Your home is an enormous investment. It is probably your greatest asset. As such, protecting it is not an option; it is a necessity. This is where a good policy comes in. We will explore Allstate Home Insurance today. They are among the largest insurance companies in the US. But does their coverage live up to the hype?

This review will explain it all down to you. We will examine their standard policies. We likewise will consider add-ons that are not mandatory. And last, but not least, we’ll discuss costs, discounts and customer service. You will get the clear picture at the end.

This will help you decide whether Allstate is right for you. While it is important to protect your home, perhaps you are running a business out of your home, which will need a different type of protection. Finding affordable business insurance is a separate but equally important step for entrepreneurs.

Who is Allstate? A Quick Overview

Allstate was founded in 1931. They have been in the insurance game for a long time. You have probably heard their slogan, You’re in good hands. They provide all kinds of insurances. This includes auto and life and of course, home insurance.

They function through a very extensive network of local agents. This means that you can often get an agent near you. Such a personal touch is a huge pull for many people. It is a face to face point of contact for what you need with respect to your policy.

Understanding the Core of Allstate Home Insurance

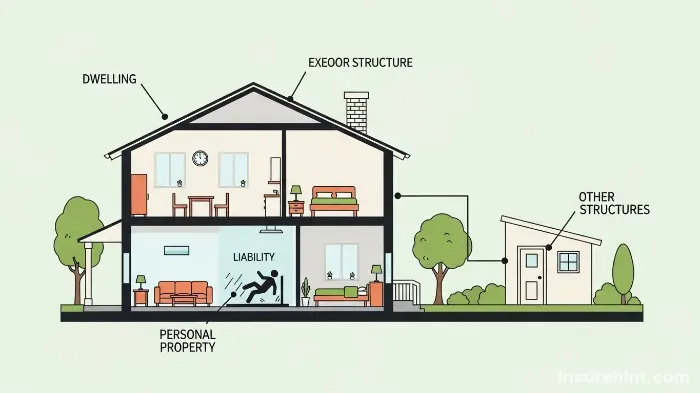

Before we get back to the details, however, let’s get the basics. Homeowners insurance is a package policy. This means that it covers both damage to your property and your liability. It insures you from being held liable for any injuries. It also includes property damage to other people.

Most homeowners policies are a pubic requirement from mortgage lenders. However, even if you own your home outright, it is a vitally important safeguard. It gives you financial health insider against unforeseen calamities. You have a first line of defense: your good policy.

What Does a Standard Allstate Policy Cover?

The standard home insurance policy offered by Allstate is comprehensive. It is designed to cover the most common risks that homeowners have. We shall deconstruct the key aspects.

Dwelling Coverage (Coverage A)

This is where the gist of your policy is. Dwelling coverage: this protects your house physical structure. This includes the walls, roof and foundation. It also includes attached buildings, such as a garage.

For example, if you’ve had a fire that damaged your kitchen, this coverage is to pay to rebuild the kitchen. The amount of coverage should be adequate to entirely rebuild your home. This is not the market value but the replacement value.

Other Structures Coverage (Coverage B)

This section of the policy addresses structures that are not attached to your house. Think in regards to your shed, a detached garage or your fence. This coverage is normally set at 10% of covering your dwelling.

So, if your house is covered for $300,000, you are going to have $30,000 for other structures. You can normally increase this amount if necessary.

Personal Property Coverage (Coverage C)

This works to protect your possessions inside the home. This includes furniture, electronics, and clothing. Basically it includes anything you would take with you in case you moved. This coverage is critical to recovery.

It is usually 50% to 70% of the coverage for your dwelling. For example, with $300,000 worth of dwelling coverage you could be covered for $150,000 worth of personal property. However, watch out for special restrictions on such things as jewelry or art. For really unique assets, such as a collector’s vehicle, you’d need a special policy, similar to the way you would insure your classic car insurance.

Loss of Use Coverage (Coverage D)

Say, a disaster is covered and your home is unlivable, what happens then? Loss of Use coverage: this helps pay for additional living expenses. This can include hotel bills, rent for a temporary apartment and restaurant meals.

This coverage is a lifesaver in a stressful situation. It helps you have a place to stay during the repair of your home. Consequently, you are able to maintain your standard of living.

