When you buy your first home, it is a giant step. It is a very exciting and emotional journey to be sure. You finally have a place to call your won. However, this new responsibility also comes with new tasks. One of the most important is house First-Time Homeowners Insurance. This guide is here to help you.

We are going to walk you through each and every step of the way. For example, you shall learn about what insurance covers. We will also show you how to find the best rates. In the long run, this is what ensures that your new investment is fully protected. So, we decided to make this process simple and clear to you.

Why You Absolutely Need First-Time Homeowners Insurance

You may wonder whether this is really necessary. The answer to this is, in short, a resounding yes. It is not only a suggestion to new buyers. In most cases, it is a hard requirement. Furthermore, it is your main monetary safety net that makes it an indispensable piece of your purchase.

Imagine fire or the major storm. Repairs could therefore cost thousands of dollars. Without insurance you would be paying this out-of-pocket. This could be financial suicide for anyone. As a result, having a solid First-Time Homeowners Insurance plan is a relief of immense peace of mind.

The Lender’s Requirement

Your mortgage lender has a huge stake in your home. Naturally, they have invested a lot of money in your property. Therefore, they must be protected with their investment. This is exactly why they will require you to carry insurance.

You are required to provide evidence of a policy. This will usually occur before you can close on the house. The policy makes sure that the home can be rebuilt. In turn, this insures both you and the lender from total loss.

Protecting Your Biggest Asset

Your home is probably your greatest asset. After all, it is not just a building. Your belongings and your memories are contained within it. This critical asset is protected with First-Time Homeowners Insurance. In other words, it protects you against unexpected disasters.

Think of it as a security blanket. It includes harm to the structure itself. In addition to this, it also includes what is inside your home. This protection is important to your financial status. For example, if you’re worried about other major life events, it can also be valuable to understand different policies such as insurance from State Farm life insurance.

“There is an “ache for home”, that lodges in all of us. The safe place for us to go as we are and not be questioned.”

– Maya Angelou

Decoding Your First-Time Homeowners Insurance Coverage

Home insurance policies can appear to be confusing. In fact, they use a lot of special terminology. But we can easily deconstruct it. For example, most new buyers are issued an HO-3 policy. This is a regular and extensive choice for first coverage.

Let’s discuss some of the key components of your homeowners insurance coverage. Each section should be understood. Subsequently, it helps you know what you are exactly paying for. After all, knowledge is power when it comes to purchasing an insurance.

Standard Coverage in an HO-3 Policy

An HO-3 policy provides comprehensive coverage. It provides structural coverage for your home for all perils. That is of course, unless they are specifically excluded. Your personal items, on the other hand, are covered for named perils. Let’s look at each part.

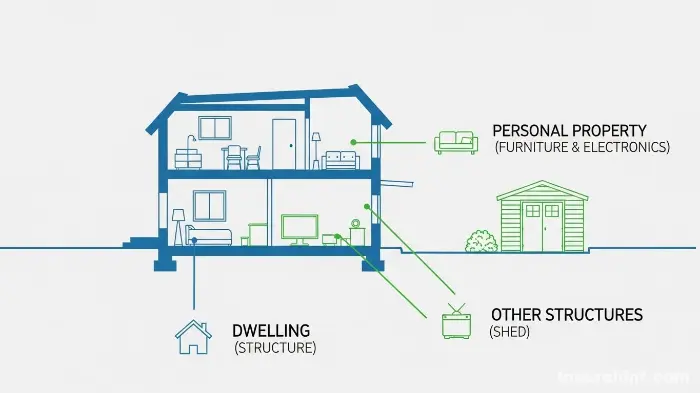

Coverage A: Dwelling Protection

This is what your policy is all about. This includes everything from the physical structure of your house. Specifically, this includes the walls, roof, and foundation. This also includes attached structures, such as a garage.

The amount of coverage should be high enough. It must cover the cost to completely rebuild your home. In addition, keep in mind, this is not the market value. It is the cost of reconstruction which may be different.

Coverage B: Other Structures

Do you have a shed or a fence? Perhaps you have a garage that is detached. Coverage B, therefore, serves to protect these structures. To that end, they are not attached to your main house.

Usually, this coverage will cover about 10% of your dwelling coverage. So, if your home is covered by an insurance for $300,000 other structures get $30,000 shelter. This is often more than you can increase if need be.

