Deciding which company provides Liberty Mutual Home Insurance to me can be a daunting task, especially as she had that catchy jingle and that emu popping up everywhere. But in addition to the clever marketing, how does their coverage really compare with the industry’s colossal giants?

You need more than just a quote to do it. You need clarity. Consequently you need a detailed breakdown of the coverage, discounts, and real world customer experiences.

This guide is a neutral and analytical deep CI. We will take Liberty Mutual Home Insurance apart by putting it head on with the competition such as State Farm, Allstate, and Geico. We’ll take a look at everything perhaps from policy customization to claim satisfaction to make for a truly informed choice for your most valuable asset.

Understanding the Liberty Mutual Difference

Liberty Mutual has been part of the insurance industry backbone since 1912. It has since developed over a century into one of the largest property and casualty insurers in the United States.

What distinguishes Liberty Mutual is that it focuses on customizable policies. Unlike some competitors who offer rigid, tiered packages, Liberty Mutual An offer that lets you build a policy that meets your own specific needs. This means that you only pay for the protection you really need.

Their approach focuses on offering a base level of protection, and offering a vast range of endorsements. This a-la-carte model is perfect for homeowners that wish to have a granular amount of control over their policy. In addition, they have a strong digital presence so getting quotes and managing your policy is easy to do online.

However, this customization can be the double-edged sword as well. With the variety of options, it’s a lot of confusion for first-time homebuyers. That’s why it is so significant to know about their core offerings before committing.

Dissecting Liberty Mutual Coverage Options

At its most basic level, a typical Liberty Mutual Home Insurance policy, sometimes referred to as an HO-3, offers a good basis. Understanding the particulars of the liberty mutual coverage is the first step of any worthwhile comparison.

This standard policy usually contains:

- Dwelling Coverage: Protect The Physical Structure Of Your House.

- Other Structures: Includes structures such as garages, sheds or fences that stand separate and apart from the home.

- Personal Property: Insures your items, everything done from furniture to electronics.

- Loss of Use: The amount covers your living costs in case your home is rendered uninhabitable during the commission of repairs.

- Personal Liability: Provides for your financial protection if somebody is injured on your property.

- Medical Payments to Others: Covers on selected minor medical bills of non-residents injured at your home.

Optional Endorsements: Tailoring Your Policy

This is where Liberty Mutual’s customization comes in. You can supplement your basic policy with a number of useful add-ons.

For example, water back-up and sump pumps overflow insurance is a popular option. This insures you against a kind of damage that is very common and very expensive and that is not usually included in the normal policies.

Another important option is identity theft protection. In a rapidly digitalized world, this recommendation renders services on how to help you regain your identity and recover financial losses. For those who have high-value items you may also want to consider adding additional coverage for jewelry, art or electronics which often are a restricted coverage under a standard policy.

The Power of Bundling: Auto, Home, and Liberty Mutual Renters Insurance

One of the biggest ways to spend less money is through bundling. Like any insurance company, insurers reward their loyal customers and Liberty Mutual is no exception. By combining your home and auto insurance, you can be eligible for a significant savings.

This multi-policy discount is one of their value props. In fact, Liberty Mutual often advertises hundreds of dollars a year savings for customers who bundle. This may significantly reduce your overall property insurance rates.

Furthermore, this strategy is not limited to homeowners. If you currently own a rental, you can begin to develop a relationship with the company with liberty mutual renters insurance. This is a smart move if you are going to purchase a home in the future.

When you bundle your liberty mutual renters insurance together with an auto policy you still qualify for a multi policy discount. Then later when you buy a home, it is often an easy transition to get your renters policy to be a homeowners policy. It will that preserves your discounts and makes your insurance easy for you. Similarly, if you need for particular policies like motorcycle insurance, you may package it together for additional savings.

“In today’s market, consumers are looking for more than just a low price, they want flexibility.” Insurers such as Liberty Mutual, which are giving its customers opportunities to construct their own policies, are fueling a huge need for their personalized risk management.”

— Insurance Market Analyst Report, 2023

Finding Every Home Insurance Discounts Possible

In addition to bundling, Liberty Mutual has an impressive list of home insurance discounts. It’s finding and applying for these that can have a big effect on your annual premium. You should take an active role in asking your agent about all possible savings.

Many homeowners pass on discounts simply because they are unaware of them. For example, having safety and security devices such as smoke detectors, fire extinguishers, and burglar alarms, can reduce your rates.

The recent replacement of your roof may also qualify for a large discount, as a new roof is less likely to be damaged by a storm. Similarly, being claims free for a specific period of time (usually from 3-5 years) shows the insurer that you are a low risk client, often leading to a discount.

Other possible discounts include:

- Early Shopper Discount: Getting a quote before your current policy expired.

- New Homebuyer Discount: For those that bought their home in the past year.

