor will determine the strategies that would fit your risk tolerance.

Step 5: Commit to Annual Reviews

An IUL is not a “set it and forget it” type of product. You have to review the policy every year with your advisor. This review should test the performance of this against the original illustration and make adjustments where needed.

“A financial plan is a living document,” as one of the leading wealth managers points out. “Products like IULs require that they are checked on a regular basis to make sure that they’re still healthy and are on track to achieving your long-term goals.”

Common Mistakes to Avoid with a Maximum Funded IUL

Over the course of my career I have come across a few common mistakes that lead to an otherwise good plan being thrown off track. Be sure to make the following Avoid the following:

- Chasing the Highest Illustrated Rate: Don’t lured in by the illustration of 8% returns forever. Focus on guaranteed elements and more conservative and realistic projection.

- Underfunding the Policy: The “maximum funded” strategy works only if you fund it. If you don’t make payments early, the high premium costs can often easily kill your cash value.

- Ignoring Internal Costs: Ask to get a breakdown of all fees. A policy that can look good on paper may have high hidden costs that will eat away at your returns.

- Surrendering Early: These policies are there for the long haul. Cashing out for the first 10-15 years will probably lead to a great loss because of surrender charges.

Conclusion: Is a Maximum Funded IUL the Right Move?

A Maximum Funded Indexed Universal Life policy is one of the most powerful and versatile financial tools on the market today. It is a unique combination of tax-free growth, downside protection and a death benefit. For the right person – usually a high income earner wanting tax diversification and long term, protected growth – it can become a mainstay of a great financial plan.

However, it is not so much a magic bullet. The complexity, high costs and capped returns are major disadvantages that should carefully considered. The success of a Maximum Funded Indexed Universal Life plan depends completely on proper structure and consistent funding and on realistic expectations. It is not a DIY project.

Before you are thinking about purchasing a Maximum Funded Indexed Universal Life policy, it’s extremely important to talk with a qualified, independent financial advisor who can take a look at your very unique situation. This is a big decision and seeking the advice of an expert is the most important thing you can do. Your financial future is too critical to take any chances.

Ultimately the key to understanding whether the Maximum Funded Indexed Universal Life strategy is a right fit for your long term financial goals is an understanding of the nuances.

Short Frequently Asked Questions (FAQ)

The principle benefit is to attain a rapid increase in the cash value of the policy. This allows for the greatest funds available for tax-deferred growth, and thereby helps the growth of the policy overcome the internal costs far faster than a minimally funded policy.

You cannot lose your money as a result of market downturns because of the 0% floor. However, you may lose money if you surrender the policy early because of a surrender charge or if internal costs of the policy are higher than the interest being credited to the account.

While you can technically take loans at any time it’s generally not advisable for the first several years. You want to allow the cash value to grow and develop a strong foundation before you begin borrowing against the cash value, which is normally after 7-10 years.

It is not better, nor worse, just different. A 401(k) is a pure retirement investment account. An IUL is a hybrid product with insurance protection. Most experts suggest contributing to your 401(k) as much as possible (especially if your employer contributes too) before you consider getting a Maximum Funded Indexed Universal Life policy.

If your policy becomes a Modified Endowment Contract (MEC), then any loans or withdrawals of gains are taxed as ordinary income. They also might be subject to a 10% penalty – if you are under age 59.5. Death benefit is also tax free.

![Compliant Drivers Program: Is It Legit for Driver Safety? [2025]](https://propinfo.site/wp-content/uploads/2025/12/Compliant-Drivers-Program-150x150.jpg)

Leave a Reply