Coverage C: Personal Property

This part includes things that are your personal possessions. Think of your furniture, clothes and electronics. If they are stolen or damaged this aids in their replacement. For more specialized items, you may require additional protection, just like you would acquire classic car insurance for a very important car.

You have two options here. One is Actual Cash Value (ACV). This covers the expense for the current, depreciated amount of the item. The other is Replacement Cost Value (RCV). This, in contrast, is a payment to replace the item itself with a new item. RCV is more expensive but without a doubt provides better protection.

Coverage D: Loss of Use

What if there is a disaster causing your home becoming unlivable. Where are you going to be staying during repairs? Loss of Use coverage: Thankfully, loss of use coverage helps with this. It is also referred to as Additional Living Expenses (ALE).

This coverage covers hotel bills and restaurant meals. Furthermore, it includes expenses above your normal living expenses. This support is extremely important through a stressful time which will enable you to keep up with your lifestyle.

Your Coverage Checklist at a Glance

Dwelling

Protects your house structure, including the roof and walls.

Personal Property

Insures your furniture, electronics, and clothing.

Loss of Use

Pays for living expenses if your home is uninhabitable.

Other Structures

Covers your shed, fence, and detached garage.

Coverage E: Personal Liability

Accidents can happen at your location. For instance, a guest might slip and fall. Your dog may bite to one of your neighbors. Personal liability coverage by any insurance protects you in these situations. As a result, it takes care of legal fees and medical bills in the event you are sued.

Most policies have a $100,000 initial coverage amount. However, experts suggest a minimum of $300,000 to $500,000. This is a very important protection on your financial future. In fact, this type of coverage is as important as professional liability insurance is for a business owner.

Coverage F: Medical Payments to Others

This coverage is for minor injuries. In this case it pays for medical bills if a guest on your property is hurt. This is regardless of which party is at fault. Essentially, it’s made to be able to deal with minor incidences quickly.

Typically, the coverage amount is $1,000 to $5,000. It can avoid a little accident turning into a huge lawsuit. In all, it is a gesture of goodwill.

What Is Not Covered? Common Exclusions for New Homeowners

Standard policies do not cover the board. Therefore, it is important to be aware of the exclusions. This way, you can purchase additional coverage if required. Unfortunately, these details are ignored by many new homeowners.

Floods and Earthquakes

Most First-Time Homeowners Insurance policies do not include flood damage. Likewise, they also exclude damage from earthquakes or mudslides. You must purchase separate policies on these risks.

If you are living in a flood prone area you may need to take an insurance against flood. You can obtain this as a result of the National Flood Insurance Program (NFIP), which is managed by FEMA. Similarly, if you have a risk of earthquakes, you will need to have a separate earthquake policy.

Maintenance and Wear & Tear

Insurance is against sudden and accidental damage. It is not a home doing a maintenance plan. Therefore, it will not cover problems from neglect. Things such as mold, rust or pest infestations will be up to you.

A leaky pipe that you ignored will not be covered. Also, normal roof wear and tear is excluded. Regular home maintenance is your best defense here.

How to Get the Cheapest First-Time Homeowners Insurance Quote

Every new home owner wants to save some money. Luckily, you are able to find affordable coverage without having to compromise on quality. The most important point is to be a wise shopper. So, let’s consider how in order to find the cheapest homeowners insurance.

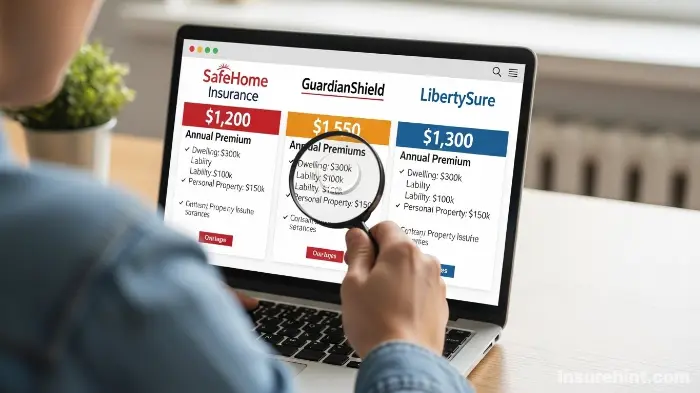

The Importance of Shopping Around

Do not accept the first offer you get. Price for insurance varies widely from one company to another. For instance, one insurance company may offer you a price of $1,200 per year. Another may offer the same coverage for $1,800.

