Driving is amazing freedom. You can go anywhere you want. However, with this freedom come great risks. That is exactly why it is so important to understand your options, such as full coverage car insurance. Accidents, after all, can occur in a second.

This is exactly where insurance comes into play. It’s your financial life jack instead of a financial illustration a wealthy banker uses to get you depressed. But what type of insurance is best? You have probably heard about the term and wonder what is meant by it.

This guide will be able to explain everything. We will explore what it is. In addition, we’ll see what it costs too. Most importantly we’ll assist you in determining whether it is right for you.

What Does Full Coverage Car Insurance Actually Mean?

Let’s clear up a big myth first. “Full coverage” is not a specific policy. You can’t just buy it off of the shelf. In fact, insurance companies don’t sell one single product with this name.

Instead, it’s a combination of different coverages. In short, it’s best considered as a type of insurance. It provides a much better level of protection. Indeed, it falls far beyond the legal minimum.

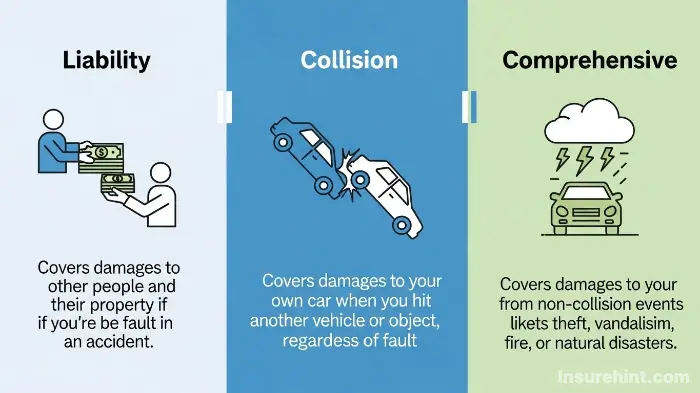

The Core Components of Full Coverage Insurance:

So, what is in this bundle? Full coverage insurance is often a three-part operation. Assaults both of them, make a great protection upon thee and thy car.

1. Liability Insurance (The Legal Must-Have)

To clarify, this is required basic coverage in every state. It’s the basis of any policy on auto insurance. Liability insurance covers loss caused for others due to your fault.

An example is that it covers the other driver’s medical bills. It also pays to have their car repaired. It didn’t, however, insure your own car. Furthermore, it does not cover your own injuries.

2. Collision Insurance (Protects Your Car)

This is the first major piece of full coverage car insurance. Collision coverage that compensates for the repair of your car. This applies after an accident that you cause.

For example, suppose that you back into a pole. Or you cause a fender bender. Collision insurance would work for you to repair your costs. Without it, you would therefore pay for those repairs out of your own pocket.

3. Comprehensive Insurance (For Non-Crash Events)

Life is unpredictable. In fact, there are many things that can damage your car other than a crash. This is where comprehensive insurance comes in to help you out.

It spans a wide range of “other than collision” events. For example, this would include theft or vandalism. It also covers damage by fire, floods or hail. If a deer runs into your car comprehensive has you covered.

“The best-case scenario is that you have insurance, and you don’t need it. The worst-case is that you need it, and you don’t have it.”

– Unknown

Put together these three parts and we have something we refer to as full coverage insurance. It keeps other people, Your Car in a Crash and Your Car from just about anything else. Unquestionably, this is the reason that so many drivers opt for this protection.

Is Full Coverage Insurance Worth It for You?

Now you know what it is. The next big question is an easy one. Is full coverage car insurance worth paying more? The answer is really based upon your personal situation.

There is no answer that fits everybody. For some drivers it is an absolute necessity. For others, however, it may be an unnecessary cost. So to break it down, let’s know when one should consider it.

When Is Full Coverage Car Insurance Required?

Sometimes, the decision is not yours to make. It could be required by a lender/leasing company. As a direct result, they have a monetary interest in your vehicle.

If you are leasing your car, your contract will require it. The same way, if you have a car loan the bank will need it. They have to protect their investment until you make the payments off. If the car is totaled, for example, they are protected from loss by the insurance payout.

