You have a small business. Running it means you work hard every day. Vehicles are used to accomplish something. Maybe it’s a van. Maybe a pickup truck. It might even be your personal car. If you drive for work you need protection. You are in need of Commercial Auto Insurance. This guide will tell you everything.

What is Commercial Auto Insurance? It is a special insurance policy. It insures your business vehicles. This involves liability and damage. Your personal car policy will not cover business use. This is a very big risk. A single accident could destroy your business. We will Sail Help You Understand This Vital Coverage.

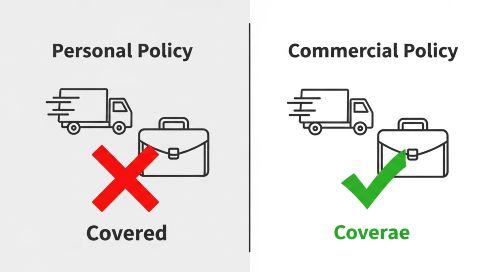

Why Your Personal Policy Is Not Enough

Many business owners commit this error. They believe their personal car insurance is good. This is a very dangerous assumption. Let’s be honest. The insurance company searches for reasons to deny instructions. The use of your car for work is a big one.

Your personal policy has an exclusion. It is commonly referred to as the “business use exclusion.” This means if you are driving for work you are not covered. Delivering products? You are not covered. Visiting a client? Not covered. Hauling tools to a job site? You are nowhere near being covered.

Vanishing Nightmare A simple fender bender turns into a nightmare. The other driver may be able to sue you. Your personal policy will deny the claim. You will have to pay out of pocket. This can cost thousands. Or even millions. Commercial Auto Insurance is meant to avoid this very problem.

The Big Question: Do I Really Need Commercial Auto Insurance?

This is the most frequently asked question. The answer is an almost always yes. If you are using a vehicle for your business, you need one. The difference between personal and business can be grey. Let’s clear it up.

Personal vs. Business Use: Drawing the Line

Commuting to your office is personal use. Driving to lunch is personal uses But what about other trips? But what if you are a real estate agent? You fetch clients around to look at homes. That is business use.

What if you are a consultant? You drive to client meetings. That is business use. Do you run a catering company? Your van delivers food. That is 100% business use. Any driving that makes you money is business use. You might be starting a new company. Finding affordable business insurance for your startup is a critical first step.

When Personal Auto Insurance Fails You

Let’s imagine a scenario. You are a baker. Your own personal minivan is used for work. A big wedding cake is being delivered. Unfortunately, you get into an accident. The cake is ruined. The other car is damaged. The driver is injured.

You file a claim. What you were doing is asked by your insurer. You tell them that you were delivering a cake. They deny your claim. You just made yourself personally responsible. Payment for the car repairs will now be required. You also need to pay for the medical bills. You have to pay for the ruined cake. (here has to be an alternative action, it is logical) This is a financial disaster.

Understanding Core Commercial Auto Insurance Coverages

A commercial insurance policy is not one size fits all. It is a bundle of various coverages. You can pick and choose. But some are not optional. You must have them.

Liability Coverage: The Non-Negotiable

This is the most significant part. Liability is the coverage on damage you do to people. It is split into two parts. Bodily Injury (BI) liability. And this is Property Damage (PD) liability.

Bodily Injury coverage pays for medical bills. It deals with people that you injure in an accident. It also covers legal fees. This is really important in case you get sued. Property Damage covers the repair of damage. It has a character that fixes the other person’s car. It also includes things such as fences or the buildings you hit.

Every state requires liability coverage. But, often, the minimums are too low. An accident that is serious can easily surpass $100,000. Much higher limits should be carried by small businesses. We recommend at least $1 million of coverage.

Physical Damage Coverage: Protecting Your Vehicles

This coverage is to protect your own cars. Liability only pays for the other guy. Physical Damage pays for you. It also has two main parts.

Collision coverage is the first component. It pays to repair your car. This is the case if you hit into another car. Or if you hit against some object, like a pole. It also discusses vehicle rollovers.

Comprehensive coverage is the second part. This includes events that are non-accident. Sort of “Act of God” coverage. It pays for theft. Coverage includes fire, vandalism and hail. Hitting an animal is also covered. When your college years are behind you, the idea of protecting your used car makes a lot of sense. This is true for any special vehicle, just like classic car insurance insures a valuable hobby.