Personal Liability Coverage (Coverage E)

Liability protection is so incredibly important. It takes up the slack in case someone is hurt on your property, and you are who is held legally responsible. It also covers you if you or family members cause damage to somebody else’s property.

For example, if a visitor slips on your icy sidewalk, this is to help pay for the visitor’s medical bills, and for your legal fees. Thinking about liability is very important, not only with your home but even in your professional life and you may need professional liability insurance.

Medical Payments to Others (Coverage F)

This is a lesser, no-fault coverage. It pays for lesser medical bills should a guest become injured on your property. It does not matter who was at fault. This can help you to avoid a bigger liability claim by resolving small issues quickly.

“The next few years will be an uncertain future we can all agree on, but protecting our home is definitely one of them. Insurance is the weapon which makes such protection a reality.”

Allstate Coverage at a Glance

Standard Coverage

- Dwelling

- Personal Property

- Liability

- Loss of Use

Popular Add-Ons

- Water Backup

- Identity Theft

- Scheduled Property

- Yard & Garden

Go Beyond the Basics with Allstate’s Optional Coverage

A standard policy is great, but sometimes you have to have more. Allstate has a comprehensive menu of optional coverages. These endorsements enable you to make your policy to suit your needs. This is a big plus in its flexibility.

Key Endorsements You Should Consider

Water Backup

This is one of the most important add-ons. A standard policy does not cover damage from a backed up sewer or drain. Also, does not include failures of sump pumps. Water backup coverage is used to fill this important gap. This way you can save thousands of dollars.

Identity Theft Restoration

In our world of digital technology, identity theft is not some kind of hypothetical threat that might happen one day. This coverage helps you to recover your identity. This ensures a dedicated case manager. It also discusses related expenses, such as attorney rates.

Scheduled Personal Property

Do you have expensive jewelry, art or collectibles? Your regular policy has limits for these things. Scheduled personal property coverage insures these items for their full appraised value. It provides broader protection, as well.

Yard and Garden

This is an Allstate unique offer. It gives you the coverage for your trees, shrubs and plants. It even includes lawnmowers and other garden tools. If you have spent a fortune on your landscaping, here it is for you.

Green Improvement Reimbursement

If there is a covered loss this add on will help you rebuild better. It offers additional funds to repair or rebuild using energy-efficient building materials. And undoubtedly, it is a great incentive to go green.

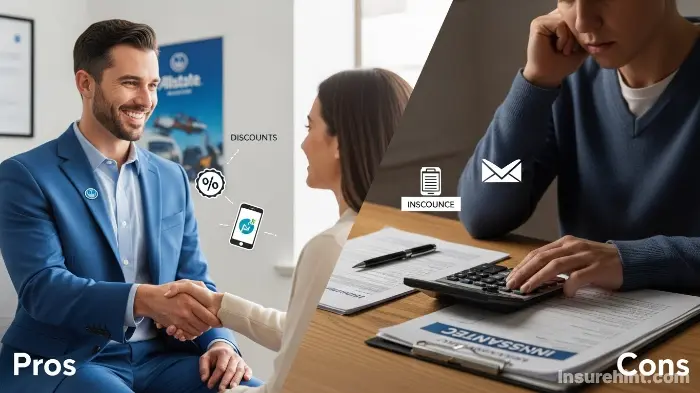

The Pros and Cons of Allstate Home Insurance

No insurance company is ideal for everyone. It’s important to balance the good with the bad. Here’s the truth on Allstate’s strong and weak points.

The Advantages of Choosing Allstate

- Large Agent Network: With thousands of agents throughout the country, it is usually easy to find an “allstate near me.” This offers personalised service.

- Strong Financials: Allstate is consistently rated highly by rating agencies such as A.M. Best. This means they have the financial stability to pay claims. You can find their recent rating here on the A.M. Best website.

- Wide Range of Discounts: Allstate offers many ways to save money. We shall discuss these in detail a little way down. These discounts can help to make their prices more competitive.

- Good Digital Tools: Their website and mobile app are easy to use. It is easy to pay bills, file claims, and access policy documents.

- Comprehensive Coverage Options: Major benefits include having the flexibility of customizing your policy with many endorsements.

The Disadvantages to Consider

- Potentially Higher Premiums: Allstate is not always the cheapest option. Their rates can be greater than some competitors. You may be able to find better rates, however, by shopping around.

