Your smile is one of your best assets. As a result, it is necessary to take care of it. A great dental plan can help. The Delta Dental PPO is popular with many because it has flexibility and savings. This guide will help you to know how to understand. In particular we will show you how to find providers. You will then learn to be a money saver.

This article is your complete resource. We’ll investigate every avenue of such a plan in order to help you make informed decisions regarding your care. Grow in. Unlock your benefits.

Understanding the Delta Dental PPO Plan

What exactly is a PPO plan? PPO is an acronym for Preferred Provider Organization. It is a type of dental insurance plan, which provides you a network of dentists. What is important is that these dentists agree to reduce rates.

The Delta Dental PPO Model Explained

A PPO plan has a special network in place. Dentists are able to join this network voluntarily. In the process, they agree upon negotiated rates of charge. These fees are at a reduced rate from their usual fees. When you see the network dentist, therefore, you save money. This forms the essence of the PPO model.

Furthermore, there is the benefit for the insurance company. They can have attractive and less costly plans. This is also a useful arrangement for dentists, who receive a steady supply of patients. In short, it is really a win-win situation for all the parties involved.

Freedom to Choose Your Dentist with a PPO Plan

Perhaps the best aspect of a Delta Dental PPO is freedom. There’s no limit on your choice of licenced dentist. You are by no means limited to a small list. This flexibility is certainly a plus for it. Even a specialist can be seen without a referral.

However, there is a catch. You will save the most money with an in network dentist. Seeing an out-of-network provider is more expensive. Your plan will cover some of the costs still, your share of the bill will be higher, definitely.

PPO vs. DHMO: A Key Distinction for Your Dental Plan

You may see the offers of DHMO plans available. DHMO stands for Dental Health Maintenance Organization and it functions very differently to a PPO. With a DHMO for example you’d have to select a primary care dentist. You also need the referrals for specialists.

On the other hand, a PPO provides greater choice. You are able to see any dentist that you wish. While DHMOs often have lower premiums, PPOs offer much greater flexibility. For this reason, a Delta Dental PPO is preferred by many people for the freedom of choice from them.

For more info on the types of plans you can check out options such as Humana Dental Insurance that also offer both PPO as well as HMO-style plans for you to choose from.

The Core Benefit: Finding Delta Dental PPO Providers

It is extremely crucial to find the right dentist. Your Delta Dental PPO plan is at its best with network providers. So, let’s discuss on how to find them. This is the first step to making your savings as large as possible.

Why a Delta Dental Network Dentist is a Smart Move

Choosing an in-network dentist is a must. These dentists have an agreement with Delta Dental. As a result, they have agreed to leave prices of services. This means that you have no surprise bills. The out-of-pocket costs that you face are predictable.

But when you do go out-of-network, this is different. That dentist is free to charge his or her full rate. Delta Dental will only pay some percentage. You then have to pay the rest of the balance. This difference can easily be hundreds of dollars.

“Every time you smile at someone, it is an action of love, a gift to that person, a beautiful thing.”

– Mother Teresa

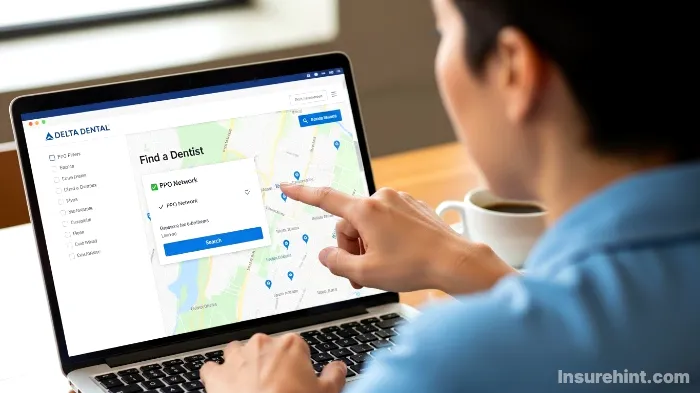

Guide to the Delta Dental PPO Provider Finder

Delta Dental makes it easy to find a dentist. In fact they have a powerful online tool. You can use it anytime. Following is the use of it effectively.

Accessing the Provider Search Tool

First you will want to go to the official Delta Dental provider search tool. This is a link that is usually on their homepage. Click on it and your search is begun. The best friend to you in this is the online tool.

