Choosing car insurance may seem like a huge task. You have such a number of options available. Two of the biggest names you will see are All State and Geico. The argument between Allstate vs Geico is a common one when it comes to drivers. Both are insurance giants. Yet, they provide very different experiences for the customers.

This guide will substantiate all these to you. We shall look at all side-by-side. Specifically, we’ll touch on coverage, costs and customer service. It is our goal to provide you with the information you need. In turn you can make a wise decision for your pocketbook and your spiritual solace. Consequently, let us dig deeper into this Allstate vs Geico insurance comparison.

A Glimpse at the Insurance Giants

Before we compare and contrast them, though, let’s meet the contenders. Understanding the background of them can certainly help with you. It gives you an idea of what each company values the most in the continued race between Allstate vs Geico.

Who is Allstate? “You’re in Good Hands”

Allstate has been in existence since 1931. Their slogan, “You’re in Good Hands” is famous. It brings to attention their central focus: customer support. Allstate has a very large network of local agents.

These agents include small business owners in your community. Due to this, they provide a personal touch. If you prefer face to face service, this is a big plus. You can walk into an office and talk to them about your policy. This model therefore is perfect for people who are looking for guided help.

Who is Geico? “15 minutes could save you 15% or more”

Geico is well known for the talking gecko spokesperson. The full-fledged name of the company is the Government Employees Insurance Company. It was founded in 1936. Geico’s primary pitch is that of savings and speed.

Their approach of direct-to-consumer removes the middleman. You deal with geico through their website or phone. And this often results in lower prices. For example, if you would like to stay on top of your budget while still be technologically savvy, Geico is a good option. They are concerned with efficiency and affordability above all else.

Allstate vs Geico: A Head-to-Head on Coverage Options

Coverage is the essence of any piece of insurance. After all it is the thing that protects you when things go wrong. Needless say, both Allstate and Geico offer the standard types of coverage. However, among their additional options is where the Allstate vs Geico comparison becomes interesting.

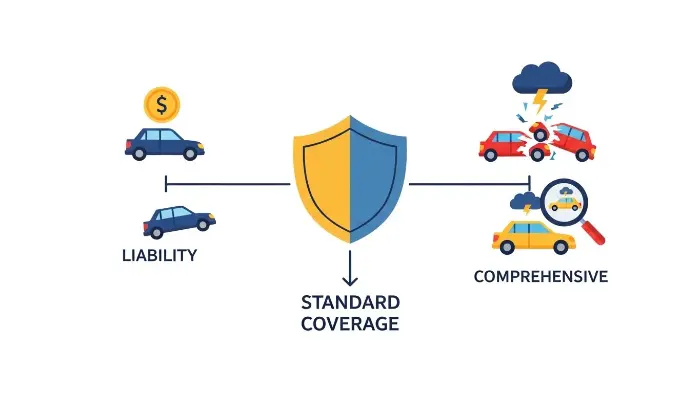

Standard Auto Insurance Coverage Explained

First of all, let’s briefly cover the basics. Most states mandate some type of these coverages.

- Liability Coverage: This covers damages that you do to other people. This includes bodily damage and property damage.

- Collision Coverage: This pays to repair or replace your car in the event of an accident.

- Comprehensive Coverage: This includes non-accident damages. For example, theft, vandalism, fire or hitting an animal.

These standard protections are available from both companies. Now, we have to go into their unique add-ons. Sometimes, you may need very short term coverage. For those situations, researching temporary car insurance might be a good thing to do.

Allstate’s Unique Coverage and Programs

Allstate auto insurance has some great things. These are intended to place added value and save you money.

Drivewise Program

Drivewise is Allstate’s telematics offering. This is using a mobile app that tracks your driving habits. For example, it will track your speed, braking and the time of day you are driving. It is possible to get good discounts on account of good driving. It is a great way to be rewarded for being a safe driver.

Accident Forgiveness

With Allstate, your rates never go up just because of one accident. This feature could prove a tremendous relief. In addition, it helps your premium remain constant even in case of a mishap. This is a valuable characteristic for any driver.

New Car Replacement

If your new car is totalled during the first two model years, Allstate will replace it. They will give you a brand new car and not just the depreciated value. This provides amazing peace of mind to new vehicle owners. For people who have unique vehicles, understanding classic car insurance also is very important.

Geico’s Special Features and Add-Ons

Geico auto insurance also has a good lineup of extras. They are concerned with realistic and cost-effective solutions.

Mechanical Breakdown Insurance (MBI)

This is a notable characteristic of Geico. It is not unlike an extended car warranty. MBI contains repairs to all mechanical parts of a new car. Moreover, it is often less expensive than a dealership warranty. This is able to save you thousands on unexpected repairs.

Emergency Road Service

The roadside assistance offered by Geoico is very affordable. It is available for only a few dollars a month in addition to your policy. It covers jump starts, towing and flat tire changes. This service is a safety net whenever you are on the road.

