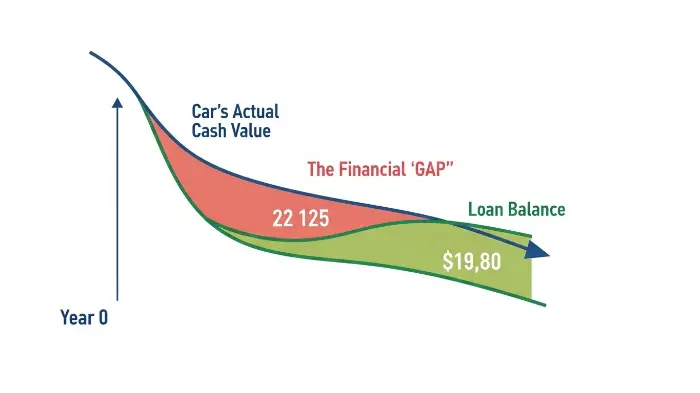

Imagine the scene. You drive your beautiful, almost new car off the lot. You feel a surge of pride. But, less than several months later, disaster strikes. A collision sums up your vehicle. The good news? Your auto insurance will pay for itself. The bad news? You owe money on your loan and they are simply paying what the car would be worth now as of today. This is where many drivers are faced with a shocking financial shortfall. This guide is here to answer the critical question that is how much is gap insurance and how you can get it sorted without overpaying on it.

This financial “gap” comes to thousands of dollars that you’d owe out-of-pocket for a car that you no longer have. It’s a nightmare situation, but something that is totally swewupable with the right coverage. We’re going to break it down all you need to know about gap insurance costs. We will hit up where to buy it, what causes the price, and sure how to know if you are getting a fair deal. In the long run, you will become a professional who knows how to invest in something and safe enough.

What Exactly Is Gap Insurance and Why Do You Need It?

Before we get into the numbers let’s get clear what we are talking about. GAP is an acronym for Guaranteed Asset Protection. It’s an optional insurance coverage that covers you against a certain financial ramen.

Think of it as a financial safety net.

Your standard auto insurance policy, such as collision or comprehensive coverage, for example, is written to pay for the Actual Cash Value (ACV) of your vehicle in the event of theft or total loss. The ACV is what your car is worth when you had it (at the time of the loss) based on the amount of depreciation.

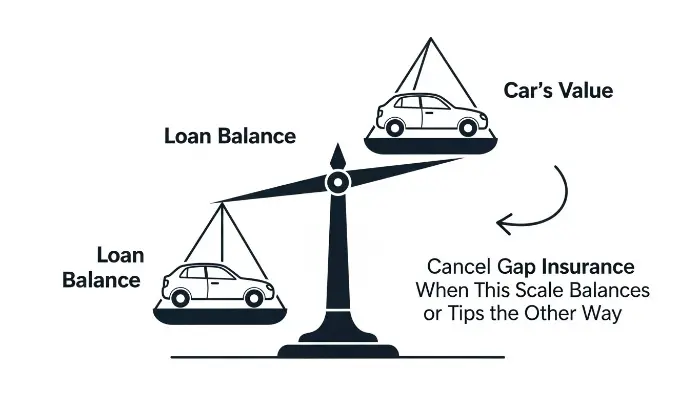

The issue here is, cars depreciate fast. The minute you drive a new car off the lot, the car loses value. Your auto loan however decreases at a much slower pace. This leaves a “gap” between your loan balance and the ACV of your car.

If your car is totaled gap insurance pays this difference.

Who Needs Gap Insurance the Most?

Not everybody requires this coverage. But to many drivers, it’s a financial saviour. The following are the reasons why you should strongly consider it if you:

- Made a proportionately small down payment (less than 20%). A smaller down payment means that you are borrowing a bigger amount of money, which means there is a bigger potential gap from day one.

- Have a long loan term (60 months or more). The longer you have to pay off a mortgage, the slower you are building the equity. Your loan balance will probably always remain over the value of the car for years to come.

- Leased a vehicle. Most lease agreements require you to actually carry gap coverage. This often is bundled into the lease price.