- Mixed Customer Service Reviews: While some have great experiences, others do not. Customer satisfaction can vary a great deal within regions as well as individual agents. It’s always a good idea to check out what people are saying pleasureized reviews.

- Availability: Due to high risks, some states, such as California, Allstate has suspended writing new home policies. You need to know if they have availability in your area.

“A pound of cure is worth an ounce of prevention. This is especially evident when it comes to protecting your home.”

– Benjamin Franklin

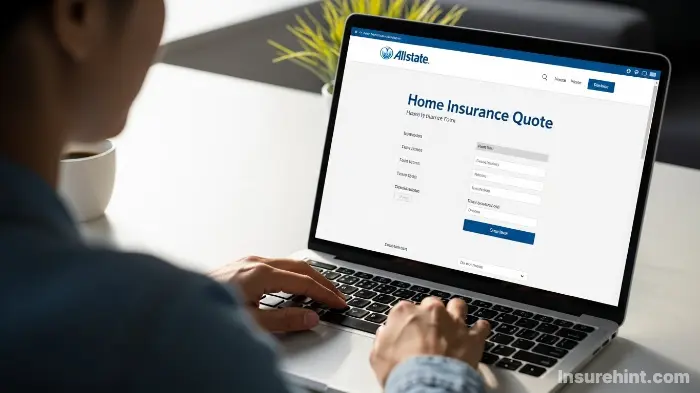

How to Get an Allstate Insurance Quote and Find Savings

The initial step is to get a quote. The price you pay for Allstate Home Insurance depends on numerous factors. Luckily, they also deliver a lot of discounts to improve your premium.

Starting the Allstate Insurance Quote Process

You can obtain an allstate insurance quote in two general ways. You can make it online by their website. Or you can contact with a local agent. The process goes online and is fast and convenient. However, talking to an agent means that you can ask detailed questions.

What Information Will You Need?

In order to receive an accurate quote, you will have to provide some information. This is including your address and date of birth. They will also ask about the construction details of the home. For example, when it was built and the type of roof. You will also need to assess how much your personal belongings are worth. It is also a good idea to know your claims history.

Unlocking Allstate’s Many Home Insurance Discounts

This is where you can really save your money on. Allstate is known for its long list of discounts. Bundling of more than one policy is a popular option. For instance, having your home and auto insurance bundled together will greatly reduce your costs. It is one of the best tips for lowering car insurance cost.

Top Discounts to Ask About:

- Multi-Policy Discount: Bundle your home and auto policies. You could also add a motorcycle policy, so looking into motorcycle insurance is a good idea.

- Protective Device Discount: For smoke detectors, fire extinguishers, and security systems.

- Early Signing Discount: Sign up for your new policy at least 7 days before your old policy expires.

- Claim-Free Discount: You will receive a discount stating that you don’t have recent claims.

- New Homebuyer Discount: If you recently managed to buy your house.

- Automatic Payment Discount: Automatically service charges should be withdrawn from your bank account.

- Loyalty Discount: For being a current Allstate customer.

Many people and families also consider life insurance policies. While you’re researching home and auto bundles, comparing offers with different providers the likes of the State Farm life insurance may offer you a wider perspective on your overall insurance needs.

Finding an “Allstate Near Me” Agent

Using a local agent offers a personalized experience. Here’s why it matters:

Personalized Advice

An agent understands local risks and can tailor your policy to fit your unique situation.

Claim Assistance

When you need to file a claim, your agent acts as your advocate and guides you through the process.

Easy Policy Reviews

An annual review with your agent ensures your coverage keeps up with your life changes.

Allstate’s Claims Process and Customer Satisfaction

Great coverage is one thing. However, an insurance policy is only as good as the company’s ability to fairly and efficiently pay claims. Let’s take a look at how well Allstate does in this very important component.

