Getting a State Farm Auto Insurance policy is easier than ever before. Gone are the days of long phone calls or mandatory office visits in order to see what your potential rate might be.

Indeed, you can obtain an in-depth and personalised quote from the comfort of your own home. This guide will help you to go through each and every step in the process.

We’ll go through everything, from how to collect your documents, getting your insurance policy options and even enjoying those monumental savings. Therefore, you can make an informed decision in a confident manner.

The Simplicity of Getting a State Farm Auto Insurance Quote Online

In the modern world, where things are moving fast, convenience is key. State Farm knows this and that is why State Farm has streamlined their online quote process. It is intended to be intuitive, fast and secure.

However, you don’t have to be a technical wizard in order to navigate their website. The platform takes you through a series of simple questions regarding your vehicle and your driving history and your coverage needs.

This approach that is digital first allows you to compare things in your own time. For example, you can make certain changes to coverage levels and view the price change in real-time. This transparency is the cornerstone of the State Farm experience.

In the end, it’s saving time and being in control of your policy that gets you a state farm auto insurance quote online.

Step-by-Step Guide to Your Online Quote

Ready to begin? There is a simple process to do this. By following these steps you can have an accurate state farm auto quote in just a few minutes. Let’s dive in.

Step 1: Gather Your Information First

The secret to a fast and smooth quoting process is preparation. While even before you open your browser, it’s a good idea to have a few pieces of information on you.

Having these things handy means that you don’t have to stop and go looking for documents, and life got a lot more efficient.

This small step just helps make sure that the quote that you get is as accurate as possible. I inaccurate information can lead into the different final premium so accuracy is important.

📋 Quote Preparation Checklist

- 👤 Personal Information:

Full name, date of birth, and address for all drivers in the household. - 🚗 Vehicle Information:

Year, make, model, and Vehicle Identification Number (VIN) for each car. - 📄 Driving History:

Driver’s license number(s) and a record of any accidents or violations. - 🏡 Current Policy (If Applicable):

Your current coverage limits for an easy comparison.

Step 2: Navigate to the State Farm Quote Tool

Once your documents are completed, your subsequent step is going to be to create a ticket for visit the official State Farm website. Be sure you are on the legitimate site in order to protect your personal information.

On homepage, you will have prominently displayed the option of getting some quote. It’s normally labeled “Get a Quote” and has an icon for auto insurance along with it.

You will begin by entering in your ZIP code. Insurance rates are very dependent on where you personally live, so this is always the first item of information needed.

After you enter your ZIP code, the system will take you to the specialty auto insurance quote form.

Step 3: Entering Your Vehicle Details Accurately

This section is very important for a more correct premium. The system will inquire about the car you wish to insure.

With many vehicles, it is possible to input the Vehicle Identification Number (VIN). This is the quickest and most accurate method as this automatically fills in the details of year, make, model and trim level.

If you do not have the VIN handy to you, you can always enter the details manually. Be as specific as possible. For example, try to choose “Honda Accord EX-L” rather than “Honda Accord.”

Additionally, you’ll answer questions regarding the main use for the vehicle (e.g., for commuting, for pleasure), estimated annual mileage and decision regarding ownership (owned, financed, leased). This is helpful to customize the State Farm Auto Insurance policy according to your specific situation. For specialized vehicles, you should also consider purchasing classic car insurance options.

Step 4: Provide All Driver Information

Next, the tool will prompt to pass information on the drivers that you want to have on the policy. This begins with the primary driver.

You will need to give your full name, birth date and driver’s license number. State Farm uses this information to view your driving record (with your permission of course).

A clean driving record can result in big bucks. On the other hand, a history of accidents or violations is likely to put you in a higher premium.

You must add other licensed drivers in your household that may use the vehicle. Withholding this information can result in later instituted denied claims. You’re always better off putting things out there.

Step 5: Customize Your Coverage and Get Your Quote

This is where you put your personal touch to your policy. State Farm will offer you a series of default coverage options based on the minimum requirements of your state.

It is up to you to change these limits. For example, with increasing your liability coverage, you can get more financial protection on your coverage or changing your collision and comprehensive deductible amounts.

Since: As you make changes, in real time the price of your state farm insurance quote will change. This way, you can find a balance between good coverage and a good premium.

After making your choices, the system will bring you to your personalised quote. You can then choose to save it, share it with an agent, or buy it directly in online.

