Running a small business is a mammoth task. You wear so many hats each and every day. One of the most important is risk manager. This is where insurance comes in. Our detailed Biberk Insurance Review becomes forum to help it. We are going to delve into whether this digital-first insurance is your best bet. It can be overwhelming to find out the right coverage but it doesn’t have to be.

You have to have effective protection that is affordable. Many entrepreneurs look for how to find affordable business insurance that won’t break the bank. Biberk is intended to address the very need. They are promising simple, direct and cheap policies. But are they delivering on their promise? Let’s find out together.

What Exactly Is Biberk Insurance?

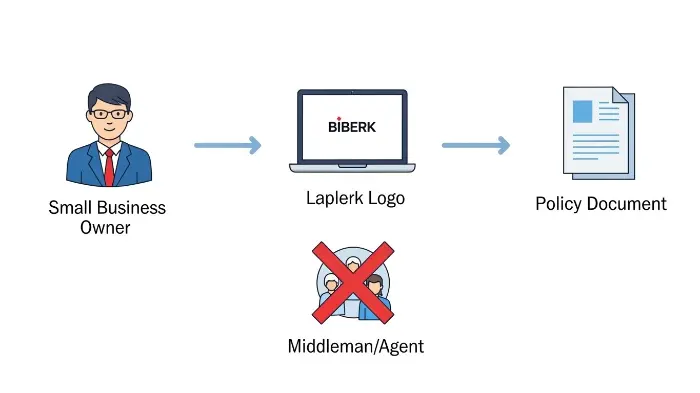

Biberk is a modern insurance company. They specialise in selling insurance directly to small business owners. This means that you purchase coverage from their website. Consequently, there are no middle man brokers or agents. This direct model is their selling point.

They say this way saves you time and money. The whole process is meant to be fast. You can obtain a policy quote and purchase a policy in minutes. This is a radical departure from traditional insurance methods. For the busy owners, this is a big advantage.

Who Is the Power Behind Biberk?

This is an important question in any insurance review. Biberk isn’t your average start-up. It does belong to the renowned Berkshire Hathaway family. Yes, the company of Warren Buffett. This backing is immense financial strength and stability.

This latter connection ensures that your policy is secure. You can count on Biberk having the resources to pay claims. For any business owner, there is nothing more priceless than this peace of mind. It indicates that Biberk is a legitimate company with a good base. You are not dealing with something unknown.

Is Biberk a Legit and Trustworthy Company?

Absolutely. There is some name-recognition power to the Berkshire Hathaway name. Moreover, Biberk’s insurance companies are highly rated. They always get an A++ rating from AM Best. This is the highest rating of all financial strength ratings.

AM Best is a global credit rating Agency. They focus on the insurance industry. An A++ rating represents an excellent ability to satisfy current insurance obligations. In simple words, they are incredibly reliable. Therefore, you can be confident while selecting Biberk.

“Risk stands for not knowing what you’re doing.”

– Warren Buffett

A Deep Dive into Biberk’s Small Business Insurance Products

Biberk provides a specialized selection of key coverage. They don’t get to be everything to everybody. Instead, they specialize in the needs of small business insurance. Let’s break down what they are offering primarily.

Biberk General Liability Insurance Review

General Liability is the backbone of the business protection. It is often a first policy which a new business purchases. It insures you against the claims on bodily damages or property. For example, if a customer slips and falls in your shop.

Biberk’s General Liability insurance covers:

- Third-party bodily injury.

- Third-party property damage.

- Personal injury and advertising injury (such as libel or slander).

This coverage is required by almost every business. From consultants to contractors, its a need to have. Biberk makes it very simple to quote and purchase online.

Biberk Professional Liability Insurance (E&O)

This coverage is also referred to as Errors and Omissions (E&O). It protects you if a client says you drank a wrong cup of coffee (i.e., made a mistake you did in your professional services). This could be a financial loss because of your advice or work.

For professionals such as accountants, consultants, and designers, this is important. A simple mistake can result in an expensive lawsuit. Biberk’s policy is for service-based businesses. It assists to pay your legal defense charges. You should consider professional liability insurance if you give any type of expert advice.

Biberk Workers’ Compensation Insurance Review

If you employ people, you probably must have workers’ compensation insurance. In fact it’s law (in most states). This policy helps to protect your team as well as your business.

It offers benefits to employees who become injured or sick at work. For example, it provides for their medical bills and lost wages. In return, it usually defends you against being sued by the employee. A number of states are covered in this crucial area by Biberk, making it simple to comply.

