Welcome to you his or her entire guide. In this article, we are going to understand the topic of Home and Contents Insurance. Indeed, such protection is essential for homeowners. It aims at securing your financial future. You have certainly slaved away for your home. After all, it is your sanctuary and biggest asset. Therefore, protecting it is not only a good idea, but an absolute must.

In particular, this article will explain breakdown of everything. We will be using simple and easy to understand language. As a result, you will learn what’s covered in. In addition to that, you’d learn what isn’t. However, ultimately, let’s get your mind at peace.

Understanding the Basics of Home and Contents Insurance

First of all, let’s find out the core idea. What exactly are you buying? In a nutshell, it’s not that difficult. This insurance is a two part shield. As a result, it will then protect both your house as well as your stuff.

What Is Home and Contents Insurance?

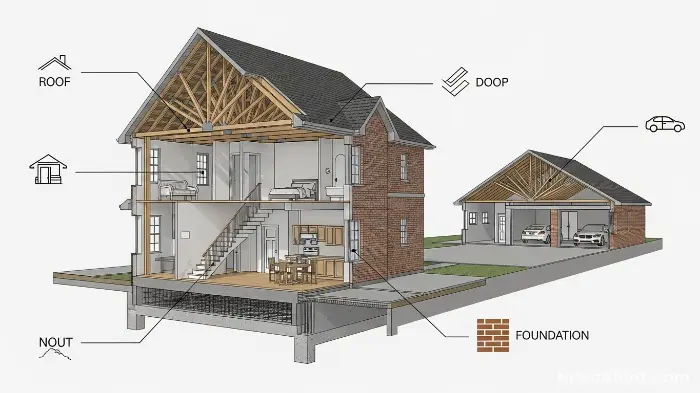

Think of it as a case of two policies in the price of one. For example, there are “home” which covers the building part of the building. This includes the walls, roof and floors. It also includes permanent fixtures. For instance, your inbuilt kitchen cabinets are included.

Meanwhile, the “contents” part addresses the belongings that you have. These are the moving things inside your house. This includes your furniture, clothes and electronics. Together, they provide a complete package with regards to the protection of your property.

Why This Type of Homeowner’s Insurance is Crucial

So, what do you need this coverage for then? A disaster can happen at any time. A fire or a bad storm may occur at any time. Without insurance for example, you could lose everything. The resulting loss of money would be devastating.

Moreover, most of the time mortgage lenders demand for it. This is because there is a need to protect their investment. The loan is made safe with the help of an insurance policy. In the end it provides you and the lender both with security. It brings priceless: so there’s no downside to the overwhelming peace of mind that comes with it.

Key Differences Within Your Home and Contents Insurance

At times, you can purchase such coverages separately. Home insurance, which is also referred to as building insurance. If you are a landlord, for example, you have a need for this. It insures the physical building that you own.

On the other hand, contents insurance is your possessions. If you are a renter, then this is definitely for you. It defends your items in the space that you rent. Homeowners, however, typically put them in bundles. Combining them into one Home and Contents Insurance policy is often more convenient and cheaper.

Your Home and Contents Insurance: A Deep Dive into Building Coverage

Now, let’s get more close in view of the “home” part. This is commonly referred to as dwelling protection. Of course, it’s the basis for your policy. It has a primary role of protecting the physical structure that you live in.

Understanding Dwelling Protection in Your Homeowner’s Insurance

Dwelling coverage is the major component. It beats to make money to repair or rebuild your house. This is in case it’s damaged by a covered event. In insurance-speak, such events are referred to as “perils.”

The amount of the coverage is very important. In particular, that should be sufficient to totally rebuild. Don’t base it on market value. Instead, you should concentrate on the cost of replacement. The cost of construction can be very high. As such, you need sufficient coverage.

What About Other Structures on Your Property?

Your policy does not only apply to the house. In fact, it frequently incorporates other structures. This means that your detached garage will be covered. Also your garden shed is protected. Fences and driveways typically come under this too.

Usually, this coverage is a percentage. It is usually about 10% of dwelling coverage. So, if your home is insured for $300,000 then your other structures have a protection of approximately $30,000. Of course, you may often increase this amount if there is a need for it.

“The best time of the day to fix the roof is when the sun is shining.”

– John F. Kennedy

This quote is reminding us to prepare beforehand. Insurance is such preparation. Indeed, it is your financial roof before the storm.

Common Perils Covered by Home and Contents Insurance

Your insurance policy will contain listed covered perils. These are the specific events that set off coverage. It is therefore important to understand them.

