Taking care of your home is a high priority. Indeed, it is probably your largest financial asset. Therefore, getting the right insurance is absolutely important. This is a guide that will help you to obtain your State Farm Homeowners Insurance quote.

We will walk you through each and every single step. In addition, you will be able to learn what information you need. You will also know about the cover options. In the end let’s make this process as simple and clear to you.

Getting a quote through the internet can sometimes be a daunting experience. However, it doesn’t have to be. We are here to break it down. By the end of this article, as a result, you will feel confident. You will be ready for getting your personalized quote. This thus provides your home with the protection it deserves.

Why Choose State Farm Homeowners Insurance?

You get lots of choice about insurance. So, why should it be you who wants to go with State Farm? For one thing, they built up a strong reputation over decades. For many they are a household name. Now, let’s solve some of the reasons why.

A Legacy of Trust and Reliability

State Farm has been in existence for more than 100 years. Of course, this is all a long history that speaks volumes. They have weathered economic storms. As a result, they have paid out endless claims. This legacy serves naturally to build up a profound feeling of trust. You want an insurance company who will be there when you need it the most. In fact, their track record reveals a commitment to policyholders.

Financial Strength You Can Depend On

An insurance policy is merely a promise. Therefore, the company must have the ability to keep it. State Farm is always getting high marks. For example, they receive top ratings from financial strength assessors. A.M. Best, for instance, frequently affixes superior ratings to them.This financial stability is just, incredible, incredibly important. It means that they have the funds to pay your claim, even after a major catastrophe.

Extensive Network of Local Agents

While you can get a quote online, help in never far away. Specifically, State Farm has an enormous network of local agents. So I’m sure there’s an agent right in your community. This is a personal dimensionality. You can then talk to an actual person about your quote.

They may be able to answer some questions you may have. This approach with both digital convenience and human support is also a big plus. Sometimes, you need just to talk through your options for something as important as life insurance.

“The ache for home is in all of us, the safe place where we can go as we are and not be questioned.”

– Maya Angelou

Your Guide to a State Farm Home Insurance Quote

So, the main even now, let’s get immersed into: However, we will take you through the process. Follow these steps to have a smooth sailing. Getting your state farm home insurance quote is certainly easier said than done.

Step 1: Gathering Your Essential Home Insurance Information

Preparation is a very, very big deal. Having information to use saves time. It also makes sure that your quote is accurate. So, before you visit the website, take these details.

Quote Preparation Checklist

Personal Details for Your Quote

To get started on the question of Where should be next, first you’ll need simple stuff about who you are like Personal Info. This consists of what and how much you purchased. State Farm uses this for identifying you. In addition, they require your current address. This is even if it’s not the property that you are insuring.

Essential Property Information

This is the most detailed and detailed part. You have to provide the address of the home. The tool provided by State Farm commonly auto-fills details. In particular it draws from public records. However, you should always check them out. Some important information are the year built and square footage. You will also be required to have the number of stories.

Details About Your Home’s Features

Next comes considering specific features about. For example, the roof over your head how old is it? What Highly Composed of (Shingles, metal etc)? In some cases newer roofs will lead to a discount. Also, do you have a security system? Is it monitored? Indeed, the finer points are important for your end-of-the-line premium. Knowing these things can help reduce your overall insurance cost.

Step 2: Navigating the State Farm Website for Your Quote

With your information in hand you are ready. Now, visit the State Farm web site. Their site is generally user-friendly. Thus, using the find the quote tool is simple.

Finding the Quote Tool

Look for a section which reads “Insurance.” It should give options of owners, not tenants, and choose “Homeowners.” You will then see a striking button. It will say “Get a Quote” or something like that. Click this in order to start the process. The making of your way to your state farm homeowners insurance policy starts right here.

Starting Your Online Application

The system will start asking for your address first. This is the starting point for the quote. After inputting the address of the property, it will be your guide. You will then proceed through a number of questions. Answer them one by one. In short, the process is programmed to be intuitive.

Step 3: Entering Property Details for an Accurate Quote

Accuracy is considered vital at this stage. After all, flawed information can produce a faulty quote. Worse, it might create problems with a future claim. So, take your time here.

