You’re in pain. is a doctor’s recommendation for physical therapy. This is wonderful news for you in terms of your recovery. But a new worry sets in soon. Learning how much does physical therapy cost can be like another injury. Medical bills are confusing and they can be intimidating.

You imagine unending hours and a piling pile of bills. It’s a common fear. Many people put off care that they need because they fear the cost. That is what this guide is there to change.

The numbers will be demystified for you. We will break down each and every factor. You’ll know about insurance coverage, cash prices and hidden fees. This knowledge provides power to you. It helps you plan, budget and put your energy where it needs to go: getting better.

We shall take an economic journey on your recovery. You should have clarity and calmness of mind.

The Initial Shock: A First Look at Physical Therapy Prices

The first question everyone wants to know is about the bottom line. So, the immediate answer to the question of how much does physical therapy cost is The figures can vary wildly. That all depends on your insurance status.

For patients with health insurance the cost is typically your copay. This is a set amount that you pay each time you go. It typically ranges from $20 to $75. It will be your insurance plan details which specify this amount.

The “cash” or “self-pay” rate is paid without insurance. This price is determined by the clinic itself. The average cost to expect to pay for a session is between $75 and $350. The first session, the initial evaluation, will most often be the most expensive. And it may go up to $400 in some cases because it’s more comprehensive.

These are only a starting point for the numbers. There are many other factors to determine your final cost. This involves your whereabouts, clinic type as well as your treatment plan. Understanding such variables is the key to managing your budget.

Understanding Your Insurance Plan’s Role

Your insurance plan is the single biggest factor in your end bill. Plans from providers like United Healthcare insurance or even Humana dental insurance plan (if it has supplemental health benefits) has specific rules. You have to know the terms such as deductibles, copayments and coinsurance.

A deductible is something that you have to pay-out-of-pocket first. Your insurance does not begin paying you for it until you meet. For instance, let’s assume that your deductible is $1,000. You pay the entire cost of PT until you’ve spent the deductible amount. Thereafter, all you’ll have to pay is your copay or coinsurance. It’s similar to the deductible on your car insurance cost.

Coinsurance is a percentage that you pay with your insurer of the cost you have to cover. If your particular plan has a coinsurance rate of 20%, you would have to pay 20% of the allowed amount for each session after you pay your deductible amount. Knowing these details is extremely important.

Does Insurance Cover Physical Therapy? Unpacking Your Policy

Many people have one question, does insurance cover physical therapy? The short answer is yes, in a majority of cases. The huge majority of health insurance plans offer some amount of coverage for medically necessary physical therapy. However, to what extent that coverage is, is what you have to investigate.

Your policy is a contract. It describes just what is and is not covered. Physical therapy is generally thought of as being an absolutely necessary health benefit. This means that plans sold on the marketplace must cover it. Plans from large employers also usually have good coverage. Your individual plan documents or your provider should be verified by confirming your plan documents.

However, “coverage” does not mean “free.” You will almost always have some out-of-pocket expenditures. This could be your copay, coinsurance or payments towards your deductible. Don’t assume that your plan covers everything and there is nothing to pay for it.

Pre-authorization and Visit Limits

One of the most common obstacles is pre-authorization. Your insurance company might require your doctor to obtain approval prior to your beginning treatment. If you fail to do this then they may deny your claims. This leaves you with the full responsibility of the bill.

Another important piece of information is the visit limits. Many insurance plans limit the number of physical therapy visits that they will cover on an annual basis. This could be 20, 30, or 60 visits. If your recovery takes more sessions than you are allotted, you may have to pay out-of-pocket for the additional sessions. Or, you can appeal for more coverage. This process can sometimes be as complicated as filing a commercial auto insurance claim.