Understanding Your State Farm Auto Insurance Coverage Options

When you receive your quote you’ll notice a number of types of coverage. Understanding what they both do is an important part of developing a policy that is actually going to protect you.

We will deconstruct the most popular alternatives that you will come across.

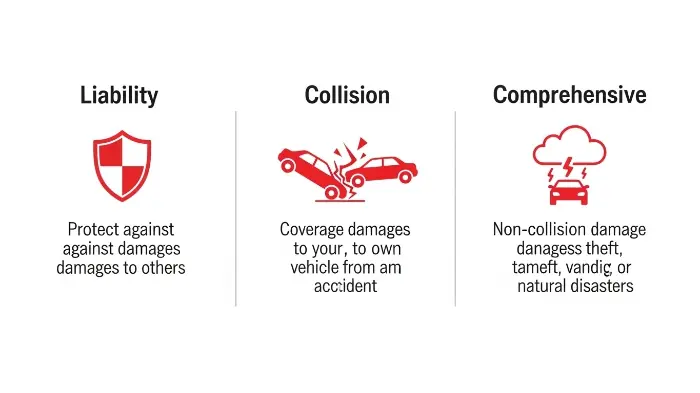

The Core Coverages in Your State Farm Auto Insurance Policy

Every policy is constructed on the basis of fundamental coverages. These are the most necessary protections.

Liability Coverage (Bodily Injury & Property Damage): That is the cornerstone of any auto policy, and is required by law in most states. It pays for injuries and property damages that you cause to others in an at-fault accident.

Collision Coverage: This is to cover the cost of repairing or replacing your own vehicle if you have had an accident, irrespective of who is at fault. If you have a car loan or lease your lender will almost certainly require it.

Comprehensive Coverage: This covers your car seek cover as a result of events other than collisions. Think of things like robbery, vandalism, fire hail or hitting an animal. Like collision, it’s usually required for financed vehicles.

These three coverages constitute the basic construction of the full coverage policy.

Optional Add-ons for Enhanced Protection

Beyond the basics, State Farm offers several endorsements, or add-ons, that will provide an added layer of security.

Uninsured/Underinsured Motorist Coverage: This is to protect you if you’re hit by a driver who has not, or has not enough, insurance to convey your medical bills and damages in a car accident.

Medical Payments (MedPay)/Personal Injury Protection (PIP): This is to help pay for medical expenses for you and your passengers in the event of an accident whether it is your fault or not.

Emergency Road Service: This is to help with such common problems as a flat tire, running out of battery or gas. It’s a little bit of money for a lot of peace of mind.

Car Rental and Travel Expenses: Let’s say your car is in the shop as a result of a covered claim-this coverage can help to pay for a rental car and if you are stuck far from home, travel expenses such as meals and lodging. This is useful in particular in conjunction with normal State Farm car insurance.

State Farm Coverage Options at a Glance

To simplify these concepts here is a table breaking down the main types of coverage and what they do.

💡 Pro Tip: Auto Insurance Coverage Guide

| 🛡️ Coverage Type | 📋 What It Covers | ⚖️ Is It Typically Required? |

|---|---|---|

| 🚑 Bodily Injury Liability | Medical expenses for others in an at-fault accident. | Yes, by state law. |

| 🏠 Property Damage Liability | Repair costs for other people’s property (e.g., cars, fences). | Yes, by state law. |

| 💥 Collision | Damage to your own vehicle from a collision. | No, but required by lenders. |

| 🌪️ Comprehensive | Damage to your car from non-collision events (theft, fire, etc.). | No, but required by lenders. |

| 🚫 Uninsured Motorist | Your injuries/damages if hit by an uninsured driver. | Optional in some states, required in others. |

| 🔧 Emergency Road Service | Towing, flat tires, lock-outs, and other roadside needs. | Optional add-on. |

It is very important to have an understanding of these distinctions. For businesses, differently nature of needs apply and which is where commercial auto insurance comes into play. Similarly, people may go for some particular plan such as Humana dental insurance when it comes to their health.

Unlocking Maximum Savings: A Deep Dive into State Farm Discounts

One of the best ways to reduce your State Farm Auto Insurance premium is by using the many available discounts. State Farm is known for having a wide range of savings opportunities.

“Insurers are more and more rewarding proactive policyholders. Discounts for safe driving and vehicle safety features no longer are favorites, but instead are industry standards that consumers should of and should seek out,” notes an analyst from J.D. Power.

Let’s learn more about some of the biggest discounts you can obtain.

