Are you tired of old-school insurance? We certainly hear you. The paperwork could be a nightmare. In addition, the phone calls tend to be endless. Luckily that’s where a new game player comes into the picture. This review examines lemonade renters insurance. It promises a fresh, digital-first experience. However, is it as good as it is cracked up to be?

We’ll dig deep into this modern day insurer. Specifically, is it really as fast – and simple – as they are claiming? Is it really possible to get a policy in 90 seconds? We will also examine their coverage options. Furthermore we are going to look at the unique AI powered claims process. Ultimately, you will know whether Lemonade is the perfect fit to protect your stuff. Let’s get started.

Part 1: Understanding the Lemonade Insurance Model

What Makes Lemonade Different?

Lemonade isn’t your typical insurance company. In fact, it launched in 2016 with an ambitious mission on its shoulders. The company wanted to turn the face of the insurance industry upside down. To perform such things, they rely on artificial intelligence (AI) and chatbots. This strategy helps them work with amazing efficiency.

Their business model is also quite unique. For example, they are a certified B-Corp. This designation means they balance their profit with some social good. The company fees themselves take a flat fee of your premium. After that, the rest is allocated towards paying claims. What’s left over? It then goes to one of the charities you choose. This is of course their famous “Giveback” program.

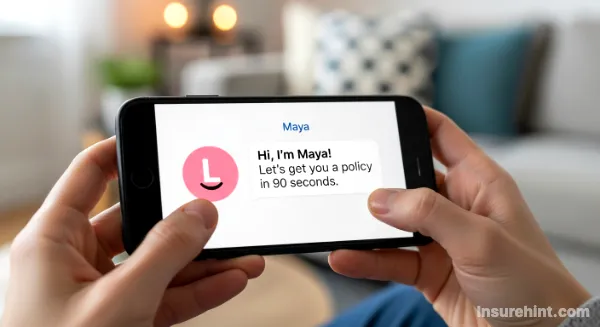

The Power of AI: Meet Maya and Jim

The secret sauce of Lemonade is its AI. You are not going to talk to a human agent initially. Instead, you’ll talk to an AI Bot, Maya. Maya deals with the quoting and signup process. She asks simple questions. In a matter of minutes, you can have a policy. Indeed, it seems to be just text messaging a friend.

Filing of a claim is also taken care of by AI. For this, you meet AI Jim. Claims are handled directly through the Lemonade app by him. Indeed, Lemonade claims that Jim can review and pay claims in seconds. This process helps in avoiding long waits and complicated paperwork. Therefore, it’s a core of their promise for a fast and easy experience. This AI-powered insurance model is a game-changer for a lot of people.

The Giveback Program: Insurance with a Heart

Many individuals do not like insurance companies. In particular, they believe that companies make money by denying claims. Lemonade, however, attempts to solve this conflict. The company takes a fixed percentage for their operations. The rest is then reserved for paying out claims.

Any residual money doesn’t get converted to profit. Instead, it’s used to donate to varies causes about which you care. You make a selection at sign-up and choose a charity when you sign-up. This could be for animal rescue, civil rights or environmental. This model means that they have no incentive to refuse paying you when you make valid claims. As a result, it makes their interests line up with yours.

“The number one thing that has been an issue in the insurance industry is the perception of the alignment of interest.”

– Daniel Schreiber, CEO Lemonade.

Part 2: A Deep Dive into Lemonade Renters Insurance Coverage

So, what is lemonade renters insurance protecting? Let’s break down the coverage. After all, it’s important to know with what you are paying. The majority of policies are based on three core pillars.

Personal Property Coverage

This is the heart of any renters policy. It works in protecting your personal belongings. Think of all of the things you own. You don’t just get your laptop, your furniture, your clothes, your TV. If they are stolen or damaged, this helps.

Lemonade insures the damage from specific events. Generally, these are typically referred to as “named perils.” They include things like:

- Fire and smoke

- Theft and vandalism

- Windstorms and hail

- Water damage from the pipes (not floods)

You decide the amount of coverage you want to covered. A good place to start, for instance, is to develop a home inventory. This list helps you to estimate the value of your stuff. Don’t underestimate the amount you own that insensitive driver! Indeed, it adds up quickly.

