You are driving down the road. Suddenly, you hear some strange sound. Your car sputters and dies. Your initial thought may be one regarding the price. Then, you tell yourself, does car insurance cover repairs?

This is a very common question among car owners. The answer though is not a simple yes or no. It really is according to the situation. Most important, the cause of the damage.

In this guide, we will explore it all in relation to this topic. We will be referring to what your policy covers. We will also take a look at what it leaves out. Furthermore, we are going to take a deep dive to specialized options. These include Guaranteed Asset Protection Insurance; and Civil Car Coverage.

Our intention is that you have a clear answer. By the end, you will certainly understand your policy well. With insurance, you will know just when you can count on getting help with repair bills from your insurance.

Understanding When Car Insurance Covers Repairs

The purpose of having car insurance is mainly to protected. It covers you against loss of money. This loss will typically result from accidents or unexpected events. It is not meant to a vehicle maintenance plan.

Therefore, the distinction is absolutely important. Is the damage caused by a sudden occurrence? Or is it due to slowly wearing them out? This difference helps to determine whether you have a valid claim or not.

Repairs After a Covered Incident

Your typical auto insurance policy is of assistance in certain areas. An example would be if you are in a collision. Your collision coverage would then cover you. It helps in paying the repair of your vehicle.

Likewise, comprehensive coverage is for other incidences. These are events that have nothing to do with crash. Think of theft, vandalism, tree falling and landing on your car. Consequently, does car insurance cover repairs in these cases? Yes, it often does.

Liability coverage is also one part of the equation. One causes an accident, and it pays for the other person’s car repairs. It won’t, however, pay you if your own vehicle is damaged. You need collision for that.

Routine Maintenance and Wear and Tear (Not Covered)

Now, let us speak a little bit about what is not discussed. Your insurance is NOT going to cover your routine maintenance. This includes things like oil changes, new tires, etc. It also removes replacement of worn-out brake pads.

The concept can understood as a form of health insurance. Your plan covers a broken arm. It does not however include your daily vitamins. Car insurance has a similar principle. This is for things that weren’t anticipated, not things that can anticipated. This is an important point many people fail to see.

What Types of Insurance Policies Provide for Repairs?

To get the full picture of the coverage that you have, you will need to know your policy. Different parts of your policy discuss different things. Let’s zero on the most popular types that do repairs.

Knowing such details is important. It makes you know whether you have the protection or not. It also helps you deal with your expectations when you have to make a claim.

Collision Coverage Explained

Collision coverage is very simple. It pays to repair or replace your car from a collision. This is the case if you hit another vehicle. It is the case as well if you hit something, such as a fence or a pole.

This coverage is optional unless you financed or leased your car. It will be required, in those cases, by your lender. You will required to pay a deductible. This is the amount before the insurance company pays. For people having financed vehicles, around commercial auto insurance additionally can give a broader knowledge for protection of vehicles.

Comprehensive Coverage in Detail

Comprehensive coverage is also very important. It covers damage from event which is not a collision. Often these things happen out of your control. This is why it is sometimes referred to as “other than collision” coverage.

Events such as fire, theft and vandalism. It is also for hail damage or hitting an animal. If your car is stolen and damaged, comprehensive helps out. Just like collision, you will get a deductible to pay.

What About Mechanical Breakdowns?

This is where many drivers are confused about. Standard policies such as collision and comprehensive coverage do not cover mechanical failure. For instance, if your transmission just dies because of age. That is not a covered event.

However, there is a special kind of coverage for the same. It is known as Mechanical Breakdown Insurance (MBI). This is an add-on policy that is offered by some insurance companies. It is an extended warranty for the mechanical parts of your car.

MBI can be a great investment. It is particularly useful in cases when you are puzzled over the question, does car insurance cover car repairs of a mechanic nature. This is unlike ordinary insurance. It is not concerned with the damage caused by accidents, but with the failure of parts.

🚗 Repair Coverage at a Glance 🔧

Does Car Insurance Cover Repairs for Your Engine?

This is quite a particular and common question. An engine repair is one of the most expensive jobs. So, does car insurance repair your engine? Once again, the reason lies in all.

