Choosing a health plan is a huge decision. You must have coverage that is suitable for your life. This is where Aetna Health Insurance comes in. As one of the nation’s leading insurance companies, Aetna has a broad selection. Therefore, being able to understand them is key. We will be walking you through their plans for 2025 land. Specifically, in this Aetna Health Insurance review, you will be able to make a smart choice.

We’re going to break everything down for you from individual plans to Medicare almost everything. As a result, you will become acquainted with costs and benefits so that you feel comfortable about your choice. Let’s go around the world of Aetna.

Understanding Aetna: A Legacy of Health

Aetna is a name everyone trusts. It has been around a very long time; in fact the company started way back in 1853. Since then it has grown tremendously. It is now a part of CVS Health. As a result of this merger a healthcare powerhouse was created.

This connection has some unique advantages. For example, you can see walk-in clinics at CVS stores. This integration seeks to make healthcare easier since it brings the services closer to you.

Why Do People Choose Aetna Health Insurance?

Aetna is a provider of choice for many people for good reasons. Firstly, they have a massive network. This means that many doctors and hospitals accept their plans. As a result, you are more likely to retain your existing doctor. A large network gives more choices to you.

In addition, Aetna has various plans available. You can find somewhere for yourself or your family. They also offer employers plans. For this reason, this flexibility makes them one of the popular choices. We will discuss these various plans in the next.

Navigating the Aetna Member Portal

Once you are a member aetna com is your best friend. This website is the centre of your plan. For instance, you can find doctors in your network. You also can look at the status in a claim. It is intended to be easy to use.

In addition, you can see your plan details here. It works for you to know your coverage a better understanding-no. Using aetna com portal is important as it makes you empowered to manage your health effectively.

Aetna’s Individual and Family Plans for 2025

If you buy insurance on your own, Aetna has options. These are often available to be sold on Health Insurance Marketplace. They are sometimes referred to as ACA or Obamacare plans. Now we will consider the various metal levels.

“The first wealth is health.”

– Ralph Waldo Emerson

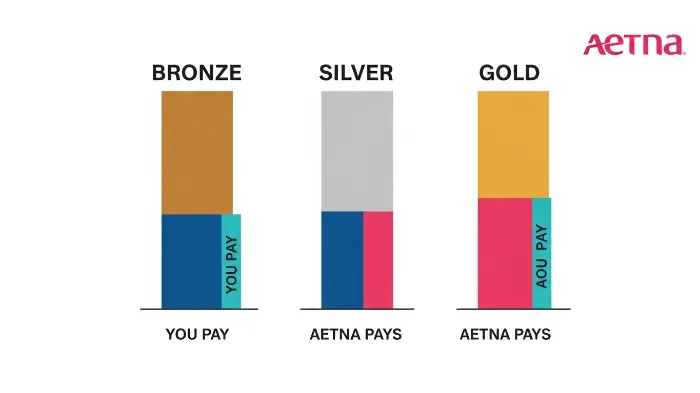

These tiers can help you to understand costs. In essence, they are called Bronze, Silver, or Gold. Each of them offers a different balance. They are a balance of monthly premiums and out-of-pocket costs.

Bronze Plans: Your Safety Net

Bronze plans have the lowest monthly premiums. However, they come with high deductibles. This means that you pay more towards care until you reach that amount for the deductible.

These plans are good for healthy people because the plans provide protection from major accidents. Think of it as a safety net. It covers you worse case scenario. If you are interested in protecting other parts of your life, you might settle for knowing the term life insurance vs. whole life insurance.

Silver Plans: The Balanced Choice

In comparison, the Silver plans often are more popular. They provide a medium level balance. The monthly premiums are higher than Bronze but the deductibles are lower as well.

For this reason, many people find these plans perfectly suitable. You receive good coverage for routine care coverage. In addition, you can be eligible for cost-sharing reductions. This can reduce your out of pocket costs even further.

