Vision is not something that we give attention. Everything we do is with the eyes. Between reading this article and driving a car. But what will you do when your vision is clouded. Care of the eye can be quite costly. This is where the vision insurance comes in. Eyemed Insurance is one of the pioneers. It assists millions of people to receive cheap eye care.

One of the questions that you may have is whether you need a vision insurance. People believe that it should be used to glasses. But it is much more than that. Stop pain in the eye, and also shield your wellbeing. They are able to identify severe problems in time. This is a guide on everything about Eyemed. We shall discuss plans and their network. You will know how to achieve maximum out of your coverage.

The True Value of Vision Insurance

Most of the health plans do not cover the routine eye care. This creates a gap in coverage. This gap is filled by Vision insurance plans. They render fundamental services cheaper. Opt to consider it as an eye wellness program. A little monthly premium you pay is the one you follow. In return, you get big savings.

It is not merely an examination of your prescription. Optometrists are able to notice the indicators of acute diseases. These are glaucoma, diabetes and even high blood pressure. There should be early detection leading to effective treatment. With insurance, there are higher chances that you may get annual checkups. It is a proactive method that is essential in your long-term health. It relates to general wellness, just as being well insured with dental cover would of oral health.

The eye supplies the body with a jewel.

-Henry David Thoreau

This jewel should taken care of. Non-monetary Eye care benefits are not only limited to a new pair of glasses. They offer peace of mind. You are aware that you will receive good care when you require it. You won’t face a massive bill. This fiscal stability is a giant value-added.

What is Eyemed Insurance?

Just what is that thing called Eyemed Insurance? It is among the biggest companies in terms of vision benefits. Employers and health plans are their collaborators. They also provide plans to individuals. Their primary aim is to bring individuals into eye care quality. They do so by a huge web of providers.

Eyemed is not an insurance company such as United Healthcare. It pays special attention to vision. Such niche will enable them to sell customized Eyemed plans. These plans are constructed based on the actual needs of the members. This covers tests, lenses, frames and contacts. They are sharp and devoted in their focus.

Vision care was made easy by the creation of the company. They desired to eliminate the misunderstandings. They provide various levels of coverage. This makes sure that there is a plan to every budget. Either single or relatives. Or you get it by your trade. Eyemed does have an answer to you.

A Closer Look at the Eyemed Provider Network

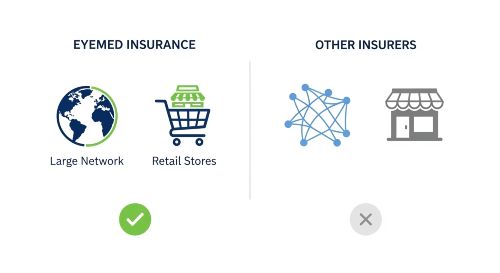

Any plan has as good a network as it has. One of its largest strength is the Eyemed provider network. It has thousands of optometrists and ophthalmologists. This vast network has lots of options. An eye doctor is something that you can find an eye doctor easily.

The network consists of both independent and retail providers. This is a big advantage of this flexibility. You are able to pay a visit to your local eye doctor. Or you may visit one of the popular retail chain.

- Free Standing Physicians: These are individual practices. They tend to offer a very individualized care. A large number of doctors within this type develop long-term relationships with their patients.

- Retail Chains: This category consists of such national chains as LensCrafters, Target Optical and Pearle Vision. They are convenient, stock extensive blends and may be evening or weekend in nature.

- Online Provision: several plans have been extended to online eyewear retailers. It is possible to order glasses or contacts conveniently at the comfort of her home.

This inclusive network guarantees access and option. Neither are you confined to a single kind of a provider. You will be able to select what suits you best. Eyemed groups its network into levels such as Insight, Access and Select. Their access points are different in number. Which network will you adopt depends on your particular plan.

Decoding Eyemed Insurance Plans

Knowing the Eyemed plans of your Eyemed so that you can use them well. Eyemed provides numerous alternatives. Through an employer, these are generally availed. They are also available directly though. The most frequent forms of vision care coverage provided are as follows, which can we dissect.

Individual & Family Plans

When you are given a chance to work on your own or your occupation does not provide any vision covers, kindly relax. Eyemed sells plans straight to consumers. The plans are excellent to individuals and families. They offer important eye exam coverage. You have an opportunity to select a plan that suits you.

Basic plans are provided in most individual plans. This incorporates having an annual eye examination. They also give a provision on frames or contact lenses. Such lens options as scratch-resistant coats may be included. The specifics differ, but the aim is to popularize eye care. The plans are almost similar to term life insurance vs whole life; you take coverage that fits your needs and best requires you in the long run.