When Full Coverage is Highly Recommended

Even when it is not required, it is often a smart move. In a few.Migration use cases, we actually strongly recommend it. You need to consider your car’s value. In addition, you need to consider your own financial stability.

Your Car is New or Valuable

Do you drive a new or expensive car? If so, full coverage insurance is a good investment. The expense of repairing or replacing a new car is extremely high.

Without the full coverage, a major accident could be devastating. In other words, you may lose your whole investment. Protecting that precious asset is important. This is also true of sought-after models or even some vehicles needing classic car insurance.

You Cannot Afford Major Repairs

Think about your savings. Would you easily be able to pay $5,000 for repairs? Or what if you had to purchase a completely new car tomorrow?

If a big unforeseen expense would hurt you financially then you need complete coverage. It provides peace of mind. As a result, you know you can’t have a financial crisis after a crash. This protection is in many cases worth the premium.

You Live in a High-Risk Area

Where you live matters a lot. For example, some areas have more incidents of stealing cars. Others may experience extreme weather such as hail or floods.

If your location is at these risk factors, then all-inclusive coverage is essential. It’s the part of your policy that protects against these events which include. As a result, it can be a real life saver.

When You Might Skip Full Coverage

On the other hand, not always necessary. Your car becomes less valuable as it gets older. At some point, the cost of having a full coverage car insurance might outweigh the benefits.

A good rule of thumb is that of the “10% rule.” If the annual cost of your collision and comprehensive coverage is over 10% of your car’s current value (which you can look up on websites such as Kelley Blue Book), then maybe it’s time to drop it. For instance, if your car is worth $4,000 and the cost of your coverage is $500 per year it may be time to reconsider.

If you have a large emergency fund you may feel comfortable self-insuring. This means you can fund the cost to replace your old car by yourself. You could then simply maintain liability coverage.

How Much Does Full Coverage Car Insurance Cost?

This is the million dollar question. The price of complete coverage car insurance ranges wildly. There are a number of factors that go into your end price.

Nationally, the cost averages more than $2,000 per year. However, it might be far more or far less than your own price. It all depends upon your particular risk-profile. Let’s see what are the main factors which the insurers in calculating your premium.

Key Factors Influencing Your Full Coverage Car Insurance Cost:

Insurers are all about risk. They make an educated guess regarding your chances of filing a claim. The greater your perceived risk, therefore, the greater your premium is going to be.

- Your Vehicle: The make, model, and yr of your car make Sports cars are more expensive to insure than sedans. In addition, there are newer cars with high repair costs also with high premiums.

- Your Driving Record: This is huge-factor. Accidents/Tickets: A history of accidents or traffic tickets will increase your rates significantly. A clean record, on the other hand, will help you get a better price.

- Your Location: Just by changing to a different ZIP code the premiums can change. Urban areas with more traffic and crime have higher than rural areas.

- Your Age and Gender: If you are a younger, inexperienced driver, you pay the most. Rates begin to go down usually after the age of 25. Statistically young men display higher rates than young women.

- Your Credit Score: In most states, insurance companies consider those that use a credit-based insurance score. As a result, a better credit history can mean higher premiums.

- Your Chosen Deductibles: This is a factor you have control over. We shall turn to this more, next.

While considering personal auto insurance, businesses have other needs. They often need special policies such as commercial auto insurance.

Top Factors Affecting Your Insurance Cost

Understanding Your Deductible’s Role

Your deducted is an important component of your policy. It is the amount that you pay out of pocket for a claim. This is before the insurance coverage kicks in.

You are free to choose the amount of your deductible. Common choices are $500, $1,000, or even $2,000. Of course, there is an important relationship here.

A higher amount of deductible means a lower premium. Alternately, the higher the deductible the lower the premium. By scheduling a higher deductible, more financial risk is placed on yourself. As a result, the insurance company gives you a reward in a lower price.

Smart Strategies for Securing Cheap Full Coverage Car Insurance

At high premiums, the situation can be daunting. But you are not powerless. Fortunately, there are many ways to find cheap full coverage car insurance that have been proven to work. You simply have to be a smart shopper.

Finding affordable coverage is a dream for many individuals. It’s similar to shopping a good deal in Humana dental insurance or other health plans. All said and done, you have to do your research.

“We are entering the age when those who take care of preparing for this future are those who will belong to it.”

