For some reason, finding the cheap auto insurance can often be a difficult quest. You want to save money. However you have also got protection you can trust. It’s a delicate balance. Many drivers fear that cheap implies low quality of service; however, not always. We are here to guide you. We will show you how to get some cheap rates. In fact, you can do this without compromising on quality coverage.

This will be a guide that will break down everything that you need. For example, we are going to discuss what influences your price. We will also dispel secrets of how to obtain low insurance quotes. Therefore, let us start your path to better-smarter savings. One can find a policy that fits your budget. And it will protect you on the road, anyway.

Part 1: The Building Blocks of Your Insurance Premium

What Determines Your Rate for Cheap Car Insurance?

Have you ever wondered why your premium is the way it is? It’s surely not such a random number. Insurance companies use complicated algorithms. They access your danger as a driver. In short, the greater the risk, the more the price. Consequently having an understanding of these things is your first step. It is the key to finding cheap car insurance. Let’s dive into the details.

The Primary Factors That Drive Your Costs for Cheap Auto Insurance

There are several key elements that have huge impact. Insurers use these on which to calculate your quote. Having awareness of them, therefore, gives you power. You can then take actions to enhance your profile.

Your Driving Record is Crucial for Cheap Insurance

This is probably the largest factor. You will not do without a good driving record. For example, there is showing that you are a safe and responsible driver. As a result of this, you get rewarded with lower rates by insurers.

On the other hand accidents and tickets will increase your premium. So, one at-fault accident can cost you a lot of extra money. Similarly speeding tickets or a DUI have a similar effect. Therefore, safe driving is direct saving.

Why Your Location Matters for Cheap Car Insurance Quotes

Your ZIP code has a big time factor in it. Insurers analyze local data. For example, they observe the pace of theft in your area. They are also taking accident frequency and litigation costs into consideration.

If you’re living in a dense urban area you may have to pay more. This is because of the increased level of traffic and crime. On the other hand, if the location is quiet and rural, the cost of insurance may be inexpensive. At the bottom line it’s all about statistical risk.

The Type of Car You Drive

The car you drive is highly important. Insurers focus on its make and the model. In addition to this, they take into account its sticker price and repair costs. For example, luxury or sports cars are an expensive insurance to sell. Their parts and labor costs live up to be expensive.

On the contrary the normal good reliability sedan cost is cheaper. Insurers also check the safety ratings of a car. In fact, vehicles with the highest safety features can help you receive a discount. If you have a special vehicle, then you may need to know about classic car insurance.

Your Personal Demographics and Their Impact

Adjustments in factors such as your age and marital status are important. Young inexperienced drivers have more accidents statistically. As a result, they are exposed to the highest premiums. Ratings usually begin to decline around age 25.

Married persons too often go for lower rates. This is because statistics show that they are safer drivers. Your gender may also play a role in some states, although the practice has been on the decline.

How Your Credit Score Influences Rates

In most states, your credit score is an important consideration. Literature showing a correlation has been found by insurers. Specifically, persons with good credit are people who do not file many claims. This is a controversial measure, at the very least.

However, a higher credit score can save you a lot of money. Improving the financial health can decrease your car insurance bill directly. Therefore, it is pay to be responsible in all areas in your life.

Understanding Coverage Types and Their Cost:

The types of coverage you decide on have a direct relationship to your bill. The policy can be customized. This has the benefit of balancing protection and cost. Getting some cheap full coverage car insurance is possible. You just have to know what you are buying.

Liability Coverage: The Bare Minimum

This is what any policy is based on. It is mandatory in almost every state. Liability is for damages you cause to other people. This includes bodily injury, property damage but not including your own car and injuries.

Collision and Comprehensive: Protecting Your Car

Collision coverage covers the cost of repairing your car. This is in the wake of an accident that you cause. On the other hand, comprehensive coverage covers other damage. For example, it explains stealing, fire, hail or hitting an animal.

Together with liability, these form “full coverage.” You probably need them if you have a car loan. For older cars (though) you may want to spare the expense in which case you should drop them. We’ll talk more on tips for lowering your car insurance cost later.

Part 2: Your Action Plan for Finding Cheaper Insurance

The Power of Comparison: Get the Best Cheap Insurance Quotes

Now you know what has an effect on your rates. It is time to utilise this knowledge. The one single most effective strategy is a simple one. Above all, you need to be shopping around. Never accept the first quote you get. The prices may be hundreds or even thousands different. This is true even when it comes to the exact same coverage.