Examples of Covered Events:

- Fire and smoke damage

- Lightning strikes

- Windstorms and hail

- Theft and vandalism

- Falling objects (like trees)

- Damage caused by aircraft or vehicles

- Water damage due to bursting water pipes

Building Coverage Exclusions in Your Property Insurance

Just as important is what the exclusions are. No policy covers everything. For example, there are certain events that are excluded by typical policies. To do this, you have to be aware of these gaps.

Common Exclusions:

- Floods

- Earthquakes and sinkholes

- Damage Caused by Neglecting maintenance

- Pest infestations (termites, rodents)

- War or nuclear events

For some of these you can purchase separate coverage. An example of an add-on would be flood insurance. We’ll discuss this more later. Similarly, you may want to consider what options you have with respect to one-of-a-kind vehicles as standard home policies won’t cover you for a prized car, which is where classic car insurance becomes essential.

Home and Contents Insurance: Protecting Your Possessions

But now instead of saying crucially: we are talking about your things. Your home is no doubt filled with things of personal significance. Personal possessions insurance, or contents insurance, will cover them. In fact it is a crucial component of your safety net in financial life.

What Exactly Counts as ‘Contents’?

Basically, it’s anything you would take in the case of you moving. Imagine for a second you turned your house upside down. Everything on the floor that is falling out is “contents.” This is a simple, but effective way to think about this.

This includes your sofa and your television. Along with that it covers your computers and your clothes. It even wherein your kitchenware and books. As you can see, it is a long list. You probably own more than you know.

Your Contents Insurance Policy: ACV vs. RCV

This is a rather important distinction. It directly impacts the issue of how much you get paid in a claim. For that reason, you have to pick and choose wisely.

Actual Cash Value (ACV): it pays for the depreciated value. For example, what is new isn’t your 5-year old laptop. ACV pays what it was worth at today’s prices. As a result of this it will be much less than you paid.

Replacement Cost Value (RCV) is different. It is the cost of purchasing a new similar item. It does not deduct for depreciation. While RCV policies have a higher insurance premium, they offer much better insurance. For this reason, most experts are in favor of RCV.

The Depreciating vs. New Asset

Actual Cash Value (ACV)

This coverage pays you for the value of the item at the time of loss. It accounts for age and wear-and-tear (depreciation). As a result, you get less money back.

Replacement Cost Value (RCV)

This coverage pays the full cost to replace your lost item with a brand new, similar one. It does not factor in depreciation. Consequently, you get more money back.

Special Limits Within Your Contents Insurance

Standard policies have a limit. In other words, they limit the amount of payouts for some items. This can be said with stuff such as jewelry and art. Furthermore, there is also some firearms and collectibles.

For example, a policy may put a ceiling (limit) quantity on jewelry theft coverage at $1,500. If you have a $10,000 engagement ring, you’ve got a problem then. You have to get additional coverage for these things. This is referred to as a “rider” or “floater.” It insures a particular item for the appraised value of that item. This is like you may require professional liability insurance for specific risks in your profession.

Additional Coverages for Your Home and Contents Insurance

A good Home and Contents Insurance policy gives more. It includes not only the building and your stuff. In fact, these coverages are nothing short of life gives. They safeguard your monetary meaningful things in different ways.

Liability Protection in Your Homeowner’s Insurance Policy

This is one of the important part. Liability protection involves financial protection. It does apply when somebody is hurt on your property. For example, the visitor could slip and fall. As a result, they may sue you for medical bills.

Your liability coverage would then cover these costs. In addition it covers your legal defense. Furthermore, it covers you in case you or members of your family cause damage to somebody else’s property. In short it’s a crucial law against lawsuit. For a lot more on liability, you should go ahead & maybe check this out tactic of an entire guide on homeowners liability simply by nolo.com.

Additional Living Expenses (ALE) Coverage

But what if your abode ceases to be habitable? A major fire, for example, could force you to leave. You would then need somewhere to stay for repairs. This is where Additional Living Expenses (ALE) is helpful.

Specifically, ALE includes additional expenses of living in a different place. It is used for paying the hotel bills or the rental home. Also, it includes meals and other expenditure required. This coverage helps to prevent a financial catastrophe from causing a second financial crisis. In other words, it makes your life as normal as possible.

Optional Add-Ons for Your Home Insurance Policy

Your needs might be unique. Standard policies provide employers with a starting point only. Luckily, you are able to customize them with add-ons. These are known as endorsements or riders.

Flood Insurance for At-Risk Homes

As we mentioned floods are excluded. However, separate flood insurance can be purchased. The National Flood Insurance Program (NFIP), which is administered by FEMA, is one of the main sources. If you are living in a flood zone this is a must have. Even if you don’t, it is worth thinking about. After all, fact is, flooding can and does occur anywhere.