- Paperless Policy Discount: Switching to electronic documents.

- Preferred Payment Discount: Setting up automatic payments.

💰 Discount Finder Checklist ✨

The Ultimate Homeowners Insurance Comparison

Now, let’s get to the main event. We’ll go head-to-head between Liberty Mutual and its top homeowners insurance comparison competitors to see how well Liberty Mutual scores. We will be analyzing four different key areas: coverage, cost, customer satisfaction, and digital experience.

This direct comparison is the best way of identifying the subtle differences that may make one company a better fit for you than another. Remember, the “best” insurer is subjective and serves entirely your individual needs and priorities.

A Head-to-Head Analysis of Liberty Mutual Home Insurance vs. State Farm

State Farm is the largest home insurance provider in the U.S. The company boasts its huge network of local agents. This creates a basic difference in customer service model as in Liberty Mutual.

Coverage Showdown

Both companies have very good standard HO-3 policies. The power of State Farm is its simplicity, accompanied by the direction of a dedicated agent. They are excellent in talking new buyers through the process.

However, Liberty Mutual Home Insurance has often more unique and modern endorsements. For instance, their inflation guard protection that automatically increases your coverage limits to neutralize inflation is an important advantage.

State Farm has similarly broad shields by way of protection whereas Liberty Mutual’s a-la-carte menu can be deeper in certain protection. If you have any specific needs, such as if you run a business out of your home and have unique valuables, Liberty Mutual may have a more tailored solution. It is always a good idea to go for a comparison of specific endorsement costs including professional liability insurance if you are running your business from home.

Cost and Discount Comparison

When it comes to cost, there’s no obvious winner, it’s very location, value of house and risk based. Generally, the coverage offered in some regions by State Farm can have slightly lower base premiums, however Liberty Mutual’s discounts can quickly fill that gap.

Liberty Mutual’s “New Roof” and “Early Shopper” discounts are especially aggressive. State Farm’s main discounted benefit is the bundling of home, auto and life insurance. If you are looking into state farm life insurance policy, then the savings added together can be massive.

The best thing to do is to get a direct quote from both. Pay mind to not only the premium, but to the deductible as well as the coverage limits. A lower cost for insurance could translate into a higher deductible at the time of a claim, which could cost you more.

Customer Satisfaction and Claims

This is where the agent model of State Farm really shines. According to the 2023 U.S. Home Insurance Study by J.D. Power, State Farm is regularly ranked above average for overall customer satisfaction and claims handling.

There is often an emphasis from customers on the personal touch of having a local agent to make the call. This can be a very comforting experience during the stressful process of making a claim. It’s also important to look at financial stability of an insurer through such resources as AM Best, where both companies have high ratings.

While having enhanced its digital claims process, Liberty Mutual on occasion receives mixed reviews on claims satisfaction. Some customers say they go through a smooth, fast process, but others feel as though they are getting stuck in a more business-like, call center setup.

The Verdict: Agent vs. Algorithm

- Choose State Farm if: You appreciate having a personal relationship with a local agent and enjoy a top cut of claims satisfaction scores.

- Choose Liberty Mutual if: You are the savvy shopper that wants to customize your policy with specific endorsements and to maximize discounts.

A Deep Dive into Liberty Mutual Home Insurance vs. Allstate

Allstate is another industry titan; known for its “You’re in Good Hands” slogan. In that sense, they are head-to-head competition with Liberty Mutual for people who like both a combination of digital tools and the availability of agents.

Coverage and Endorsements

Allstate and Liberty Mutual both have very similar coverage structures. Both offer a strong base policy with a wide range of optional add-on.

Allstate’s stand out features include their Claim RateGuard; where your rates will not increase following your first claim. They also have a strong “new home” discount.

On the other hand, Liberty Mutual Home Insurance has more flexibility in its personal property coverage. That could have high sub-limits for specific categories of items or make it easier to add scheduled personal property endorsements for valuables. This would make it a good choice for collectors or those who have expensive hobbies.

Analyzing Property Insurance Rates and Discounts

The price of both companies are competitive pricing. Allstate tends to reward customers for being proactive when it comes to home maintenance and safety. Their “Responsible Payer” and “Easy Pay Plan” discounts are not unlike Liberty Mutual’s.

However, Liberty Mutual’s bundling discount is often cited as being one of the most significant on the industry. If you have a clean driving record, and you can package it with a policy such as commercial auto insurance the savings in your home policy could be huge.

The most important thing to do is run a full quote for all your policies together. Don’t just compare the home insurance premium; The total insurance cost of your insurance package is what really matters.

Claims Process and Customer Feedback

Allstate, like State Farm, has a good level of satisfaction with claims in J.D. Power studies. They have a positive reputation claims process that includes their Digital Locker app. that helps you inventory your belongings before disaster strikes.