“Visit limits come as a surprise to patients.” Always check with your insurance provider concerning your annual cap on the amount of physical therapy you receive before you start your physical therapy treatments. This one question will save you from hundreds or thousands of dollars in unexpected bills.” Maria Sanchez Certified Medical Billing Specialist

How Much is Physical Therapy Without Insurance? A Deep Dive

This is a daunting journey to face without a safety net. So, how much is physical therapy without insurance. The cash-pay rate – that’s what you’ll be looking at. As mentioned this will usually range from $75 to $350 per session. The national average is in the neighborhood of $150 a session.

When you ask the question how much is physical therapy without insurance, the initial evaluation by the clinic is a big expense. This is the first visit, which is longer and more in-depth. The therapist makes an evaluation, develops goals, and a treatment plan. This session easily can run $250 to $400. Subsequent visits are generally less time consuming and less costly.

Many clinics are willing to work with self-pay patients. They may offer discounts for paying for anything upfront. Some even offer package deals. For instance, you can perhaps purchase a bundle of 10 sessions at a discounted rate per visit. Discounts and plans of payment never hurt to inquire. This is an important step for anyone who is paying out of pocket. Just like your physical recovery, financial planning is also a very important part of your recovery.

Factors That Influence the Cash-Pay Price

Several factors determine the final price tag for uninsured patients. The biggest one is where you are located. A clinic in a major city such as New York or San Francisco will charge more than will one in a rural town. This indicates the more expensive cost of living and doing business. Much like with rates for classic car insurance can vary by state so do medical costs.

The experience and specialty of the therapist also plays a part. A highly specialized therapist who has advanced certifications may be able to charge more. And finally, the type of clinic is important. A sizable hospital-based outpatient center often has a higher overhead. Therefore, their prices may be higher as opposed to a small independent private practice.

Price Comparison: Insured vs. Uninsured Patients

| 📊 Metric | ✅ With Insurance | 💰 Without Insurance |

|---|---|---|

| 💵 Initial Evaluation | $20 – $75 Copay | $200 – $400 |

| 🏃 Standard Follow-Up Session | $20 – $75 Copay | $75 – $200 |

| 💸 Total Cost (10 Sessions) | $200 – $750 (Post-Deductible) | $875 – $2,150+ |

📌 Note: These are estimates. Your actual costs will vary based on your plan, location, and treatment needs.

Decoding Your Bill: The Secret World of Physical Therapy Billing Units

Have you ever looked at a medical bill and thought you had no idea what a medical bill was? It is wicketwork of fees and bills. Understanding physical therapy billing units is the secret to understanding your statement. It helps you to understand what exactly you are paying for. Clinics do not just charge a flat fee per hour.

Instead they bill your insurance (or you) on specific procedures. Each procedure has a code in the CPT (Current Procedural Terminology) code. These codes are then billed at 15 minute blocks, referred to as “units.” This system is standard for the healthcare industry. Learning about physical therapy billing units enables you to go over your bills to ensure that they are accurate.

The number of units billed per session is dependent on two things. First, the particular treatments that you receive. Second, the amount of time that the therapist spends with you face to face.

The 8-Minute Rule Explained

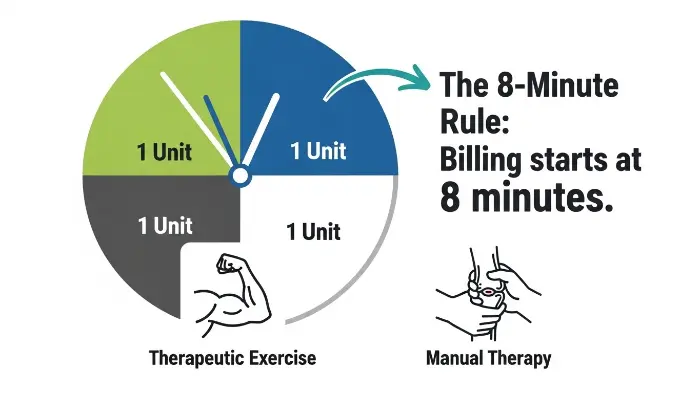

The “8-Minute Rule” is a rule intended for use by Medicare. Many private insurers such as those offering State Farm life insurance or other health products also have it. It determines the way therapists bill for time-based services. In order to bill for one 15-minute unit, the therapist must spend a minimum of 8 minutes performing this service.