– Malcolm X

Preparation is of key importance in your insurance search. A little goes a long way to save big money. Well, so let’s look at the best strategies.

The Power of Comparison Shopping

This is the one most important tip. Never accept the first offer you get. Instead you will need to shop around and compare quotes.

Prices for exactly the same coverage can range in the hundreds of dollars. This occurs between different companies because each is having its own way of calculating risk.

You want to be able to obtain three to five full coverage car insurance quotes at the very least. This will give you a good idea of the market. You can then get the best deal for your budget. Using online tools of course makes this process fast and easy.

Ask About Every Possible Discount

Insurance companies offer a huge list of discounts. The catch though is that they do not always automatically apply them. As a result, you have to ask for them often.

Here are some discounts to look for the most frequently:

- Multi-Policy Discount: Bundle your auto and home insurance.

- Safe Driver Discount: For having a clean record.

- Good Student Discount: For young drivers who are good students.

- Defensive Driving Course: For completion of an approved course.

- Low Mileage Discount: If you don’t drive very often.

- Safety Features Discount: For cars with airbag, anti-lock brake etc.

These small discounts can certainly add up to big savings. There are plenty more tips for reducing your car insurance cost which you can research.

Your Discount Discovery Checklist

Optimize Your Deductible

As we mentioned earlier your deductible is relevant. The direct way of keeping premium low is choosing a higher deductible. In fact, you could save 15% to 30% in the area of collision and comprehensive costs.

Just make sure you are going with a deductible that you can afford to pay. And specifically, make sure you keep that amount in your emergency fund. In this way, you will be ready in case you need to file a claim.

Maintain a Good Driving Record

This is a long-term strategy. Your behaviors while behaving behind the wheel come at a direct cost to your wallet. Avoiding accidents and tickets is therefore the best way to keep your rates low.

A single at-fault accident can cause your rates to increase for three to five years. So, drive safely, obey the laws and be focused. You will thank yourself in the long run, even your wallet will thank you. It is true that safe driving will always be the best policy.

Improve Your Credit Score

Your credit can certain affect your insurance rate in ways that you may not think so. Insurers establish a correlation between credit management and driving risk.

One of the ways you can improve your score is if you pay bills on time. In addition, try to reduce your overall debt. Checking your credit report for errors is also a good idea and clean up your credit you can get free copies annually through government authorized as explained by the Federal Trade Commission. For more on financial planning, you may find a State Farm life insurance review to be helpful.

Customizing Your Full Coverage Policy: Optional Add-Ons

Basic full coverage car insurance is a great start. However, you can go further in terms of protection. Insurers have numerous optional coverages, or “riders.”

These add-ons fill certain gaps. As a result, they deliver additional peace-of-mind. Let us understand some of the most common ones that you can include in your policy. There are also some situations which may require some unique policies such as temporary car insurance for short-term needs.

Uninsured/Underinsured Motorist (UM/UIM)

What if you are struck by someone who has no insurance? Or what if they do not have enough insurance to cover your bills? This is a frightfully common problem; in fact, according to the Insurance Research Council approximately 1 out of 8 drivers on the road are uninsured.

UM/UIM coverage will protect your in this exact case. You use it for your medical bills and in some states for fixing the car. In many states, this coverage is even required. Even if it’s optional, however, we highly encourage it. For details on health related plans, check out the following guides on United Healthcare insurance.

Gap Insurance

If you have a loan/lease, gap insurance is very important. Cars are depreciating, or losing value, quite quickly. For this reason it’s possible to owe more than your loan than the car is actually worth.

If your car is totaled, your collision coverage pays its current market value. That may not be sufficient to pay off your loan. Gap insurance, then, covers this “gap“, whereby it pays the difference to the lender.

Rental Reimbursement Coverage

After an accident, the repair of your car could take you days. How are you going to go to work or school? This is where rental reimbursement helps.

This is the affordable add-on that will pay for the rental car that yours is being repaired in. It’s a small price to pay for major convenience when you need it most.

Roadside Assistance

This is another popular option, and a low cost one. It gives you assistance in case you breakdown on the road. Services usually include towing, battery jump starts and changing flat tires.

