An Annuity is a powerful financial tool to provide an answer for one of the largest questions associated with retirement: “Will my money last as long as I do?” It’s a contract between you and an insurances company made with the aim to have a reliable source of income.

Imagine a Personal pension you create for yourself? You pay in excess of it over a period of time or a one-time lump sum basis. In return, the insurer commits to making you a series of payments for a set period of time, or even for the rest of your life.

This is not some kind of investment like with a stock or mutual fund. Instead, it is more a security measure. It works as an insurance against longevity risk (the very real possibility of living too long for your nest egg). For many, this brings great management of the mind.

Understanding how this product works is the first step to more secure retirement. We are going to demystify the process, from the first funding, all the way to the day you get your first check. Let’s rule out how it can slot in your financial future.

What Exactly is an Annuity? (And What It Isn’t)

At its basic, annuity is a concept that is straightforward. You provide money to an insurance company. That money increases with time, normally on a tax deferred basis. Then, the company repays it to you in the form of an income stream.

Think of it like in reverse which would be like reverse your mortgage payments. Instead of you sending money to the bank each and every month, the insurance company sends you money. This basic trade is what creates it like no other retirement vehicle.

It’s important to differentiate an annuity and its traditional investment, however. While some types possess an element of investment, their primary task is to provide an income, and not aggressive growth. Of course, your 401(k) or IRA is to accumulate wealth; your annuity is to distribute the wealth in a predictable way.

This distinction matters. It is used to frame what the purpose of the product is. You aren’t purchasing it in order to double your money overnight. You are buying it to make sure that you have a steady paycheck when you no longer work. This is a defensive strategy for your financial play book.

Many insurance products, such as State Farm life insurance or term life insurance, are there to insure against dying too soon. An annuity insures against living too long.

The Core Components of Your Annuity Contract

Every annuity contract has a small number of players and phases. Knowing those will make you a much more educated buyer.

First of all, there’s the Owner ( Masa Life Owner ) (that’s you ). months – You buy the contract and make the decisions.

Second is the Annuitant. This is the person whose life expectancy is used for the calculations of the payments. Usually the owner and the annuitant are one and the same person.

The third is the Insurance Company. This is the financial institution that issues the contract and ensures the payments. It’s important to select a high rated, stable company.

The contract itself has two major phases:

- Accumulation Phase: During accumulation this is the period of growth. You contribute to the annuity and your money is invested and earns interest or investment returns tax free.

- Payout (Annuitization) Phase: This is the time when you “turn on the tap.” You transform your lump sum into a stream of payments which you know are safe.

This is sort of a foola way to put the money from saving to spend it when you retire.

“Annuities are not for the young. They are for people with 5 to 10 years to retirement that fear running out of money. It’s a way of offloading risk on an insurance company.” – Suze Orman

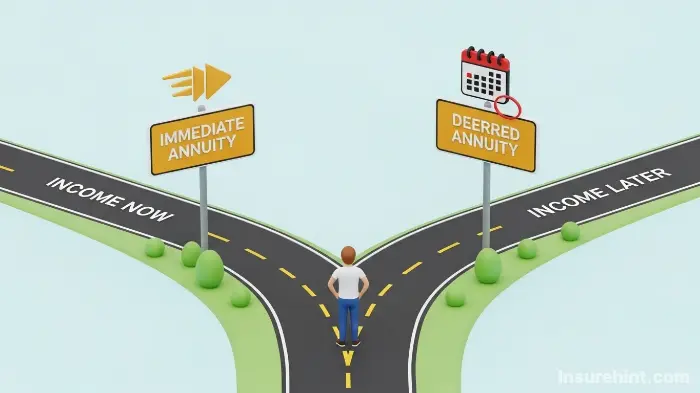

Immediate Annuity vs. Deferred Annuity: When Do You Get Paid?

One of your first choices will be that of an immediate annuity versus a deferred annuity. This decision is entirely up to you when you need the income to start.

An immediate annuity, as the name implies, begins to pay you quite immediately. And you usually finance it with one, large sum of money (such as a 401(k) rollover). Payments will start as soon as 1 month after purchase. This is ideal for those who are already in their retirement years and need income now.