The Power of Telematics: Drive Safe & Save™

The Drive Safe & Save program is the usage-based insurance (UBI) or telematics program offered by State Farm. It’s a strong tool for the safe drivers to get significant discounts.

Here’s how it works: You use an application on a smartphone (or an application connected into your car via an application, such as OnStar) that keeps track of your driving habits. This includes things such as acceleration, braking and cornering, as well as speed and phone use.

The safer you drive the higher the discount you get. State Farm says their customers can save up to 30% on their premium with this program.

It’s an excellent way to make your premium based on your real behavior and driving more than on your demographic. It affects your personal car insurance cost directly.

Discounts for Students, Young Drivers, and Safe Habits

State Farm has specific programs for younger drivers, who tend to pay the highest amounts for car insurance.

Good Student Discount: Students who maintain a “B” average or better in high school or college, usually can qualify for a discount of up to 25%. You will need to show proof (e.g. report card, transcript).

Steer Clear® Program: This is a refresher course for drivers under the age of 25 that have a clean driving record. Completing the program, involving modules and driving logs as well as a mentor, can earn you a great discount.

Defensive Driving Course Discount: In many different states, passing an approved defensive driving course will also make your rates lower, and it will make your rates lower, no matter what your age is.

These programs save not only money but these practices also will encourage safe driving habits from an early age. This is an integral part of the value provided with State Farm car insurance.

Maximizing Your Savings on State Farm Auto Insurance

Beyond driving programs: There are many other ways to save. Bundling is one of the most effective.

Multi-Policy Discount: If you package your State Farm Auto Insurance with any of your other policies, such as homeowners, renters, or even State Farm life insurance, you can receive a significant discount. This bundling strategy often is one of the biggest money-savers.

Multi-Car Discount: If you get insurance with State Farm for more than one car, it will also cut away the premium for each car.

Vehicle Safety Discount: Cars that have safety features such as anti-lock brakes, airbags and anti-theft get lower rates. You can look up what safety features your car has on the manufacturer’s website or obtain the safety rating for your car on the IIHS website.

Always ask your agent or look at the online quote tool carefully, to make sure that all applicable discounts are applied to your state farm auto insurance quote.

💰 State Farm Discount Finder

Are you getting every discount you deserve? Review this list!

Multi-Policy

Bundle auto with home, renters, or life insurance.

Multi-Car

Insure two or more vehicles on the same policy.

Good Student

Maintain a good GPA for a significant discount.

Why Choose State Farm for Your Auto Insurance Needs?

With so many insurance companies out there to choose from you might be wondering what makes State Farm different than the rest? The company has managed to build a reputation over the past few decades for several key reasons.

These are some of the reasons why it is one of the largest and most popular insurers in the US. There are other service providers such as United Healthcare insurance who have a similar strong brand presence in their respective fields.

Analyzing the Financial Strength of State Farm Auto Insurance

An insurance policy is only as good as the ability of the insurance company to pay out claims. Financial strength is an important, and frequently neglected factor.

State Farm is regularly rated best in the industry by major financial rating agencies such as A.M. Best (A++ Superior) and S&P Global Ratings (AA).

These high ratings mean a superior ability to meet ongoings of insurance obligations. In other words, you can be assured that State Farm has the financial resources to be there for you when you need them the most.

This financial stability ensures incredible peace of mind by especial assuredness that your claim will be paid on honest and in a timely manner provided during a widespread disaster. It’s one of the advantages to having a good State Farm Auto Insurance policy.

Customer Service and Claims Satisfaction

Over and above financial ratings, actual customer experience is paramount. State Farm is not unknown for its massive network of local agents.

While you can administer your policy completely online or through the mobile application, having a local agent as a point of contact offers a personal touch that most people appreciate. Your agent can help you to understand complicated coverages terms like the difference between term life insurance and whole life or specific policies like professional liability insurance.

In terms of customer satisfaction, State Farm usually scores well in national surveys. For instance, the J.D. Power U.S. Auto Insurance Study generally ranks State Farm among or at the top in many regions for customer overall satisfaction.

According to a report by Investopedia, “A powerful agent network is a significant differentiator for legacy insurance companies such as State Farm, since it provides a degree of personalized care that digital-only companies have been unable to mimic.”

This combination of digital convenience and personal support is a huge part of why millions of customers make the decision to choose and stay with State Farm. For people with special needs, such as motorcycle insurance, it’s great to have an agent to speak with.