Medical Payments and Uninsured Motorist

What if you or your employees get hurt? The Medical Payments coverage (MedPay) helps. It pays for medical bills. It has the capacity to cover you and your passengers. This is regardless of who was at fault. It is a good, cheap coverage to have.

Uninsured/Underinsured Motorist (UM/UIM) is very important. What if someone hits you? And they have no insurance? Or they have very low limits? Your UM/UIM policy will pay. It covers your medical bills. Coverage for lost wages can also be included. Essentially, it is the kind of insurance that the other driver should have had. This is just as important for a car as it is for motorcycle insurance.

Beyond the Basics: Specialized Coverages to Consider

Your business is unique. Your commercial vehicle insurance should as well. You are able to add special coverages. These are known as endorsements. They fill specific gaps.

Hired and Non-Owned Auto (HNOA)

This is a very important one. Do you ever rent cars for work? That is “Hired Auto.” Do employees ever use their own cars for work? That is “Non-Owned Auto.”

Think about it. You send an employee to the Bank. They use their personal car. They cause a mammoth accident. Who gets sued? The employee and your business. Your regular policy will not cover this. HNOA coverage will. It frees your business from this exact threat.

Loading and Unloading Coverage

This is often overlooked. The fact is that it could not be covered by your standard policy. Let’s imagine you are a delivery man. You are unloading a heavy box. You drop it on someone’s foot. Or you drop it on their expensive car.

Loading and Unloading coverage pays for this. It covers damage or injury. This harm has to occur while performing the act. The process of loading down or unloading your vehicle. If you are moving goods, you will need this.

Other Key Endorsements

You can add a whole range of other options. Towing and Labor (costs of a tow). It also includes basic roadside assistance. Rental Reimbursement is to pay for a rental. You use it while your work vehicle is at the shop. This ensures your business stays in motion. Sometimes you need coverage for only a short period of time. You might explore temporary car insurance for specific projects.

Coverage Checkup: What Does Your Business Need?

Your needs are dependent on your operations. Wriend uses this simple guide for you to learn which coverages are critical for you.

Quick Coverage Checkup

If you…

Own or lease vehicles in your business name.

You Need…

Standard Commercial Auto Policy

(Liability + Physical Damage)

If you…

Have employees using their personal cars for work tasks.

You Need…

Hired & Non-Owned Auto (HNOA) Coverage

If you…

Deliver goods, haul tools, or transport materials for clients.

You Need…

Loading & Unloading Coverage with higher liability limits.

Who Needs Commercial Vehicle Insurance?

Let’s take a poster asking the question, ‘who has to have this?’ It is not just for big fleets. Many Radius Small Businesses are at Risk Do you happen to include yourself on this list?

Businesses That Own, Lease, or Rent Vehicles

This is the most obvious case. In case your business name is on the title, you need it. This includes delivery vans. It includes food trucks. Company cars for salespeople are also covered. Essentially, this applies to any vehicle owned by the business. Leasing a vehicle is the same. The lease agreement will require it.

Businesses Where Employees Use Their Own Cars

We covered this with HNOA. But it is worth repeating. This is a huge liability gap. As the employer, you are liable. You are liable for what your employees do on the job. Their personal insurance will not cover your business.

This is a key part of your total commercial insurance package. It protects your business assets. This is just as vital as professional liability insurance, which protects you from errors in your work. Both are about managing risk.

Sole Proprietors and Freelancers

Do not assume you are safe. Many freelancers are at risk. Are you a photographer? And you drive up to gigs with expensive gear. That is business use. Are you a plumber? Your truck is your office. It is full of tools.

Even gig workers need it. Uber and Lyft drivers, to take two examples. The company offers some insurance. But within the context of a passenger situation only. What about when you are driving to a passenger? There are gaps. A good business car insurance policy fills those gaps.

“Risk comes from ignorance more than anything — not knowing what you’re doing.”

This is very true for insurance. Not knowing your policy gaps is a huge risk. You must understand what you are paying for.

Factors That Determine Your Commercial Auto Insurance Cost

How much will this cost? The answer is “it depends.” Insurers consider a wide variety of things. They are all trying to make guesses of one thing. Thus, how likely you are to make a claim?

Your Industry and Business Type

Your industry is a big factor. A construction company is a high-risk company. They have heavy trucks. They are on busy job sites. A real estate agent is more low-risk. They just drive a sedan. Expect to pay more for risky jobs. The Small Business Administration (SBA) offers great resources on business risk.

