Thinking of our parents growing old can be hard. We want them to enjoy their golden years to the fullest. However, future planning is a true act of love. This includes taking into account their final wishes and costs. That is just where Final Expense Insurance comes in. In short, it is a way to deal with such expenses gracefully.

This guide can take you understand everything you need to know. For example, we will touch on what it is and why it is important. You will also learn how to communicate with your parents about it. By the end, you will, therefore, be confident and ready.

Why You Should Think About Final Expense Insurance Now

Procrastination is simple, especially when the subject is unpleasant. Yet, it is incredibly important to plan ahead. In fact, waiting can place a lot of stress and financial strain down the road. For this reason, let’s take a look at why it is a good idea to act now.

The Emotional Weight of Final Expenses

When a parent dies, the grieving is just too much. The last thing you want, therefore, is to have to think about money. Decisions concerning funeral arrangements are hard enough as it is. Consequently, it becomes much worse when financial pressure is added.

A plan on the other hand took that burden off your shoulders. It enables the family to concentrate on remembering and healing. This is perhaps the greatest gift that you can give each other. Ultimately, it helps his or her death be a dignified goodbye without the stress added to the end.

The Financial Burden on Loved Ones

Funeral ceremonies are surprisingly costly. In fact, the costs can add up very quickly. According to the National Funeral Directors Association, a funeral with a viewing and burial costs the average $7,800 or more. In addition, this number can easily rise even higher.

Many families just don’t have this much saved. As a consequence, this can result in debt or challenging financial decisions. Final Expense Insurance covers the funds needed. It thus insures the security of your savings and financial stability in your family.

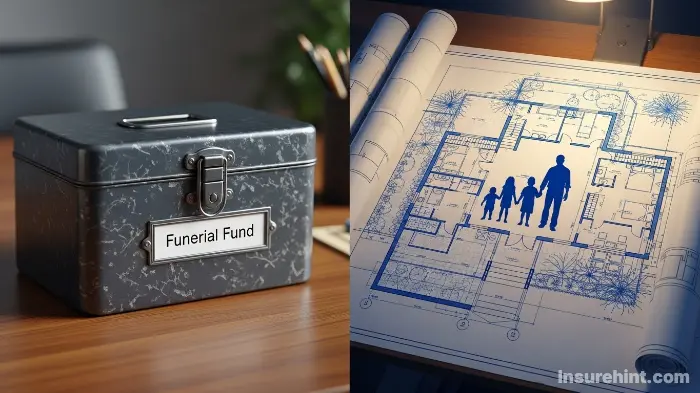

Protecting Your Parents’ Legacy

Your parents worked hard their entire life. Subsequently, they built a legacy to be left to you. This could be a home, savings or other assets. Unexpected costs of a funeral, however, are able to chip away at that legacy.

A specific insurance plan protects their estate. In addition, it ensures that the inheritance they intended for their family remains intact. This is about celebrating their work of their life. In essence, you are ensuring any final wishes. Similarly, having your own financial plan on the table could involve exploring other options such as term life insurance vs. whole life insurance.

“The most important thing you can leave to your family is how a predetermined, pre-funded plan has come about.”

– Charlie “Tremendous” Jones

Understanding Final Expense Insurance: The Basics

Well, what exactly is this kind of insurance? It’s selling ahead easier said than done. We can deconstruct the fundamental ideas. Above all, it is designed for a very specific purpose.

Final Expense Insurance is a form of whole life policy. It usually comes with a minimal death benefit. This benefit is intended specifically to meet the end-of-life costs. Whether it’s a financial bridge for when one of the certainties of life occurs, think of it as a financial recovery safety net.

How It Differs from Traditional Life Insurance

The benefit amounts of traditional life insurance tend to be large. These are to replace income or pay off a mortgage. For example, a good State Farm Life Insurance review would indicate policies focused on support of a long-term family.

Final expense policies, on the other hand, are different. They have smaller amounts in coverage, generally from $5000 to $25000. The first priority is not income replacement. Instead, it’s about defraying immediate specific costs.

What Does Final Expense Insurance Coverage Typically Include?

The name gives a big clue. The final expense insurance coverage is rather flexible. The money is given to the beneficiary (often an adult child). They are then able to use it for any costs that arise.

Common expenses include, in the form of things like:

- Funeral home services

- Burial or cremation costs

- Casket or urn

- Cemetery plot

- Headstone

- Medical bills

- Legal or probate fees

The money can be used for anything. There are, ultimately, no restrictions on the manner in which the benefit is spent. This flexibility is a great advantage.

The Simplicity of Funeral Insurance for Seniors

You may also hear that this product is referred to as funeral insurance or funeral cover. These are terms that are often used interchangeably. In the end, they are all alluding to the same basic concept. It is a simple insurance product that is accessible to everyone.