On the other hand, a deferred annuity is one for future income needs. You can pay for it in either a lump sum or a series of payments over many years. This period is the accumulation period, in which your money grows tax-deferred. The main deferred annuity benefits, however, are this long-term growth potential, in addition to locking in a future income stream. Maybe you can purchase one in your 50s to generate income from your late 60s or 70s.

Which one to do is up to personal timeline. Are you retiring next year? An option that is immediate does make sense. Is retirement still ten years away? The deferred annuity benefits of tax deferred growth are very likely to be more attractive.

Exploring the Main Types of Annuities

All annuities are NOT made Equal. The type that you choose will determine the level of your risk and potential for growth. The three primary categories are fixed, variable and indexed.

Your decision here will have a great impact on how your money will perform during the accumulation phase. It’s a balancing act between safety on the one hand and the potential for greater ability to earn greater return on the other.

Let’s share a breakdown of each one so which one you might potentially pertain to your financial personality.

The Fixed Annuity: Your Rock of Stability

The best idea if you want the most conservative type of annuity is the fixed annuity. It functions somewhat like a Certificate of Deposit (CD) from the bank.

With a fixed annuity, the insurance company provides as guarantee to you a specific, defined interest rate for a set number of years. For instance, you may receive a rate that is guaranteed for 5% for a term of 5 years. Your money grows at that rate and it is immune to the whims of the market.

This is the ultimate “sleep at night” option. You know exactly what your return is going to be. There is no guesswork involved and no market risk. The trade-off, of course, is that your returns may not keep organizers up with high inflation or a booming stock market.

However, for retirees who are more concerned with capital preservation than anything else, the predictability of a fixed annuity is its strongest point of view. It forms a good basis for a retirement income plan. Just like you might look for cheap commercial auto insurance vehicle for a business, this product provides certain financial protection you can anticipate.

The Variable Annuity: Higher Risk for Higher Reward

If a fixed annuity is similar to a CD, a variable annuity is more similar to a 401(k). It provides the possibility of much higher returns, but comes at the same time with market risk.

With a variable annuity, you have your money invested in a portfolio of sub-accounts like mutual funds. These sub-accounts may be stock, bonds, and other securities. Your account’s value will vary on a daily basis, depending upon the returns of these underlying investments.

This means that you could see great growth. However, it also means that you could lose the principal in case of poor market. Many variable annuities come with various riders (for an additional fee) that can add some downside protection or guaranteed minimum income level, but the main product is linked to the market.

This type of annuity is more suitable for people who have a longer time horizon and a higher risk tolerance. They are happy to endure market ups and downs for the possibility of greater long-term rewards.

The Fixed-Indexed Annuity: A Hybrid Approach

A fixed indexed annuity as an investment (FIA) attempts to provide the best of both worlds. It is the performance of both a fixed annuity and the growing power of a market index such as the S&P 500.

Here’s How it Works Your principal is structured so that you’re safe from the vagaries of the market, the way a fixed annuity is structured. You will not loss money if the market crashes.

However, your interest earnings are related to the performance of a market index. If the index goes up then you get a share of that gain. The insurance company will most often cap your upside potential with “caps,” “participation rates” or “spreads.”

For instance, let us say the S&P 500 gains 10%, with a cap of 8% in your annuity, then you are going to receive credited back as 8% interest. If the market didn’t earn 5%, then you just get 0% interest for that period or time – you don’t lose money. This product is potentially complex, which makes it important to understand its particular ways of crediting.

Fixed vs Variable Annuity

📊 Fixed vs. Variable Annuity: A Quick Comparison 💰

| ⚡ Feature | 🔒 Fixed Annuity | 📈 Variable Annuity |

|---|---|---|

| 💎 Principal Risk | None. Principal is guaranteed by the insurer. | Yes. Principal can fluctuate with market performance. |

| 🚀 Growth Potential | Modest and predictable. Tied to a fixed interest rate. | High. Tied to the performance of underlying investments (sub-accounts). |

| 🧩 Complexity | Low. Easy to understand. | High. Involves prospectuses, sub-accounts, and various fees. |

| 🎯 Best For | Conservative individuals prioritizing safety and predictability. | Those with higher risk tolerance seeking market-based growth. |

