Are you thinking about your dental health? Many of us put it off. The potential cost can be scary enough. This is where Aetna Dental Insurance comes in. It promises to help make dental care affordable. But can it really be worth your money?

We will get to know all about Aetna. Well we’re going to have a look at what their plans and costs are. We’ll even be viewing what real customers have to say. This guide will help you to make up your mind. Let’s see if Aetna is along for your oral health ride.

Understanding the Giant: Who is Aetna:

Aetna is a massive name in health insurance. They have been around for very long. In fact, their history dates back to 1853. That’s a lot of experience. They are now a part of CVS Health. This partnership is looking to make a better health experience.

Aetna has more than just dental plans. They offer health and pharmacy benefit as well. Consequently, they serve millions of members in the country. Their goal is to help people on their way to better health.

“Every tooth in a man’s head is more valuable than a diamond.”

– Miguel de Cervantes

Why Prioritizing Dental Insurance is a Smart Move

Many people believe that dental insurance is a “nice to have.” This thinking can be a very expensive mistake. Your oral health is directly related to your overall health. Problems in your mouth can have a spread to your whole body. Therefore, it is very important to take care of your teeth.

The High Cost of Neglect

Think of what the cost of a simple filling is. It can be hundreds of dollars. Now, imagine it requires a root canal procedure or a crown. Those costs can readily reach into the thousands. Without insurance these procedures may wipe out your savings. Dental insurance coverage is a kind of financial safety net, just as finding affordable business insurance is a good way to safeguard a new company from the unexpected.

For instance, the regular cleanings can avoid major problems. The dental plans provide full coverage of most dentists on these at 100%. This is to get you to get preventive dental care. It’s much less expensive to avoid a problem than it is to repair one. This is a fundamental advantage of having a good plan.

Connecting Oral and Overall Health

Did you know bad teeth are the cause of heart disease? It’s also linked to diabetes as well as other serious conditions. Your mouth is a window on the health in your body. Therefore, a good affordable dental insurance plan is an investment. It is an investment in your long-term well-being, not just your smile.

A Deep Dive into Aetna Dental Plans

Aetna knows one size does not fit all. They offer a number of Aetna dental plans. Each one has been designed as per different needs and budgets. Let’s distinguish them for you so you can imagine which of them may probably best for you.

Aetna PPO Dental Plans: The Power of Choice

The most popular is the PPO plan. PPO is abbreviation for Preferred Provider Organization. These plans allow you to have the most flexibility. You can see any of the licensed dentists you please.

How Aetna PPO Works

With an Aetna PPO dental plan you have a dental network. This network is a community of dentists. These dentists have agreed to charge Aetna members reduced rates. If you see an in-network dentist, you pay the least amount of money. However, it is not impossible to see an out-of-network dentist. Aetna, however, will continue to pay a part of the bill. It just won’t be as much.

Pros of Aetna PPO

- Flexibility: There is no limit to your options of the dentist.

- No Referrals: You will not need a referral to see a specialist.

- Large Network: Aetna has one of the wider dental insurance networks.

Cons of Aetna PPO

- Higher Premiums: There is a tradeoff to this flexibility, which may be a higher level of premiums. Premiums are usually higher.

- Deductibles: You have to meet often a deductible before the coverages come into action.

Aetna DMO/HMO Plans: The Budget-Friendly Option

If you are seeking fewer expenses, then consider the DMO plan. DMO is an abbreviation for Dental Maintenance Organization. This is working like an HMO for health insurance. This is a great way of managing your dental plan costs.

How Aetna DMO Works

With an Aetna DMO dental plan you must have a primary care dentist. This dentist is your level of contact. You must see this dentist for all you care. If you need to see a specialist you need a referral from him or her. Also, you must use dentists that are within the DMO network. There is no coverage for out-of-the-network care, except in an emergency. This structure is very much similar to what you could find in a Humana Dental Insurance HMO plan.

Pros of Aetna DMO

- Lower Premiums: These are also some of the cheapest plans.

- No Deductibles: Most DMO plans don’t have any deductibles.

- No Claim Forms: Your dentist does all this paperwork.

Cons of Aetna DMO

- Less Choice: You are required to stay within the smaller DMO network.

- Referrals Needed: Seeing a specialist involves an additional step.

Aetna Indemnity Plans: The Traditional Route

Aetna also provides indemnity plans. These are more conventional insurance schemes. They pay a predetermined percentage of the covered services. You have total freedom of choice when it comes to choosing a dentist.

You pay your dentist for his services. Then, you make a claim with Aetna. Aetna reimburses you for his or her portion. These kinds of plans are not as common anymore. However, they offer the ultimate degree of freedom if you’re willing to do the paperwork.