The application process is usually not difficult. For example, it may involve answering certain health questions. In many cases, there is no need to do a medical exam. This makes it much easier for seniors to qualify.

Funeral Service Fees

This covers the funeral home’s services, embalming, viewings, and transportation. It’s often the largest single expense.

Burial or Cremation

Includes the cost of a casket or urn, the cemetery plot or niche, and the burial or cremation process itself.

Outstanding Bills

The death benefit can be used to pay off final medical bills, credit card debt, or any other outstanding financial obligations.

Key Features of a Good Final Expense Insurance Policy

Not all policies even created equally. For this reason, it’s important to have an understanding of the different types. This knowledge would then assist you to choose the best for your parents’ situation. Next to consider are the general policy structures.

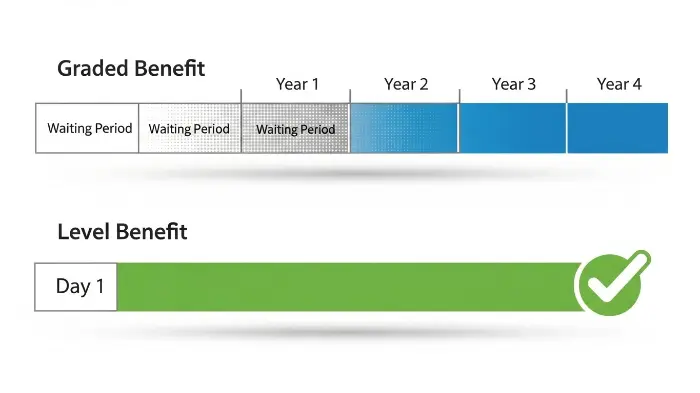

Guaranteed Acceptance Policies

These policies are what they say in the name of. In short, acceptance is a surety for applicants in particular age groups. There are no questions asked whatsoever regarding health. This is thus an excellent one for people who have serious health problems.

However, there is always a trade off. These plans have always had a “graded death benefit.” This means if the insured dies in the first two or three years the full benefit is not paid. Instead the insurer will usually make a refund of the premiums paid, plus interest.

Simplified Issue Funeral Cover

This is the most common type of Final Expense Insurance. This application requires the answering of some health questions. However, it does not require a medical examination. It’s therefore easier than conventional underwriting.

Based on the answers, the applicant can qualify for a better rate. They may also get a death benefit level. This then makes it a popular choice for seniors in average to good health.

Graded Death Benefits Explained

We said this of guaranteed acceptance plans. A graded benefit is really a waiting period. Its task lasts normally for two years. If death from natural causes occurs during this time there is an unfortunate beneficiary who doesn’t get the full payout.

After the end of a waiting period, the full death benefit is then payable. Death as the result of an accident, however, is typically covered in its entirety from day one. This structure gives room for insurance companies to cover high-risk group individuals. It’s wise to now review what your parents are doing regarding their own plans, such as their Humana dental insurance, too, to get a complete idea of what their needs are.

Level Death Benefits: The Gold Standard

A level death benefit is the best case scenario. It implies that the policy gives you the assurance of the full final expense insurance coverage from the very first day. Therefore, there is no waiting period of natural death.

To qualify for a level benefit plan, your parents will have to be in reasonably good health. Being honest in answering the health questions is absolutely key. In the end, this type of policy provides the greatest level of security and peace of mind.

How Much Does Funeral Cover Cost?

This is the million-dollar question, or few-thousand-dollar question. The cost for a funeral cover policy certainly differs. A number of factors come into play. This in turn helps you to budget and compare offers effectively.

Factors Influencing Premiums

The premium is the monthly/annual payment. It’s based on a few away from variables:

- Age: Logically when the younger the applicant is the lower the premium.

- Gender: Women live longer than men and they will often pay a bit less.

- Health: Healthier people generally are able to get better rates.

- Coverage Amount: An example would be if a $20,000 policy will cost you more than a $10,000 policy.

- Policy Type: Also, almost guaranteed issue plans are commonly more expensive than simplified issue.

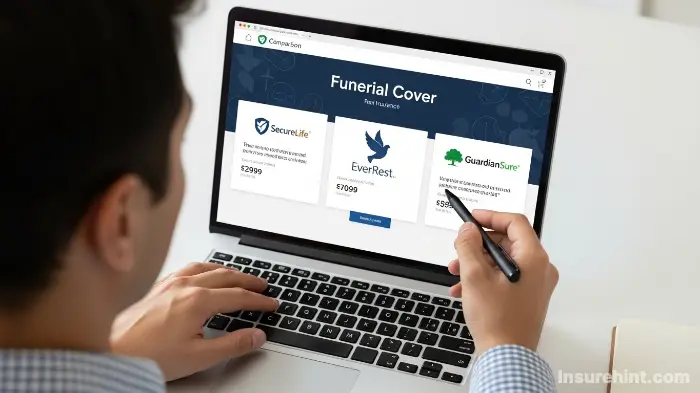

Getting Quotes and Comparing Prices

Never accept the first offer you see. In fact, it is very important to shop around. Get quotes from a number of different insurance companies. You can do this by means of an independent insurance agent.