The All-in-One Business Owner’s Policy (BOP)

Business Owner’s Policy: A Business Owner’s Policy or BOP is a smart package. It is a combination of General Liability and Commercial Property insurance. Often times, it has a lower cost than when the policies are purchased separately. This makes it a very popular choice among small businesses.

Biberk’s BOP is a streamlined solution. It insures your physical possessions, such as your office or inventory. At the same time, it includes liability claims. It’s a good match for some of the main street businesses, such as retail stores or small offices.

Biberk Commercial Auto Insurance

Does your business have or use vehicles? If so, a personal auto policy is not sufficient. You must have commercial auto insurance. This insures you against accidents that occur while driving for work. A personal policy will probably refuse to make such a claim.

Biberk offers this important coverage for business vehicles. No matter if you have one truck, or a small fleet of vans. Having a guide to commercial auto insurance can help you to understand all the details. It makes you properly protected on the road.

Other Important Coverages Offered

Biberk also has other types of policies. They have extended their offerings over the years. These can include:

- Cyber Insurance: Insurance against data You’re More Likely To Experience A Data Breach – Cybercriminals watching, hackers and cyber criminals dependencies are employed to safeguard your information.

- Umbrella Insurance: Was used to provide additional liability insurance in addition to your other policies.

These policies deal with more specific modern risks. It demonstrates Biberk is responding to the needs of today’s business. This is a good sign that in any Biberk Insurance Review.

The Biberk Quote and Buying Experience

One of Biberk’s greatest claims is to be simple. So, we subjected their online quotes process to the test. The experience is a major component of this review.

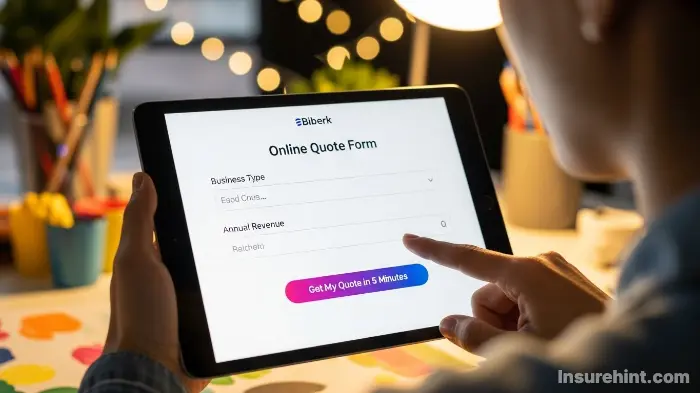

Getting a Biberk Insurance Quote Online

This process begins on their homepage. You select on your business type and state. Then, a series of simple questions is asked by the system. These are designed to be easy for any person to respond to. No need from you to be an insurance expert.

The questions cover:

- Your industry/specific services.

- Your annual revenue.

- The amount of employees you have.

- Your business location.

The whole process seems to be intuitive and quick. In most cases, you can get a Biberk insurance quote in 5 minutes. This speed is a huge advantage for entrepreneurs who are on the go.

Simplicity in the Application and Purchase

Once you get your quote, it is just as easy to buy the policy. You can review the details of the coverage and of course the limits. In the event you like the price you can pay on the web using a credit card. Your policy documents and certificate of insurance are available immediately.

This ability to access this instantaneously is a game-changer. For instance if you require proof of insurance for a client contract, you can get it now. There is no waiting until an agent gets back to you via email. This is where the direct to consumer model really shines. It eliminates friction from the process.

Managing Your Policy Through the Online Portal

After you purchase, you do everything online. Biberk has a customer portal that is easy on eyes. Here you can:

- Access and go to your policy documents.

- Make payments.

- Request modifications of your coverage.

- File a claim.

This style of self-service allows you the control. It is just right for technology comfortable people. It is very much like online banking. However, it could be one downside for people who prefer to repetitively speak to a person when they make even little changes. Some individuals still make sense of the traditional choice like a State Farm life insurance agent.

“The secret of getting ahead is getting started.”

– Mark Twain

Biberk Insurance Costs: An Analysis of Affordability

Price is a key issue for every small business. Model of direct: Biberk’s direct model is supposed lower costs But is the Biberk insurance really affordable? Let’s investigate.

What Factors Influence Your Biberk Premium?

Insurance pricing is complicated. Your ending cost will depend upon many unique factors. Biberk is no different in respect. The major factors behind your premium are:

- Your Industry: A construction company has more risk than say a graphic designer. Therefore, their premium will be greater.

- Your Location: Legal and medical costs are different by state, so this impacts on rates.

- Business Size: The size of your business – your annual revenue and the number of employees you employ.