Why You Absolutely Must Compare Quotes for Cheap Auto Insurance

Each insurance company has its formula. One company may penalize the young drivers very much. Another may be more interested in credit scores. A third could have the fantastic rates for your particular car model. However, you will not know unless you look.

Compare and contrast quotes is similar to a job interview. You are the employer. The insurance companies are the candidates. Ultimately, you want to find one that is the best for the job. The job is protecting you for the cheapest bit of money they can, to get that cheap auto insurance you’re after.

How to Get Cheap Car Insurance Quotes the Smart Way

Getting quotes is something that should be a planned process. It is not a random searching in nature. Follow the following steps for the best results. This will help you to find really cheap auto insurance.

Step 1: Gather Your Information

Preparation Before you get started, prepare your documents. This will make the process smooth and fast. You will need:

- Driver’s license numbers of all drivers.

- Vehicle information (VIN, car make, model, year).

- Current insurance policy information (for comparison).

- An estimate of your annual travel.

Step 2: Use Online Comparison Tools

The number one thing your friend is the internet here. There are many websites which let you compare quotes. In fact, you can receive quotes from several companies at once. You only type your information in once. Then, you get a number of estimates. This is being incredibly efficient. It spares you the trouble of visiting the sites of individual insurers.

Step 3: Contact Local and Direct Insurers

Don’t stop with online tools. Also, contact independent insurance agents. They work with a number of companies. They can google them for deals that you wouldn’t be able to find on your own. Furthermore, be sure to call direct insurers who don’t use agents. Some big shot companies fall into this category.

A combination of different methods will best. Just like having a diverse financial portfolio, a diverse strategy of shopping for insurance is smart. It’s similar to comparing a State Farm life insurance policy with other policies.

📊 Key Factors Influencing Your Premium

Driving Record

Clean history leads to lower rates.

Location

Urban areas often have higher premiums.

Vehicle Type

Safety and repair costs are key.

Credit Score

A better score can mean better rates.

“The cost of doing nothing is much higher than the cost of a mistake.”

– Meg Whitman

This quote is exactly applicable here. The inaction of not shopping around will lose you money. You will definitely end up paying more than you should for your insurance.

Part 3: Unlocking Every Possible Discount

Don’t Leave Money on the Table: Essential Discounts for Cheap Car Insurance

After getting quotes the next step is discounts. Insurers sell an enormous selection of them. However, they don’t necessarily apply them automatically. You often have to ask. Therefore, be sure to be taking every single discount to which you are eligible. This is an important step to be able to get cheap car insurance.

Driver-Based Discounts

These discounts are according to you and your habits. They are reward systems for safety and doing the right thing.

Good Student Discount

You or one of your policy is a student? If they get a “B” average or better, then you can save. This discounted price can be quite large. In short, that’s a reward for responsible behavior in school.

Safe Driver Discount

This is a big one. If you have a clean record for a certain period of time (typically 3-5 years) you receive a discount. Some companies even have “accident forgiveness” programs. These programs are for long term customers.

Defensive Driving Course

And many insurers have a discount for taking a course. It must be an approved defensive driving. Frequently the discount takes place for a few years. In addition, you will be a safer driver. In conclusion, it is a win-win situation.

Policy-Based Discounts for Cheap Insurance

These discounts have to do with the way you structure your policy. Smart days to do that and you can save a lot of money. For example, you may combine various forms of insurance.

Bundling or Multi-Policy Discount

This is one of the easiest and largest discount. Insure your car and home from the same company. Or you may package auto and renters insurance. This might be true with other policies such as Humana dental insurance if it is offered by the parent company. The savings may be substantial.

Multi-Car Discount

Do you have more than one automobile in your home? Insuring them all on the same policy it is a great idea. It will almost always result in an overall lower price. Moreover, it is much cheaper than insuring each car individually.

Payment Discounts

How you pay also can save you money. Paying your premium all at once is one way. This would avoid monthly installment fees. In addition, setting up automatic payments (EFT) too can get a small discount. Every little bit helps.

Vehicle-Based Discounts

The features of your car can save you money as well. Safety and security gets rewarded.

Anti-Theft Devices

Does the alarm system work in your car? Or perhaps a tracking device such as a GPS? These are features that deter thieves. As a result, insurers may offer you a discount for your all-inclusive coverage.

Safety Features

Modern cars are stuff full of safety technology. airbags, anti-lock brakes (ABS) and daytime running lights are the norm. These features deal with the reduction of accident severity. Thus, they can bring you a discount on your premium for cheap auto insurance.

