The open road calls to you. It’s a feeling of pure freedom. It’s an experience unlike others, all the wind and those things, and the trip. However there is one crucial step before you turn the throttle. You require the appropriate security. And there Geico motorcycle insurance comes in. Their famous tagline has been heard by a substantial number of riders. The question they ask is whether or not Geico is the most affordable choice.

It is this question that we are going to discuss today. Deep down we are going to meddle. We will examine the coverage options of Geico. Their numerous discounts we will unmask. And we will also be able to find out how their pricing performs. We are aiming at providing you with the clear, helpful information. You are then left with making the best decision to make about your bike and your budget. This is your ultimate guide to motorcycle insurance. Let’s get started on this journey together.

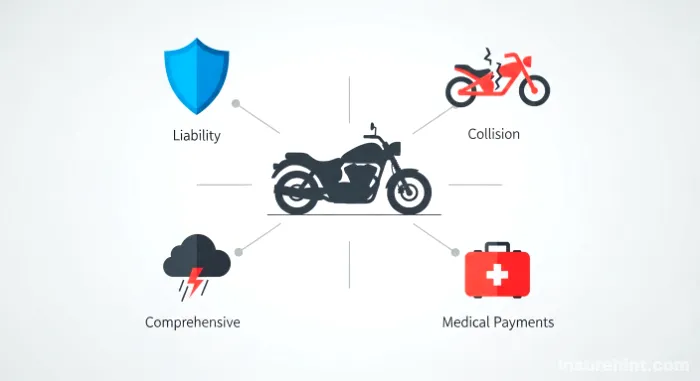

What Does Geico Motorcycle Insurance Actually Cover?

To begin with, what are you paying? An insurance policy is a promise of protection. Geico motorcycles insurance provides good collection of standard coverages. The basis of your policy is these. This knowledge will assist you to make a decision on what you require.

Core Liability Protection

This is the simplest coverage which is required by law. It is not a type of insurance of your bike and your injuries. Rather, it is the money that other people may injure. Get to consider it your financial defense.

Bodily Injury Liability

You can make people get hurt in case of an accident. On this coverage they can compensate their medical expenses. It is also able to compensate them in terms of their wages lost. It is a vital part of your motorcycle liability insurance.

Property Damage Liability

This section of your policy compensates the loss of property by other individuals. E.g. it would reimburse repairs on some other vehicle. It may also include a broken fence or mailbox.

Protecting Your Own Motorcycle

Liability is for others. What of your prized possession? The following coverages refer to your own bike. They are very much necessary in case of a motorcycle loan.

Collision Coverage

Even the most successful riders have accidents. Collision coverage assists in providing the individual to repair or replace the bike. This is applicable in case you collide with another car or an object. All you are required to do is first pay your deductible.

Comprehensive Coverage

This covers events associated with non-collision. Keep in mind that it is protection from life’s surprises. It consists of theft, vandalism, fire, or storm damage. They are usually even addressed in hitting an animal. But it is a great peace of mind to have it. In certain bikes, such as the bikes that are insured under a classic car insurance, the coverage is crucial.

Protecting Yourself and Your Passengers

People should care about their health. These coverages are oriented on your medical expenses and that of any passenger. The rules can vary by state.

Medical Payments (MedPay)

MedPay would assist in paying off medical bills on your behalf and passengers. This is insurance whether one is at fault or not. It is a fine security blanket to short-term costs.

Personal Injury Protection (PIP)

There are states where PIP is mandatory as opposed to MedPay. It is more comprehensive. Medical expenses, lost earnings and other expenses can covered with PIP. It assists you to stand on your feet once again economically. To learn more about PPO and HMO insurance, you may refer to this guide on United Healthcare insurance.

Uninsured/Underinsured Motorist Coverage

So what would happen when somebody hits you but does not have insurance? Or are not numerous enough to pay your bills? This coverage steps in. It saves you against reckless road mishaps.

The ideal man is a man who applies his mind as a mirror. It grasps nothing. It regrets nothing. It receives but does not keep.”

– Chuang Tzu

Geico’s Specialized Coverage for Riders

Geico is aware that the needs of riders are different. They provide a number of supplements to supplement your policy. These extras could be very essential following an event. They demonstrate that Geico comprehends the motorcycle lifestyle.

Accessories and Custom Parts Coverage

Were there custom pipes and an added seat? Yet, sissy bar or saddlebags? A great number of riders personalize their bikes. Standard policies may not cover these expensive additions. Custom parts coverage (CPE) ensures your upgrades are protected. Geico tends to habitually add a free base. When you need to, then you can buy more. It is a necessity to anyone owning a modified bike.

Roadside Assistance with Towing

Failure to follow a great day of riding can spoil a good ride. The roadside assistance of Geico is 24/7. It is useful in event of a flat tire or dead battery. Including towing back to the nearest repair shop is also a part of this. It is a small add-on that will save you a massive headache. Comfort during long journeys is provided by it. It may only cover a time frame when a vehicle is used and here temporary car insurance may considered as the way out.

