Thinking about the future can be a daunting exercise. We get it. But planning for your family’s financial security is one of the most important things that you will ever do. This is where Life Insurance comes in. It’s a potent weapon that is meant to save your loved ones.

This guide will take you out with all eyes and teach you the way of all things step by step. What we would like you to know is that we want you to be confident and prepared.

Why Thinking About Life Insurance is Important

You may feel that you are too young to need it. Or maybe you think that it is too complicated. Many people feel this way. However, life insurance is not so much about you as it is about them. It’s for the people who are relying on your income. It is a promise that they will be okay financially, whatever happens. To take this one step is an incredible peace-of-mind for all.

What Exactly is Life Insurance? A Simple Breakdown

Let’s break it down to smaller pieces on this big topic. At its core, it’s a contract. You agree to pay some amount of money called a premium. In return, the company takes an agreement to pay a huge amount of money, without any tax, to your family if you die. It is a very simple and powerful concept.

The Core Concept: The Death Benefit

The money that your loved ones receive is known as the death benefit. This is the central feature of any policy. It can be used for anything that they need. They may pay off the mortgage or they may pay daily living costs. The choice is completely up to them. This flexibility is a key reason why it’s so valuable.

Key Players in a Policy

Understanding the terms will have you some comfortable feeling. There are just a few key roles:

- Policyholder: It is you, who is the person who owns and pays for the policy.

- Insured: That is the person whose life is covered with the policy (usually also you).

- Beneficiary: Who will receive the death benefit, i.e., person, people or entity as you choose.

- Insurer: The company that provides the insurance coverage.

Why Do You Need Life Insurance?

Everyone’s reason is little different. Motivation will influence the kind of the policy you pick. But the majority of the reasons fall into a few main categories. It’s about ensuring a safety net to those that you leave behind.

Protecting Your Loved Ones

This is the main reason why people purchase life insurance. It ensures that your family would be able to maintain your standard of living. It can substitute your income for years to come. This is so that they do not have the immediate stress of financial collapse to grieve. It also accounts for final expenses, such as funeral expenses, which can be very costly.

Securing Major Debts

Most of us have debt. A mortgage is a big one. So are car loans, or student loans. If by any chance you were to pass away, these debts don’t go away. They may become an enormous liability to your family. A policy can help supply the liquidation in order to pay off these debts completely. This can spare your family from a loss of the home.

Future Financial Goals

You have dreams about the future of your family. Maybe you want to make sure your children go to college. Or perhaps you would like to leave something to an inheritance. Life insurance can be used to pay for these goals. It ensures that you will have money for him, even if you will not. It’s the way to keep promises that you’ve made.

Business Continuity

Do you have a business with a partner? If yes, what happens to the business when one of you dies? A special kind of policy (known as “key person” insurance) can help. The death benefit provides the surviving partner with the money to purchase the deceased partner’s shares. This is critical part of planning for affordable business insurance and making sure your company survives.

Do You Need a Financial Safety Net?

I have a spouse, partner, or children who depend on my income.

I have a mortgage or other significant debts to cover.

I want to fund future goals like a child’s college education.

I am a business owner with partners who rely on me.

The Main Types of Life Insurance Plans

You will find two major types of life insurance plans. They are term and permanent. Understanding the difference is of the utmost importance when it comes to choosing a policy. One is simple and temporary. The other is more complicated and lasts a lifetime. Let’s look at both.

Term Life Insurance: The Simple & Affordable Choice

Term life insurance is the most popular and easy is term life insurance. It offers coverage for a certain period of time, or “term.” Common terms are 10, 20, or 30 years. If you violent on during this term, your beneficiaries is the beneficiary’s gets of the death benefit. If the term expires and you are still alive, it is just that the coverage has expired.

Think about it as a business where you rent an apartment. You have a great place to live, for a given period of time. When your lease is up, you have options to renew the lease or move. You don’t build any equity. Due to its simplicity, term life insurance is the best way to get cheap life insurance. To many, this is all they need. You can get more into depth of specifics comparison term life insurance vs. whole life insurance.

“The time when it would have been best to plant a tree was 20 years ago.” The second best time is now.”