Actual Cash Value (ACV) vs. Replacement Cost (RCV)

It is vital to understand this difference. One is that ACV pays for the depreciated value of your item. An RCV policy, on the other hand, pays for a brand new one. Lemonade normally has ACV as standard. However, often you are able to upgrade to RCV for a slightly higher premium. We have highly recommended the upgrade.

Personal Liability Protection

So this is incredibly important coverage. Basically, it is for you financially. You wonder what if a person gets hurt in your apartment? Conjure up a guest that slips and falls. They could for instance sue you their medical bills. Fortunately, you have personal liability insurance to cover your back.

Includes legal fees, medical payments. Standard policies, for example, often have $100,000 in coverage. You can usually be able to increase this amount. Because of this, and considering the way that lawsuits can be very costly, this is a lifesaver. This protection is not only for your home though. It can also cover you in the event that you accidentally damage someone else’s property. However, it does not cover professional mistakes; for that, you would need separate professional liability insurance.

Loss of Use (Additional Living Expenses)

What if a fire makes your apartment unlivable? Where would you go? Well, this is where Loss of Use coverage is useful. It is also referred to as Additional Living Expenses (ALE).

Lemonade will pay for temporary housing. This may be a hotel or short term rental. It also covers extra costs. This includes things such as restaurant meals. It helps you in maintaining your normal standard of living. As a result, you can concentrate on getting back on your feet.

Personal Property

Protects your belongings like furniture, electronics, and clothing from theft or damage (fire, smoke, etc.).

Personal Liability

Covers you if you’re legally responsible for accidents that injure others or damage their property.

Loss of Use

Pays for hotel stays and other living expenses if your home becomes uninhabitable due to a covered event.

Part 3: Customizing Your Lemonade Policy

A basic policy is quite a good starting point. However, other times you’ve got to have more. Therefore, there are several add-ons that Lemonade makes available. These in turn allow you to customize your coverage according to your life. This is where you can get extra coverage.

Extra Coverage for Valuables

Standard renters policies have a cap. In the industry, they know these sub-limit as such. As an example, jewelry coverage may have a maximum coverage of $1,500. So, what if you engagement ring is more valuable? You will need extra coverage.

Lemonade has the power to schedule high-value items. This includes:

- Jewelry

- Fine art

- Cameras

- Bicycles

- Musical instruments

You give the details and an appraisal. They add it to your policy. This is to ensure that your most prized possessions are fully protected. This is the same way one would get classic car insurance for a special car.

What Isn’t Covered by Lemonade Renters Insurance?

It’s very important to know what’s out. It helps avoid denials of claims that may come up incorrectly. Lemonade renters insurance does not cover:

- Floods and Earthquakes: These need to decided on separately.

- Your Roommate’s Stuff: Your policy only covers you. They need their own.

- Your Car: The damage to auto is excluded. For that, you have to have a separate policy. This is true if you need coverage on a car, motorcycle insurance or even commercial auto insurance.

- Bed Bugs and Pests: Pests removal is usually a task for the landlord to perform.

- Damage from Undocumented Pets: If you have a pet not on your policy, damage it might cause is not covered.

Part 4: The Cost of Lemonade – Is it Really Cheaper?

Lemonade’s biggest lure is to priced. Policies begin as low as $5 a month. Obviously, this makes it very attractive. But is such price realistic to the people? First of all let’s analyze the renters insurance cost.

How Lemonade Determines Your Premium

There are multiple elements that have an impact on your end price. The minimum cost is 5 dollars, which is a fundamental plan. It has minimal coverage. The cost that you will have to pay will depend on:

- Coverage Amounts: The greater the property and liability coverage, the more expensive is the coverage.

- Your Location: The priciest at the state, city and even zip level. The regions with the highest level of crime are more expensive.

- Your Deductible:this is the amount you pay before the insurance funds in. The less the deductible, the better the premium.

- Your Claims History: The lower your previous claims the higher your rates.

- Construction Characteristics: The age and the constructing of your building may be influential.

Despite these, Lemonade is still regularly cheaper. Finally, their AI-based model reduces overhead. This in fact enables them to transfer savings to you. It is always prudent to compare rate as you would in order to find good business insurance at a good price.