What Does Aetna Dental Insurance Actually Cover:

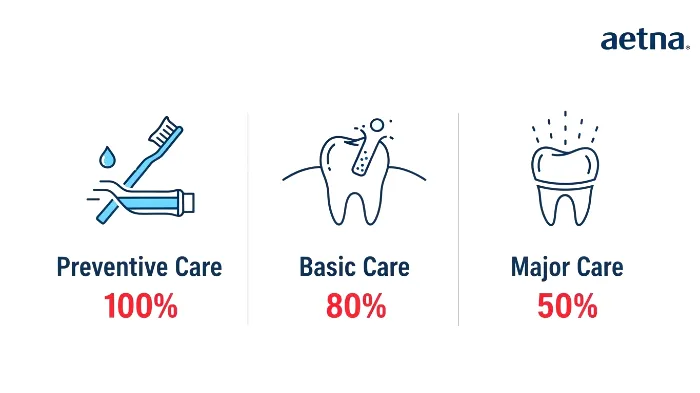

Understanding your dental insurance coverage must is such. Most Aetna plans are structured the same way. It’s often called the 100-80-50 model. This is a percentage that Aetna pays for different types of care, once your deductible has been met.

100% Coverage: Preventive and Diagnostic Care

Aetna highly promotes preventive dental care. For this reason, they generally cover such services at 100%. This means you only pay nothing out-of-pocket for them. This category includes:

- Regular checking up and cleanings (normally 2 times a year).

- Standard X-rays.

- Fluoride treatments are provided to children.

80% Coverage: Basic Dental Procedures

This next level is common dental problems. After you have met your deductible, Aetna usually covers 80% of the cost. While you are responsible for the remaining 20%. Basic services dial clinics other common services involve:

- Fillings for cavities.

- Simple tooth extractions.

- Scaling (deep cleaning) of the problem area – deep cleaning (periodontal scaling).

50% Coverage: Major Dental Services

This category is for more complex and more expensive procedures. For these major dental services, Aetna normally covers 50% of the price. You pay the other 50%. The level of craftsmanship that goes into a well-made crown can be every bit as precise as the restoration of a classic car. Both will need the special type of insurance to ensure your investment is well-protected. Some or all of these services include:

- Crowns.

- Root canals.

- Bridges.

- Dentures.

- Dental implants (with the coverage of individual plans).

All plans have an annual maximum is important to keep in mind. This is the most Aetna will have to pay for your care in a plan year. Once you reach this limit you are liable for 100% of the costs.

The Aetna Dental Network: Finding a Provider

The size of a particular insurer’s network is a huge factor. Aetna shines in this area. They have one of the largest Aetna dental providers network in the United States. This is a big advantage for the member.

Why a Large Network Matters

A large network implies more choice and convenience. You will probably have a dentist closer to your living or working area if you choose an in-network dentist. This saves you time and travelling. It also means if you move, it’s quite possible that with ease you can find a new dentist in Aetna.

How to Find Aetna Dental Providers

Aetna makes it easy to locate a dentist. And you might be able to make use of the provider search tool on their website. You can filter by location, specialty and even language. This will ensure you find a provider that is a perfect fit to you and your family.

“The best and cheapest dentistry is when the right thing is done extremely well the first time and it lasts for a long time.”

– Dr. Gordon Christensen

How Much Does Aetna Dental Insurance Cost?

This is the big question of many people. The cost of Aetna Dental Insurance varies a great deal. There is no single price tag. A number of factors determine your monthly premium. Understanding the following can help you to manage your dental plan costs.

Key Factors That Affect Your Premium

- Your Location: Dental care is more costly in some states than in others. This is reflected in insurance premiums.

- Plan Type: PPO Plan costs more than DMO/HMO Plan.

- Coverage Level: The higher the annual maximum on the plan, the higher the cost.

- Number of People: Individual plans are cheapest. Family plans cost more.

On average, you can expect to spend anywhere from $20 to $70 per month to purchase an individual Aetna dental plan. Just as it’s important that you would look for tips on lowering down your car insurance cost, you should compare quotes to find the best dental rate.

Don’t Forget About Out-of-Pocket Costs

Your premium isn’t all that you pay. You also need to budget for:

- Deductibles: The set amount of money which you pay before Aetna begins to pay.

- Copayments: Charge of specially agreed fee for a service (very common in DMOs).

- Coinsurance: Amount you pay from your pocket (by percent, i.e. 20% for filling).

It is important that the details in the plan be carefully read. Understand all possible costs prior to your enrolment. This helps to avoid any surprises later on.

Real Voices: Aetna Dental Insurance Reviews and Reputation

So, what is the opinion of actual customers? An Aetna Dental Insurance review from a real user is a wonderful thing. In general, Aetna enjoys a mixed, but generally positive reputation. They are a well-established company with a good financial rating.

They continue to score highly in J.D. Power’s studies of patient satisfaction with their dental plans. This goes to show they are doing many things right. However, as with any large insurer, they have their share of complaints. It’s a similar landscape when you look at a major provider like United Healthcare Insurance when it comes to varying experience. You can click on their rating on the Better Business Bureau (BBB) for further information.