– Chinese Proverb

Whole Life Insurance: Lifelong Coverage with a Twist

Whole life is one of the permanent insurances. As the name implies, it is for your entire life. As long as you pay off on the premiums the policy never expires. It also has a savings component known as “cash value.” A portion of your premium goes into this account and spells out over time, tax free.

Think now of buying a home: it is like the above. Your payments are greater than rent though you are building equity. You can borrow against this cash value or you can even surrender the policy for the cash. This makes it much more expensive than term insurance. It’s a more advanced financial product that is aimed at a particular wealth-building or estate planning goal.

Other Types of Permanent Life Insurance

Besides whole life you may hear about other types of permanent policies. Universal Life has greater flexibility. You can vary your premiums and death benefits. In the Variable Life the cash value portion is allowed to go to the stock and bond sub-accounts. These are advanced options. As a beginner, you should in general concentrate on knowing term and entire life first.

How Much Life Insurance Do You Actually Need?

This is the million dollar question, sometimes literally. The answer is personal. It depends upon your income, debts and needs of your family. Don’t just guess. There are easy techniques to obtain a very good estimate.

The DIME Method

This is a great acronym to help you to remember what to include. It gives you a very solid number that is personalized.

- Debt: Sum up all your debts (the ones excluding mortgage). This includes credit cards, car loans and student loans.

- Income: How many years will your family need your income? Multiply your yearly annual income by that number (e.g. 10 years until the kids are adults).

- Mortgage: Add your remaining silk balance mortgage.

- Education: Estimate future costs of college for your children.

To get a comprehensive amount of coverage, add these four numbers together.

A Simpler Rule of Thumb

For those who think DIME is too much, it does have something easier to begin. Many financial experts suggest that you get coverage that equals between 10 and 15 times your annual income. So, if you earn $60,000 per year you would be shopping for a policy between $600,000 and $900,000. This is just an estimate but it’s good way better than just a wild guess.

Using an Online Calculator

For the most precise notion, implement a free web-based calculator. Many reputable financial web sites offer them. These tools use to guide you through a detailed questionnaire. They help you to consider things that you might have overlooked. A good place to go for such tools is the non-profit Life Happens, which is committed to educating consumers.

Term Life vs. Whole Life Insurance

Term Life

- Coverage Length: Fixed period (10, 20, 30 years).

- Cost: Much lower premiums.

- Cash Value: None. Pure insurance.

- Complexity: Very simple and easy to understand.

- Best For: Covering specific debts and income needs for a set time.

Whole Life

- Coverage Length: Your entire lifetime.

- Cost: Significantly higher premiums.

- Cash Value: Yes, builds a savings component.

- Complexity: More complex, a financial tool.

- Best For: Estate planning or lifelong dependent needs.

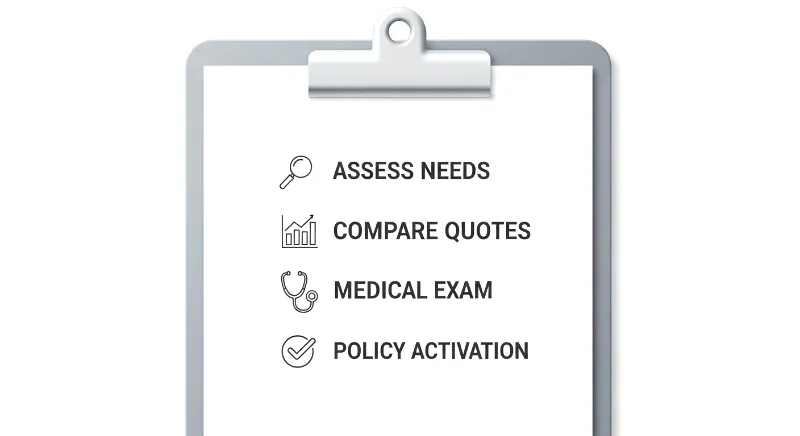

The Step-by-Step Process to Get Life Insurance

Buying a policy may sound like a scary undertaking, but it is a straightforward process. Knowing about what steps to take ahead of time helps it is much easier to get around. Then that is what you’ll be getting from beginning to end.