Filtering Your Search for the Right Dentist

Then you will enter in your location. You can use your address, your city or zip code. Then, you can choose your specific Delta Dental PPO network. This is a very important step.

It is also possible to filter by specialty. For example, you can look for children’s dentist. Or may be you need an endodontist. The tool allows you to narrow down the results, which will save you a lot of time.

Verifying a Dentist’s Network Status

Once you get a list you have to check their status. The online tool is pretty good in terms of accuracy. However, it’s always a good idea to make doubting sure. Call the office of your dentist directly.

Simply ask them, “Do you participate in the Delta Dental PPO network?” This one simple call is the preventative for headaches later on down the road. It also establishes you to get the best rates. You can also make sure that they are taking new patients.

What if My Dentist Isn’t In-Network?

What happens if you love your current dentist but he or she is not in the network? You have a choice to make. Of course you can still see them. Your PPO plan will pay for some of the cost.

However it will require you to pay more out-of-pocket. You have to decide whether it’s worth it. Alternatively, finding a new in-network dentist could be the answer. Many great providers are in the network. Maybe it is a good time to do a switch.

In-Network vs. Out-of-Network: A Cost Snapshot

In-Network Dentist

~ $150

You pay a small copay. Delta Dental pays the rest of the negotiated rate.

Out-of-Network Dentist

~ $250+

You pay the difference between the dentist’s full fee and what Delta Dental covers.

*Sample costs for a routine dental cleaning. Actual costs will vary based on your specific plan and location.

Maximizing Your Savings with a Delta Dental PPO Plan

It is great to have a Delta Dental PPO plan. Knowing how to use it though is even better. Let’s examine strategies for save on dental care. This includes getting to know the details of your plan.

Understanding Your Delta Dental PPO Plan Details

Your plan documents are of utmost importance. They outline everything that you need to know. Therefore, make some time to read them carefully. Pay attention to these key terms.

Deductibles and Copayments Explained

A deductible refers to a set fixed amount. You must pay it each year. This is done before your insurance starts paying. For instance, the amount of your deductible could be $50.

A copayment on the other hand is a fixed fee. You pay it for some of the services. For example, you may have a cophay of $25 for an office visit. Understanding for budgeting for care.

Annual Maximums and Your PPO Plan

You have an annual maximum of your plan. This is the issue where the most that your plan is going to pay in a year. A common maximum is around $1,500. For this reason, it is important to be able to track your usage.

If you must have a boatload of dental work, organize it. You may divide the treatments during two years. This helps you to get the most out of your benefits. A pre-treatment estimate can also come in handy. Similarly understanding the maximum of other policies, such as State Farm life insurance, is important to managing your finances.

Coverage Tiers: Preventive, Basic, and Major

Most Delta Dental PPO plans are three tiers. These are ones for different types of service.

- Preventive Care: Generally this will be covered at 100%. It consists of cleanings, exams and x-rays.

- Basic Care: This tier includes care for fillings and simple extractions. Coverage is often around 80%.

- Major Care: This includes crowns, bridges and dentures. The coverage is generally about 50%.

It is crucial to know these percentages. It accordingly aids you in estimating your costs well.

The Power of Preventive Care with Your PPO Dental Plan

The best way to save money is to keep heapy. Your Delta Dental PPO does encourage this mechanism. Specifically, it discusses preventive care on a high level. Sometimes, it’s even 100% covered.

Therefore, you should have a regular checkup. Get your teeth cleaned twice a year. This helps in catching the problems at an early stage. For more reliable sources on oral health, the American Dental Association offers some very good resources on the oral health topic at MouthHealthy.org. A small cavity is much less expensive to repair than a root canal. By definition, preventive care is a smart investment.

Coordinating Benefits and Other Insurance

Are you covered by more than one dental plan? This may occur if you and your spouse have coverage. This is referred to as coordination of benefits (COB). One is primary plan and other is secondary plan.

The secondary plan may help provide a way to pay for what the primary fails to. As a result, this may help you lower your out-of-pocket costs. This principle is true for other areas, too. For example, small business owners will often require a number of different policies, such as health insurance and affordable business insurance, to be adequately protected.

Navigating Procedures with Your PPO Dental Benefits

Your dental insurance network determined that you get access to many procedures. Understanding how they are covered by your Delta Dental PPO is the key. So, with that, let’s deconstruct certain typical services.