Your Vision Benefits at a Glance

Most Eyemed Insurance plans offer a core set of benefits. While exact amounts vary, you can typically expect:

Eye Exam

A small copay (e.g., $10) for your annual comprehensive exam.

Frames

An allowance (e.g., $130) towards any frame of your choice.

Lenses

Standard plastic lenses covered in full after a small copay.

Employer-Sponsored Plans

Eyemed Insurance is most frequently acquired by way of an employer. Most firms do it as a part of their benefits package. This comes in combination with health and life insurance. Employers plans are frequently quite extensive. They may enjoy more benefits as compared to individual plans.

Organizations which provide such benefits consider them as the investment in the health of the employees. It is an advantage that can used to attract and retain talent. These benefits are an operational cost to a firm as would the need to have commercial auto insurance. There are various plan designs that employers can use. They are free to tailor the allowances and frequencies. This is even more flexible as they can offer a plan that suits their budget. It is a win-win situation.

Key Differences in Plan Tiers

All Eyemed plans are not equal. They tend to be of varying grades. You can find such names as Basic, Enhanced, or Premium. Copays and allowances are the primary disparities. The most fundamental plan will include the basics. It suits well to a person who requires a simple prescription.

A premier plan offers more. You shall receive more allowance on frames. It implies that you have access to designer brands. It could also be more extensive in terms of lens enhancements. As such, anti-glare or progressive lenses. The process of settling on a plan involves optimization of cost and requirements. Take into account the frequency of the need to have new glasses. Give also consideration to the kind of lenses you use. This will assist you to choose the appropriate tier.

Maximizing Your Eyemed Eye Care Benefits

The first step is to insured. The next is to know how to use it. You would love to take the best eye care benefits. This is the knowledge of the process. It is about being an intelligent customer. We will go through the steps of making your coverage to work.

How to Use Your Vision Care Coverage

It is easy to use your Eyemed Insurance. This is made easy and user-friendly. You most of the time will not even have to make a claim. The optic doctor provides everything in his/her office.

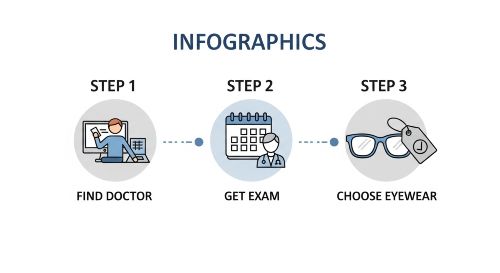

The general steps to be observed are as under:

- Locate a Network Provider: Go to the Eyemed site or app in order to find an eye doctor. It is possible to search by place or name. Ensure that they are within your own network of your plan.

- Click On Appearances: Call to make appointment. Make them aware that you are Eyemed Insurance insured. They will request that you provide them with your member information.

- Go to your Exam: When you visit your doctor, you will get a complete eye exam. They will examine his eyes and eye condition.

- Select Your Eyewear: Once you are examined you are able to select the wearable or have contacts fitted. Your benefits will discussed by office employees. They will also demonstrate what is covered, and what you will pay out of the pocket.

It’s that simple. EY is directly billed by the provider. You simply pay your copay and whole losses. A significant portion of bureaucracy is eliminated with this streamlined process.

Understanding Your Allowances and Copays

In order to maximize, you must be familiar with the terms. A copay is a fixed fee you pay. An illustration of this may be in the form of a copay of 10 dollars to have your eye examined. An allowance is the sum the plan will spend on an item. As an example, the possible allowance of frames would be a $150 allowance.

When you get those frames which cost you 200 bucks, you apply your 150 allowance. You then pay the remaining $50. This knowledge will aid you in planning on how to spend on eyewear. Always make your provider explain your costs. They ought to assist you to make choices within your budget. It is a good financial idea to be proactive on reducing your cost.

The first step towards the clear picture is the eye examination carried out every few weeks.

– Dr. David K. Miller

This is a quote that stresses action. Do not put away your perquisites. Buy studying material, pass that exam. It is an advantage that you already pay.

How Eyemed Coverage Works: 3 Easy Steps

1. Find A Provider

Use the online directory to locate an in-network eye doctor near you.

2. Receive Care

Schedule your exam. Your doctor’s office will verify your benefits.

3. Pay Less

Your plan covers a large portion. You only pay copays and overages.

Taking Advantage of Discounts and Special Offers

Your vision benefits do not end in allowances. There is also a special member discount at Eyemed. These may offer huge additional savings. As an illustration, you could receive a second pair of glasses with a discount. This would be awesome provided you are in need of prescription sunglasses.

Other common offers include:

- Lens Enhancement Savings: Buyer discounts and special offers on some of the most popular options at the time such as anti-glare, blue light filtering and Transitions lenses.