Annual vs. Monthly Payments

Lemonade gives an option of paying a year at a discount. You can save a lot of money by this, should you have the money to do it. It makes your budget light too, also. You pay it once and are all paid throughout the year. This is or can be among the best saving tips, just like finding tips on how to reduce your car insurance cost.

“Price is what you pay. Value is what you get.”

– Warren Buffett

This is a very true quote in the case of insurance. It is not that the cheapest is always the best. You must have to make sure that the coverage is of genuine value.

Part 5: The User Experience: Fast and Easy?

It is time to test the key selling point of Lemonade. Is the process as smooth as they are being said to be? In particular, we will examine the registration and filing transportation accommodation claim.

The 90-Second Signup Process

We passed through the sign-up procedure. It’s impressively fast. You go to the appearance of their site or download the application. The AI bot, Maya, greets you.

She poses a number of straightforward questions:

- Your name and address.

- If you have a roommate or pets.

- In the event that you possess smoke detectors or security system.

- The value of your belongings.

In responding to you, Maya is compiling your quote. The interface is pleasant and easy to use. No bewilderment of insurance lingo. This was more of a quiz than a form. In the case of a basic policy, it is possible to get a quote and to pay less than two minutes.

The Famous 3-Second Claim

This happens to be the boldest statement of Lemonade. Are they able to pay a claim in 3 seconds? It is a surprise that in some cases, the answer is yes. With simple straightforward claims it works perfectly.

The process of claims is as follows:

- Open the Lemonade app.

- Tap the “Claim” button.

- AI Jim appears to help you.

- You record a short video. You are telling in it what happened.

- You furnish any documentation as required such as a theft police report.

The anti-fraud algorithms of Jim are then executed. They are systems which study your claim. Whereas, in case everything is verified, the money is forwarded immediately. It is deposited straight to bank account. Undoubtedly, it is a revolutionary process.

Nevertheless, not everything is that easy. It is obvious that more complex cases have to reviewed by humans. An enormous fire or a liability claim, e.g., will be more time consuming. It will then taken over by a human claims expert. At that stage, the process is also controlled using the app. Therefore, it is leaner compared to conventional approaches. There are other times when you may only need it in a temporary capacity and that is why the temporary car insurance facility can be an interesting study at such times.

Part 6: Lemonade Renters Insurance – The Pros and Cons

There is no flawless insurance company. Lemonade has obvious advantages. It also has some weaknesses. To give thee a balanced range Weighs them.

The Lemonade Balance Sheet

The Pros

- Extremely affordable starting prices.

- Fast, digital, and user-friendly experience.

- Quick claim processing for simple cases.

- Socially conscious Giveback program.

- Easy to customize coverage in the app.

The Cons

- Not available in all 50 states yet.

- Customer service is primarily digital.

- May not be ideal for complex insurance needs.

- No option to bundle with non-Lemonade auto insurance.

- Coverage add-ons can increase the price significantly.

Diving Deeper into the Advantages

The low cost is a huge plus. As an illustration, each dollar is important to students or young professionals. Renters insurance is very affordable since the premiums are low. Also, speed is another significant advantage. You will get covered in your lunch break. That convenience is not at all comparable to other companies.

The Giveback program also is a strong motivator. And besides, it is pleasant to have the idea that you can use your money to benefit someone good. This approach builds trust. Plus, it also makes you feel that you are a part of something bigger.

Considering the Disadvantages

Availability is the greatest disadvantage though. You can check their website to see if they operate in your state. This list is growing, but it’s not nationwide yet. Furthermore, if you appreciate the face-to-face approach of service, Lemonade may not be for you. There are no local agents to visit. Rather, there is no physical communication.

Although they also provide other lines such as pet and homeowners insurance, they do not allow combining a car policy with that of another company. Large time insurers such as State Farm tend to offer huge bundle discounts. You can as well seek other kinds of plans such as Humana dental insurance or even Compare term life to whole life insurance which Lemonade does not provide as a package.

Part 7: Customer Service and Industry Reputation

The service of an insurance company is all that you need. Naturally, this is particularly so when you have to make a claim. How is Lemonade in customer service and reputation therefore?

Analyzing Customer Reviews

The reviews of Lemonade among customers are not bad. People are fond of convenientpay and cheap prices. The app is ranked highly on iOS and Android. The ease of quick painless account creation is acclaimed by many users.