Step 1: Assess Your Needs

To begin with, figure out how much you need to be covered and what policy is right. Dime goes into 7. 571 dimes by 65% = number of quarters. 571 * 65% = number of quarters. 371 = number of quarters. Decide whether simple term life insurance will work, or you have needs that require you to get a permanent policy. This first step has everything to do with you – and your family.

Step 2: Compare Life Insurance Quotes

Do not accept the first offer that you see. Prices can vary radically from company to company for the exact same coverage. Get more than one life insurance quotes. You may accomplish this either through an independent agent or an online marketplace. Comparing quotes is one of the best tips on how to reduce the cost of car insurance, and the same applies here.

Step 3: The Application Process

Once you select a company, you will complete an application. This will request your personal information, income, as well as detailed health information. Be completely honest. Lying or not telling the whole truth will cause your claim to be also denied later. The short-term gain is not worth the risk of losing your family in the long run.

“Honesty is the first chapter in the book of wisdom.”

– Thomas Jefferson

Step 4: The Medical Exam

Most policies will require taking a brief medical exam. A licensed examiner will visit your house/home office. He or she will take your height and weight. He or she will also take your blood pressure and blood and urine samples. Some companies have “no-exam” policies, but are frequently more expensive for the same coverage. Your overall health may also affect other policies, such as obtaining good Humana dental insurance.

Step 5: Underwriting – The Waiting Game

This is where the insurance company determines your risk. They will review your application, your results of medical exam and other public records. They could run a check of your driving history, or check your writer’s prescription history.

This process takes a couple of weeks. The job of the underwriter is to classify your level of risk for setting your final premium. The riskiness of your job can also factor in, and something to consider when it comes to policies such as professional liability insurance.

Step 6: Policy Approval and Activation

Once underwriting is complete you will receive a final offer. And if you accept it, the company will send you the policy documents. Read them carefully. To be able to activate your coverage, you have to sign the documents and make your first premium payment. Congratulations! Your family is now protected.

Factors That Affect Your Life Insurance Rates

Insurers are in the business of risk. They have the responsibility to set your premium based on what they believe are the chances that you’re likely to die while the policy is in force. There is much that goes into this calculation.

Your Age and Gender

This is a big one. The younger you are when purchasing a policy the cheaper it’s going to be. Rates are much higher with every birthday. Statistically, women live longer than men and hence they often pay slightly less for life insurance.

Your Health History

Your present health and the history of your family’s medical issues is of vital importance. Underwriters will seek conditions such as heart disease, diabetes or cancer. Having a well managed health condition is much better than unmanaged. This is why it is also important to have good health coverage such as from United Healthcare insurance for your overall financial picture.

Lifestyle Choices

What you do every day matters. Smoking or tobacco use Smoking is the single biggest factor that will set your rates increasing. Risky hobbies such as skydiving, scuba diving or racing can also add to your premium. Even your driving record can make a difference – similar to that of motorcycle insurance.

The Policy Itself

Finally, the policy you choose has an impact on the price. A larger death benefit will be more expensive. A long term length will also cost more. A $1 million, 30 year policy will have a higher premium than a $500,000 policy with a 20 year term.

What Drives Your Life Insurance Cost?

Higher Cost Factors

Older Age, Smoking, Chronic Health Issues, Risky Hobbies

Lower Cost Factors

Younger Age, Being a Non-Smoker, Good Health, Safe Job & Hobbies

Finding Cheap Life Insurance Without Sacrificing Quality

Everyone wants a good deal. Getting cheap life insurance doesn’t mean that you have to make do with a bad policy. So it means being a good smart shopper. There are a number of proven ways to cut your costs.

Buy Sooner Rather Than Later

This is the most simplest way to save money. Because age is one of the major rating factors, as you get older, the more you may have to pay in premiums. And locking in a low rate when you are young and healthy will save you thousands of dollars over the life of the policy.

Live a Healthy Lifestyle

Insurers reward healthy behaviours. If you smoke, stopping the habit is the single best thing you can do in order to decrease your rate. Most companies have non-smoker rates as long as you have been nicotine-free for a minimum of 1 year. Keeping down weight and blood pressure maintains health also.