- LASIK Discounts: There are lots of plans which collaborate with laser vision correction centers in order to provide their members with a special price of the procedure.

- Hearing Aid Discounts: Through partnerships, some Eyemed plans also provide savings on hearing aids, extending your wellness benefits.

Never forget to visit and visit the “Special Offers” section at the Eyemed member portal. You could get some kind of a bargain you had not been expecting. It is a little akin to some sort of exclusive policy of classic car insurance; it is a certain deal to those with the knowledge to seek. Such additional discounts can mean a lot. They assist you in acquiring optimal technology in your eyes.

How Eyemed Compares to Competitors

Eyemed is a big competitor, but they are not the only ones. There are also great plans in companies such as VSP and Davis Vision. Meet the needs by looking at the network when comparing providers. Does it offer your preferred eye doctor? The Eyemed provider network has a reputation of size and retail. This is one of the main strengths of many people.

Secondly, compare details of the plan. Consider appearance of allowances of frames and contacts. Test the exam and lens costco reeve. There are plans with reduced premiums however with reduced allowances. It’s a trade-off. To evaluate the standards of health and vision care, an external authority is the American Academy of Ophthalmology, which provides clinical guidelines on taking care of the eyes.

In the long run, you must rely on the best provider. Your place, funds and vision wizardry count. In case you care about convenience and retail choice, Eyemed is a competent opponent. Coverage obtained by some may be a package deal by their employer and thus reviewed thoroughly. That is why it is essential to know all your advantages, including vision, and professional liability insurance provided you are a small business owner.

How to Enroll in an Eyemed Vision Plan

Do you want to get an eye care insurance. The process of enrollment is normally not complex. CHOICE: The choice of the way you are taking depends on your circumstance. The majority of people will join via their employment. The rest will self-registered.

Enrollment Through Your Employer

Enrolling to Eyemed Insurance is not tricky should your company sell it. This normally occurs during the period of the open yearly enrollment. All the forms will supplied by your HR department. You will analyse the available plans and select your plan. The deductions are then removed on your salary.

This is the easiest and usually most cost-effective method of obtaining coverage. The cost is often subsidized by the employers. When you are a new employee, then you can usually enroll immediately. Do not lose your enrollment time. This may be the sole opportunity to enroll in the year just like you do not wish to miss the deadline of taking temporary car insurance before a trip.

Direct Enrollment for Individuals

What happens when your boss does not provide a plan. You can still get Eyemed Insurance. You may go to their web site and enroll directly. It is an excellent alternative to freelancers, retirees, or gig workers. You will visit the existing vision insurance plans in your state.

You are able to cover a comparison on coverage and costs. The process is instructed on the site. In case of plan selection, the payment of a premium can made online. This makes you and your family have the vision benefits you require. This is the most straightforward method of getting coverage that works well on various kinds of protection, allowing both vision and motorcycle insurance. To find out more facts about general eye health, a very good source of information has been cited in the National Eye Institute.

A Clearer Future for Your Eyes

Your vision is precious. One of the most good investments you can make is protecting it. Eyemed Insurance offers an avenue of affordable and quality eye care. It has a large Eyemed provider network and flexible Eyemed plans, which makes it have a complete solution.

It is empowering to know your vision benefits. This enables you to need to have control of your eyes. Get regular exams. Use your allowances wisely. And be sure to watch out about additional discounts. With the right strategy, you will be able to have a good view and tranquility. This can done without going broke. It is a component of your general financial scheme just like searching cheap business insurance in the case of an entrepreneur.

Frequently Asked Questions (FAQs)

This can be easily checked with the provider locator tool that is on the Eyemed website. You can use the name of the doctor, the office name or the location to see whether they are in-network or not in the particular plan that you cover.

Sure, there are lots of Eyemed plans with advantages to online retailers. Glasses.com, LensCrafters.com and Ray-Ban.com tend to be covered by in-network online choices; a comprehensive list of these online stores can be found by looking at the plan details.

You will get lowered benefits, although. The provider usually must be paid in full during the service. Then, you file a claim form with Eyemed where your claim is partially reimbursed.

This will depend upon the frequency of your plan. A new pair of glasses (frames and lenses) is available after every 12 or 24 months according to most Eyemed plans. Check your plan summary re your particular frequency.

Eyemed does not cover the full cost of LASIK as a standard benefit. They do however, have a large discount on the procedure via their system of LASIK providers, which can save you a lot of money.

![Compliant Drivers Program: Is It Legit for Driver Safety? [2025]](https://propinfo.site/wp-content/uploads/2025/12/Compliant-Drivers-Program-150x150.jpg)

Leave a Reply