Helmet and Safety Apparel Coverage

Your gear protects you. It can also be very expensive. Geico will provide coverage on your helmet and safety gear. This must be in your jacket, gloves and boots. In the event they get destroyed in an insured accident, this assists in the replacement. It is an intelligent safety consideration to the riders.

Trip Interruption Coverage

Want to do a long distance tour? Trip interruption coverage is an excellent concept. In case your bike gets impaired somewhere miles away when your bike is covered in case of loss, then this is helpful. It can pay back your accommodation, meal, and other transportation. It transforms a disaster that might have happened into a manageable inconvenience.

The Core Question: Is Geico the Cheapest Motorcycle Insurance?

This is the question a million dollars to most riders. The simple answer is: maybe. Geico is considered to competitive in price. They are usually becoming some of the cheapest. However, the low cost motorcycle insurance company to which your friend is insured might not the cheapest one to you. A special riddle of yours is the last premium. Let us have a look at the compositions that constitute your price.

Key Factors That Influence Your Insurance Rate

All the insurers concern risk assessment. They take a lot of data to forecast the probability of your likelihood of filing a claim. The following are the most significant factors that Geico will put into consideration.

Your Riding Record and Experience

This is a big one. The clean driving record is an advantage. No accidents, tickets implies that you are less risky. On the other hand, history of claims will increase charges. The years as a licensed rider are also important. The more experience that is gained, the lower are the premiums.

The Type of Motorcycle You Ride

A bike is not a bike in the mind of an insurer.

- Sportbikes & Supersports: These are powerful bikes which are very popular in thefts. More high-speed accidents are also linked to them. This results in them being the most costly bikes to insure.

- Cruisers & Touring Bikes: These are not expensive to insure. Not sheer speed but for comfort and distance they are made.

- Engine Size (CCs): The bigger and more powerful the engine the higher the insurance rate.

- Bike Value: A brand-new, expensive bike will subjected to greater insuring charges than an older, used bike.

Your Location

The place of residence and riding greatly influences it. In cities where there is increased traffic and higher theft as a percentage will have a higher premium. The rural regions typically have lower rates. Your ZIP code is an important factor in pricing.

Personal Demographics

The age you are and whether you are married could impact on your rate. Statistically safer are older married riders. They usually are charged less as compared to young and single riders.

How You Use Your Motorcycle

Do you commute to work using your bike? Or is it just for weekend fun? Daily commuting implies longer time on the road. This adds to your risk and your premium. The less expensive one is the pleasure use. The use of business presence alters the risk profile, just as it is in the case of cars under commercial auto insurance.

How to Get Accurate Geico Motorcycle Insurance Quotes

The only way to know for sure is to get a quote. The process is straightforward. You can get motorcycle insurance quotes online or by phone. Be prepared with the following information:

- Your driver’s license number.

- The Vehicle Identification Number (VIN) of your motorcycle.

- Details on your riding history and any safety courses.

- An estimate of your annual mileage.

Be honest and accurate with your information. This will ensure your quote is reliable. It will also prevent any issues if you need to file a claim later.

Unlocking Major Savings: Geico Motorcycle Insurance Discounts

Geico has many discounts and this is one of the strongest points of the company. This is usually the way they are able to arrive at such low prices. These discounts may combined by smart riders to reduce their premiums considerably. You are not supposed to think you are taking them all. You often have to ask.

Discounts You Should Always Ask About

Discounts that are the most common and useful are to broken down. Review this list carefully. You may be leaving money on the table.

Multi-Policy Discount (Bundling)

It is among the simplest and largest discounts. You can save in case you have a second policy with Geico such as auto or home insurance. Loyalty displays through bundling your policies. Geico rewards you for it.

Motorcycle Safety Course Discount

Did you attend a motorcycle safety course? There are a lot of different programs accepted by Motorcycle Safety Foundation (MSF). Doing one gets you proved that you are a responsible rider. Geico gives it a good discount. It is efficient and cost effective in addition to enhancing your competency. To save more, just look at these tips in reducing your car insurance cost.

Mature Rider Discount

Do you consider yourself an experienced rider who is quite old enough? Geico can provide the years of safe riding discount. It appreciates that the risk posed by mature riders is usually reduced.

Good Driver or Claim-Free Discount

In the case you have been going without accidents over the last few years, you are ready to have some reward. The good driver discount offered by Geico can be very high. It is how they say their goodbyes to you as you are okay on the road.

Multi-Bike Discount

Do you have more than one motor bike? Having Geico insure them all with Geico can earn you a multi-bike discount. Their simple way to save is by having a collection.

Membership and Affiliation Discounts

Geico partners with hundreds of organizations. This includes alumni associations, employers, and riding clubs. Are you a member of the American Motorcycle Association (AMA)? Or Harley Owners Group (H.O.G.)? Be sure to mention it. You could unlock an exclusive discount. Even business owners can save money even though some of them can easily find an affordable business insurance.

Anti-Theft Device Discount

The issue of theft of motorcycles is severe. In case your bike has an anti-theft system installed by the factory or in an after-market system, inform Geico. This will get you a minor yet sweet discount.