Choose the Right Term Length

Don’t buy more than you need. Match the length of your terms to the time-length of your longest financial obligation. If your mortgage will be paid off in 22 years, then 25 years will probably be a better deal than 30 years. This can save you an amazing amount of money on your premiums. This is distinct from insurance for specific assets, for example, when you need temporary car insurance for a specific period of time.

Work with an Independent Agent

An independent agent is not attached to one company. They work for you. Their task is to shop your profile with dozens of insurers in order to find you the best rate. This is often the most efficient when it comes to comparing the market and determining hidden savings. Some major companies have their agents working largely independently such as State Farm Life Insurance, so it’s good to compare both routes. For more information you can also turn to such official resources as the National Association of Insurance Commissioners (NAIC).

Dwivedi says “an investment on knowledge pays the best interest.”

– Benjamin Franklin

Common Life Insurance Mistakes to Avoid

To know what not to do is just as much important as knowing what to do. Avoiding these common pitfalls will insure your policy will work the way it is intended when you need it most – when your family needs it.

Procrastinating

Waiting is the most common and most expensive mistake. Not only do rates increase with age, but an unexpected health problem could make you extremely costly to insure or even put you out of the insurance pool altogether. The time to get coverage is now, while you are as young and healthy as you are ever going to be.

Buying Too Little Coverage

Many people take their needs for granted. A $100,000 policy may seem like a lot of money, but it may not last long and after paying for a funeral, a mortgage, replacing lost income. Use the DIME method in order to obtain a realistic picture. It’s better to have too much and not enough.

Not Reviewing Beneficiaries

Life changes. You might get married, have kids or get divorced. It is very important to review your beneficiaries following any significant life change. You want to ensure that the money goes to the right people. An out of date beneficiary designation is a common and heart-breaking problem.

Forgetting About Employer-Provided Insurance

Insurance through your job is a really good perk. However, it’s usually not sufficient coverage. It’s also often not portable, i.e. you lose it if you lose your job. Model on students some discussion of why you could supplement it and why it isn’t essential; e.g.

Think of it as a nice supplement, not your primary policy. By holding a private policy, you are in control. The same logic can be applied to other niche policies, for example, you wouldn’t rely on your personal policy to cover work vehicles, you’d need commercial auto insurance.

Reviewing and Managing Your Policy

Your life insurance policy is not a “set it and forget it” product. Your life will change and your needs may change as well. Plan to review your policy on a periodical basis every few years or with the onset of a major life event.

You should take your coverage under consideration after you purchase a new home, have another child, or take a big raise. However, you may discover that you require more protection. On the other hand, as you grow older and your children grow up on their own, you may require less.

You can learn more about insurance needs as they change over time by reading more about specialized topics, such as classic car insurance. For very comprehensive financial advice a website such as Investopedia can also be very useful.

Your First Step Towards Peace of Mind

We have covered quite a lot of ground. Now you know what life insurance is and why life insurance is important and how to obtain life insurance. It may be a big decision to you, but it is a manageable one. It is one of the most selfless financial decisions that you can take.

The first step of the journey is one step. That step is taking out your first life insurance quotes. Have a look at what is out there, and how much it can cost. Protecting the future of your family is a great act of love. You have the knowledge now. It’s time to put it into action.

Frequently Asked Questions About Life Insurance

Yes, you absolutely can. Many people have a policy through work and a private term policy. You can also “ladder” multiple term policies to ensure that your coverage diminishes as your financial needs reduce over time.

As for the term policy, if you stop paying then we will lapse the policy and your coverage will end. For policy of whole life, the company may use the accumulated cash value to pay the premiums for some time before it lapses.

In all or almost all cases the death benefit that is paid to your beneficiaries will be 100% income tax free. This is one of the best advantages of life insurance.

Most traditional policies require one to get the best rates. However, there are a lot of “no-exam” or “simplified issue” policies available. They have their convenience they offer guarantee at a higher price.

The optimum age is as young as possible (your twenties or thirties). This is when you are able to lock in the lowest rates for decades. However, it’s never too late to get a coverage so that you get to protect your loved ones.

![Compliant Drivers Program: Is It Legit for Driver Safety? [2025]](https://propinfo.site/wp-content/uploads/2025/12/Compliant-Drivers-Program-150x150.jpg)

Leave a Reply