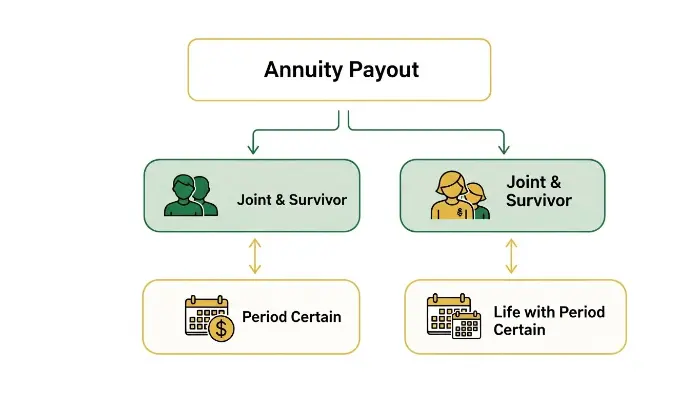

Demystifying Annuity Payout Options for Your Future

When you choose to begin receiving income (the annuitization phase), you are faced with a serious decision: the annuity payout options. This decision is used to figure out how, as well as for how long, you’ll get your money. Importantly, this choice often is not reversible.

The following are the most common annuity payout options:

- Period Certain: You get payments for a specific period of time, such as 10, 15, or 20 years. In case you die before the end of the period, your beneficiary receives the balance payments.

- Life Only (Single Life): You are paid for the rest of your life. This one usually offers the uppermost monthly payment. However, payments cease when you die; and, there is no payment to heirs”I am not sure why the term coffers, or unfortunately, margins, describes such accounts.

- Life with Period Certain: This is a hybrid. It makes payments on your life, and also guarantees payments for a set number of years. If you die within that frequency-then your beneficiary receives the remainder of the guaranteed payments.

- Joint and Survivor: This type is applied to two people (usually spouses). Payments are not discontinued so long as either person is alive. The payment amount may lessen after the first person dies (e.g. 50% or 75% of the original amount).

Understanding the Importance of Your Annuity Choice

Choosing the appropriate payout structure is a prime matter. A “Life Only” option may provide you with more income, but a “Joint and Survivor” option will ensure your spouse is taken care of. Your health, whether or not you are married and if you want to leave money to heirs, will all affect this decision. It is as personal as the choice between multiple types of motorcycle insurance based on your bike and riding habits.

Be sure to model each of the scenarios carefully before committing to something. This is perhaps the single most important decision that you will make with regard to your annuity.

The Promise of a Guaranteed Lifetime Income

The single most powerful feature of an annuity is the ability to provide a guaranteed lifetime income. This is the characteristic which no other financial product can match in the same certainty.

A guaranteed lifetime income vehicle converts some of your life savings into your own pension. No matter how the stock market is doing, regardless of how long you are living, that check is going to show up every single month. This will be the predictability that can be the bedrock of a retirement budget.

It enables you to cover your essential costs – your housing, food, healthcare, utilities, and also think of the dependable source of money. This frees up your other assets (like your 401(k) or brokerage account) for other discretionary spending, travel or legacy goals. You can be more aggressive with managing those assets as you have your basic needs met.

For so many this security is invaluable. It takes out the pressure of having to continuously watch account balances and fear market downturns. The peace of mind provided by a guaranteed lifetime income is often the main reason why people buy an annuity. It’s a layer of protection just as having good Humana dental insurance or United Healthcare insurance – you are hoping for the best but preparing for the worst.

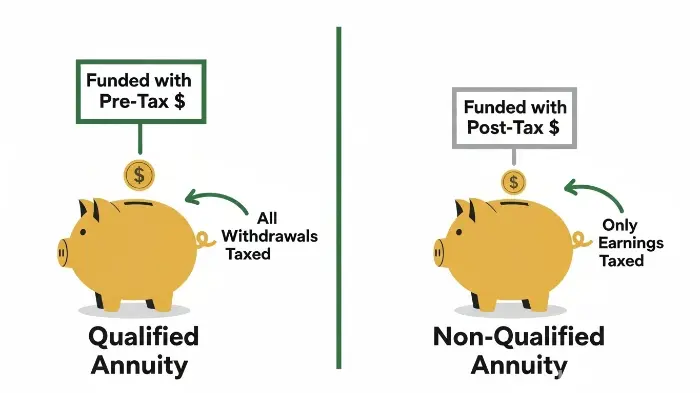

The Tax Implications of Your Annuity

Understanding the tax treatment of your annuity is essential. The rules depend on how you funded it. Annuities are categorized as either qualified or non-qualified.