Common praises include their huge network and easy claims process for PPO plans. Common complaints are related to the denials of claims or confusion regarding the DMO network rules.

👍Pros of Aetna

- Huge provider network increases choice.

- Wide range of plan types (PPO, DMO).

- Strong focus on preventive care.

- Well-known and financially stable company.

- User-friendly website and mobile app.

👎Cons of Aetna

- PPO plans can have higher premiums.

- DMO plans are restrictive.

- Annual maximums can be low on some plans.

- Waiting periods for major services.

- Customer service experiences can vary.

Who is Aetna Dental Insurance Best For?

Aetna Dental Insurance is a good fit for many people. However, it’s especially suited to certain groups. Let’s see if you fall into one of them.

Individuals and Families

For families, Aetna’s sizable PPO network is a huge plus. It’s easier to find the kind of dentist who’s going to be the best with both adults and kids. Plus, after you have one plan, your life can be made easier because of it. It’s part of creating a full-safety net for the people you love, which also means looking into options such as the ones found in our State Farm Life Insurance Review.

Small Business Owners and Freelancers

If you’re self-employed, you don’t want to be without. Aetna has individual plans that you can purchase directly. For small business owners, being able to offer Aetna can be a great employee perk. It’s an important machine of the jigsaw, the same way having the right professional liability insurance for your services or commercial auto insurance for company vehicles is essential for total business protection.

Seniors

A large number of seniors are living on a fixed income. Aetna has plans that can be accessed in conjunction with Medicare. These plans tend to be targeted to the services that seniors may need most, such as crowns and dentures. Having predictable costs are extremely important. For a better glimpse on long-term financial planning, comparing term life vs. whole life insurance is also an important step.

How to Enroll in an Aetna Dental Plan

Getting started with Aetna is very easy. Here is the simple procedure to follow to get enrolled.

- Visit the Aetna Website: Their site is the best thing to start with. You can also visit US Government marketplaces such as Healthcare.gov.

- Enter Your Information: You will need to enter your zip code. This is to help Aetna show you the plans that are available in your area.

- Compare Your Options: Very carefully consider the Aetna dental plans. Look at the premium, deductible, network and levels of coverage.

- Choose Your Plan: Choose a Plan Identify what plan would be right for your needs and budget.

- Complete the Application: Fill out the online application. You’ll need personal information for each one of the people who are being covered.

- Make Your First Payment: Once you make your payment your coverage starts on the certain start date. Remember there may be waiting periods for some of the benefits, so it isn’t really like buying temporary car insurance for full coverage, as soon as you need it, on a weekend trip. Plan accordingly.

“A genuine smile comes from the heart, but a healthy smile needs good dental care.”

– Unknown

The Final Verdict: Is Aetna Dental Insurance Worth It:

After this didactic Aetna Dental Insurance review, what’s the conclusion? For a vast majority of people, the answer is yes. Aetna Dental Insurance is a relatively good player in the marketplace. Its massive network and variety of plans make it an all-rounder.

If you prefer being flexible and have options, the PPO plans are great. You will pay a bit more but you will often find the freedom is worth it. If your primary goal is to find the most affordable dental insurance, then the DMO plans are an excellent budget-friendly option, provided that you are OK with the network restrictions.

The key is to do your homework. Choosing the Right Plan Understanding your specific needs is the first step to choosing the right plan, just as riders on a motorcycle need a special kind of motorcycle insurance guide in order to cover their unique risks on the road. Read what is called the “Evidence of Coverage” of any plan you are looking at.

By making the right choice, Aetna Dental Insurance can be an important tool to protect your money and most importantly your health. For more expert information on oral health, you can always visit American Dental Association website.

Frequently Asked Questions (FAQs)

Some Aetna plans do offer orthodontic coverage but it’s not out of the norm. In most cases you have to purchase a particular plan or an add-on rider. There is an almost always the lifetime maximum for this benefit.

Yes, most Aetna PPO plans are subject to a waiting period. This is often 6 to 12 months when it comes to major services such as crowns or bridges. DMO plans do not have waiting periods typically.

You can use it for preventative care such as cleanings almost as soon as your plan starts. However, for simple and major services, you may be required to meet a waiting period and pay your deductible before the service.

If you see an in-network available PPO or DMO dentist then they will typically file the claim for you. If you visit an out-of-network dentist who accepts a PPO plan, you may be required to pay based on the plan eventually applying for reimbursement from Aetna using a claim form.

You may usually be warned if you are able to cancel your plan. If you have a plan, you can normally cancel it by contacting Aetna customer service directly. Be sure to ask about any specific procedures or in terms of deadlines if you do not wish to be billed for another month’s worth of service.

![Compliant Drivers Program: Is It Legit for Driver Safety? [2025]](https://propinfo.site/wp-content/uploads/2025/12/Compliant-Drivers-Program-150x150.jpg)

Leave a Reply