Gold and Platinum Plans: Comprehensive Coverage

Gold plans have high monthly premiums. In return, they have low out-of-pocket costs. And if that is the case, your deductible will be much less. In other words Aetna pays for a larger share of your medical bills.

These are great for people who require a lot of care. If you suffer from a chronic disease, then think Gold. You can save in the long run a lot of money. Platinum plans are similar, but they are even more comprehensive. However, they are less common.

A Deep Dive into Aetna Medicare Plans

Above all, in the case of those 65 or over Medicare is key. Aetna Medicare plans are a major part of their business. They have a number of options for the way you can receive your Medicare coverage. This gives you freedom depending on your health and budget.

You can only get a plan that’s all-in-one, or you can supplement Original Medicare. For basic information of its basic site, Medicare.gov is an excellent site of the official government. Let’s have a look at the choices that Aetna offers. Indeed, this is an important one to make for your retirement years.

Understanding Aetna Medicare Advantage (Part C)

Aetna Medicare Advantage plans are very popular. They are also called Medicare Part C. Ultimately, these plans include a combination of different parts of Medicare. They package Part A (hospital), and Part B (medical).

Most include Part D (prescriptions), as well. This makes them a convenient all-in-one package. Aetna runs the plan for you. You use Aetna’s network of doctors. Some people find a lot of value in these plans, as others do one of the unique coverages on the market like classic car insurance for their prized possessions.

Common Types: HMO vs. PPO

You will often see two types of Advantage plans, which are the major and lesser types. They are HMOs and PPOs.

- HMO (Health Maintenance Organization): You must be using the doctors in a network of doctors. You also need to have a primary care physician (PCP). In addition, referrals are necessary to see specialists.

- PPO (Preferred Provider Organization): More Freedom on Your Part: You have the option to see in or out of network doctors. However, staying within the network is less expensive. Most of the time, you do not require referrals.

Extra Benefits You Might Get with Aetna

A tremendous magnet for Aetna Medicare Advantage plans are the extras. The Original Medicare does not cover these. For example, many plans have dental, vision, and hearing coverage.

Some Aetna plans also include gym memberships. They may offer meal delivery after a hospital stay. These benefits are more geared to your overall well-being and therefore they can bring great value to your plan.

Aetna Medicare Supplement (Medigap)

What if you are a fan of Original Medicare? You can still obtain help from Aetna. A Medigap plan is helpful in paying your part of the costs. This includes such things as deductibles and coinsurance.

Medigap plans are standardized by the government. A Plan G from Aetna is the same as Plan G from another company. However, Aetna’s pricing and customer service may vary. Medigap is predictable costs and is a relief for many. This type of financial protection is similar in scope for businesses to professional liability insurance.

Aetna Part D (Prescription Drug Plans)

If you have Original Medicare you need drug coverage. Aetna has standalone Part D plans. These plans allow you to pay for your medications. A plan has a list of covered drugs that are covered under that plan called a formulary.

It is important to review this formulary. Be sure your prescriptions are in the list. This will help you save on possible surprise costs at the pharmacy. Similarly, as important as comparing health plans, comparing drug plans is also necessary.

Beyond Health: Aetna’s Ancillary Insurance Options

Your health is more than just doctor visits however, it also involves your teeth and eyes. Aetna understands this important connection. As a result, they have two plans: dental and vision.

These plans can often be purchased separately. Other times, they are bundled with health plans. Let’s look at some of things Aetna dental and Aetna vision offers.

A Closer Look at Aetna Dental Insurance

Good oral health is associated with good overall health. Aetna dental plans help you manage the costs. They promote preventive care such as cleanings. Early diagnosis of such issues can help to avoid larger issues in the future.

Like their health plans, Aetna offers different types of dental plans. The two most popular ones are DMO and PPO. These options come in different degrees of flexibility and expense, similar to the options you’d have with United Healthcare insurance.