Here’s a quick breakdown:

- 1 unit: 8 to 22 minutes

- 2 units: 23 to 37 minutes

- 3 units: 38 to 52 minutes

This rule is applicable to one on one time-based services. For example, therapeutic exercise or manual therapy is a rule in this regard. It’s a major concept in the world of physical therapy billing units.

Service-Based vs. Time-Based Codes

Not all codes are made on the 8-minute rule. CPT codes are divided into two major categories. This distinction is very important when analyzing how much does physical therapy cost.

Service-based codes are billed as one unit, time not relevant. An initial evaluation is one prime example. The therapist charges one unit for the evaluation, regardless of the length of time it takes (an hour, for example).

Time based codes are for one-on-one patient contact. This includes things such as manual therapy or therapeutic activities. These are the codes that are subject to the 8-Minute Rule. Your bill will display several units for such services. This is why a 60-minute session may have 4 or more separate charges on it. It is also the reason why the cost may increase so fast.

How Much Does Physical Therapy Cost Based on Location?

Where you receive your care has a huge impact on the price. The cost may vary considerably between a hospital and a private clinic. Let’s break it down in regard to the different settings.

A hospital-based outpatient physical therapy department has some of the highest costs. Hospitals have huge overhead costs. They transfer these costs to patients. An evaluation here could cost 30-50% more than elsewhere.

A private practice clinic is typically the compromise. These are stand-alone businesses that are run by physical therapists. They have less overhead than a hospital has. This often means more competitive pricing to cash-pay patients. They may also be more flexible when it comes to offering payment plans. It is also an excellent choice when you are on a tight budget.

And last but not least home health physical therapy. This is for the homebound patients who are unable to travel. One of the therapists visits your house. This is a service that is often more costly per visit in terms of travel time and logistics. However, usually insurance covers it as long as it is deemed medically necessary. Your doctor has to certify that you are not able to leave your home for treatment.

The Urban vs. Rural Price Gap

Beyond the type of facility, your city or state is of immense importance. It’s a simple case of supply and demand plus the cost of living. A clinic in downtown Manhattan has more rent and payroll. This directly affects the cost of treatment for the physical therapy for its patients.

On the other hand, a clinic in a small town in the Midwest has fewer expenses. This enables them to bill less for the same services. Research from organizations like the APTA often indicate great regional variations in their price. When making a budget you should always take into consideration the average costs for your given area. A simple search on the internet for the clinics in your area can provide you with a better idea.

Is Physical Therapy Covered By Insurance? A Closer Look at the Fine Print

We know that in most cases, the answer to “is physical therapy covered by insurance?” is yes. But it is the devil in the details. Your Summary of Benefits and Coverage (SBC): Your best friend. This is a legally required document and describes your costs and cover in language that you can understand.

When you look your SBC over, check for your copay for “Specialist Visit.” Physical therapists are generally specialists. Also, have a look at the section on “Rehabilitation and Habilitation Services.” This is where you will find information as to any visit limits and any requirements for pre-authorization. Another important bit of the puzzle is knowing whether a referral is necessary or not. These are questions which it is worth calling your provider to ask.

Navigating Deductibles and Out-of-Pocket Maximums

There is no bargain when it comes to understanding what will be deductible. If you are using a high-deductible health plan (HDHP), you may be paying the full, negotiated rate for numerous sessions. This rate is what the insurance company has agreed to pay the clinic. It is usually lower than the cash pay rate.

For example, the “list price” of a particular session may be $250. The negotiated rate from the insurer may be $120. You would be responsible for $120 per session until you have met your deductible. This can add up. The positive thing is that such payments are included in your out-of-pocket maximum.

Your out-of-pocket maximum is the out-of-pocket maximum you will be responsible for paying for covered services during a year. Once you reach this maximum, your insurance covers 100% of the costs the rest of the plan year. This is your financial safety net of all safety nets. It insures you from catastrophic costs. This concept applies in various types of insurance including health, motorcycle insurance.