This distinction is not based on the quality of the product, but rather the source of money used for buying the product.

Qualified vs Non-Qualified Annuity Funds

A Qualified Annuity is bought using pre-tax money. This means that you used money taken from a tax-advantaged retirement account, such as a 401(k), 403(b), or a Traditional IRA. Since you never paid tax on the contributions or on the growth, every dollar that you withdraw from the annuity is taxed as ordinary income.

A Non-Qualified Annuity, on the other hand, is bought with after-tax dollars. This is money from your savings, brokerage account or inheritance. With this type your withdrawals are reflected on a Last-In First-Out (LIFO) basis.

This means that the earnings are withdrawn first and taxed as ordinary income. After all the earnings have been withdrawn, you begin taking home your original principal (your cost basis), this amount is returned to you tax-free.

For all types of annuities, the growth on the annuity is tax-deferred. You don’t pay any taxes on the interest or gains of the investment every year. Taxes are not due until you start taking withdrawal. For specific rules, not the least, about early withdrawals before age 59 1/2, it’s always a good idea to speak with a tax professional or visit the guidelines for the official IRS.gov website.

“I don’t like annuities. They’re complex, they’re expensive, high commissions, they have big surrender charges . . . You’re loaning an insurance company money for 15 years and they’re gonna charge you a fee if you ask for it back.” – Dave Ramsey

The Hidden Costs: Fees, Charges, and Surrender Periods

Dave Ramsey’s criticism is a signpost for a critical area, costs. An annuity is not the easy come product. We’ve all heard dreadful tales of where people quite amicably go, include fees and restrictions are not involved.

The greatest obstacle is the surrender charge. This is a penalty for investing more than a certain amount (usually 10% per year) during the “surrender period.” This period may last as short as 3 or as long as 15 years. The penalty is usually very high at the beginning and reducing with each year. For instance, it could be that 9% in year one, 8% in year two, and so on until it gets to zero.

This “lock-in” feature gives the insurance company stability and therefore allows them to make long-term investments. But it places a severe restriction on your liquidity. You should never inject money you need in case of an emergency into an annuity.

Other possible fees are and include:

- Administrative Fees: Annual flat fees or percentage of the account value.

- Mortality & Expense (M&E) Charges: Found in variable annuities these cover the insurance guarantees.

- Investment Expense Ratios: Fees about the sub-accounts within a variable annuity.

- Rider Fees: Extra fees for optional riders such as enhanced death benefits or lifetime income guarantees.

These costs can do the math, and they have an effect on your overall return. Always ask for a full illustration of any fees before you sign any contract. The car insurance cost is important but understanding annuity cost is much more crucial.

Pros & Cons Checklist

🛡️ Annuity Pros & Cons at a Glance 💡

🐖 The Pros (Advantages) ⭐

- ✓ Guaranteed Income: Provides a reliable paycheck for life, protecting against outliving your savings.

- ✓ Tax Deferral: Your money grows without being taxed annually, enhancing compound growth.

- ✓ Principal Protection: Fixed and indexed annuities offer protection from market downturns.

- ✓ Customization: Multiple payout options and riders to fit your specific needs.

☂️ The Cons (Disadvantages) ⚠️

- ✗ High Fees: Can have multiple layers of costs that reduce returns (commissions, M&E, rider fees).

- ✗ Illiquidity: Surrender charges make it expensive to access your money early.

- ✗ Complexity: Contracts can be difficult to understand, especially variable and indexed types.

- ✗ Ordinary Income Tax: All gains are taxed as ordinary income, which is often a higher rate than capital gains.

Who is an Annuity Right For? (And Who Should Avoid It?)