The Vehicles You Use

It is the vehicles that are important. The cost of a heavy dump truck is very expensive. It can cause massive damage. It will cost a lot to insure. A small, light sedan is cheap. It costs less to insure. The age, value and weight are all calculated. Keeping vehicle costs down is smart. You can find tips for lowering car costs that apply here, too.

Your Drivers and Their Records

Who is driving your vehicles? This is a huge factor. Insurers will pull MVRs. These are Motor Vehicle Reports. They show a driver’s history. Speeding tickets are bad. DUI convictions are horrible. A clean record is key.

You must hire good drivers. You should have a clear driving policy. Many insurers offer discounts. This is for businesses that train drivers. Or for businesses that monitor driver safety.

Coverage Limits and Deductibles

This is the part you control. Higher coverage limits cost more. A $2 million policy costs more than $1 million. But the extra protection is worth it. Do not skimp on liability.

Your deductible also matters. This is what you pay first. You pay it before insurance kicks in. A higher deductible ($2,000) means a lower premium. A lower deductible ($500) implies a higher premium. You must balance savings with risk. It’s part of your total financial plan, much like choosing a State Farm life insurance policy.

What’s Your Business Risk Level?

Insurers place you in a risk category. This impacts your premium more than anything else. Where do you fall?

Commercial Auto Risk Spectrum

Low Risk

Consultants, agents, or sales staff driving small sedans for client visits — minimal road exposure.

Medium Risk

Service providers like caterers, electricians, or delivery vans carrying equipment or goods.

High Risk

Construction, trucking, or towing companies — high mileage and heavier vehicle operations.

How to Get the Best Business Car Insurance Policy

You are ready to buy a policy. How do you get the best deal? Do not the first quote, simply buy. You must be a smart shopper.

Step 1: Assess Your True Risk

First, know what you need. Do not guess. Make a list. Write down every vehicle. Include their VINs, year, make and model. Elect all the individual people that may drive. This includes employees and family members.

Then, list all business uses. Do you haul tools? Is delivering food part of your job? Does your work involve driving long distances? The more details you can find the better. This will make sure that you will receive an accurate quote. You will not be paying for coverage you do not need.

Step 2: Gather Your Documentation

The insurers will require paperwork. Get it ready now. This will make the process faster. You will need to have your driver’s license numbers. You will need all MVRs. Have your business registration information. This is your EIN or business license. You also need the vehicle titles or leases.

Step 3: Shop Around and Compare Quotes

This is step is the most important. Do not take the first offer. Try and get at least 3 different quotes. You may call round insurers individually. Or you can use independent agent. An agent can shop for you among different companies.

When your comparison Ask close and look closely. Make sure that the quotes are “apples-to-apples.” One quote might look cheaper. But it may have lower limits. Or a much higher deductible. You must compare the same coverage. It’s just like comparing Humana dental insurance PPO and HMO plans. The details matter most.

Managing Your Policy and Handling Claims

Getting the policy is only the beginning. You must also manage it. And you need to know what to do in case you have an accident.

This quote is perfectly applicable here. Do not wait for an accident. Know you policy before you need it. Understand your coverages. Know your deductible. Keep your insurance card in every vehicle.

What to Do After an Accident

An accident is stressful. Try to stay calm. Follow these steps.

The very first thing you should do is make sure that everyone is safe. get vehicles out of the traffic if possible. Second, call 911. Always get a police report.

Third, document everything. Take pictures of all cars. Get some pictures of the license plates. It is also important to get the name and insurance of the other driver. Finally, try to get the names of any witnesses. Do not admit fault. Just state the facts.

And then finally, call your insurance agent. Do this as soon as possible. They will then begin the claims process.

The Claims Process Explained

Once you have reported it, things go quickly. The insurer will designate a claims adjuster. The adjuster will make contact with you. They are going to ask you for your side of the story. They will also examine the police report.

The adjuster will use to inspect the damage. They will give an approximate cost of repair. They will engage in conversation with the other driver. Their job is on determining the fault. And to determine the payout. This process can be complex. It is comparable to navigating United Healthcare insurance claims; good documentation is your best friend.

Keeping Your Policy Up-to-Date

Your business is not static. It changes. Your insurance has to change along with it. You need to review your policy on a yearly basis. Did you buy a new truck? You must add it to the policy. Did you sell an old van? You must remove it.