Check on the auto-filled information. For example, the system could say that your home is 2,000 sq feet. If you know it is 2,200, correct it. Similarly, don’t be dishonest about the construction materials.

The same holds true with updates you have made. Did you replace any plumbing or the electrical systems? Be sure to mention it. This detail is crucial to a correct state farm home insurance quote.

Step 4: Customizing Your State Farm Home Insurance Coverage

This is where you individualize the policy. It is possible to change coverage amounts here. This is useful in fitting your needs and budget. A standard policy has a number of parts. Let’s look at the main state farm home insurance coverage components.

Dwelling Coverage (Coverage A)

This gives protection to the physical structure of your home. Specifically, it deals with the walls, roof, and foundation. You would like to have sufficient cover to compete and rebuild your home completely. The tool for quoting will suggest an amount. This is based on local construction costs. However, more often than not, you can make an adjustment to it. In brief, it is an important component in your defense.

Personal Property Coverage (Coverage C)

This covers your belongings. For instance consider furniture, electronics, and clothing. If you could turn your house upside down, everything falling out is personal property. Often this is a percent of your dwelling coverage. Nevertheless, you can in many cases increase this if necessary. Making a home-inventory can help you find out how much.

Liability Protection (Coverage E)

Liability coverage is very important. It protects you financially. For example, what if the person gets injured on your property? Or what if the opportunity exists that you may accidentally damage another’s property? Liability coverage is for liability payments for legal fees and damages. This is one area that you do not want to scrimp on. In fact, it’s as necessary as having good professional liability insurance for your career.

Additional Living Expenses (ALE) (Coverage D)

When a covered event is the cause of making your home unlivable, what if? A fire, or a major storm, for example. In that case, ALE helps pay for temporary housing. It can be used for hotel bills, meals at restaurants. In short, this coverage helps in keeping your life stable at a trying time.

Step 5: Finding Home Insurance Discounts and Potential Savings

Everyone loves to save money. Luckily, there are a lot of discounts from State Farm. The quote tool will ask questions to determine if you are a candidate. Therefore, make sure that you answer them carefully.

Common discounts include:

- Bundling: Home and auto insurance bundled – this is a big one. It can result in substantial savings.

- Protective Devices: Security alarms, smoke detectors and fire extinguishers can reduce your premium.

- Roofing Materials: Impact resistant roofing can provide you with a discount, particularly in areas prone to hail.

- Claims-Free History: If you did not file a claim for several years, you may find payment to be rewarded for it.

- New Home: Most newer homes tend to be less expensive for insurance.

Exploring these to go through these is a smart move. Ultimately, that ensures that you receive the best possible price for your state farm homeowners insurance.

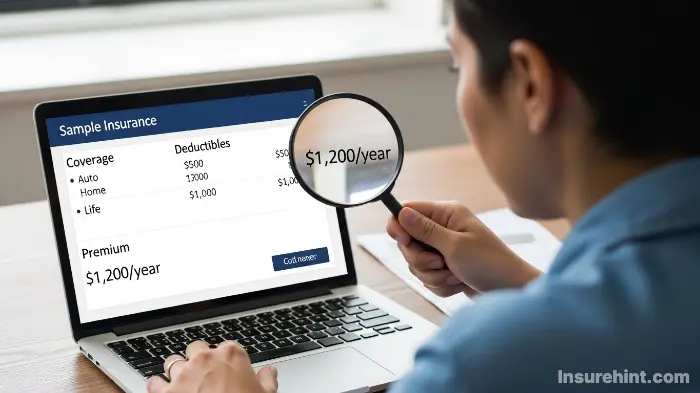

Step 6: Reviewing and Finalizing Your State Farm Home Insurance Quote

You are almost there. The last screen will provide you with your quote. It will give you detailing of your coverage amounts. Also, it will give you your estimated premium. This premium can be presented as a monthly or annual expense.

Take some time to go over anything. How is the name for your spell correctly spelled? Is the address right? Furthermore, are the coverage limits what you wanted? If something doesn’t look to be right, just go back. You can modify the information and recalculate the quote. Once you are satisfied you can then save it. You can also go ahead and buy the policy online or contact an agent.