Rideshare Insurance

If you are driving as an Uber or Lyft driver, this becomes necessary. Your personal policy will probably not cover you at work. Geico car insurance has a hybrid insurance. It covers you for both personal use and ride hailing driving. It’s a smooth process of keeping yourself hugged to yourself. For businesses, commercial auto insurance is a must-have on company vehicles.

“The best insurance is the insurance which you know.” Read the fine print, ask questions and select coverage that will really protect your assets.”

Coverage Add-On Comparison

Allstate’s Standouts

- 🚗 New Car Replacement: Replaces a new, totaled car.

- 🛡️ Accident Forgiveness: First accident won’t raise your rates.

- 📱 Drivewise Program: Rewards you for safe driving habits.

- 🏠 Claim-Free Rewards: Get money back for being claim-free.

Geico’s Standouts

- 🔧 Mechanical Breakdown: Cheaper than an extended warranty.

- 🤝 Rideshare Insurance: Covers you for Uber/Lyft driving.

- 🆘 Emergency Road Service: Affordable 24/7 roadside help.

- 💰 Multi-Policy Discounts: Huge savings for bundling policies.

Allstate vs Geico: A Detailed Car Insurance Cost Comparison

Cost is usually a determining factor for many people. The Allstate vs Geico price difference can be huge. Let’s see what they do when it comes to pricing and discounts. In general, Geico is usually cheaper. Their direct model for example, saves on the overhead costs.

However, this is not always the case in everyone. Your final price is dependent on lots of personal factors. Therefore, it’s always to be able to get quotation from both to see the real winner in the Allstate vs Geico cost battle.

What Affects an Allstate Insurance Quote?

It’s easy to obtain an Allstate insurance quote. Your price will depend on several important things. These include your age, driving record and location. Similarly, another big factor is the type of car that you drive.

Allstate car insurance may be more expensive to start out with. But their broad range of discounts can definitely fill in the gap. For example, their Drivewise program can result in big savings. It also helps a lot to bundle your auto insurance policy with home or renters insurance. Learning about how to lower your car insurance cost can make a huge difference at any time.

How Geico Calculates Your Premium

Geico has a reputation of offering competitive pricing. They heavily use data to assign their rates. There are similar factors used to calculate your geico auto insurance premium. The conditions of your driving history, your credit score, and the zip code where you live have everything to do with it.

Because their business model has been so efficient, they are able to pass which on to you. They have a reputation for being one of the least expensive of the national insurers. This is particularly so if the drivers have clean records.

Auto Insurance Discounts: Geico Car Insurance vs. Allstate

Discounts are your best friend when purchasing an insurance. Finding the ones that you qualify for is key. Both companies, for example, offer plenty of them.

Frequently Available Discounts from Both Insurers:

- Good Student Discount: For young people who have good grades while driving.

- Safe Driver Discount: For having a clean record for a number of years.

- Multi-Policy Discount: Example of bundling car with home, renters, or even life insurance.

- Vehicle Safety Features: For having Air Bags, Anti-lock brakes etc.

Allstate’s Unique Discounts:

- eSmart® Discount: For going paperless.

- Early Signing Discount®: For signing your policy early.

- Responsible Payer Discount: Good payers.

Geico’s Unique Discounts:

- Military Discount: For active duty and retired members.

- Federal Employee Discount: For current or retired federal workers.

- Membership Discounts: For the membership of specific alumni groups or organizations.

Getting an allstate quote can reveal to you what discounts you can receive. After that, compare it to what Geico’s offer. This is their only way of knowing for sure.

Customer Service Face-Off: The Allstate vs Geico Experience

When you have an accident, you sure want help. You need an insurer who will be responsive and fair. The experience of customer service is a big part of the Allstate vs Geico debate.

Allstate’s Agent-Focused Approach

Allstate hangs its hat on personal service. The presence of a local agent can be a huge advantage. They can have you through the claims process. In addition, they can help you get the right coverage. If you believe in this human connection, Allstate is a winner.

However, this can sometimes slow something down. You may need to work during office hours of your agent. Overall though, that this is comforting to many people. Having someone you know you can use a phone call to is a big plus. It’s also important to be able to protect your career with the proper cover and knowing about professional liability insurance is a great place to start.

Geico’s Digital-First Experience

Geico’s model is designed for quickness and efficiency. You can make a claim any time of the day or night via their mobile or their website. Their call centers are also extremely well rated for how responsive they are. This is ideal for those who feel comfortable handling the things in an online manner.

The disadvantage is a lack of personal agent. Or you may be talking to a different person each time you call. For some this just feels impersonal. On the other hand, for others, it’s a small price to pay for reduced premiums and faster service.

J.D. Power Rankings and Customer Satisfaction

To obtain an unbiased picture, we can refer to ratings by a third party. J.D. Power, for instance, has annual studies on insurance satisfaction.

In recent years, the performance of both companies has been quite good. However their strengths are in different areas. Allstate tends to test higher in the in-person agent experience. Geico, in contrast, often ranks at the top of the heap for its digital tools and website. For more in-depth rankings you can visit the official J.D. Power auto insurance study.

“Price is what you pay. Value is what you get. When it comes to insurance, never compromise anything for the sake of a cheap price. – Warren Buffett

It’s obvious that both companies are strong. Which one is better will depend on what you value the most. Do you want a personal guide or however to the electronic way to speed up it up.