✅ Your Discount Checklist for Cheaper Insurance

Are you getting all the savings you deserve? Review this list!

Good Student

For students with a ‘B’ average or higher.

Bundling

Combine auto with home or renters insurance.

Anti-Theft

For cars with alarms or tracking systems.

Pay in Full

Avoid installment fees by paying upfront.

Part 4: Fine-Tuning Your Policy for Maximum Savings

How to Adjust Your Coverage to Get a Cheap Insurance Rate

Getting cheap insurance quotes is only the beginning. You can also further reduce your premium. This includes changing your policy details. Ultimately, it’s the question of finding the sweet-spot. You need sufficient coverage but not so much.

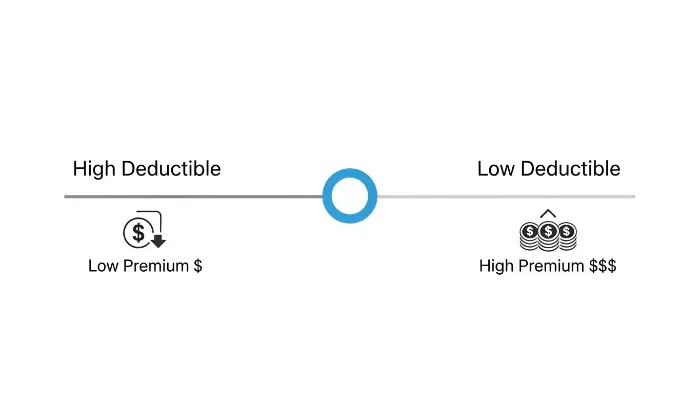

Choosing the Right Deductible for a Lower Rate

Your deductible is the money that you pay out-of-pocket. This payment is for a collision/ comprehensive claim. The relationship is simple. A higher deductible, therefore, has a lower premium.

For example, your deductible may be $500, but by increasing it to $1,000 it is possible to save money. It may reduce your premium by between 15% and 30%. Just make sure that you can afford the higher amount. You need to have that cash available to you in case you need to file a claim.

Re-evaluating Coverage for Cheap Full Coverage Car Insurance

Your needs change over time. The extensive coverage you may have needed for a new car, may be overkill for a 10-year-old one. Consequently, this is a vital topic to review.

If your car is old and has little market value think about it. The price of collision and comprehensive coverage may be more than the car is worth. And you could save a lot if you dropped them.

You would then only be covered by a liability insurance. For some businesses, being able to understand their specific needs could mean looking into commercial auto insurance.

The Impact of Your Annual Mileage

The amount of driving you do certainly makes a difference. You’ll end up paying more if you have a long commute. This is because you find yourself on the road more which is a higher risk. However, what if the situation changes for you?

Perhaps you are now working from home. Maybe you began taking the public transit. In that case, you will have to notify your insurance company. A lesser annual mileage can result in a “low-mileage discount.” This is a simple method of obtaining cheap auto insurance.

“Beware of little expenses. “One small leak will sink a great ship.”

– Benjamin Franklin

This is so true for insurance. Small insignificant coverages add up. It can keep your financial ship afloat to look for these “leaks” in your policy.

Part 5: Advanced Strategies for Long-Term Savings

Maintaining Your Rate for Long-Term Cheap Auto Insurance

Finding low auto insurance is great. To keep it cheap is even better. Your work is not done after you purchase the policy. In fact, you have to be proactive to keep your low rate for years to come. This requires a long-term way of thinking.

The Ongoing Importance of a Clean Driving Record

We mentioned this before. However, it is worth repeating. Your driving record is a moving document. It has the single biggest impact on your rate in the long run. One accident or ticket and your savings have disappeared.

Drive safely. Obey traffic laws. Try not to be distracted by your phone. A record without records that is clean not only keeps you safe, but it also keeps your wallet full. In short, it is the gift that keeps on giving. For those working in certain fields, keeping a spotless professional record is also important, which is why some require professional liability insurance.

Annually Reviewing Your Policy and Shopping Around

Don’t just “set it and forget it.” Your Insurance Policy requires an annual check-up. At renewal time, do two things. First, examine what you already have in terms of a policy. Has there been a change in any of your needs?

Second, shop around again. Don’t assume that your current insurer is still going to be the cheapest. A competitor might come along and now offer a better rate with cheap auto insurance. This annual habit will save you hundreds of dollars.

Plus, it makes your existing insurer honest with you. To find out more about various types of policies, you may wish to compare term life vs. whole life insurance, because the rules of regular review are similar there, as well.