Understanding Your State Farm Homeowners Insurance Coverage in Depth

A basic quote is a great start. However, it is better to have deeper understanding. Let’s go into some of the nuances of coverage. This will help you to make a more well-informed decision. After all, your policy is not just that price. It’s a promise of protection.

Standard Home Insurance Coverage vs. Optional Add-ons

A standard policy (sometimes known as an HO-3) offers extensive coverage. But it is not covering everything. You can add extra protection. These add-ons are known as endorsements or riders.

What’s Typically Included in Standard Coverage?

Your typical state farm home insurance coverage is against common perils. These include fire, wind, hail, and theft. It also incorporates the living, personal property and liability protection discussed. However, it is of vital importance to read the “named perils” or “exclusions” within your policy document.

Popular Endorsements for Your Homeowners Insurance

Depending on the location where you live, you may require more. The following are some common endorsements to look at.

- Water Backup Coverage: Typically, sewer or drain backed up aren’t included in a standard policy. This endorsement increases that protection. In fact, it is a quite common and messy problem.

- Identity Restoration: This helps you recuperate from identity theft. For example, it can afford expenses and expert help.

- Valuable Personal Property: Do you have any fine art, jewelry, or collectibles? There are limits on these things in a standard policy. This rider, however, gives them a higher coverage. It’s just like one might purchase special insurance for classic cars.

- Flood Insurance: This is a large one. To be clear, homeowners insurance does not cover flooding. You have to purchase a separate policy. This often is through the National Flood Insurance Program (NFIP) which you can learn about on FloodSmart.gov. State Farm agents can help get this policy.

- Earthquake Coverage: Similarly, earthquake damage is an area that is not standard. If you live in an area prone to earthquakes, then you will need this separate endorsement.

“The Lighthouse House is a house made of walls and beams; a home is built with love and dreams.”

– Ralph Waldo Emerson

After Your State Farm Home Insurance Quote: What Are the Next Steps?

You have a state farm home insurance quote. So, what do you do now? First, avoid being quick to make a decision. Take a few final steps to make sure that you are making the best choice.

Dwelling Protection

Covers the physical structure of your house against damage from covered perils like fire or wind.

Personal Property

Protects your belongings, such as furniture, electronics, and clothing, even when they’re not in your home.

Liability Shield

Protects your assets if someone is injured on your property or you cause damage to theirs.

Comparing Your Home Insurance Quote with Other Insurers

It’s just always a good idea to shop around. A quote from State Farm is a good one to go by. However, you should also obtain quotes from 2-3 other good insurers. This helps to compare the prices and coverage options.

Just like you might compare different types of PPO and HMO plans, comparing home policies is sensible. Just make sure that you are comparing apples to apples. That is, quote for similar coverage and deductibles.

Speaking with a State Farm Agent About Your Quote

The online quote is an appraisal. For a final (binding quote), you should converse with an agent. An agent will be able to look over your information. Plus, they can indulge and look for further discounts that you may have missed. Furthermore, they are able to explain complex policy language in simple terms.

This human interaction can be of invaluable value. That also ensures there are no surprises down the road. They can even talk through other insurance needs, such as affordable business insurance if you are working from home.

Making the Final Decision and Purchasing Your Policy

After comparing quotes and talking to an agent you’re getting finally ready it. It will be possible to now make an informed decision. If you settle for State Farm, the agent can close the policy. You will then need to choose a start-date. You will also make your first payment. Congratulations! As a result, your home is now safe.

Managing Your State Farm Homeowners Insurance Policy

Your job is not over once you purchase the policy. Indeed, insurance is not a “set it and forget it” product. Proper management is key. This is because your coverage should be maintained throughout time.

The Importance of Annual Homeowners Insurance Reviews

Review your policy with your agent on an annual basis. Life changes and so do your insurance needs. For instance, did you expand your house? Have you purchased some costly new furniture? If so, you may have to add to your coverage.

A yearly review is a way that you can keep your policy updated. In addition, this is also a good time to see if you are eligible for new discounts. Sometimes policies change, as do the options of United Healthcare insurance.