DMO vs. PPO Dental Plans

A DMO (Dental Maintenance Organization) plan is similar to an HMO. You select a primary care – Dentist from the network. This dentist is responsible for taking care of all of your care. Costs are generally less, but your choice of dentists is limited.

In contrast, with a PPO (Dental Preferred Provider Organization) plan there is more freedom. You can see whichever dentist you want to see. However you will save money by being in the Aetna network. PPO plans tend to be more costly than DMOs.

What Do Aetna Dental Plans Cover?

Most Aetna dental plans are based on a 100/80/50 structure. This means:

- 100% coverage for Preventive Care (cleanings, exams).

- 80% coverage for basic procedures (fillings).

- 50% coverage for major procedures (crowns, bridges).

Coverage information for which may vary and you should ensure to see your particular plan. Having an understanding of these percentages is very important if you want to budget for your dental care costs.

Seeing Clearly with Aetna Vision Plans

Your eyesight is precious. Aetna vision plans help you protect. These plans make people’s eye care more affordable. They normally cover regular eye exams.

Diagnosis of eye problem early: Regular exams can be a means of detecting eye problems in time. In fact, they can even identify other medical problems, such as diabetes. It is a small investment in your long-term health to have an Aetna vision plan.

Coverage for Exams and Eyewear

Most Aetna vision plans offer a yearly allowance. You get coverage of an eye exam on an annual basis. Then, you receive an allowance for glasses or contact lenses.

For instance, you may plan your exam entirely covered. It may then give you a $150 allowance for frames. Anything more than that you pay for. This structure greatly facilitates making budgets for new glasses. For those who travel, having a reliable coverage is just as important as having temporary car insurance for a short-term vehicle rental.

- Preventive Care

- Fillings & Basic Care

- Crowns & Major Work

- Large PPO Network

- Annual Eye Exams

- Frames Allowance

- Contact Lenses

- Lens Enhancements

Analyzing Aetna Health Insurance Costs

Of course cost is a huge factor for everyone. The price of Aetna Health Insurance depends on many things. It is not an answer of one size fits all. Your individual circumstances will set your premium.

It’s also important to look past the premium. Deductibles and copays have to be considered. For unbiased data about industry trends, non-profits such as the Kaiser Family Foundation (KFF) are a good source of research. A complete financial picture is a must.

Key Factors Influencing Your Premiums

Several things are involved with your monthly rate. These are the factors insurance companies consider:

- Age: Older people usually pay more.

- Location: There are variations in healthcare costs in every state and county.

- Plan Tier: For example, Gold plans cost more than Bronze plans.

- Tobacco Use: People who smoke have had premiums that are often higher.

- Dependents: Addition of spouse/ children adds cost.

Understanding these things can help you predict your likelihood of expenses. Finding ways to deal with these costs is important, which is why many are on the lookout for car insurance tips on how to lower your car insurance as well as other policies.

Understanding Deductibles, Copays, and Coinsurance

These terms can be confusing. Let’s break them down simply.

- Deductible: You will have to pay the amount to get you care before your insurance will start paying for it.

- Copay: That is some amount you must pay every time you utilize a service such as the doctor who charges a doctor visit at 30 dollars.

- Coinsurance: A percentage of the cost you pay after you have met your deductible. For example, you pay 20% and Aetna pays for 80%.

You have all these costs you need to take into consideration. A low premium plan may have a high deductible. This could be even more expensive if you require lots of care.

“It is ‘health that is real wealth and not pieces of gold and silver”

– Mahatma Gandhi

Is Aetna Worth the Cost? A Look at Pros and Cons

Naturally every insurance company has its strengths as well as weaknesses and Aetna is no different. It is a smart thing to weigh the pros and cons. This helps you to make up your mind about whether or not they are the right fit. It’s a similar process to looking around to other insurers, like in a State Farm life insurance review.

The Pros of Choosing Aetna

- Large Network: Aetna has one of the largest networks of doctors and hospitals.

- Integrated Care: The CVS Health partnership gives easy access to clinics and pharmacies.