Did you hire a new employee? They need to be added to the driver list. No, do you no longer deliver goods? You may be able to reduce your coverage. An annual checkup is smart. It ensures you are covered. And it ensures you are not paying too much.

Special Considerations for Commercial Auto Insurance

The world of commercial vehicle insurance is a complex one. There are some special cases. These may or may not be of relevance to you. But it is good to know they are there.

Understanding DOT and Federal Filings

Does your business cross state lines? Do you operate heavy trucks? You can be regulated by the feds. Rules exist by the Department of Transportation (DOT).

You may need special “filings.” These file forms your insurer. They give you proof that you have enough insurance. Two examples include the MCS-90 or the BMC-91. These are common when it comes to trucking between states. The Federal Motor Carrier Safety Administration (FMCSA) has more details on these rules.

Fleet Insurance for Multiple Vehicles

Are there 5 or more vehicles in your You may be eligible for a fleet policy. This is a good thing. A fleet policy is simpler. It has all your vehicles on a single plan. There is only one renewal date.

It is also often cheaper. Insurers offer fleet discounts. They can also rate the fleet as whole. This means that one bad driver has less impact. If your business is expanding, ask for fleet insurance.

Commercial vs. Personal: The “Why” Revisited

Choosing the right policy is key. It’s like choosing between term life and whole life insurance. Each one is built for a different purpose. One is not better. But one is right for you.

A personal policy protects your personal assets. A commercial auto insurance policy protects your business assets. Trying to get one to do the job of another is a recipe for disaster.

Personal vs. Commercial: A Head-to-Head Comparison

Still not clear what is the difference? This is easily broken down by this basic comparison.

The Future of Commercial Insurance

The world is changing. And insurance is changing with it. New technology making policies smarter. This is good news for small business owners.

The Rise of Telematics

Have you heard of telematics? This is also known as Usage-Based Insurance (UBI). A small device is plugged into your car. Or you use a phone app. It monitors the habit of your driving.

It tracks speed. Braking is also monitored. The time of day is recorded as well. Good, safe drivers can get big discounts. This is a great way for businesses to save on money. It makes your employees drive safely. This helps in reducing accidents and reducing your premium.

How Gig Work is Altering Commercial Vehicle Insurance

The gig economy is huge. Millions of people drive out of job. This has opened a new insurance void. It is not covered under personal policies. But complete commercial insurance can be costly.

Insurance companies have developed new products. These are known as “rideshare endorsements.” You add them to your own personal policy. They “turn on” coverage of the business. Some of these are applicable only when you are working. This is a flexible and cheap option. It is ideal for using for a part-time business.

Your Final Checklist

You have learned a lot. It is critical to protect your business. A complete guide to commercial auto insurance is your first step. Here is your final checklist.

- Assess: Do I make use of any vehicle for work?

- Verify: Does my personal policy cover this? (Hint: It doesn’t.)

- List: Make a list of all the vehicles, drivers, and business usages.

- Shop: Get at least 3 quotes for commercial auto insurance.

- Compare: Compare not just the price, but look at limits and deductibles.

- Review: All year revise your policy. Update it as you grow.

Do not leave your business open. One accident can destroy everything. The right business car insurance policy allows you to work confidently. It is a small fee to pay for full peace of mind. For additional information, too, the Insurance Information Institute is a good starting point.

Frequently Asked Questions (FAQs)

The biggest difference lies in coverage. A personal policy excludes business-related driving. A commercial auto insurance policy is specifically designed for business use.

Often, yes. This is because business use has higher risks. You drive more miles. You may carry heavy tools. The vehicles may be larger. The possibility of a lawsuit is also greater.

No. An insurance company will not permit this. A vehicle used primarily for work must be on a commercial vehicle insurance policy. If you lie, your claim will be denied.

Some personal policies provide a “business use” rating. This is very limited. It might include a consultant driving to meetings. It will not be about delivery of goods, hauling tools.

There are many ways to save money. Hire drivers with clean driving records. Choose a higher deductible. Ask about telematics. And most importantly, simply shop around and compare quotes on a yearly basis.

![Compliant Drivers Program: Is It Legit for Driver Safety? [2025]](https://propinfo.site/wp-content/uploads/2025/12/Compliant-Drivers-Program-150x150.jpg)

Leave a Reply