Beyond Price: Evaluating Geico’s Overall Value

I do not always use the cheapest policy. A low price is great. However, it will be useless when the company is not available to you when you need it the most. We have to consider the value of Geico as a whole. These are customer service and financial stability.

Customer Service and The Claims Process

It is here that an insurance company really made a name to itself. Geico generally receives positive ratings for customer service. They have convenient mobile application and Web site. You are able to pay a bill, access your policy, and even start a claim online.

It is the claims process that will be of utmost importance following the accident. You want it to be quick, just, and smooth-sailing. Geico has a high number of adjusters. They are seeking to make claims effective. Nevertheless, experiences may be different. It is never perseverous to see recent customer reviews in an organization such as the Better Business Bureau (BBB) or J.D. Power.

A poor claims experience may cost you dearly than several dollars on your premium. The same reasoning can used when it comes to the topic of such usage as professional liability insurance, where the quality of the claims handling is of utmost importance.

It is said that a thousand miles starts with a step.

– Lao Tzu

Financial Strength: Can Geico Pay Its Claims?

You must know that your insurer will be able to fulfill its claims even in a major disaster. This is calculated in terms of financial strength ratings. Insurance companies are rated by top rating companies such as AM Best. Geico has always scored well (usually A++ or Superior). This implies that their financial capabilities are very high to fulfill financial obligations. You will be safe in knowing that Geico will be able to cover your claim. This stability is a key consideration, be it in the purchase of a straightforward motorcycle policy, or a complex one, that is a State Farm life insurance.

The Competition: How Does Geico Compare?

Geico is an insurance giant. However, these are not the only ones. Motorcycle insurance providers need to compared in order to find the best deal. Other major players include:

- Progressive: This is another best competitor as they usually compete with the Geico directly on the price. They are renowned to have plenty of motorcycle covers.

- Dairyland: This is a motor award company that offers insurance of motorcycles, especially those that are highly risky.

- Allstate: This is a conventional insurer which has a good network of agents and coverage.

- Nationwide: Has a good reputation of customer service and a number of various discount offers.

All companies apply their price algorithm. One may prefer seasoned riders on cruiser. Some other people may have a better offer to a new rider in a sportbike. The point is to receive the quotes of 3-5 companies.

This will provide you with an actual feeling of the market. It guarantees that you are not paying exorbitantly on your full coverage motorcycle insurance. The decision of a proper policy is crucial as is the selection of term life insurance vs whole life insurance.

Making the Final Decision on Geico Motorcycle Insurance

Therefore, does Geico motorcycle insurance suit you? They are an elite company and there is much they offer. They usually have extremely competitive prices, which is due to an enormous list of discounts. A broad range of coverages is also held by them, and they are highly financially strong. This is confirmed by the sources of authority such as the Insurance Information Institute.

Nevertheless, they do not necessarily have the lowest price per individual rider. The final rate will depend on how exceptional you are i.e. your bike, record, and location. It is not necessary to just assume Geico is the best. Do your homework.

- Determine Your Requirement: Determine whether you require the basic motorcycle liability insurance or the full cover insurance. Look at such add-ons as roadside assistance.

- Get a Quote from Geico: go through their online quote tool or call them. Deliver quality information.

- Get Quotes from Competitors: At least 2 other quotes should obtained.

- Compare Apples to Apples: It is suggested to ensure that the limits and deductibles of the cover are the same in all the quotes.

- Factor in Discounts: Inquire any firm about all the discount offers to have the lowest possible price.

- Consider the Company: Look at customer service ratings and financial strength. Don’t just focus on price. Peace of mind is an easy option when needed sometime. These points should similarly considered when examining such alternatives as Humana dental insurance.

When you do this, you will be able to make the best selection of policy. You will get just right price and protection as well as peace of mind. Then you are able to get down to what really matters having a good ride. To know the safety information and statistics, one should always take reference to a reliable source such as the National Highway Traffic Safety Administration (NHTSA).

FAQs About Geico Motorcycle Insurance

Yes, it might be an available choice in the state of Geico. Having a disappearing or reducing deductibles, your collision deductible may reduce every year that you go without a claim.

Geico does not usually sell “seasonal” policies, however, you are free to adjust your coverage. Only a few riders reduced the coverage to a comprehensive when storing the bike in winter. This safeguards theft or damage as well as saving money.

Yes, it is possible to cover your passenger. In case you are not on the right you would cover their bodily injuries under your Bodily Injury Liability. There is also an option of including Medical Payments (MedPay) insurance on your passenger as a way of giving him a higher level of protection, whether one is at fault or not.

Geico covers a very broad range of bikes. This includes cruisers, sport bikes, touring bike, scooters, and mopeds. Nevertheless, specialty insurers could an excellent choice in case of highly customized or very old bikes.

The superior tips would be to maintain a clean driving record, enrol in a safety course, bundle your policies and inquire about all the available discounts. An increase in deductible can also reduce your premium though you have to make sure that you are able to cover it in the event of a claim.

![Compliant Drivers Program: Is It Legit for Driver Safety? [2025]](https://propinfo.site/wp-content/uploads/2025/12/Compliant-Drivers-Program-150x150.jpg)

Leave a Reply