- Wide Range of Plans: They provide numerous options ranging from individual to medicare.

- Strong Ancillary Benefits: Their dental and vision plans are strong, as well as the comprehensive nature of Humana dental insurance.

- Member Tools: The aetna com website and mobile app are good tools.

The Cons of Choosing Aetna

- Cost: In some areas, Aetnas costs for premiums are higher than their competition. For a small business, cost is a really important factor as they look for affordable business insurance.

- Availability: Aetna Health Insurance does not offer individual ACA health insurance plans in all states. You must check your local Market Place.

- Customer Service: As with any large company customer service experiences vary. Some members report problems with claims.

How to Enroll in an Aetna Health Insurance Plan

So, are you ready to take up your Aetna sign up? The process depends on the time of the year. There are particular times at which you may enrol. Knowing these dates is very important.

Open Enrollment: Your Main Chance

Open Enrollment is a time of year every fall. During this time, anyone may sign up for a new health plan. For ACA plans, you may shop and compare on the official HealthCare.gov website. The enrollment period of time typically runs from November 1 to January 15. In the case of Medicare, the window for annual elections is October 15 to December 7.

This is your best bet to join Aetna. Or you can make a change to your existing plan. These are essential dates that must be missed.

Special Enrollment Periods (SEPs)

The question, then, is what if you miss Open Enrollment? It may not be too late for you to sign up. A Special Enrollment Period is induced by a life event. For instance:

- Losing other health insurance.

- Getting married or divorced.

- Having a baby or adopting.

- Moving to a new zip code.

These events provide a window of time for 60 days to sign up. You will have to provide proof of the life event. This is akin to having proof of ownership for a vehicle in order to obtain a commercial auto insurance policy.

Getting Help from Agents and Brokers

The insurance world is complicated. You do not need to find your way without an escort. Licensed insurance agents or brokers can be of help. They can help you know your options on Aetna. They can also help you go head to head with Aetna against other carriers.

Their services are usually free to you as they will be paid by the insurance companies. An expert can ensure that the process goes much better. For specialized applications such as to find the best motorcycle insurance rates an agent’s help is invaluable.

Final Thoughts: Is Aetna the Right Choice for You?

Aetna Health Insurance is a strong contender. They provide an enormous network and a broad range of plans. Also, their integration with CVS Health is a real convenience. The Aetna Medicare, aetna dental, and aetna vision plans are especially competitive.

However, cost and availability can be problems. You must do your research. Check the official marketplaces or aetna com website. Zip code is to find out what is available. Then, compare carefully between the plans and costs of the plans.

Ultimately, the most effective plan is an individual one. It is up to you, your health needs and wallet. Therefore, Aetna Health Insurance is definitely one of the best insurance companies to consider for 2025.

Frequently Asked Questions (FAQs)

Aetna offers both PPO and HMO plans as well as other plans, such as EPOs. The type of plan you can get depends on where you live and whether or not you’re getting insurance through an employer, the ACA Marketplace, or Medicare.

Yes, Aetna has two separate plans: aetna dental and aetna vision. In addition, many of their Aetna Medicare Advantage plans include these benefits as well in the package, which is a major selling point for their plans.

The easiest way is to access the provider search tool from the official aetna com website. You can filter according to specialty, location, and acceptance of new patients.

Yes, Aetna was purchased by CVS Health in 2018. This partnership seeks to achieve greater integration in healthcare, which will involve a combination of insurance and pharmacy services as well as retail health clinics.

Aetna’s participation in the ACA Marketplace varies from year to year. Towards 2024, they existed in more than a dozen states. You would need to first check HealthCare.gov during Open Enrollment to ensure they are available at your specific county for 2025.

![Compliant Drivers Program: Is It Legit for Driver Safety? [2025]](https://propinfo.site/wp-content/uploads/2025/12/Compliant-Drivers-Program-150x150.jpg)

Leave a Reply