The Importance of a Doctor’s Referral

Does your plan require a referral from your Primary Care Physician (PCP)? This is a typical requirement for HMO plans. Often PPO plans have greater flexibility. With some they may have you go directly to a physical therapist without a referral.

However 50 states have some form of “Direct Access.” This means that you can be evaluated and treated by a physical therapist without having to be referred to the physical therapist by your doctor. The catch? Your insurance may still require a referral so that it will be reimbursed. If you are using Direct Access and your plan requires a referral, then you may be stuck with the bill. Always check your policy first; Knowing whether is physical therapy covered by insurance under Direct Access is of crucial importance.

“The biggest mistake that I see is that patients assume their insurance works the same everywhere.” A PPO plan may not require a referral to see a PT, but an out-of-network clinic can still leave one with massive bills. Never forget to check whether a clinic is in-network or not when you visit it the first time. – David Chen, PT, DPT

Strategies to Lower Your Physical Therapy Costs

The most important part now is saving money. The first step is to know how much does physical therapy cost. Actively managing those costs are the next. You have a great deal of power over you.

First, talk to the clinic. Be upfront on your financial situation. If you are paying by cash, ask for a discount. Many clinics are willing to give self pay patients a discount of 10-25%. This is because they do not want the administrative hassle of billing insurance. It’s a win-win.

Also, ask about payment plans. Spreading the cost across several months may make it much more manageable. Don’t be shy in negotiation. The price is not always set in stone. This is especially the case if you are committing to a long course of treatment. This is a good financial practice, just as finding affordable business insurance.

Using HSAs and FSAs for Tax-Free Savings

If you have a Health Savings Account (HSA) or a Flexible Spending Account (FSA) use it! These accounts enable you to pay for medical expenses using tax-free money. This is an immediate and large saving.

You can use your HSA or FSA debit card to pay for copays, deductible expenses or full cash pay sessions. This is essentially a discount, in the form of your income tax rate. If you know that you will need physical therapy, make sure you are contributing to these accounts during your open enrollment period.

Asking for a “Superbill” for Reimbursement

What if you have a favorite out of network therapist? You’re not necessarily out of luck though. You can pay the cash rate of the clinic in advance. Then, ask them to prepare you a “superbill.”

A superbill is a detailed and itemized receipt. It has all the details that are required by your insurer. This includes the information regarding your clinic, your diagnosis codes and your CPT codes for the services you received. You can submit this superbill yourself to your insurance company. They will then reimburse you up to the out of network benefits under your plan. It’s more work, but it gives you the opportunity to see the provider that you want. This process is about taking control of your health and finances like the right professional liability insurance to protect your career.

How Much Does Physical Therapy Cost: A Real-World Example

Let’s walk through a scenario. Meet Sarah. She sprained her ankle and her doctor ordered 12 sessions of physical therapy.

Sarah has a PPO plan that has a $1,500 deductible and a $40 specialist copay. She has not yet met any of her deductible for the year. The PT clinic is in-network.

The list price of the clinic for an evaluation is $300, and follow-up visits are $175. However, her insurance has a negotiated rate of $150 for the evaluation and $90 for follow ups.

For the first visit (evaluation), the cost for Sarah is $150. For the next 15 sessions ($90 each), she pays $1,350. At this moment, she has paid for a total of $1500, fulfilling her deductible. For the rest of the sessions, she only pays her $40 copay. Her financial journey illustrates precisely how much does physical therapy cost when going through a deductible.

What if Sarah Had No Insurance?

Now, let’s see what the same scenario would be without insurance. Sarah would be subject to the clinic’s entire cash-pay rate. Let’s assume that the clinic offers a small discount to the self-pay patients.

The first evaluation may be $250. Follow-up visits could cost $150 each. For her 12 session plan of care, her total cost would be: $250 + (11 x $150) = $1,900.