Digital Tools: Mobile Apps and Websites

In the modern day and age, a good app is a must. Both the insurers have invested heavily in their technology. So let’s check out how their digital offerings rate.

Using the Allstate Mobile App

The Allstate app is powerful. You can use it to access your policy documents, as well as ID cards. In addition you can also file a claim directly off the app. This includes photos of the damage uploaded.

Its largest feature is the integration with Drivewise. The app provides you with immediate feedback on your driving. This in turn helps in gaining discounts. Furthermore, you can get roadside assistance with a one-tap.

Navigating Through the Geico Mobile App

The Geico app is well known for being user-friendly. It is clean, simple and very fast. Everything you need can be easily found. You can pay for your bill, access your ID cards, and obtain a quote on your new vehicle.

But geico’s virtual assistant, kate, is a cool feature. It is able to answer your policy questions much faster. The claims process on the app is also simplified. Geico has invested a lot of effort in trying to make its digital experience seamless. This is a massive attractant to the people who are their intended audience. This is also the case with other forms of insurance, such as Humana dental insurance, where digital tools are becoming important.

Who is the Ideal Customer?

The Allstate Driver

You value personal relationships. You want a local agent to guide you. Bundling multiple policies, like home and auto, is a priority for you. You also appreciate programs that reward you for loyalty and safety.

The Geico Driver

You are budget-conscious and tech-savvy. You prefer managing your policy online or via an app. You want a quick, no-fuss experience and are confident in choosing your own coverage options to save money.

Beyond Standard Cars: Other Types of Insurance

Your insurance needs may be more than a simple car. As an example, what about if you possess a special vehicle? Or what if you run a business? And let’s see how Allstate and Geico deal with these cases.

What Is Classic and Motorcycle Insurance?

Both companies have specialty vehicle coverage. For example, if you have a prized possession you want it protected. You can either take out a policy against your classic car or find comprehensive motorcycle insurance. The options and the pricing will differ. Therefore it is always best to obtain a specific quote for these items.

Do They Address Your Business Needs?

If you use a vehicle for work, you need commercial auto insurance. Both companies offer this. For startups, the business insurance is a critical step, so finding the right insurance is important. They can offer other business policies as well. This gives you the opportunity to bundle and save more.

Bundling with Other Insurance Products

Bundling is one of those easiest ways to save money. It is heavily promoted by Allstate and also by Geico. You can include your auto insurance in:

- Homeowners Stewart or Renters Insurance

- Life Insurance (Term life vs. Whole life is important)

- Dental or Health Insurance (Providers such as United Healthcare Insurance have a number of different plans)

The more you can bundle the more you can save. This is an important way of reducing your total insurance expenses. For general information on insurance, the Insurance Information Institute is a great place to go.

“The future is a place where those who get prepared for it today. – Malcolm X

This quote is very true in the case of insurance. Preparing for the unexpected is after all the point.

Conclusion: Reaching a Final Decision in the Allstate vs Geico Battle

So after all this, which one is better then? The honest answer is: it depends on you. In the case of this Allstate vs Geico matchup, there is no singular winner for everyone. The last type is really up to personal preference and need.

You should choose Allstate if:

- You want an individual agent in your region.

- You are willing to possibly pay more to get a premium service.

- You want special coverage items such as new car replacement.

You should choose Geico if:

- Your number one priority is to find the lowest price possible.

- You are tolerant of a digital first approach and a self servicing approach.

- You make it worth for their military or federal employee discounts.

The best thing you can do is to get quotes from both. Go on to their web sites and fill the forms. It will take like 15 minutes for each. Then, compare this coverage and the final price. Look at the discounts for which you are eligible. A great place to obtain vehicle safety ratings, which affect insurance rates, is the IIHS website.

Only then, will you know which is the right one for your particular situation. With the hope that this guide for Allstate vs Geico has made a decision much easier on you. Drive safely!

Frequently Asked Questions (FAQs)

Often, yes. Geico’s direct to consumer model typically leads to lower base rates. However, with all of the discounts available from Allstate, some drivers may find that their final price is competitive.

Both of them have highly-rated claims process. Geico is praised for its fast digital claims. In contrast, Allstate receives kudos for the individual attention offered by regional agents during a claim.

Yes. Allstate has their Drivewise program, while Geico has their DriveEasy program. Both are using an app to monitor your driving habits and in turn reward you with discounts for being a safe driving driver.

Yes, switching is simple. You only have to buy your new policy and then contact your old policy to cancel. In order to avoid a lapse in coverage, make sure your new policy is in effect before pasting the old one.

Both have long list of discounts. Geico is very well known for military and federal employees discounts. Allstate, on the other hand, has quality discounts for bundling, paying in full, and been a loyal customer. The “better” one depends on the discounts for which you qualify.

![Compliant Drivers Program: Is It Legit for Driver Safety? [2025]](https://propinfo.site/wp-content/uploads/2025/12/Compliant-Drivers-Program-150x150.jpg)

Leave a Reply