How to File a Claim with State Farm

If the worst comes to pass, you need to file a claim. Fortunately, State Farm makes this process easy. You can file a claim online, using their mobile app or you can call your agent to file your claim. The most important thing is to act on it as quickly as possible.

Also, write down the damage by taking photos and videos. If it is safe to repair, make temporary repairs to prevent more damage from occurring. A claims adjuster will next call you to work you through the rest of the process.

Keeping Your Policy Information Updated

Did you get a new phone number? Or did you change your e-mail address? Keep your current contact information with State Farm. This is so that you do not miss important notices. In addition, if you make safety upgrades, tell your agent.

For example, GNO/GFD of new siding, a new roof or a monitored alarm system can reduce your premium. You certainly want to avail of these savings. Staying on top of your policy is as important as managing your motorcycle insurance or any other policy.

Maximizing Value from Your Homeowners Insurance

Getting the most from your State Farm Homeowners Insurance is Key. It’s more than just a low price though. It’s also having the right protection. And, it’s about knowing everything about good benefits.

Understand Replacement Cost vs. Actual Cash Value

This is a very important distinction. Actual Cash Value (ACV) that would pay the depreciated value of your property. In contrast, Replacement Cost Value (RCV) is the payment of the cost of replacing it with a new, similar item. RCV coverage is much better, and although higher cost.

For voting on where your dwelling will be, almost always you want RCV. This is to ensure you actually can rebuild your home. For personal property, though, generally you have a choice. Be sure to talk to your agent about this. This is a decision as basic as picking between term life and whole life insurance.

The Role of Your Home Insurance Deductible

Deductible is the next time you pay something before insurance is obtained. A higher deductible tends to result in a lower premium. On the other hand, a lower deductible will mean a higher premium. Choose a deductible you can easily put up the cash to pay one moment’s notice.

For instance, it is not unusual to see a $1,000 deductible. Don’t make it $5,000 just because it saves you on the premium if you don’t have $5,000 sitting around. For useful safety tips you can always go to a good site such as the National Safety Council.

Leveraging the State Farm Mobile App

In today’s world, convenience is important. The State Farm mobile app is a powerhouse. For example, you may see your policy documents. You can also pay your bill. You can even make a claim from your phone.

The use of these digital tools can make governance of your policy much more manageable. In effect, it puts control right at your fingertips, whether it’s your home policy or primary commercial auto insurance.

“Safety is not expensive, safety is invaluable.”

– Jerry Smith

Protecting your home is one of your most important financial decisions that you will make. Purchasing a State Farm Homeowners Insurance quote via online is the first. By being ready and knowing your choices, you can in turn obtain a policy that provides you with peace of mind. It’s a vital safety net. For general questions about insurance, a very good non-biased place to go is the Insurance Information Institute.

Now you have learnt the whole process. From compilation of documents to customized your state farm home insurance coverage you’re now standing ready. You also have the knowledge to manage your policy in a long-term.

This knowledge makes you understand how to protect your home and family successfully. Remember, sometimes there is a need for short-term coverage, and understanding things like temporary car insurance can be of assistance in different situations.

Frequently Asked Questions (FAQs)

You will need information such as your personal information, the address of the property, the year it was constructed, the square footage, the type of construction, and the safety features, such as the presence of alarms and the age of the roof.

Yes. You may be able to reduce your premium by bundling with auto insurance, having security systems, having a younger roof, having a claims free history, and choosing a higher deductible.

No, a normal homeowners policy will not cover the damage caused by floods. You need to purchase a separate flood insurance policy, which one of the State Farm agents may help you obtain.

Dwelling coverage protects the physical structure of your house (walls, roof). In contrast, personal property coverage provides protection to your belongings inside the house (furniture, electronics and clothes).

Yes, it is highly recommended. An agent can confirm your information, find out what else is available for you in terms of discounts, explain your coverage in detail and give you a final, binding quote for your State Farm Homeowners Insurance.

![Compliant Drivers Program: Is It Legit for Driver Safety? [2025]](https://propinfo.site/wp-content/uploads/2025/12/Compliant-Drivers-Program-150x150.jpg)

Leave a Reply