You should go for getting at least three to five quotes. This provides you a proper view of the market. Then, you will be able to compare the prices and coverage offers side-by-side. Getting a good insurance quote on your homeowners plan is a question of doing your homework. Likewise, when it comes to insuring a vehicle, you need to explore all tips for lowering your car insurance cost.

Factors That Impact Your New Home Insurance Premium

Insurers take many things into consideration. On these they will help them calculate your level of risk. It helps to understand them for you to be able to see why your rate is the way it is. Plus, some of these factors you are able to control.

- Location of Your Home: Is your location prone to crime or natural disasters? Additionally, the proximity to a fire station and fire hydrants is also a factor.

- Age and Construction of Home: Newer homes often feature better rates. For example, materials such as brick are more fire resistant. This can also reduce your premium.

- Your Credit-Based Insurance Score: Insurers have discovered that there’s a relationship between credit and claims. Thus, having a better credit history could make your insurance cost less.

- Your Claims History: If you have had some claims before then you might be faced with some higher rates. This is because it means you are a higher risk.

- Protective Devices: Smoke detectors, burglar alarms, and sprinkler systems can all be used to earn you discounts. In short, they decrease the risk of any major damage or theft.

What Determines Your Home Insurance Rate?

Many elements influence your premium. Here’s a look at the key factors insurers evaluate.

Property Details

- 📍 Location: Risk of theft & disasters.

- 🧱 Construction: Materials and age of the home.

- 🔥 Fire Safety: Proximity to a fire station.

Personal Factors

- 💳 Credit Score: Higher score can lower rates.

- 📜 Claims History: Fewer claims mean lower costs.

- 🐶 Pets: Certain dog breeds may increase rates.

Policy Choices

- 💰 Deductible: Higher deductible lowers premium.

- 🛡️ Coverage Limits: How much protection you buy.

- 📦 Bundling: Combining home and auto insurance.

How to Lower Your Costs

You are powerless over your premium. In fact, there are a number of smart moves you can make. These actions can have a major saving for your policy.

Increase Your Deductible

The deductible is what is discussed and that you pay out-of-pocket on a claim. After that, the remaining amount is paid by you in insurance. A higher deductible, therefore, is a lower premium. For example, you can save as much as 25% on the cost by increasing it from $500 to $1,000.

However, you should be careful with this. You need to be sure that you will be able to comfortably afford your deductible. In other words, you need to have that much saved in case of an emergency.

Ask About Discounts

All insurance companies have numerous discounts. Usually, you just have to ask for them. A common one is bundling. This means purchasing your home and auto insurance from the same company. Bundling can serve as a good way to save you lots of money, similar to searching for affordable plans for United Healthcare insurance.

Other discounts include things such as:

- New home construction discount.

- Retiree discount.

- Loyalty discount.

- Claims-free discount.

- Home security system discount.

Improve Your Home’s Safety

Making yourself safer is your home can also reduce your costs. For example, do you install a monitored security system. A sprinkler system is also a great addition. In addition it may help to reinforce your roof or install storm shutters.

These upgrades minimize the risk of a claim. In turn, this proactive behavior earns a reward from insurers. So, inform your insurance agent about the improvements that you carry out.

“Loss is coming from not knowing what you’re doing.”

– Warren Buffett

Special Insurance Considerations for New Homeowners

As a first-time buyer, you may be faced with unique situations. Your insurance needs may vary over the years. As a result, it is prudent to try to keep these possibilities in mind from the beginning. Your First-Time Homeowners Insurance doesn’t finish with the initial purchase.

What About Homeowners Insurance for Rental Homes?

Are you thinking of putting a room for rent? Or possibly the entire house in the future? If so, standard homeowners insurance was just not going to be enough. This is a very important point that many people fail to grasp.

A standard policy applies to an owner occupied home. Once you have a tenant, you tenant’s risks are then changed. You should inform your insurance company immediately. They may provide an endorsement to your policy. Alternately, you may need a landlord policy. This is a type of homeowners insurance for rental homes. This is a certain kind of insurance, just like there’s a commercial auto insurance for business vehicles.

Landlord policy usually includes the structure. It also gives liability protection. However, it does not address the tenant’s personal property. Your tenant will need his own renters insurance for that.

Navigating the Claims Process

Filing your first ever insurance claim can be scary. But if you are prepared, then it is doable. The first step is, of course, to contact your insurer straight away. You should also ensure you take steps to prevent any more damage.