How Life Changes Affect Your Cheap Car Insurance

Major life events and their impact on your rates: Having major life events may influence your insurance rates. For instance, taking the marriage as a mode, your premium can get reduced. To move to a safer neighborhood can too. Buying a house may put you in a position where you get a great bundling deal.

On the flip side, adding a teen driver will bring it up drastically. When such occurrences occur, you’ll need to call your insurer. See the effect that it has on your policy. It may even be a good trigger for shopping for new cheap car insurance quotes. The same logic goes for other coverage such as plan from United Healthcare insurance.

Considering Usage-Based Insurance (Telematics)

This is a modern choice of savings. Usage-Based Insurance (UBI): Monitor your driving habits. This uses an app on a smartphone or a tiny device in your car. For example it keeps track of things such as:

- How hard you brake.

- How fast you accelerate.

- The times of day you drive.

- Your total mileage.

If you are a real safe driver, this can be great. You can get substantial discounts depending on your actual behavior. However, if your foot is made of lead, then it could backfire on you. Thankfully there are many programs that will provide a discount just for trying.

Part 6: Navigating Special Insurance Scenarios

Addressing Unique Needs for Cheap Auto Insurance

Not everyone is alike the typical driver. Some situations need to be dealt with with special care. Whether you’re a 16-year-old driver or are driving an exotic vehicle, there are ways that you can afford to find coverage.

Insurance for Young or High-Risk Drivers

Young drivers are exposed to the highest rates. There is no way around that. However, there are things that can be done to decrease the blow. We’ve told you about the good student discount. That’s a must.

In addition, adhering to a parent’s policy is almost always cheaper. It is far more affordable than game to obtain a separate one. Selection of a safe but modest car is also essential. A souped-up sports car is a formula for an astronomical premium. For a different sort of travel mode, you might also consider motorcycle insurance.

What if You Need Coverage for a Short Time?

Sometimes, all you need is insurance for a short period of time. Maybe you’re borrowing a car. Or maybe you are in between vehicles. In these cases, you may consider your own temporary car insurance. It gives the coverage of a short and defined period of time. This can be more cost-efficient than an ordinary six month policy.

Finding Cheap Insurance After a DUI or Major Violations

Getting insurance after an incident of serious violation is difficult. It is also very expensive. In fact, a lot of standard insurers may not even cover you. You will probably need to look for a company who deals in “high-risk” or “non-standard” insurance.

In most States you will have to fill out an SR 22 form. This is a financial responsibility certificate. The catch here is to drive perfectly. Over time (usually 3-5 years) the violation will be less impactful. Your rates eventually will be back down.

Your goal, therefore, should be to get back on the normal insurance market as soon as you can. For the business owners, finding the right business insurance is also a journey and this guide on affordable business insurance can help.

Conclusion: Your Path to Affordable, Quality Coverage

We have covered a lot of the ground. The one thing to take with you is this: there is no reason why you can’t find cheap auto insurance. It just takes some efforts and some knowledge. It’s not about finding a magic bullet. Rather, it is about using a series of smart strategies.

By following these steps you may be able to reduce your premium. You can do this without compromising the quality protection that you and your family deserve. You are now equipped to be armed with the knowledge. Go out there and find the cheap car insurance policy that is perfect for you.

For more information on auto safety standards that can affect rates you can visit the National Highway Traffic Safety Administration (NHTSA) For general insurance knowledge the Insurance Information Institute is a good place to go. Finally for the consumer perspective the Consumer Reports explains a lot of great things.

Frequently Asked Questions (FAQs):

You should purchase new car insurance quotes at least once a year, just before your insurance is set to expire. In addition, you should also look for new quotes whenever you have a major life change, such as moving or purchasing a new car.

No. The “soft pull”; when insurance companies perform a credit check. These do not affect your credit score as “hard pulls” do such as for loans or credit cards.

Not necessarily. The cheapest policy may have very low coverage limits or have a very poor customer service reputation. Instead, you want to get the best value, which is a balance between a low price and quality coverage from a reliable company.

That’s going to be more difficult and more expensive, but it is possible. You may need to look at companies that deal in high risk drivers. In the end, the best plan is to get down to safe driving to build up a good record with time.

The quickest method is to make use of an online comparison online utility. These websites allow you to enter your information one time. Then, you get quotes from several different insurance companies in only a few minutes.

![Compliant Drivers Program: Is It Legit for Driver Safety? [2025]](https://propinfo.site/wp-content/uploads/2025/12/Compliant-Drivers-Program-150x150.jpg)

Leave a Reply