Liberty Mutual has made a significant investment into its mobile app and online claims portal. For people who are comfortable playing things from the digital side the process can be very efficient.

However, customers who feel more comfortable speaking to a person throughout the process may find Allstate’s model of combining digital tools and accessible agents more reassuring.

The Verdict: Customization vs. Claim Guard

- Choose Allstate if: You want the security of having features such as Claim RateGuard and would prefer a company with consistently high claims satisfaction ratings.

- Pick Liberty Mutual if: Customization of the policy is your greatest concern and getting the largest bundling discount possible is your main priority.

📊 Competitor Comparison Matrix 🎯

| ⚡ Feature | 🗽 Liberty Mutual | 🏠 State Farm | 🛡️ Allstate |

|---|---|---|---|

| 🎯 Best For | Policy Customization | Agent Relationship | Claim Forgiveness |

| 💰 Key Discount | Large Bundling Savings | Home/Auto/Life Bundle | New Home/Safe Driver |

| ⭐ J.D. Power Score | Average | Above Average | Above Average |

| 📱 Digital Tools | Excellent | Good | Excellent |

Liberty Mutual Home Insurance vs Geico: A Unique Matchup

This is a slightly different comparison. Geico is mostly an auto insurance company. For home insurance they’re an insurance agency who put you in touch with one of their network of companies, who may include Liberty Mutual itself.

Understanding the Geico Model

When you buy a home insurance quote from Geico, you are not actually buying a Geico Home Insurance policy. You’re purchasing a policy with a third party underwriter such as Liberty Mutual, Travelers or one of the best home insurance companies.

The main advantage in this case is convenience. If you are currently with Geico auto insurance, through Geico portal you can manage your home policy. They deal with the front-end experience, but the claim for that will end up being processed by the underwriting company.

Is There a Cost Advantage?

Sometimes, yes. Because of their huge size, Geico can negotiate very good terms with their partners. You might find that going through Geico will get you a tad bit better of a deal on a Liberty Mutual Home Insurance policy than going to Liberty Mutual directly.

Auto and home bundling discount through Geico is also really strong. This is one of the important factors that make many people loyal to their platform. For people who want to save on their car insurance cost, bundling via geico is an enticing possibility.

The Downside: The Middleman

The biggest disadvantage is the possibility of confusion during a claim. You could potentially start the claims process with Geico instead, but you’ll end up being handed off to the underwriting partner. This can add an extra layer of communication that can frustrate some customers.

If your policy is underwritten by Liberty Mutual, your claims experience will be like that of any other Liberty Mutual customer. The one difference is in how you originally bought and bundled the policy. This is also the same if you require specialized policies such as classic car insurance, where the process is similar to this.

The Verdict: Simplicity vs. Direct Service

- Choose Geico (for Home Insurance) if: You already have Geico auto insurance and are most concerned with the convenience of just one point of contact for billing and first inquiries.

- Choose Liberty Mutual Directly if: You want to have a direct relationship with your underwriter from the very beginning, particularly with dealing with your claims and expressing very specific details about the coverage.

“While customer-facing metrics like satisfaction scores are important, the foundation of any great insurer is its financial strength’. A high rating from an agency such as AM Best means the company has the capital to pay the claims even in the event of widespread catastrophe.”

— Senior Financial Analyst, Insurance Sector

So, Who Should Choose Liberty Mutual Home Insurance?

After this highly detailed comparison, it becomes apparent what the ideal Liberty Mutual customer profile is. This isn’t being better or worse its right fit.

The Customizer and Savvy Shopper

You are the perfect candidate for Liberty Mutual Home Insurance, if you love to tinker with options. There is no need to have a one size fits all policy. You want to add water back-up protection, increase your liability limits and be sure your home office equipment is fully covered.

Or you are a conscientious shopper. You like the process of locating all the possible discounts. You are excited with the concept of putting together a new roof discount and bundling discount, plus a paperless discount. You’re willing to put in the time to construct the perfect policy at the best price.

The Digitally-Minded Homeowner

You prefer to deal with your accounts using the internet or an app. The idea of calling an agent for every little question seems like an inefficient thing to do. You want to be able to download your policy documents, file a claim to have a claim status checked all from your smartphone.

Liberty Mutual’s powerful digital tools play to this preference directly. Their online portal and mobile app is user-friendly and comprehensive so that there is a high degree of self-service possible. If you need other types of insurance, such as affordable business insurance, you prefer being able to obtain a quote quickly online.

The Bundler

You understand the power of loyalty. You want all your primary insurance policies, home, auto; might even be a term life insurance policy, all under one roof for the best possible insurance savings and to make it easier on you for making payments. Liberty Mutual Home Insurance highly rewards this behavior with some of the greatest multi-policy discounts in the industry.