Document everything in a careful manner. For example, take photos and videos of the damage. Make a list of all damaged / lost items Also, save all your receipts for repairs and cost of living. An arranged approach will definitely make the process smoother. For example, having a right health plan, like Humana dental insurance PPO, helps make dental claims a lot easier.

Your insurer will then send your adjuster. This individual will inspect the damage. They will establish the cost of repairs to you. Be cooperative but be your own advocate, as well. Above all, do not be afraid to ask questions. A great resource to have in understanding your rights is the Insurance information Institute.

A Step-by-Step Guide to Buying Your First-Time Homeowners Insurance Policy

Now you have the basics comprehend something. As a result, you are ready to buy your first policy. Follow these simple steps. This will ensure that you are getting the right coverage at a fair price.

Step 1: Gather Your Information

Before you try asking homeowners insurance quotes, get some details. Insurers will need this information in order to provide you with an accurate price.

You will need things like:

- The property address.

- The year the home was built.

- The square footage.

- Information on the type of construction (brick, frame).

- Information concerning the age and type of materials the roof is made from.

- Your personal information, including your birthday.

Step 2: Compare Multiple Quotes

Make use of an on the web value comparison device or simply make contact with an independent agent. This is the way to get multiple quotes the easiest way. An independent agent, for example, works with a number of companies. They are able to fit the best fit for your needs.

When you are comparing, you need to look beyond the price. Be sure to have similar coverage limits and deductibles on all quotes. In short, it is important to have an apples to apples comparison. This is similar to comparing different life insurance, such as term life vs. whole life, and which would be better for you.

Step 3: Read the Fine Print

Once you have selected a company, look up the policy documents. Yes, this can be tedious. But it is amazingly important. You need to know all the detail of your homeowners insurance coverage.

Pay attention to the part of the exclusions section. Also, ensure that you look out for limits for precious items such as jewelry or art. You may need a special ending such as an account of a rocky island or a slave ship or something for these. Understanding your policy is as important as knowing the rules for other types of coverage, such as motorcycle insurance.

Step 4: Finalize Your Purchase

After a review, it is time to purchase. And you will be required to make your first premium payment. The insurance company will then issue your insurance policy. Afterwards you will receive the declaration page.

This page provides a summary of your coverage. You will need to provide this document for your mortgage lender. They need it for your closing. Also, save a copy so that you have one for your own records. Consider, whether you will need ongoing or temporary car insurance for your move-in process as well.

Conclusion: Securing Your New Beginning

Congratulations and welcome to your new USA home. It is certainly a major achievement. Securing the right First-Time Homeowners Insurance is the last step in protecting it. It’s a Non Negotiable aspect of Responsible So There Home Owners! Ultimately, it provides the shield to your finance and your future.

By knowing your coverage, shopping around for quotes for the cheapest homeowners insurance and being proactive, you are in the driver’s seat. You are not really purchasing a policy. Rather, you just are purchasing security and peace of mind. This makes it possible for you to truly enjoy your new home, knowing you are ready for the unexpected.

For any small business ventures you might do out of your home remember to look into affordable business insurance as well. An independent insurance agent can be a great partner and they can give valuable guidance. They can help you deal with state specific regulations, such as your state’s department of insurance.

Frequently Asked Questions (FAQs):

And you need dwelling coverage adequate to rebuild your home entirely. For liability, the experts suggest a minimum of $300,000 to $500,000. An agent may be able to assist you in “[calculating]” the specific amounts based on the specifics of your home and your assets.

Market value: This is what your house would sell for today. Replacement cost, on the other hand, is the price of reconstructing your home and making it similar in materials. You should always insure for replacement cost.

It is possible. Filing a claim can result in your premium going up upon the time of your renewal as insurers will find you to be a higher risk. This is why paying for small repairs out-of-pocket and saving claims for significant damage is often a very wise thing to do.

Yes. Insurance companies can refuse you coverage for many reasons. For example, these may include a high-risk place (such as frequent wildfires), a home that’s in poor condition or even having multiple insurance claims in the past.

You should look at your policy on an annual basis. This way your coverage is secure to continue to satisfy your needs. If you’ve completed major renovations or have acquired some valuable new possessions, then you will have to update your policy to reflect the increased value.

![Compliant Drivers Program: Is It Legit for Driver Safety? [2025]](https://propinfo.site/wp-content/uploads/2025/12/Compliant-Drivers-Program-150x150.jpg)

Leave a Reply