A Quick Comparison: State Farm vs. Competitors

While State Farm is likely a top contender, it’s always a smart move to be informed about the competitive landscape. Here is a general view of how it compares with other major carriers.

vs. GEICO: GEICO is often competing heavily on price and they are known for their direct to consumer model and catchy adverts. However, State Farm’s agent network is more personalized, which is preferred by many.

vs. Progressive: Progressive is a leader in innovation including with its telematics (Snapshot) and online tools. State Farm’s Drive Safe & Save is a direct competitor, and both options are great choices for usage-based insurance.

vs. Allstate: Allstate also has a strong agent network and similar coverage options. The price selection between the two is often a matter of regional differences in pricing and preference for one particular agent over the other.

Ultimately the best insurance provider for you will depend upon your individual needs, location and driving profile. That’s why obtaining a state farm insurance quote to get a price comparison is a so important step to take.

Preparing for Your State Farm Auto Insurance Application

Once you have your quote and are ready to go forward then the application process is the last thing you need to do. It’s an actual formalization of information that you provided for the quote.

You will be asked to agree to all the details of your vehicles and drivers. This is now your final booking opportunity to correct any mistakes.

Be ready to give your payment information. You can usually pay for your policy by credit card, debit card, or from an electronic funds transfer (EFT) from your bank account.

Deciding the start date—the effective date—might also be necessary. You can often set this for the same day or at some future date which is helpful in situations where your current policy is expiring soon. This is also a good time to consider other needs such as finding affordable business insurance.

The process is meant to be seamless, especially if you have already carried out the online quote.

The Final Steps: Reviewing and Purchasing Your Policy

Before you hit “purchase” take a bit of time for a final review. Scrutinize that over-time the coverage limits, have deductibles and total premium one more time.

Make sure that all drivers and vehicles are listed out correctly. Also make sure that all the discounts you are eligible for have been deducted.

You will be provided with a series of policy documents via e-mail. You can download and save these and provide them for your records. This package contains your insurance IDs cards, policy declarations page and a complete policy contract.

The declarations page is of particular importance. It’s a breakdown of your coverings, limits and four costs. Read it carefully.

Once you are satisfied, you can make the payment and your State Farm Auto Insurance policy will be in force. Your digital ID cards will be available to you instantly from the State Farm mobile app. This is much more convenient than having to wait for cards to come in the mail, especially if you happen to be in need short-term coverage which is related to temporary car insurance.

Conclusion: Your Journey to a Better Policy Starts Now

In conclusion, obtaining a State Farm Auto Insurance quote through your telephone is a fast, transparent and enabling process. By collecting your information in advance and carefully following the step-by-step tool, it is possible to obtain an accurate and personalized rate in a matter of minutes. Remember to look around for all the discounts available, especially bundling offers and the drive safe and save program to get the most savings for your money.

So, understanding the options you have for coverage, whether you need free minimal liability or some added-value supplementary coverage, enables you to provide yourself with the benefit of real holiday and lose nothing out on the road. With its high financial ratings and famed customer service State Farm is a leading choice to millions of drivers nationwide. The digital tools that are available at this point have made it easier than ever before to determine if it’s the right decision for you. Your new and improved State Farm Auto Insurance policy is just a few clicks away.

Frequently Asked Questions (FAQs)

The online process is very efficient. If you have all your personal information, vehicle information, and driver information in hand you can usually receive a full state farm auto quote in 5 to 10 minutes.

No, getting an insurance quote is considered a “soft inquiry” and does not impact your credit score. Insurers use the insurance score, which is based on credit, in some states to help to determine rates, but the inquiry itself is harmless.

Absolutely. State Farm’s online tool normally gives you a telephone number or an option of “find an agent.” You can easily pause your online quote and make a contact with a local agent to ask questions or get specific advice before completing the quote.

The fastest ways of getting your quote down would be to increase your deductibles (the amount you would pay out-of-pocket for a claim) and making sure all of your discounts are applied. Combining insurance and bundling with a home or renters policy typically has the most critical lone discount.

Yes. After making your insurance purchase online you will have instant access to your digital proof of insurance (ID cards). You may download them and print or have the information anywhere with the State Farm mobile app. This assures that you are covered in law immediately.

![Compliant Drivers Program: Is It Legit for Driver Safety? [2025]](https://propinfo.site/wp-content/uploads/2025/12/Compliant-Drivers-Program-150x150.jpg)

Leave a Reply