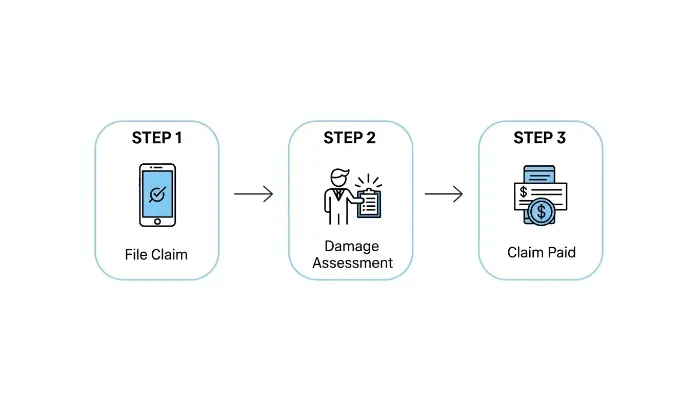

How to File a Claim

Allstate offers a number of convenient ways to file a claim. You can do it 24/7 with the help of their mobile app. Additional claims you can file on their website or on their claims hotline. Finally, you can contact your local agent yourself for help.

They also have something called QuickFoto Claim. If the damage is minor, you can simply submit photos of the damage on your cell phone. This can make it much faster to perform claims for smaller issues. This is especially useful for damage to a car, and good to know if you’re also looking at their commercial auto insurance for your business.

A Look at Customer Satisfaction Ratings

Allstate’s customer satisfaction ratings are generally average to slightly above average. In the J.D. Power 2023 U.S. Home Insurance Study they came out right around the industry average. You can find detailed results at the J.D. Power website.

Some customers rave about their positive claims experiences. Others are experiencing slow response times and disputes on settlement amounts. Your experience may vary considerably depending on your specific adjuster as well as the involvement in your account from your local agent. It is a mixed bag, and that is common for big insurers.

It’s underscored immore that the needs of insurance also change. Today you may need home insurance, but tomorrow you may need the temporary car insurance, for a very short-term need. An Allstate agent will often be able to assist with these diverse products.

Comparing Allstate to Other Major Insurers

How does Allstate Home Insurance compare with the competition? It is always smart to compare. Companies such as State Farm or Geico and Progressive also enjoy a large market share. Many families also depend on group plans for health needs, such as that provided in a United Healthcare insurance guide.

Who is Allstate Best For?

Allstate is a great fit in most cases for homeowners who:

- Appreciate a local agent relationship.

- Want to bundle home and auto policies for a big discount.

- Have a broad interest in additional and diverse optional coverages to tailor their policy.

- Appreciate easy-to-use digital platforms such as a mobile app.

Who Might Look Elsewhere?

By contrast, you may fit in better with another company if you:

- Are primarily focused on finding the absolute lowest price.

- Live in a state in which Allstate has limited new policies.

- Prefer to get online in a more streamflowed, agentless experience constants.

Different life stages also require different insurance products. A young family may have the priority of term life vs whole life insurance to secure the future of their family. Similarly, many seek out good dental plans, in which a look at Humana dental insurance is a common aspect of financial planning.

Final Verdict: Is Allstate Home Insurance a Good Choice?

So, is Allstate Home Insurance Worth It? The answer is, it depends on what your priorities are. They are a financially strong company. They have excellent, customizable coverage options. Additionally, their very long discount list and agent network are major pluses.

However, their premiums may be on the higher side. Customer service is also inconsistent depending on where you are. The best way of knowing for sure is to get a personalized allstate insurance quote. Then, you can compare it with quotes of a couple of other top-rated companies.

At the end of the day, ensuring your safety & security in your home is a decision that needs care. Allstate is a very strong contender. They are the tools and coverage to offer many homeowners peace of mind. They are definitely worth including in your insurance shopping.

Remember to also be aware of common policy exclusions like flood damage which generally requires a separate policy from the National Flood Insurance Program.

“In addition, ‘Risk comes from not knowing what you’re doing.’ Take time to know your insurance coverage.”

– Warren Buffett

Frequently Asked Questions (FAQs)

No, like most standard home insurances, Allstate does not cover damage due to floods. You will have to buy a separate flood insurance policy.

It cannot be denied that bundling is one of the best ways to save. Allstate has a major multi-policy discount for bundling your home and auto insurance.

You can use the agent locator tool on the Allstate official website. Just enter your ZIP code and you will get a list of local agents.

It can be. Allstate’s premiums are sometimes higher than competitors, but their extensive discounts can make them very competitive. It’s essential to get a quote.

Yes, Allstate has renters insurance available. It gives similar personal property and liability protection for those who rent their homes.

![Compliant Drivers Program: Is It Legit for Driver Safety? [2025]](https://propinfo.site/wp-content/uploads/2025/12/Compliant-Drivers-Program-150x150.jpg)

Leave a Reply