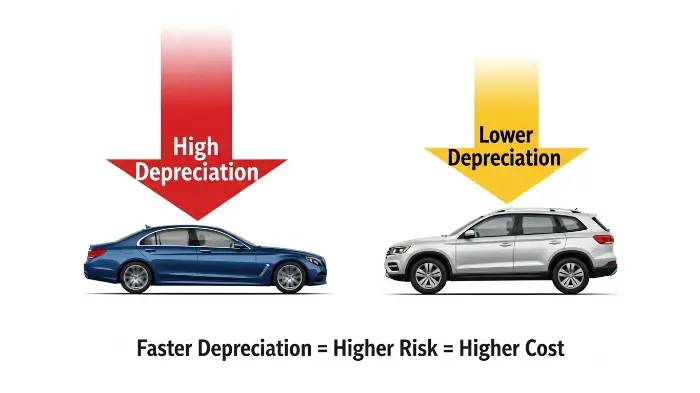

- Bought a car that depreciates quickly. Luxury cars, some EVs, and models that experience high performance often lose value more quickly than their equivalent of an average sedan or SUV. In some cases, even a unique policy, such as classic car insurance may have different rules on depreciation to consider.

- Rolled negative equity into your car loan. If you were “upside down” on your old car, then you added that debt to your new loan. This provides a guarantee for a gap that is significant.

Expert Quote: “The very first two years with a new car loan is unquestionably the most vulnerable period for car drivers,” says automotive finance profession expert Sarah Jenkins. “Depreciation is highest and the loan balance is at the highest. This is the danger zone that gap insurance offers its greatest value.”

The Core Question: How Much Is Gap Insurance?

So, let’s get to the main event. The answer of how much is gap insurance will be depended hugely on where you purchase it.

Here’s the quick breakdown:

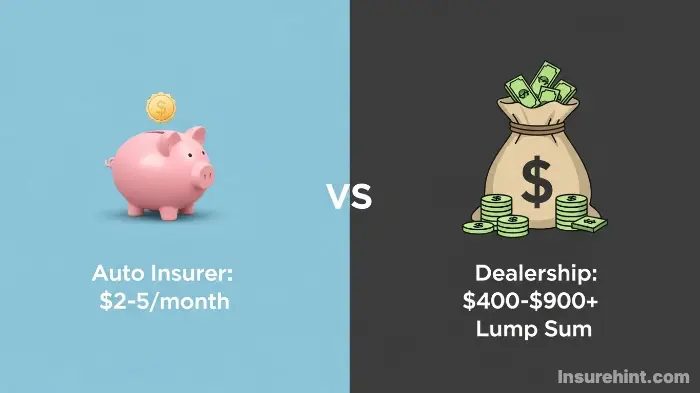

- Through an Auto Insurer: Starting at $20 to $40 per year. This is the cheapest and most affordable option.

- From a Dealership or Lender: This is typically a one-time lump sum of money of $400 to $900+, on average. This is later rolled into your auto loan.

The difference in price is enormous. A dealership can burn you for 10 times what your own insurance company would charge you. This is the one most important thing to understand about the cost of this coverage. We’ll get to why there is this difference in just a moment. Understanding this is among the very best tips for lowering your car insurance cost overall.

Where to Buy Gap Insurance: Comparing Your Options

You typically have 3 places in which to purchase gap coverage. Each have their own pros and cons especially when it comes to price.

1. Through Your Current Auto Insurance Company

This is almost always the cheapest and best way to get gap insurance. You just call your agent or login to your account and insert it to your current policy.

- Pros:

- Extremely affordable. In many instances a mere few dollars per month.

- Easy to add. It’s a reward to what you are already doing.

- Convenient claims. If you’ve been completely totaled, you have just one company to deal with in this case for both the comprehensive/collision claim and also your gap claim.

- Cons:

- Not all insurers offer it. Some smaller companies or non-standard companies may not have this option.

- Vehicle restrictions. There may be rules about the age of the car or the value of the car. It’s not the same thing as the specialized coverage such as motorcycle insurance that is designed for a specific asset.

2. From the Car Dealership or Lender

This is the most common method of purchasing gap insurance because it is offered as part of the car buying process. The finance manager will present it as an easy add on.

- Pros:

- Convenient. You can take care of it at the same time as you purchase your car.