Routine Checkups and Cleanings

As said, this is the preventive care. Your health insurance company probably covers this at 80 to 100%. There is no reason not to have these visits. Indeed, they are the basis for good oral health. They are also going to save you money in the long run.

Fillings and Basic Restorative Work

Did your dentist discover the existence of a cavity? In that case, then with a filling you will need a filling. This falls under basic care. Your plan will be able to cover a large portion of the cost. Typically, the rate that you will be paying is about 20% of the negotiated rate.

Major Services: Crowns, Bridges, and Implants

Sometimes, more is required in the way of work. When dental health specialist in Singapore has privileged to see the suffering of a broken tooth, some might require a crown. This is taken as a major service. Your Delta Dental PPO will pay a portion of the costs. Usually, this is around 50%. You can find extensive government backed research and health topics to understand why these procedures are so important to long term health.

Because of how costly these types of procedures are, it is imperative that planning be important. Get an advanced estimate on the pre-treatment first. This is to tell you exactly how much your plan is going to pay. It also displays your expected cost out of pocket.

Understanding Waiting Periods for Your PPO Dental Plan Benefits

Some plans exist that have waiting periods. This implies that at a certain time prior to that, you have to have the plan for certain procedures. Waiting periods, for example, are common with major services.

For example, you may even have to wait for six months for a crown. Preventive care and the basic care however usually have no waiting periods. In any case always check your plan details for this information.

Advanced Tips for Your Delta Dental PPO Plan

You know the basics. Now then let’s know some best expert tips. These will help you to become a power user of your plan. Ultimately, you can save more money and even more hassle.

Getting a Pre-Treatment Estimate

This is one of the most powerful tools that you have. Before any major procedure Ask your dentist for one. They will then submit the treatment plan to the Delta Dental.

Delta Dental respond back with an estimate. This document explains what they have to cover. Furthermore, it indicates what you are going to be in debt for. This process helps to stay out of surprises, thereby helping you to budget with confidence. Many people also get pre-quotes for things like motorcycle insurance so that they can be financially prepared for any eventualities.

Appealing a Denied Claim

Sometimes, one’s claim may or may not be denied. Don’t panic if this happens. You have the right of appeal of the decision. The first thing you need to do is to find out why it was denied.

The reason for the denial letter will be described. It could be a new simple coding error. Or perhaps there is more information that is required. An appeal to the Tribunal may be made by you or your dentist’s office. Just follow the treatments given by Delta Dental.

Using Your FSA or HSA with Dental Insurance

Do you have a Flexible Spending Account (FSA) account? It’s a Health Savings Account (HSA), or is it? You can use these pre taxed dollars. Specifically, they can pay for out-of-pocket dental costs.

This is a marvelous way to save money. You can use it for deductibles, copayments and for coinsurance. It even works for services that are covered by your plan, such as cosmetic services. In short, with regard to your health, it’s a smart financial choice.

Savings Checklist

Beyond the Basics: Special Considerations for Your Plan

Your Delta Dental PPO plan can pay for more than you think. Let’s consider the some special situations. These include orthodontics, as well as emergency care. It’s important to understand such benefits as well.

Does Your Delta Dental PPO Cover Orthodontics?

Many families require orthodontic care. This includes those that use braces and clear aligners. Does your plan cover it? The answer is: it depends. Some Delta Dental PPO plans include it. Others, however, have it as an optional extra.

There is normally a lifetime maximum for orthodontic coverage. This is unlike your yearly maximum. For example, the plan may pay as much as $2,000 over a lifetime for braces. You will have to consult your plan documents to obtain specifics. This is a very important advantage for many families.

“A genuine smile comes from the heart, but a healthy smile needs good dental care.”

– Anonymous

Emergency Dental Care While Traveling

A dental emergency may occur in any place. What if you’re on vacation? Luckily your PPO plan is a great protection. One can see any licensed dentist for an emergency.

While the dentist is likely to be out-of-network, your plan will help. It will generally cover emergency care at the in network level. This will give you peace of mind while travelling. This is just like having to have temporary car insurance when you are away from home.

How PPO Plans Can Benefit Small Businesses

Ringside constructant Match Makers: Are you a small business owner? Offering good benefits is important to attracting talent. A Delta Dental PPO plan is a great option, as it provides employees with the desired flexibility.