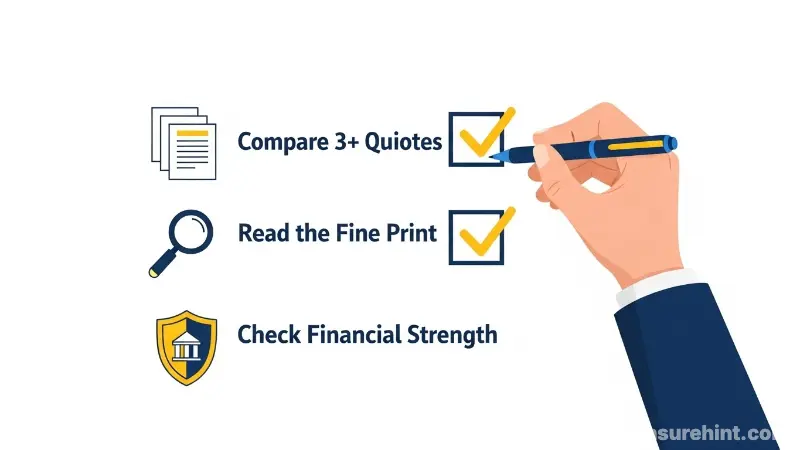

Final Considerations Before You Decide

Choosing an insurance provider is a big financial decision. Before you sign on the dotted line with any company, send them these last words.

First of all, always get at least 3 quotes. Use this guide to choose three competitors that fit your profile – maybe Liberty Mutual, State Farm, and Allstate are the three. Compare them, line-by-line, with respect to premiums, deductibles and coverage limits.

Second, read the fine print. Understand the things that are excluded from your policy. For example, flood and earthquake damage are almost never covered by the standard home insurance and require separate policies. Similarity, certain health related coverages are separate case like if you were looking for Humana dental insurance or United Healthcare insurance.

Finally, consider the long term relationship. Is financial strength of the company sound? Are they investing in technology that will help make your life easier as they go forward? Do their ethics of values coincide with yours? Finding a partner: Answering these questions will help you find one, and hopefully, not just a provider either. Even if only you need coverage for a short while, such as with temporary car insurance, it pays to do your research.

Conclusion: Making the Right Choice for Your Home

Ultimately, the Liberty Mutual Home Insurance vs Top Competitors debate between the two companies isn’t really a question of finding a winner. It is living to seek the correct match of your special situation. Liberty Mutual cuts out a powerful niche which is the ideal choice for homeowners who require customization, are at ease with a digital first experience and are eager to take advantage of large bundling discounts. Its flexible policy structure lets you pay for precisely the protection that you need and nothing that you don’t.

While competitors such as State Farm offer a more personal touch, agent driven insurance, and Allstate offers unique features such as claim forgiveness, Liberty Mutual does stand tall in the pursuit of those who wish to be in the driver’s seat of their policy making. By comparing quotes, knowing your own priorities, and doing the digging to get the discounts you can be confident if your home is under their protection. Your final decision should be based on a balanced view of cost, coverage and service in order to have peace of mind in years to come with your Liberty Mutual Home Insurance policy.

Frequently Asked Questions (FAQs)

Yes, in most cases. The personal liability portion for a standard Liberty Mutual Home Insurance policy usually extends to incidents such as a dog bite. However, coverage may be denied or limited if you own a dog from one of their breeds they consider to be a high-risk breed or the dog has a history of being aggressive. At all times you should tell your insurer about your pets.

Inflation guard is an optional endorsement that will automatically increase your dwelling coverage limits annually. This is to help make sure that your coverage is keeping up with the increasing costs of construction and labour (for example) so that you’re not underinsured if you have to completely rebuild your home after a total loss.

Customer experiences vary. Liberty Mutual has a streamlined digital claims process that many believe is efficient. However, they have average scores in J.D. Power’s property claims satisfaction studies, below some top competitors like State Farm. Your experience might vary, depending upon how complex your claim is, and who is assigned to handle your claim.

Yes but it will probably impact your premium. There is a practice by most insurers, such as Liberty Mutual, of using an insurance score (which is based partially off your credit history) to determine rates. A lower credit score can mean higher premiums, since there are statistics that the lower your score, the higher your probability of making a claim.

This is also called “Loss of Use”, also known as Additional Living Expenses (ALE), which stands for the amount of money that you have to spend if your home becomes uninhabitable due to covered peril. This can include hotel bills, restaurant food and other necessary bills that are above your normal cost of living while your home is being repaired. The limit of the coverage is usually expressed as a percentage of your dwelling coverage.

![Compliant Drivers Program: Is It Legit for Driver Safety? [2025]](https://propinfo.site/wp-content/uploads/2025/12/Compliant-Drivers-Program-150x150.jpg)

Leave a Reply