Let’s look at the scenarios. The answer to does car insurance cover engine repairs completely depends on the circumstances that have caused the damage to occur. This is a very important distinction to make.

“An auto insurance policy is a contract for dealing with risk from unforeseen events, and is not a warranty for the machine itself.” It is understanding this difference that is the key to managing your expectations and your finances. – Insurance Industry Analyst

When Engine Repairs Are Covered

It is your engine that can covered in a couple of situations. For example, if you are in a front-end crash. The effect could cause serious damage to your engine. In this instance, your collision coverage will be helpful in paying for the repairs.

Comprehensive coverage could also be applicable. Imagine that your choosen your car to pass the deep street which has flooded with water. If the water gets into the engine and destroys it, comprehensive may cover the replacement. Similarly, if there is an engine fire that is a covered event, too.

When Engine Repairs Are Not Covered

Problems with most of the engines are not covered. This is because they usually tend to be a result of age or lack of care. For example, if you don’t change your oil. The engine could seize up. This is considered to a maintenance problem.

Your insurance company will let you know this is not a valid claim. Similarly, a timing belt, if it snaps because it is old, is not covered. In most cases answering the question of does insurance cover car repairs for the engine will come down to proving an external, covered event caused the damage. Without that you are probably on your own for the bill. It is also a good idea to check out to see whether your United Healthcare insurance plan has any roadside assistance benefits, as some do.

The Ultimate Guide to Guaranteed Asset Protection (GAP) Insurance

Sometimes, there is no possibility of repair. Your car may have totaled out after you had an accident. This means that the cost of repair is excessive to its value. This is where a new problem can occur.

You may owe more than your car loan than the car is worth. This difference is referred to as “the gap.” This is where Guaranteed Asset Protection Insurance comes in.

What Is Guaranteed Asset Protection Insurance?

Guaranteed Asset Protection Insurance or GAP insurance is a coverage that is optional. It is made for total loss situations. It is the amount of difference between what your car is really worth (called ACV – actual cash value) and what you still owe for your car (because you’re either in a car loan or lease).

For example, let’s say your car loan you have $20,000 to paid off. Following an accident, your car’s insurer determines that the ACV of their car is only $15,000. That leaves a $5,000 “gap” that you still have to pay. GAP insurance would help to cover that $5,000. Without it, you would be paying for a car that you no longer had.

How Does GAP Insurance Work in a Total Loss Scenario?

The process is pretty process-orientated. First, there is the primary insurance company who pays out. They will send a check for the ACV of the car, less the amount of your deductible. This check is normally forwarded to your lender.

Then, you make a claim to your GAP provider for your claim. You will provide the settlement documents from your principal insurer. The GAP insurer, then, calculates the remaining loan balance. They manage to pay your loanies that much money and close it. It brings such a huge sense of peace of mind. For those with unique vehicles, a good understanding of value in classic car insurance can provide some parallels of understanding.

Who Needs GAP Insurance?

Not all people require GAP insurance. However, for some people, it is highly recommended. Consider it if you made a little down payment. Sometimes a down payment of less than 20% will be a powerful trigger.

You should also get it for high loan terms. Any loan that is over 60 months means you will be “upside down” for longer. If you drive a lot, your car will lose its value quicker. Finally, if you rolled the negative equity from one previous loan into your new one, then GAP is very necessary.

🚗 Visualizing “The Gap” in a Total Loss 📊

⚠️ Your Financial “Gap” (You Owe):

💰 $5,000

🛡️ This is the amount Guaranteed Asset Protection Insurance covers.

An In-Depth Look at Civil Car Coverage

Apart from traditional insurance, other products are available. The Civil Car Coverage is one such product. It is important to be able to realize what it is and what it is not. Many people view these offers and get confused.

It is often advertised as a way out of expensive repair bills. However, it works in a different way than a GEICO or Progressive policy. Knowing the difference is the most important thing to be a smart consumer. This is especially true if you are worried about whether does insurance cover car repairs.