This is a considerable out-of-pocket cost. However, with a question about a payment plan, Sarah may be able to stretch this cost to 4-6 months. This makes the financial burden a lot more palatable. This is a proactive approach when facing the situation of large medical bills. It’s as important as finding good temporary car insurance for when you need it for a short period of time.

Decoding a Physical Therapy Bill (CPT Codes)

📌 These codes (and units) appear on your bill and determine your final cost.

The Final Analysis on How Much Does Physical Therapy Cost

The cost of physical therapy is not a cut and dry number. It’s a complicated equation with a lot of variables in it. Insurance is the largest factor, but location, type of treatment and choice of clinic are all major components. The thing to take away is to take the initiative.

Don’t wait until the bill comes to begin asking questions. Call your insurer before you first consult. Confirm your benefits. Inquire about prices at the clinic for insured and uninsured patients. Knowledge is your best defense against surprising medical debt. Websites such as Healthline frequently give a division of typical treatment prices.

You should also not be afraid to discuss costs with your therapist. They can often customize your treatment plan in a way that will be more cost effective. For example, they may be more focused on a stronger home exercise program. This may be able to decrease the number of visits you need to make to the clinic. Your health is the priority, but there is another kind of health that matters, too – your financial health. Exploring options such as a term life insurance policy can also be included in a larger financial wellness plan.

Conclusion

Ultimately, the answer to this question is that it depends, on how much does physical therapy cost. But you are now armed with the knowledge to help you come up with a more accurate answer for your own situation. You know how big the contrast is between the insured and uninsured rates.

Being confident about asking a clinic about their cash-pay discounts is now possible. You know to check to see if there is pre-authorization and go to limits with your insurance. Knowledge of the fact that the cost in a hospital will probably be greater than a private practice is also helpful.

Most importantly, you’ve been educated about the secret language of physical therapy billing units. This way you are in a position to scrutinize your bills, and ensure that you are being charged fairly. You possess the means to act as a self-advocate to your health and the wallet.

Don’t enforce your financial fear so that you don’t receive the care you need. Through being an educated and proactive patient, you can control the cost. You can put your attention to your recovery. The route to healing is more obvious if you know and can plan for how much does physical therapy cost.

Frequently Asked Questions (FAQ)

The best thing to do is to call your insurance company directly by the number on your ID card. You can also use the online provider directory for your insurance company. Finally, you can call the clinic itself and ask them to check up your insurance coverage before booking an appointment.

Yes, especially if you are paying with cash. Many private clinics will be willing to offer either a “prompt-pay” discount or package deals for several sessions. It never hurts to ask the billing department its options. Less common for copays set by insurance is negotiation.

You have the right of an appeal. You and your doctor can submit a letter of medical necessity regarding why, to recover from your illness, the treatment is very important. While not always successful, many denials that were made are overturned on appeal. Don’t give up after the “no” is met.

Generally, yes. Physical therapy is also covered by insurance provided that it is medically necessary and you are progressing. For chronic conditions this could be referred to as “maintenance therapy” which some plans may place limits on. Check your policy for information on long term care coverage.

If you do not even need 2-3 visits, it might be manageable to pay the cash rate. Expect to pay between $200-$400 for the initial evaluation, and then $75-$200 for each follow up. Always obtain a price quotation in advance so there are no surprises with regard to how much does physical therapy cost.

Yes, they are very different, and both are crucial for a clinic. General liability insurance for physical therapy covers non-treatment related accidents that happen at the clinic. For example, if a patient slips on a wet floor in the waiting room or trips over a piece of equipment, this insurance would cover their injury claim. It’s for “slip-and-fall” incidents. In contrast, professional liability insurance (or malpractice insurance) covers claims related to the actual physical therapy treatment itself—like if a specific exercise or technique causes an injury.

![Compliant Drivers Program: Is It Legit for Driver Safety? [2025]](https://propinfo.site/wp-content/uploads/2025/12/Compliant-Drivers-Program-150x150.jpg)

Leave a Reply