Furthermore, group plans can be rather affordable. They communicate that you are interested in the well-being of your team. This is a useful component of a full benefits package. It also complements other pieces of key coverage, such as commercial auto insurance for company vehicles.

Common Mistakes to Avoid with Your Dental PPO

In order to really have mastery over your plan, you also need to know what not to do. Avoiding Pitfalls Common form causes need to be avoided. This will save you time, money and frustration. The following are mistakes to look out for.

Assuming a Dentist is In-Network

Never take a dentist to be in your network. Even if they were last year, things can change. In fact, networks are updated on a constant basis. A dentist may disassociate from a network at any time.

Therefore, always do your homework before your appointment. Use the online tool. Then, call the office for the verification. This is a five minute exercise that can save you hundreds of dollars. Results in the most common and most expensive mistake people make. Just like you would be sure for your classic car insurance, you need to be sure of your dental network status.

Not Understanding Your Annual Maximum

Your annual maximum is a limit. Once you have reached it, the plan no longer pays. It’s important to know about this limit. A lot of people forget and get a shock at the end of the year with big bills.

If you are going to get lots of work this is to plan with your dentist. For example, it may be possible to plan procedures over two calendar years. This allows for using two years worth of your yearly maximum. It’s a strategic way of controlling the cost.

Neglecting Preventive Visits Because You Feel Fine

“My teeth don’t hurt, so I’m fine.” This is a dangerous form of thinking. Many dental problems, after all, do not cause pain to begin with. A small cavity or some early gum disease cannot give any warning at all.

Your Delta Dental PPO has a lot of incentive for preventive care. So, use this benefit. It is the ultimate single best way to save on dental care and preserve your health. When you turn down free money and miss these visits, you are crazy. It’s also a smart habit similar to making yourself regularly review your term life insurance vs. whole life insurance options.

Forgetting to Check Your EOB

After each visit, Delta Dental will send an EOB. This is called an Explanation of Benefits. It is not a bill. Instead, it displays what the dentist charged. It also displays what the plan paid includes what you owe to.

Always review your EOB. Then, compare it with the bill of your dentist. This is so that you are being charged correctly. It also helps you to track your deductible and annual maximum. It’s a vital part of managing your dental care, as reviewing a United Healthcare insurance statement is for managing medical care.

Your Smile, Your Savings: Taking Control of Your Dental Health

The Delta Dental PPO plan is a huge tool. It gives you the freedom of choice when choosing your provider. It’s also cost-saving by huge margins. But for the plan to work you must use it wisely. You have to be a proactive patient.

Understand your benefits. Find an in-network dentist. Use preventive care. Get pre-treatment estimates. By following the advice in this guide, you will be able to take complete control. You will be saving your smile and your wallet. Lowering costs is a goal for all types of coverage, from dental plans to finding ways for lowering your car insurance cost.

Your Dental Health is A Journey That Lasts A Lifetime. With the right plan and the right knowledge you are now well equipped. So go ahead and agree to that checkup. Your future self will be glad that you did. For people who use their line of work to earn their living, having the proper cover, such as professional liability insurance is as important as having a good dental plan.

Frequently Asked Questions (FAQs)

The best way is the Delta Dental’s official website’s “Find a Dentist” tool. After this, call the dentist’s office directly to assure they accept your one particular plan.

The greatest difference lies in choice. With a Delta Dental PPO you are able to see any licensed dentist, but save more in-network. With a DHMO, you have to find a specific network to use and you often have to get some referrals for specialists.

It means that your insurance will cover 80% of the negotiated rate for the service, when you’ve paid your deductible. You are responsible for paying the remaining part (20%) (this is called coinsurance).

Yes, you can. Your PPO plan provides you with the ability to see any licensed dentist for an emergency. The plan will usually provide some coverage, often with the in-network benefit level, to help out with the costs.

Preventive care such as cleanings and exams help to find the problem early when it is easier and cheaper to treat. Since most Delta Dental PPO plans cover it at a high percentage (and often 100%) it’s the best way to get sewn in when it comes to keeping yourself healthy and low-cost.

![Compliant Drivers Program: Is It Legit for Driver Safety? [2025]](https://propinfo.site/wp-content/uploads/2025/12/Compliant-Drivers-Program-150x150.jpg)

Leave a Reply