It is very convenient to have. For example, you just make one call to your insurer for help. It can save from being stuck on the side of the road.

Medical Payments (MedPay) or PIP

Medical Payments coverage or MedPay helps in paying for medical expenses. It specifies available after an accident, no matter who is to blame, you and your passengers receive cover. It is a good supplement to your health insurance.

Personal Injury Protection (PIP) is similar, but is more expansive. For instance, it can also cover lost wages. In some “no-fault” states, PIP is a mandatory coverage. Comparing life insurance policies like term life insurance vs. whole life insurance analysis demonstrates the similarities by which different coverages address different needs.

Getting Full Coverage Car Insurance Quotes and Handling Claims

You know about the coverage and the costs. So, now let’s speak of the doing stuffs. The question is How do you actually get full coverage car insurance quotes and utilize your policy?

How to Get Your Quotes

Getting quotes is easier now than have ever before. There are several possibilities for you to choose from. Naturally, each one has its own pros and cons.

- Online Quote Tools: The best way to find a solution is to use online quote tools and it is the fastest method. There are many websites which allow you to compare quotes from numerous insurers simultaneously. You have to just enter your information once.

- Independent Agents: An independent agent has several insurance companies they work with. Thus, they are able to shop around for you. They may find you deals you would not find on your own. This is also applicable for specialized fields requiring the professional liability insurance.

- Direct from Insurers: You may also contact an insurance company such as Geico, Progressive or State Farm insurance directly. Visit their Web sites or call them for a quote.

To obtain accurate quotes you will need some information in hand. This includes your driver’s license number, car’s VIN and driving history.

What to Do After an Accident with Full Coverage

Having an accident is stressful. Knowing what they should do will make a big difference. Thankfully, your comprehensive coverage insurance is at your disposal to help.

- Ensure Safety: First, ensure that there are no injuries. Then, go to a safe location, if possible.

- Call the Police: A police report is important to your claim with your insurance company.

- Document Everything: Take Emma Photographs of the damage and the scene. Also, exchange information between the two of you.

- Contact Your Insurer: Finally, call your insurance company as soon as at all possible. You agent will help you through the claims.

“I’ve learned that you can’t have a plan in advance for everything.” Sometimes, you just need to be ready for anything.”

– Unknown

This quote is the best way to describe the essence of insurance. It teaches you to be ready for the turns of life. Similarly, like a car, having the right motorcycle insurance is very important to riders.

The Final Verdict on Full Coverage Car Insurance

So, is full coverage car insurance the right choice? For most drivers with a car of any significant value, the answer is a resounding yes. It’s more than just an expense. In reality, it is an investment in your financial security and peace of mind.

It transforms your auto policy from a simple legal requirement into a powerful protective shield. For example, it protects your car from crashes, theft, weather, and more. For businesses, exploring affordable business insurance options is just as critical.

Ultimately, the decision is yours. Weigh the cost of the premium against the potential cost of a major accident. Can you afford to replace your car out of pocket? If not, then the protection offered by full coverage insurance is invaluable.

The key takeaway is to be an informed consumer. Understand what you’re buying. Shop around for the best cheap full coverage car insurance rates. And finally, build a policy that truly fits your life.

Your 3-Step Action Plan

Frequently Asked Questions (FAQs)

Liability only covers damages you cause to others. In contrast, full coverage car insurance adds protection for your own vehicle through collision and comprehensive coverages.

A good guideline is to consider dropping it when your annual premium exceeds 10% of your car’s cash value. If your car is worth $3,000, and full coverage costs $400/year, for instance, you might drop it.

Generally, a comprehensive claim (like for hail damage or theft) has a much smaller impact on your rates than an at-fault collision claim. In fact, some insurers may not raise them at all.

Yes, most insurers allow this. You could, for example, choose a higher deductible for collision (which is usually more expensive) and a lower one for comprehensive to balance cost and risk.

No. While the core components (liability, collision, comprehensive) are standard, the policy limits, add-on options, and service quality can differ greatly between companies. For this reason, always read the policy details carefully.

![Compliant Drivers Program: Is It Legit for Driver Safety? [2025]](https://propinfo.site/wp-content/uploads/2025/12/Compliant-Drivers-Program-150x150.jpg)

Leave a Reply