Several carriers can be compared for you by an agent. This not only saves you time, but can also save you money. They can assist in locating a policy that is right for your parents for their health profile and for their budget. Finding ways to save is always smart such as learning some easy tips for lowering your car insurance cost.

“Planning is bringing the future into the present so that you can do something about it now.”

– Alan Lakein

The Major Benefits of Final Expense Plans

We have touched upon many benefits already. But, let’s summarize the greatest advantages. These plans will provide more than money. In addition, they give emotional and practical support.

Peace of Mind for Everyone

To know that there are funds set aside is a huge relief. For one thing, your parents can rest easy knowing that they won’t be a financial burden. You and your siblings have a sense of peace of mind, as well. Specifically, you are aware that you can fulfill their wishes with no panicked money demands.

This emotional security cannot be put into words; it is priceless. It’s the main reason that so many people opt for Final Expense Insurance. In the end it makes a tough time manageable.

Quick Payouts: A Key Benefit of Funeral Insurance

Final expense claims usually are paid very quickly. In fact, the nature of the process is to be fast. Since the amount of benefit is less, there’s less red tape. Many companies, for instance, are able to pay claims within days of receiving the death certificate.

This speed is critical. Funeral homes almost always require up-front payment. A quick payout therefore ensures you have the cash on hand. In comparison, the process of settling a large estate may take months or even years. For more information about financial regulations, also see the Federal Trade Commission’s Consumer information on funeral costs.

Flexible Final Expense Insurance Coverage

The death benefit will be paid in a tax-free lump sum. The beneficiary can then use it for whatever he/she sees fit. While it’s supposed to be used for funeral costs, there are no legal restrictions.

And if the cost of the funeral is less than the amount of the benefit, what remains is yours. For example, you can use it to pay your parent’s final credit card bill. Or it could be the expenses of travel for family members. This flexibility is a trademark of funeral insurance.

Talking to Your Parents About Final Expense Insurance

This can be the hardest part. The conversation needs a touch of sensitivity and care. But, it’s a necessity discussion. The following are some of the tips to make it a bit easier.

Choosing the Right Time and Place

Don’t introduce it at a Holiday Dinner. Instead look for a quiet and private moment. It is much better to have a quiet afternoon than a rush out the door in the morning. Also, ensure that there are no distractions.

The atmosphere should be comfortable and relaxed. This helps you to show that you are taking the conversation seriously. It also tells them that you are respectful of their feelings.

Framing it as a Gift of Love

Don’t strike up the discussion of death. Instead, cause it to be a conversation on how to plan and a conversation about love. For instance you could say something like, “Mom, Dad, I was thinking about how we can make sure that everything is easy for the family in the future.”

Focus on the fact that this is to honor their wishes. You want to make their goodbye just the way they would want it to go. It’s an act of care, not that morbid of a topic. You are helping them to preserve their legacy. In the same way, if they owned a business, it would be equally as important to protect its future with professional liability insurance.

Listening to Their Concerns

Your parents will, no doubt, have questions and feelings. Listen to them. Don’t dismiss their concerns. For example, they may feel you are rushing things. They may not have to think about it.

Acknowledge their emotions. Mean, I know this is not easy to discuss. Be patient and gentle. After all the idea is to start the dialogue, not take a decision in one day. The conversation simply may have to occur over time.

Choosing the Right Provider

Finding the Best Final Expense Insurance Companies

Are your parents on board, so the next step is research. You want a reliable company. The insurer should be financially sound and also have a good reputation. Here is what to look for.

Researching Company Ratings

Independent agencies rate the financial strength of insurance companies. A.M. Best is the most well-known. A high rating (like A- or better) implies that the company is very likely to be able to pay its claims.

You can find these ratings on these A.M. Best website or through an insurance agent. Don’t pick a company who has a poor financial rating no matter how low the premium is. To sum it all up, it’s just not worth the risk.

Comparing Different Policies

As discussed earlier, you need to compare apples to apples. First is to look at the premium on the same coverage amount. Then, check to see if the policy has gradation or level benefit. Last but not least think about riders and/or extra features.

For example, some policies may allow child riders. Some may have an accelerated death benefit for terminal illness. These features can certainly provide value. It’s also a good time to review other family policies, like United Healthcare insurance, to see if the policy option of bundling has any advantages.