- Claims History: A business that has a history of claims will pay more.

- Coverage Limits: The higher the limits the more protection which means greater cost.

Because of this, there is no one size fits all price. Your quote will be on a unique need-to-know basis regarding your business’s risk profile.

Is Biberk Cheaper Than Competitors?

In many cases, yes. By eliminating the agent’s commission, Biberk is often able to provide cheaper prices. This is particularly so for standard, low-risk businesses. Many users are saying that they save a lot of money compared to traditional quotes.

However, this no longer always is the case. For highly specialized or high-risk industries, a traditional broker may come up with better options. They are able to shop your policy with multiple specialty carriers.

Therefore, it’s always a good idea to compare. Getting a quote from Biberk is not costly and it is fast. You have nothing to lose by checking their price. You can even use tips for lowering car insurance costs and apply them to your commercial auto policy to help you find savings.

How to Find Savings with Biberk

Biberk has a couple ways to manage your costs. One of the best ways is through the selection of a Business Owner’s Policy (BOP). Bundling your liability and property coverage will often yield a discount.

In addition, you can change your deductibles and coverages. A higher deductible will decrease your premium. However, it means you are paying more from your pocket if you have a claim. It’s a tradeoff between his or her upfront expense and future potential expense. Paying your premium annually rather than monthly sometimes can save you small sums of money too.

Pros and Cons of Biberk: A Balanced Perspective

No insurance company is perfect for everybody. A fair Biberk Insurance Review must look at the good and the bad. Let’s weigh the pros and cons.

- Cost-Effective: Direct model often leads to lower premiums.

- Speed and Convenience: Get a quote and policy in just minutes online.

- Financial Strength: Backed by Berkshire Hathaway with an A++ rating.

- User-Friendly: Simple website and policy management portal.

- Instant Documents: Get your Certificate of Insurance immediately.

- Limited Human Interaction: Not ideal for those who prefer an agent.

- Fewer Customization Options: May not suit very complex or unique businesses.

- Not in All States/Industries: Some businesses may not be eligible for coverage.

- Digital-Only Claims: Filing and managing claims is primarily online.

- Fewer Policy Types: Lacks some specialty coverages like health or [dental insurance](https://propinfo.site/humana-dental-insurance/).

The Clear Advantages: Why Biberk Is a Great Choice

The biggest pro is the combination of price and convenience. For the normal small business, the capability to obtain a cheap coverage in that fast is unmatched. The support of Berkshire Hathaway gives it a credibility of trust that is difficult to ignore. This is no fly by night operation.

The self-service model provides empowerment to the business owners. You Insurance Controlled: You are in control of your policy. This transparency is a godsend for change from the oftentimes opaque nature of traditional insurance. This is a significant factor in our positive Biberk Insurance Review.

The Potential Drawbacks: Where Biberk Falls Short

The digital-first model is also its biggest weak point. If you want a personal relationship and an agent from the area, Biberk is not for you. You can’t just stroll into an office and talk to others about your needs. Similarly, complex businesses may require more custom than Biberk provides.

Furthermore, their service can be restricted. While they are currently growing, they aren’t operating in all states for all types of policy. High-risk industries might be refused coverage. Also, they are specialized in business insurance which means you can’t combine it with other needs like a personal United Healthcare plan for your family.

Biberk Customer Service and Claims Review

Great prices and easy website are great. But how is Biberk when you actually do need them? The claims process is the true test of any insurer.

The Biberk Claims Filing Process

Biberk is encouraging you to file claims via their portal website. The design of this process is to be simple. You log into this site, fill out some information about the fall and upload any relevant documents. Then you are assigned a claims adjuster to their case.

Form of communication is mostly emails and the portal. This maintains a digital version of it all. For simple claims this process can be very efficient. However, for a complex liability litigation, some may find the lack of phone-based hand-holding to be stressful.

What Do Biberk Customer Reviews Say?

Online Biberk customer reviews are a mixed bag, which is indicative of insurance companies. Many customers rave about the simplicity of the sign-up process and low prices. They love having speed and convenience.

On the other hand, some of the negative reviews are relating to claim handling. Customers occasionally complain of low response times or disputes over claims payouts. It’s necessary to read these reviews with a tad bit of a critical eye. Unhappy customers often are the most outspoken. However, constant themes in reviews can be telling.

The Balance of Digital vs. Human Support

Biberk does have phone support for customer service and claims. So, you can talk you human if need to. However, their primary model and workflow are digital. They direct you to their on-line somewhere beginning. This is a conscious business model decision. It also means that their overhead is kept low, which means your savings.