- Cons:

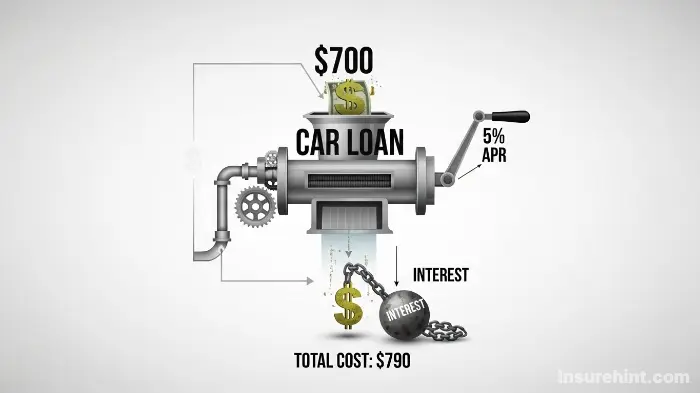

- Significantly more expensive. The dealership charges the price up significantly.

- It’s financed. The high lump-sum cost is added to your car loan, meaning you end up paying interest on your car loan for years. A $600 gap policy means that it could cost you over $700 at the end of your loan.

- Harder to cancel. Getting them a refund for part of that you don’t use can be a hassle.

3. From a Standalone Gap Insurance Provider

A few companies specialize in selling gap insurance directly to consumers, on the Internet.

- Pros:

- Can be competitive. Prices can be lower than a dealership, however, prices will usually be higher than your auto insurer.

- An option if your insurer doesn’t offer it. When you don’t want to spend a lot of money at the dealership, it offers you a way around it.

- Cons:

- Requires more research. You need to research the company and ensure they are a reputable one.

- Less convenient claims process. You ultimately will have to arrange for coverage between your primary insurer and the gap provider.

Cost Comparison: Where You Buy Matters Most

🚗 Coverage Provider Comparison Guide

Auto Insurer

Dealership/Lender

Standalone Co.

How Much Is Gap Insurance Per Month? A Breakdown

When you’re trying to budget, asking how much is gap insurance per month is a smart move. When adding gap coverage to your auto policy, you can expect this monthly cost to be very low, typically between $2 to $5. For a yearly cost of $24 to $60, it’s one of the most affordable additions you can make. Understanding how much is gap insurance per month through an insurer versus a lender is key to saving money. For drivers who need flexibility, understanding options like temporary car insurance can also be beneficial, but gap coverage is about long-term loan protection.

How Much Is Gap Insurance Through Dealership? The Hidden Costs

Many car buyers are curious about how much is gap insurance through dealership financing, mainly because it’s the option presented to them most forcefully at the time of purchase. As we’ve seen, this is consistently the most expensive route to take.

The reason this dealership-offered coverage costs so much more is twofold: markup and interest. The dealership charges the price up significantly. The high lump-sum cost is added to your car loan, meaning you end up paying interest on your car loan for years. This critical detail is often glossed over, making it essential for consumers to question how much is gap insurance through dealership offers before signing any paperwork. For those managing multiple types of coverage, from auto to business insurance, keeping costs separate and transparent is key to good financial health.

Key Factors That Influence Your Gap Insurance Price

While the seller is the biggest factor, other variables also help determine your final price, whether you’re paying a lump sum or a monthly fee. These factors contribute to the overall risk the insurer is taking on.

The Value of Your Vehicle

It’s simple math. The more expensive your car, the larger the potential dollar amount of the “gap.” A $50,000 vehicle will have a much larger potential gap than a $20,000 vehicle. Therefore, insuring a higher-value car will generally cost more and directly influences the final calculation of how much is gap insurance.

Your Vehicle’s Depreciation Rate

Not all cars lose value at the same rate. Some models are known for holding their value well, while others (often luxury or performance cars) depreciate like a rock. Insurers know this. They use depreciation data to assess risk. You can check estimated depreciation rates on sites like Kelley Blue Book (KBB).

Your Loan-to-Value (LTV) Ratio

This is the most technical factor, but it’s crucial. LTV compares the amount you borrowed to the car’s actual value.

- High LTV (100%): You are “upside down.” You owe more than the car is worth. This happens with small down payments or rolled-over debt. This equals a higher gap insurance cost.

- Low LTV (100%): You have equity. You owe less than the car is worth. This happens with large down payments. You may not even need gap insurance.