Earthquake Insurance Protection

Similarly, earthquakes are not the norm. You need this if you live in an area where there’s likely to be an earthquake. California is one of the best examples. Fortunately, the earthquake insurance is available. It will cover damage from shaking on the ground.

Accidental Damage Coverage

Specific policies against certain perils are standard policies. But what about accidents, simple accidents? For example, with access to paper, what if you spill some paint on your new carpet? Or what if the child you know breaks a window? Accidental damage cover can obviate this. It’s an optional extra to give you greater protection to cover mishaps that could happen.

Navigating Your Home and Contents Insurance Policy and Premiums

Understanding your document of the policy is vital. After all, it is a legal contract. It includes an outline of your coverage, limit and duty. Let’s try and take the mystique out of some the important aspects. This will then help you effectively manage your policy.

How Your Home Insurance Premium Is Calculated

Insurers take a variety of things into account. They use them to rate your insurance premium. Knowing them can, therefore, help you to find savings.

Key Factors Influencing Your Premium:

- Location: First, it costs more for high-risk areas. This includes places with high crime, common storms etc.

- Construction: Additionally, brick homes may be less expensive to insure than wood frame homes.

- Age of Home: Older homes may have more risks. For instance, they could have old electrical systems.

- Claims History: Also, history of filing claims will increase your rates.

- Credit Score: In most locations, better the credit score more is the chance of getting a lower premium.

- Protective Devices: Finally, the presence of smoke detectors and security systems can get you discounts.

The Important Role of the Deductible in Your Insurance

Your deductible is your first payment, the amount that you pay first. You pay it at your own expense on a claim. Then, the remainder is paid by the insurance company. For example, say that you have a $1000 deductible. A storm causes $10,000 in damage. You pay $1000, and your insurer covers the remaining amount, $9000.

You have choice between the amount of deductible. A higher deductible will generally mean a lower premium. However, you need to ensure that you can afford it. You will need that cash on hand in case you file a claim.

What Determines Your Home Insurance Premium?

Your Location

Home Construction

Safety Features

Your Claim History

Deductible Amount

Credit Score

Reading the Fine Print of Your Home Insurance Policy

Tempting as it is to just file the policy away. However, please don’t do this. You have to read your insurance policy. It is, after all, the final word regarding your coverage. No other mandated disclosure does more harm than to look carefully at the “Declarations Page.” Specifically, this page lays out your coverages and your limits.

Also, take the read time of the “Exclusions” section very well. This section informs you about the things that are not covered. If you have any questions, contact your agent immediately. In sum, it is always better to understand your policy now in order to avoid surprises in the future. It’s just as important as knowing your options for health coverage, such as those in a United Healthcare PPO plan.

The Home Insurance Claims Process: What to Do When Disaster Strikes

Knowing what is covered by your policy is one thing. However, knowing how to use it is another. The process of making a claim can be extremely stressful. Luckily, there can be a lot of preparation that will make it a lot smoother.

Making a Claim on Your Home and Contents Insurance

If you are going to file a claim, you need to do it quickly. Follow the following set of steps for the best possible outcome. Indeed, this organised approach contributes to success.

- Contact Your Insurer: The first thing that you need to do is call your insurance company or agent right away. They will be able to get you through the rest of the steps.

- Document Everything: This means documenting the damage by taking photos and videos of it. Do this before you do any cleaning or anything else like moving. Detailed documentation is certainly your best authoritative.

- Prevent Further Damage: Then, make some temporary repairs if necessary. For a damaged roof for example, cover it with a tarp. Be sure to save receipts of materials that you purchase.

- Keep Detailed Records: Also, initiate a claim file. Make a record of all your conversations. Specifically, a good example is to take notes about the key information that includes the date, time, and individual that you spoke with.

- Work with the Adjuster: Finally, the insurer will send an adjuster. They will assess the damage. Be cooperative and give all your documentation.

Why You Must Create a Home Inventory for Your Insurance

A home inventory is crucial. It is a list of your possessions in detail. For example, there should be descriptions, purchase dates and values. Photos and receipts also are very helpful.

Imagine trying to remember everything you own when there is a fire? Of course, that would not be possible. Making a claim much easier is a home inventory. You could, however, use an app, use a spreadsheet, or even simply do a video walkthrough. Most importantly, store this inventory outside of your home. A cloud service is the perfect option. This is a bit like having a business inventory, where commercial auto insurance is required for the vehicles used.

“By neglecting to prepare, you are preparing to fail.”

– Benjamin Franklin

This famous quote applies perfectly here. Literally, a home inventory is your preparation. In other words, it ensures that you can recover what you’ve lost.