There are however some negative reviews. The complaints, including most, are related to the views of the claims process. Whereas easy claims take a short time, complex ones can be frustrating. Certain customers cannot find a human easy. They are therefore left in a free fall with the AI bot. It is a typical growing pang of tech-first companies.

Official Ratings and Financial Strength

Official ratings are prudent to look. Consumer complaints are followed by National Association of Insurance Commissioners (NAIC). The index of complaints at Lemonade is generally superior to the industry average. This is a good sign.

It is also important in being financially strong. Finally, you would want to know that your insurer is able to comply with claims. Lemonade has a Demotech rating of A (Exceptional) which is a financial analysis company.

This rating means that they possess high capability to keep to their policies. That is why it is a reliable choice among tenants. You may read more reviews such as our State Farm Life Insurance review to get a better idea about the reliability of the insurers.

Part 8: Who is Lemonade Renters Insurance Best For?

Lemonade renters insurance is a great product. But it is not a universal remedy. It is most appropriate with a particular kind of customer.

The Tech-Savvy Millennial and Gen Z Renter

If you live on your smart phone you are supposed to use Lemonade. You are more of a texting than a talking person. Besides, you appreciate speed and convenience. You are at ease with online-only service. They make college students and young professionals best candidates because of these reasons. Their insurance requirement is often straightforward.

The Budget-Conscious Renter

Lemonade is difficult to compete with, in case you are concerned more with the cost. Its low entry price makes it affordable to practically everybody. Even if you do not own much, liability protection is essential. Lemonade makes it affordable.

Renters with Simple Coverage Needs

Provided that your apartment is a regular one, and your possessions are common, Lemonade will suit you very well. Their platform is designed for simplicity. You may desire a conventional agent in case you have a complicated occupational arrangement or extraordinarily esteemed, special collections.

They are able to provide more personal guidance. As an example, other individuals may be seeking broad health care coverage, such as those offered by the United Healthcare Insurance, which is another and more intricate demand.

Simplicity equals the supreme sophistication.

– Leonardo da Vinci

Lemonade is the embodiment of this value. They have divested the complexity. Their product is basic and budget-friendly that can suit the majority of renters.

Part 9: The Final Verdict on Lemonade

So, now let us answer our original question. Is lemonade renters insurance really fast, cheap, and easy?

Fast? Absolutely. The sign-up process is the most fastest in the industry. Simple claims can likewise be resolved with unbelievable speed.

Cheap? Yes. For most renters Lemonade will one of the most affordable ones that can offered to them. And their tech-driven efficiency makes actual savings possible.

Easy? Overwhelmingly, yes. The app is intuitive. The language is simple everyday English. The entire process is user-friendly from quote to claim.

Lemonade has succeeded in disrupting a traditional industry. They have created a product that appeals to the modern consumer. It’s ideal for the Brits who want cheap and simple protection. Furthermore, it’s a great choice among the digitally native generation.

Of course you should always shop around. Get quotes from your couple of providers. For example, an independent source such as Forbes Advisor usually has great comparability tools. Nevertheless, Lemonade should definitely be on your list.

It is an innovative approach and customer-centric design that makes it a top contender within the renters insurance market. As an enlightened customer it’s also good practice to know your rights which you can read about on websites such as the Consumer Financial Protection Bureau.

For renters who are looking for an easy, affordable and modern way to insure, Lemonade is a great choice. It meets the promise of being fast, cheap and easy.

Frequently Asked Questions (FAQs)

Policies start at $5 month. However, you will hear your actual cost will depend upon your location, coverage amount, and deductible. Most people pay towards good coverage between $10 and $25 per month.

Yes. Lemonade is a full license and regulated insurance company. It has an “A” financial strength rating from Demotech that means it can reliably pay out claims.

Lemonade is available in most, if not many, states in the U.S. They are expanding rapidly. The best thing to check is to go to their website and plugin your address.

No. Your policy will only cover you and your stuff. Your roommate will need their own separate policy in order to be protected.

Lemonade charges a flat fee to operate its business. After paying claims any remaining money in the premium pool is donated to a charity of your choice at the time when you sign up.

![Compliant Drivers Program: Is It Legit for Driver Safety? [2025]](https://propinfo.site/wp-content/uploads/2025/12/Compliant-Drivers-Program-150x150.jpg)

Leave a Reply