Who Is the Ideal Customer for Biberk Insurance?

Biberk has a very specific target audience. Understanding whether you are in this group is the key. This will help you choose whether they are the right fit for your needs or not.

Startups, Solopreneurs, and Freelancers

If you are just starting out, Biberk is a good choice. The price and simplicity associated with them are perfect for new businesses on a tight budget. Freelancers and solopreneurs who need straightforward liability coverage can be insured in a matter of minutes.

This eliminates a large barrier to being protected. The federal Small Business Administration has numerous resources for startups, and obtaining insurance is one of the first steps.

Small Businesses in Standard-Risk Industries

Biberk is right for “main street” businesses. Think retail shops, consultants, photographers, small contractors and restaurants. If your enterprise operations are simple, Biberk’s policies are likely to be a perfect fit. They have fine-tuned their offerings for these kinds of companies.

Tech-Savvy Owners Who Prefer DIY Solutions

Do you want to manage your finances via an app? Do you like to have the control and transparency? In case: If it is yes you will love the Biberk model. Business owners who are comfortable in technology will find the online portal empowering and efficient.

It’s insurance for the digital age. It’s so different from selecting and comparing options such as term life vs. whole life insurance, and these choices usually require detailed consultations between agents.

Comparing Biberk to Other Insurance Options

To complete our Biberk Insurance Review, let’s see how they compare to the competition. This is important in terms of context.

Biberk vs. The Traditional Insurance Agent

Personalized advice and service by a local agent. They get to know you and your business. They can even shop your policy with more than one carrier. The bad news about the internet is that this service is not free, so the cost of internet is included in your premium. Biberk simplifies that cost by replacing the agent with technology. This should be the basic trade-off you should consider.

Biberk vs. Other Insurtechs (Next, Hiscox)

Biberk is not the only digital insurer. Companies such as Next Insurance and Hiscox work with a similar model. They also have quick online quotes and direct-to-consumer policies. The main distinctions are in their target industries, the coverage specifics, and pricing.

- Hiscox’s strong focus is professional services.

- Next Insurance has a habit of going after contractors and the trades.

- Biberk has a voracious appetite for all kinds of small businesses.

The best thing to do is get quotes from all three. It takes a matter of minutes for each of them. This will give you a good idea of who will provide you with the best value for your specific business. Even though you may be thinking of something niche like classic car insurance, the principle of comparison shopping remains true.

“The price of light is cheaper than the cost of darkness.”

– Arthur C. Nielsen

Final Verdict: Is Biberk Insurance Right for Your Business?

After careful consideration, our conclusion is obvious: For a big part of small business owners Biberk is an excellent choice. The combination of affordability, speed and financial stability is a powerful one.

If you are a startup, or a solopreneur or a regular small business then you should definitely get a quote from Biberk. The process is so fast and easy there is no reason not to. You may discover that you can obtain the same or better coverage for a relatively lower price. Even if you just want short-term insurance, it is worth looking at, like someone might look into temporary car insurance.

However, if you run a really big business or have very specific, complex risk you may be better off with a specialist broker. The same goes if you are very big on face-to-face service. At the end of the day, it will come down to your business requirements and personal preferences.

We hope this Biberk Insurance Review has provided you with feedback clarity and high processing power to make a confident decision. Protecting your business is one of the most important things that you can do. Biberk makes for a fascinating modern approach to doing it.

You can get a quote directly with this page from the Biberk website to start your road going. Or perhaps you can even start exploring some other options, such as motorcycle insurance, as you can see how different insurance markets work.

Frequently Asked Questions (FAQs)

The answer is yes, Biberk is a superior choice for general liability insurance, particularly for small businesses with standard risk. The fact that their process is all online is one of the things that make it quick and easy to get this basic coverage for a competitive price.

On average it can take about 5 minutes for you to get a quote from Biberk. The online application asks some simple questions about your business – the process is fully automated for speed.

No, but they are related. Both Biberk and Geico are subsidiaries of Berkshire Hathaway group of companies. The result of this is that they will have the same parent company, and its huge financial strength behind them.

Yes, Biberk has a customer service phone number to deal with support and claims. While they’re a digital-first company and encourage using self-service through the web, you can contact a human being if necessary.

Biberk is available in many states, but not ALL of them with ALL types of policies. Their availability is always growing as well, so it’s best to check out their websites for the most up-to-date information on their availability for your specific location and needs.

![Compliant Drivers Program: Is It Legit for Driver Safety? [2025]](https://propinfo.site/wp-content/uploads/2025/12/Compliant-Drivers-Program-150x150.jpg)

Leave a Reply