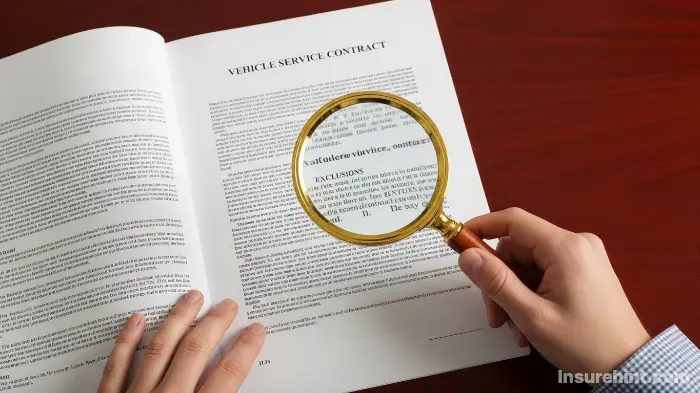

What is Civil Car Coverage?

Civil Car Coverage not car insurance. It’s a vehicle service contract (VSC), or VSC as it’s also known by, in which a vehicle comes with a kind of an extended warranty. It is a promise to pay for certain specified repairs. These will usually be for mechanical or electrical failures.

This product is intended to fill the gap left by normal insurance. As we have discussed, insurances don’t cover wear and tear failures. A VSC such as the Civil Car Coverage is specifically for those issues. That could be your engine, transmission, AC, etc. This can be particularly helpful for individuals with older vehicles or those looking to save on budgets, partially similar to one could budget for other necessities such as Humana dental insurance.

Analyzing the Civil Car Coverage Reviews

When you search for civil car coverage reviews you get mixed results. This is common for most of the VSC companies. Some customers are extremely pleased. They had a significant repair covered and saved thousands. To them they feel they got the peace of mind they paid for it’s worth.

However, there are many civil car coverage reviews that prove to be negative. These are frequently a result of denials of claims. Customers might have believed that a repair was covered, but it was included in the exclusions written in the contract. This makes it all the more important to read the contract carefully before making a purchase.

“With any service contract for a vehicle the fine print is the main story. What is excluded is just as important if not more important than what is included.” – Consumer (Protection) Advocate

So, Is Civil Car Coverage Legit?

The question “is civil car coverage legit?” is a good one. The answer is yes, the business model is legitimate. Vehicle service contracts are a part of legal products sold nationwide. Civil Car Coverage is the actual company that provides this type of contracts.

However, legitimacy does not ensure a good experience. The value of the product is totally dependent on the terms of the contract. You need to be aware of the waiting period, the list of components covered and the exclusions. If you understand what you are buying, then it can be a helpful tool. Not doing so can result in frustration. For high value professionals, reading the fine print of specific coverages such as professional liability insurance can be a similar exercise.

How to File a Claim for Car Repairs

Only knowing that you have coverage is only half the battle. You also need to know the proper way to go about such a claim. A smooth claims process can make a stressful situation that much easier to torture through.

Following the right steps is very important. It advocates the efficient processing of your claim. It also increases the likelihood of a successful outcome.

Your Step-by-Step Guide When Does Car Insurance Cover Repairs

The following is a very good guide to follow. The answer to the central question of does car insurance cover repairs is found through this process. If you have a covered claim, these steps will result in payment of your claim.

Step 1: Ensure Safety and Report the Incident.

First, get to a safe location. In case there are injuries, then call 911 straight away. If it was a collision or crime then file a report to the police. An official report is of great importance for your claim.

Step 2: Document Everything.

Next, take some photos using your phone and shoot some videos. Document the damage of every vehicle. Get pictures from the area surrounding the area too. Also, interchange information with any of the other drivers involved.

Step 3: Contact Your Insurer.

After that, contact your insurance company as soon as possible. Most have 24 * 7 claims hotlines or mobile apps. Giving them all the details of the event. This officially begins the process of claims.

Step 4: The Inspection by the Adjuster.

Afterwards, an insurance adjuster will placed in charge of your case. They will check the damage done on your vehicle. In this type of harassment, they can do it either in person or with photos you submit to them. Their job is to estimate the cost of the repair.