An annuity is a special purpose tool and is certainly not a one-size-fits-all tool. It’s most appropriate for a certain kind of person.

An annuity might be a good fit if you:

- Are at or close to retirement (most commonly 55plus).

- Have a main objective of generating an assured stream of income.

- Have already retired other tax-advantaged retirement accounts (such as your 401(k) and IRA).

- Are worried about the volatility in the stock market and are looking to de-risk a percentage of your overall investments.

- Are well health and worried about longevity risk (running out of money).

For these individuals, investing some part of their assets into an annuity can provide a strong floor of-income. This is a strategy recommended by many financial advisors, and there are resources such as those from trademarks such as AARP that speak about income planning during retirement.

You should probably avoid an annuity if you:

- Are young – in your prime earning years. Your focus should be on investments that are more growth-oriented.

- Need to keep your savings liquid in case of an emergency situation or for opportunity.

- Have not already maxed your 401(k) or IRA contributions These are the account which usually have minimize fees.

- Have a high tolerance for risk and does not mind managing his or her own investment withdrawals.

- Have a pension or other sources of guaranteed money that already take care of your necessities.

Just as the business owner has to weigh the costs of affordable business insurance against the risk, the retiree has to weigh the costs of an annuity against the risk of a shaky income.

Conclusion: Is an Annuity the Right Move for Your Retirement?

An annuity can one of the pillars of a secure retirement, but it has to used properly. It’s not an investment for creating the maximum amount of wealth; it’s an insurance product for assuring income. By turning part of your savings into a retirement income stream, you transfer one of the biggest risks from your shoulders, namely a downturn in the markets and a long life, to an insurance company’s.

The key is to know the different types of them, from the reasonable fixed annuity that appears safe, to more complicated variables. You have to be brutally honest on fees, surrender charges and lack of liquidity. Furthermore, the choice of the right annuity payout options is a critical and in many cases permanent decision that will affect your financial life for decades. For some the dream of guaranteed lifetime income is at least a sense of peace that cannot found in other products.

Ultimately, an annuity should used as part of a diversified plan, and not the whole plan itself. It is best used in conjunction with other assets such as stocks, bonds and real estate. Do your homework and ask the hard questions and consider consulting with a fiduciary financial advisor. This will help you to determine if this powerful tool is the right choice to complete your retirement puzzle. By making an educated decision you can relax and have a predictable income stream by having an annuity.

Frequently Asked Questions (FAQs)

Most states have “guaranty associations” to protect the holders of annuities up to a point (i.e. $250,000) in the event of failure of their insurer. It’s still very important to select a company with a high financial strength rating (A or better) from agencies such as A.M. Best or S&P to reduce this risk.

It depends on the type. In the case of a fixed or fixed-indexed annuity, your principal is generally safe from the loss of the market thanks to the protection of the insurance company. In a variable annuity there is a risk to your principal as it is invested in the market and there is a chance that you will lose money if your sub-accounts do not perform well.

The bad reputation is often because of high sales commission selling complex unsuitable products to uninformed buyers. High surrender charges and the confusing fee structures have also played a part. However, when a low-cost, simple annuity is used appropriately for its intended purpose, the purpose of income generation, it can a very effective tool.

Yes, but that depends on what type of payout option you select. If you go for a “Life Only” option then payments would cease at the point of your death. If you make one of the following choice “Period Certain” and “Joint and Survivor” if you pass away during the accumulation phase, your named beneficiaries will receive the remaining payments or the cash value of the account. Just as you require professional liability insurance in certain occupations, you need to make sure your annuity has the appropriate beneficiary protections.

Most contracts provide you the option to withdraw a set percentage often as high as 10% annually without any sort of penalty. Some also provide waiver for terminal illness or needs for long term care. For anything beyond that for the period of the surrender, you will probably pay a fee. It’s not as flexible as a bank account is or even getting temporary car insurance for a short term need. Making a long-term commitment is what an annuity is all about.

![Compliant Drivers Program: Is It Legit for Driver Safety? [2025]](https://propinfo.site/wp-content/uploads/2025/12/Compliant-Drivers-Program-150x150.jpg)

Leave a Reply