Watch Out for Red Flags

Be careful about the following things. For instance, if an offer is too good to be true, then it probably is not! Watch out for very long waiting periods in policies. For graded plans, two or three years is the norm; any more and you’d be seriously ticked off.

Also, be suspicious of high pressure sales tactics. A good agent will teach you and not push you. It is important that you read the details of the policy before signing anything. Owning a unique asset like a vintage vehicle also needs special attention and you’d want to understand everything about classic car insurance to avoid any similar red flags.

Applying for a Final Expense Policy

The application process for Final Expense Insurance is designed to be a quick and easy process. In fact, it’s one of its selling points. Let’s go through the process that is pill normally taken.

The Application Steps

First of all, you’ll fill out the application form. This can, in many cases, be done online or over the telephone. It will be asking for basic information: name, address, date of birth, and Social Security number.

Next you will be answering the health questions. Then, you’re going to have to choose a beneficiary and the amount to cover. Lastly you will configure your payment method. The entire process is sometimes less than 30 minutes.

The Medical Questions (or lack thereof)

For simplified issue policies, the health questions are key. For example, they will inquire about recent hospitalizations. They will also ask about significant sicknesses such as cancer, heart disease, or lung disease.

Answer these questions with no lies. The insurance company will look at your medical and prescription history. A dishonest answer can therefore result in the policy being cancelled or a claim being denied. This is very important.

What Happens After Approval?

After applicable, a decision will be quickly received. Sometimes it’s instant. Other times it may take a couple of days. After acceptance, the company will then send the actual policy via mail to your parents.

Examine the policy closely, once it arrives. There is always a “free look” period of 10-30 days. In this period, you can void the policy for a full refund in case you change your mind. Even if you’ve had to take out temporary car insurance in the past – perhaps in a pinch – you know how important it is to read the fine print.

Other End-of-Life Planning Steps

Final Expense Insurance is one piece to this puzzle. Comprehensive end of life planning, however, includes a few other important steps. Addressing these gives a sense of even greater peace of mind.

Creating a Will or Trust

A will states how the assets of your parents should be divided. It also identifies an executor to control the estate. Without a will, the property is divided at the discretion of the state. This can obviously lead to family disputes.

A trust is another tool that can be used to avoid probate court. Both are necessary to a smooth transfer of assets. Legal advice is highly recommended here.

Healthcare Directives

A living will gives your parents wishes on how they want to be treated medically. This is for in case they become unable to speak. Additionally, a healthcare power of attorney allows one to name someone to make medical decisions for them.

These documents are crucial. They make sure the healthcare wishes of your parents are respected. They also relieve the family of a heavy burden.

“A myriad of other proverbs and phrases she uses have been documented for thousands of years, including ‘Someone’s sitting in the shade today because someone planted a tree a long time ago.”

– Warren Buffett

Organizing Important Documents

Keep all important documents in place. This includes birth certificates, marriage licenses and Social Security information. Besides, add bank account information, records of investments, insurance policies.

This includes all kind of policies from the property coverage such as commercial auto insurance if they owned a business, to life policies. Making a master list of contacts, passwords and account numbers is incredibly helpful for the person who will be handling the estate. Even being aware of the details of their motorcycle insurance can save a lot of hassles.

Securing Your Family’s Future with Final Expense Insurance

We have covered a considerable amount of ground. From what is Final Expense Insurance to talking to your parents. It is without a doubt a powerful tool when it comes to financial and emotional security.

This one is not just an insurance policy. It’s a plan for dignity, respect and peace. It does ensure that your final goodbye to your parents is about love, not money. Furthermore, it ensures their dodo does not harm their legacy and your family.

Making the first step is the biggest part. So, start the research. Some words about the conversation get ready. By doing some planning today, you are making a great gift to your whole family and a gift that continues forever. Whether it’s making plans for a funeral or finding cheap business insurance, it’s always the wisest thing to take proactive steps.

Frequently Asked Questions (FAQs)

Yes, you can usually rake the benefit right to a funeral home. This makes the process easier, but also less flexible should costs be below expectations.

Final expense is a form of whole life insurance. This means that it never expires as long as the premiums are paid. As such, it will remain with them for their whole life.

No, life insurance death benefits, including Final Expense Insurance, are generally paid to the beneficiary 100% tax-free.

Yes, you can purchase a policy for your parents. Still, they will have to know about it and agree to the application. They will probably have to answer the health questions as well.

That’s great! But, you should review their existing policy nonetheless. Ask whether it is sufficiently large to set aside the funeral expenses as well as other financial needs A small final expense plan can also still be a good one to have to ensure that cash is available quickly.

![Compliant Drivers Program: Is It Legit for Driver Safety? [2025]](https://propinfo.site/wp-content/uploads/2025/12/Compliant-Drivers-Program-150x150.jpg)

Leave a Reply