Your Location (State Regulations)

Where you live matters. Some states have regulations that can cap how much a dealership can charge for gap insurance. Additionally, regional theft rates and accident frequencies can slightly influence the base rates offered by insurance companies.

Your Credit Score

Your credit score doesn’t typically affect the price when buying from your auto insurer. However, when buying from a dealership or lender, it can play a role. A lower credit score often means a higher interest rate on your auto loan, which indirectly makes the financed gap policy even more expensive over time. Policies like commercial auto insurance are also heavily influenced by business credit and history.

How Much Is Gap Insurance in Texas? A State-Specific Look

Given its massive auto market, a common question is, “how much is gap insurance in Texas?” The general cost principles apply here just as they do elsewhere: buying from your insurer is cheapest.

The average cost of gap insurance in Texas from a dealership might range from $500 to over $900, depending on the vehicle and the dealership’s pricing strategy. The good news for Texans is that the state has a competitive insurance market, so shopping around with major auto insurers will likely yield very low annual rates, often in the $30-$60 range. You can learn more at the official Texas Department of Insurance website. Knowing these details is as important as understanding the nuances of your professional liability insurance if you’re a business owner.

Let’s Talk Numbers: How Much Is Gap Insurance for a Car?

Seeing real-world examples helps illustrate how much is gap insurance for a car. The true cost becomes clear when you see the potential financial gap you are insuring against, which can easily amount to thousands of dollars.

Example 1: A New $35,000 SUV

You buy a new SUV, a popular choice for families.

- Purchase Price: $35,000

- Down Payment (10%): $3,500

- Loan Amount: $31,500

- One Year Later: The car is totaled in an accident.

- Car’s Actual Cash Value (ACV): $26,000 (It lost ~25% of its value).

- Loan Balance Remaining: $27,500

- The “Gap”: $27,500 (what you owe) – $26,000 (what insurance pays) = $1,500

You would owe $1,500 for a car you can’t drive anymore.

- Gap Cost from Insurer: ~$40 for the year.

- Gap Cost from Dealer: ~$600 rolled into the loan.

In this case, spending $40 to avoid a $1,500 bill is a clear win. It’s a small price for significant peace of mind, much like choosing the right State Farm life insurance policy for your family’s future.

Example 2: A Used $20,000 Sedan

You purchase a reliable, two-year-old, used, sedan.

- Purchase Price: $20,000

- Down Payment (5%): $1,000

- Loan Amount: $19,000

- Six Months Later: The car is stolen and never recovered.

- Car’s Actual Cash Value (ACV): $17,000

- Loan Balance Remaining: $18,000

- The “Gap”: $18,000 (your debt) – 17,000 (the insurance money) = 1,000

Even with a used car with a smaller loan, there is a gap.

- Gap Cost from Insurer: ~$30 for for the year.

- Gap Cost from Dealer: ~$500 which is rolled into loan.

Again, the math is clear. The small annual payment of your insurance company is a good investment, in my opinion, as it demonstrates that the question of how much is gap insurance is secondary to where you buy it.

How Much is Gap Coverage Insurance and What Does It Actually Cover?

It’s helpful to be precise. When people ask how much is gap coverage insurance then they are asking the cost of this particular protection. The price you pay is directly related to what that policy does – and does not do.

It’s not a blank check. It has one job and that’s to pay the difference between your primary insurance settlement (the ACV) to what’s left on your loan. Understanding the policy limits is as important as knowing how much is gap coverage insurance will cost you.

What’s Covered?

- The remaining loan or loan/lease in balance following the payment of off ACV.

- This is for “total loss” occurrences covered by your primary policy such as:

- Waiting collision against any other vehicle/object.

- Theft.

- Vandalism.

- Fire, flood or other natural disasters.

What’s NOT Covered?

This is just as important to get your head around. Gap insurance will not cover:

- Your primary insurance deductible. Some rare, premium gap policies may come with deductible help, but the standard one does not. You will, however, have to pay your deductible.

- Late fees and missed payments or other punishments on your loan.

- The cost of extended warranties or other insurance products that were included in your loan.

- Mechanical problems such as blown engine, transmission problems.

- A down payment on your next automobile.

- Anything less than a “complete destruction.” It doesn’t pay for repairs.