Step 5: Get Repair Estimates.

You can use one of them for an easy process. You have the right, also, to be able to choose your own mechanic. A detailed and written estimate should be held by you. For many, the availability of affordable repair options is just as important as the availability of ways of lowering your car insurance cost.

Step 6: Repair and Payment.

Once the estimate has been approved, the shop can start repairs. The health insurance company will pay the shop directly, from which your deductible will deducted. Or, they may send the check to you. You then pay the shop and you pay your deductible. This completes the claim. For those who need a car while having their car repaired, looking at temporary car insurance options can a good idea.

The Financial Aspect of Car Repairs

Controlling the cost of car repairs is of great concern. Even with an insurance, you have a deductible. If there is a repair not covered by it, you have to pay the whole amount. This can be a great financial burden.

This is why it is so important to have a dedicated emergency fund. Financial experts, at financial websites such as NerdWallet, advise saving 3-6 months of living costs. This fund can be very stressful for when unexpected car repairs pop up. It is a preventive action, just as purchasing insurance is itself.

Comparing insurance providers is also an important financial strategy. Some companies offer better rates or other perks. For example a comparison of one policy with a large insurance provider compared with a policy such as State Farm life insurance may show different bundling discounts available for auto insurance policies.

Every dollar that can saved on premiums can put towards your emergency fund. This is a keen manner to get on top of your overall financial health. For those who are looking at long term financial planning, learning the difference between term life insurance vs whole life insurance is also a good exercise.

Conclusion: A Nuanced Answer to a Simple Question

So, is car insurance for repairs included? As we have seen the answer is complex. It all depends on the cause of damage not necessarily the damage itself. Policies usually cover accidents and unforeseen events. Routine maintenance and wear and tear is not.

We have found out that collision and comprehensive policies are your main shield. They cover the possibility of sudden damage shielding you from the financial shock. Knowing how and when does insurance cover car repairs to vital.

Furthermore, we discovered some special products. Guaranteed Asset Protection Insurance is an important insurance against total loss cases. It insulates you against being upside down on your loan. Meanwhile, some products, such as Civil Car Coverage, provide one mechanism for dealing with the cost of mechanical breakdowns, though reading the fine print is necessary. This is a very significant point. The Insurance Information Institute (III) provides some great resources on this.

Final Takeaways for Car Owners

Ultimately, it is up to you to be an informed car owner and that is your best defense. Read your policy. Understand your coverages. Learn the difference between an insurance and a warranty. By doing so, surprise will never catch you. You will not only get to know what exactly to do when your car requires a repair. The question of does car insurance cover repairs will be no longer a mystery.

For specific vehicles such as motorcycles, there is a separate policy such as motorcycle insurance which has its specific rules. Finally, to those maintaining a business, business insurance is another level of needed financial protection that can found for affordable rates. According to the National Highway Traffic Safety Administration (NHTSA), proper maintenance to your vehicle can prevent many of them from happening in the first place, which decreases your need of any coverage.

Frequently Asked Questions (FAQs)

Yes: if you have collision coverage. This policy covers the repair of your car regardless of who is at fault in any accident. You will required to pay your deductible.

That is, only if you have rental reimbursement coverage. This is an optional add on to your policy. It pays for a rental car for up to a certain number of days at a certain daily limit.

It is possible. Filing a claim; most notably an At-Fault collision claim, can result in an increase in premium at your next renewal. However, comprehensive claim (for say hail damage) would impact your rates not as much.

OEM is an abbreviation for Original Equipment Manufacturer. These parts are brand specific on your car. Another company produces aftermarket parts. Your insurance may well only pay for aftermarket parts in order to save money unless you have special OEM insurance.

People know this as the statute of limitations, and it changes from state to state and from one insurance policy to another. You should never overlook reporting the incident and filing the claim as soon as possible so that you face no issues. Waiting too long would result in your claim being denied.

![Compliant Drivers Program: Is It Legit for Driver Safety? [2025]](https://propinfo.site/wp-content/uploads/2025/12/Compliant-Drivers-Program-150x150.jpg)

Leave a Reply