Smart Ways to Save on Your Home and Contents Insurance

Home and Contents Insurance is a Standard. However, that doesn’t mean that you have to overpay. There are many clever ways to reduce your costs. So, let’s discuss some of the strategies from the top.

Bundle Your Policies for Big Savings

One of the simplest ways of saving is through bundling. Most companies offer discount multi-policy. For example, you can bundle your home and auto insurance. Some even allow you to add on life insurance. Researching different life insurance options, such as a State Farm life insurance policy, can show what such bundling opportunities exist. This can often result in high savings on all your premiums.

Increase Your Deductible

As we have covered earlier, a higher deductible reduces your premium. If you have a healthy emergency fund then this is a great one. Just be sure you can easily afford to pay the more. It’s a question of trade-off between cost per month and pay out-of-pocket when it comes down to it.

Improve Your Home’s Security and Safety

The lower-risk home is something insurers love for certain. As a result, you can get discounts by making your home safe. For example, install a security system that has monitoring. Add dead bolt locks and smoke detectors.

Upgrading where the old plumbing or electrical systems are also can help. These steps minimise the probability of a claim, so your insurance company will reward you for this. Along with this, following the top tips for reducing your car insurance cost includes reducing risks.

Maintain a Good Credit Score

The reason for this is that your credit history can affect your rates. Insurers like to use a credit-based insurance score. This is because they have found that there is a correlation between the credit and claims. Therefore, if you maintain a good credit, it can help you get a better rate.

Shop Around and Compare Quotes

You do not want to just accept the first quote that you obtain. Insurance prices can vary a great deal from company to company. For this reason, get quotes from a minimum of three different insurers. You can also work by means of an independent agent.

They can do shopping on your behalf in the market. This is a right step to make sure you get the best value scenario. This is true with all types of insurance from finding affordable business insurance to getting the best Humana dental insurance plan.

Ask About Other Discounts

There may be other discounts available to you. For example, certain insurance companies will provide discounts for retirees. Others offer loyalty discount. So, don’t be afraid from asking to your agent. Just ask them “What other discounts am I eligible for?”

You may well be pleasantly surprised. It’s also smart to check your needs from time to time, just like in the case of term life insurance vs. whole life insurance. Even short term needs, such as those provided by temporary car insurance, need to be carefully compared.

Claim Filing: Do’s

- 📞Call your insurer immediately after a loss.

- 📸Take extensive photos and videos of all damage.

- 📝Keep a detailed log of all communications.

- 🛠️Make temporary repairs to prevent more damage.

- 🧾Save all receipts for repairs and living expenses.

Claim Filing: Don’ts

- ⏳Don’t delay reporting the claim to your insurer.

- 🗑️Don’t throw away any damaged items until told to.

- ✒️Don’t sign any settlement papers you don’t understand.

- 🗣️Don’t give a recorded statement if you feel unsure.

- 💸Don’t begin permanent repairs before the adjuster’s approval.

Your Home, Your Castle, Your Protection

Your home is just more than just a building. It’s a place of memories of security. Above all, that is years of your hard work. Home and Contents Insurance is the necessary tool to take care of it. It is not a luxury, but a basic component of good homeownership.

From dwelling protection to liability coverage, each one of the parts of each policy plays a role. As a result, it builds a financial pyramid around your life. By knowing your policy, you give yourself power. By making the appropriate choices as to coverage you accordingly secure your future. You can even get some great rates with specialized insurance such as motorcycle insurance online by applying these same principles.

Take the time to spend on review of your existing policy. If you don’t have one, then start shopping away today. A little bit of work at this point can save you from financial ruin in the future. To conclude, be protective to your castle. For more information, the Insurance Information Institute has some excellent sites.

Frequently Asked Questions (FAQs)

In general, you need sufficient dwelling coverage to fully rebuild your residence at today’s building cost. For contents, a home inventory will help you find the overall worth of your personal possessions.

No, standard Home and Contents Insurance policies almost always leave out flood damage. For that reason, you need to buy a separate flood insurance policy for that protection.

Actual Cash Value (ACV) makes payment for the depreciated value of your items. On the other hand, Replacement Cost Value (RCV) pays the cost to purchase a new item that is similar in nature. RCV offers a better coverage with higher premium typically paid.

It might. In fact, with many insurers your premium will increase after any claim. That is why, it is often a good idea to pay for minor repairs yourself if the expense is below or near your deductible.

Yes, absolutely. Renters insurance is in principle contents insurance for tenants. It will provide insurance for your own belongings inside your rented apartment or house but it will also cover the important liability coverage.

![Compliant Drivers Program: Is It Legit for Driver Safety? [2025]](https://propinfo.site/wp-content/uploads/2025/12/Compliant-Drivers-Program-150x150.jpg)

Leave a Reply