Expert Quote: “Common misconception holds that gap insurance will be the one to cover the deductible. It is not so, and they say so, claims adjuster David Reed. Your gap policy pays in on the “out” of your comprehensive insurance or collision insurance after your deductible has been paid. Always be ready to pay out of pocket that first sum of money yourself.”

Understanding these exclusions is vital. It’s like knowing the difference between PPO and HMO plans when you consider Humana dental insurance or a United Healthcare insurance plan; the details draw the value.

Is Gap Insurance Worth It? A Cost-Benefit Analysis

So, is paying for this coverage a smart payment? The answer to “how much is gap insurance” is only one-half of the equation. The other is determining your own personal risk.

🤔 Should You Get Gap Insurance?

Yes, It’s Absolutely Worth It If…

No, You Can Probably Skip It If…

For an unbiased look at auto-related add-ons, outfits like Consumer Reports often make excellent data-driven suggestions you can use to make a final decision.

When Can You Cancel Gap Insurance?

Gap insurance is not a lifetime commitment. And you only need it so long as the “gap” exists. The moment you owe less on your loan than your car is worth you no longer need the cover. This point is called bringing positive equity.

You should be cancelling your gap insurance as soon as your loan balance falls below your car’s market value.

How to Cancel and Get a Refund

- Determine Your Car’s Value: Utilize or enlist the help of a service such as KBB or NADAguides that clearly shows you what your vehicle is truly worth.

- Check Your Loan Balance: Look at your most recent loan statement.

- Contact Your Provider:

- If with your insurer: It would only need a mere telephone call or an internet request to get you to cancel it off the policy. This center will end with your next billing.

- If with your dealership/lender: This one is more complex. You’re going to have to call the finance department of the dealership or the finance standalone provider. You will have to provide proof of your current loan balance (or that the loan is paid off).

- Request a Refund: If you made a lump sum payment at the dealership, you are entitled to a prorated refund for the unused portion of the policy. Be persistent because you may have to follow up to get your money back. Comparing life insurance options such as term life vs. whole life is a long-term commitment, but gap insurance is intended to be on a temporary basis.

Conclusion: Finding the Best Price for Your Peace of Mind

We have explored this topic from every angle and the answer to how much is gap insurance is now given: between affordable low to surprisingly higher depending on where you purchase it. For a few dollars a month, you add it to your auto policy and be extremely well protected. By accepting the dealership’s offer you could end up spending hundreds, if not a thousand, dollars more than you should have been spending over the life of your loan. That key to making a smart financial decision is knowing this difference.

Your best strategy is simple. When out in the market for a new car and you know that you will need this coverage, call your insurance agent before heading out to the dealership. Get a quote. This way, when the finance man comes with his expensive offer you can comfortably refuse knowing you have a much better deal on the shelf! After protecting your assets, be it a car or your health, is about being informed. Ultimately, taking the time (just a few minutes) to obtain quotes is the only way that you can really know how much is gap insurance for your particular vehicle and loan.

Frequently Asked Questions (FAQ)

Yes, you can almost always get gap insurance after purchasing a car. The easiest and cheapest method is to call your auto insurance provider and request that they add one to your existing policy. And this is typically much more affordable than settling for a high priced dealership deal after the fact.

No, your standard gap insurance will not cover your deductible. It only makes payments equal to the difference between the outstanding loan amount and the actual cash value of the car. You are still responsible for your out-of-pocket comprehensive or collision deductible.

You can then cancel it within a short period of time, when you no longer need the coverage once the loan is paid off. If you made a lump-sum incident to the dealership, you are entitled to a prorated refund for the unused portion. Getting in touch with the gap insurance provider to initiate the cancellation and refund process.

No gap insurance is not mandatory by state law. However, your lender or leasing company will require it often if you chose to get your loan with them, as many times you may have to put forth a small down payment. In these cases, it is important to understand how much is gap coverage insurance but its purchase is mandatory.

The gap is the difference between what you lie down on your loan and what your car is worth. In a claim the formula is – (Your outstanding loan balance) – (The Actual Cash Value payout from your primary insurer) = The Gap. Your gap policy is created to pay this amount.

![Compliant Drivers Program: Is It Legit for Driver Safety? [2025]](https://propinfo.site/wp-content/uploads/2025/12/Compliant-Drivers-Program-150x150.jpg)

Leave a Reply