You’ve got the van. The dream of the open road, already awake to a new view every morning, are so close by that you can almost taste the coffee by the campfire. But then, the real life questions come. The biggest one? How much is campervan insurance? It’s a question that can seem as big and as daunting as the landscapes to which you’re likely to make your ultimate summit hike. Don’t worry. We’re here to get you on the road: a roadmap.

This guide is your co-pilot. We’ll walk you through the curvy road of insurance costs to take apart everything you need to know. We’re going to discuss average prices and things to consider that you just cant see and expert’s advice on costs saving. By the following you will know just how to on the protection of your dwelling on the wheels without breaking the bank. So let’s get you insured and get you on your way.

Understanding the Basics of Campervan Insurance

First things first let’s be clear, campervan insurance is not standard car insurance so no campervan insurance covers your car for repairs, neither does it cover the breakdown of your car. Think of it as a hybrid policy. It is a combination of the features of auto insurance and elements of a homeowner’s policy. This is because your campervan is both a vehicle and a place of living.

Your policy needs to cover:

- The vehicle itself during transit.

- Your personal belongings inside.

- Liability if someone gets hurt in or around your van.

This unique combination is an important reason why getting the right policy is so important. A normal auto policy simply won’t cover the custom cabinetry, or the solar power system and the laptop you use for work. It’s a different beats like insuring a specialty vehicle. The principles are different from the classic car insurance, which focuses on agreed value and limited use for collectible cars.

Most campervans fall into the Class B RV insurance category. These are van chassis, either an articulated or articulated van, like Ford Transit, Ram ProMaster or Mercedes Sprinter, that have been converted for living. They are smaller than the Class A (bus-style) or Class C (truck-chassis) motorhomes, which also influences your final campervan insurance cost.

How Much Is Campervan Insurance on Average? The Numbers You Need to Know

So, alright, let us get to the main event. You want to know how much is campervan insurance. While there is no magic number here, we can put a pretty decent baseline on it. Most van owners in the United States can expect a cost of $800 to $2,500 per year.

This works out to approximately $70 to $210 per month.

Of course, this is a wide range. A weekend warrior of a basic build will pay a lot less than a full-timer in a high-tech, $150,000 plus conversion. Your personal details play a huge role. These figures are a starting point for your budget.

To give you more of a picture here is a breakdown of estimated annual motorhome insurance rates.

Estimated Annual Campervan Insurance Costs

🚐 Van Insurance Cost Comparison

| Driver & Van Profile | Low-End Annual Cost (Basic Coverage) | High-End Annual Cost (Full-Timer Coverage) |

|---|---|---|

| Part-Timer: 30s, clean record, $50k van value, 5k miles/year | $900 | $1,400 |

| Full-Timer: 30s, clean record, $90k van value, 15k miles/year | $1,500 | $2,500 |

| DIY Conversion: 40s, 1 minor ticket, $70k value, 10k miles/year | $1,200 | $2,200 |

| Retired Couple: 60s, excellent record, $120k van, 8k miles/year | $1,100 | $1,900 |

Disclaimer: These are estimates. Your actual camper van insurance quotes will vary.

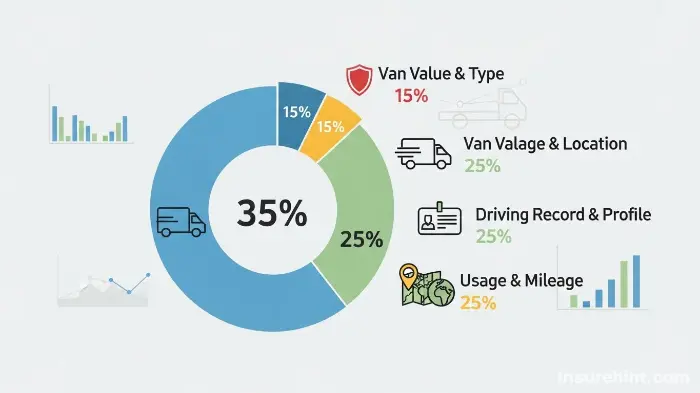

Key Factors That Determine Your Campervan Insurance Cost

So, why there is such a large price difference? Insurance companies are all about risk. They take dozens of data points to determine your likelihood of filing a claim or not. The higher the risk, the higher is your premium. Let’s dissect the most important factors that impact how much is campervan insurance.

The Type and Value of Your Campervan

This is one of the largest cost drivers. A completely new, professionally constructed Storyteller Overland will cost more to insure than a 10-year-old Ford Transit that you fixed up yourself.

- Vehicle Age & Value: The higher the market value of your van is, the more expensive it is going to cost the insurer to replace. A $150,000 van is more expensive to cover, for example, than a $40,000 one.

- Van Class: Class B campervans typically are the cheapest to insure of all the RVs. They are easier to drive and park than giant Class A motorhomes so you will get fewer accidents.

- Engine & Safety Features: A van equipped with modern safety features such as automatic braking, blind spot monitoring and anti-lock brakes, for example, can get you a small discount.

Your Driving History and Personal Profile

Insurance companies look squarely at you; the driver; just as much as they look squarely at the van. You are the fellow behind the wheel after all.

- Driving Record: This is huge. A few clean driving records, no accidents or traffic violations, will get you the best rates. Tickets for speeding or DUIs will make your premiums go through the roof.

- Age and Experience: The younger and less experienced (typically less than 25 years old) a driver is, the higher their risk is considered to be, and therefore the more they will have to pay. Rates tend to reduce with age and a long clean driving history.

- Credit Score: In several different states, insurance uses a credit-based insurance score. A better credit history usually gives us a better premium for credit history, as it’s viewed as a sign of responsibility.

How You Use Your Campervan (Usage)

how you intend to use your van is an important question that your insurer will ask. Be honest here as misrepresenting your usage can mean voiding your policy.

- Recreational vs. Full-Time: This is, by far, the most important distinction. Recreational use (weekends, vacations) implies the lower mileage, less use, and lower risk. If you’re living full-time in your van, you’ll need a “full-timer’s policy” and that policy is more expensive. It offers you liability coverage like a houseowneroipse, insuring you even while you are parking.

- Annual Mileage: The more you drive, the more accidents you are likely to have. Insurers will request an estimated annual usage of miles. A policy for 5,000 miles per year will be cheaper than 20,000 miles.

“The biggest mistake new van lifers make is under estimating their usage. Be realistic about being a vacationer or full-timer. The right policy means peace of mind and what’s more unpriced than that on the road.” – A seasoned van life blogger.

Your Location and Where You Travel

Geography is important for the world of insurance.

- Garaging Address: The zip code at which you have primary parking or storage of your van has an impact on your rate. An urban area where rates of theft and accidents are higher will have higher premiums compared to a quiet rural town.

- Travel Plans: Standard policies cover travel in U.S. and Canada. If at all you plan to drive your van into Mexico you will need to buy a separate, specialist policy, often referred to as the Mexico Tourist Auto Policy.

Your Chosen Coverage Levels

Insurance is not one-size-fits-all. You can customize your policy and the more coverage you prefer, the more it will cost. Key coverages include liability, collision and comprehensive. These are your building blocks of your policy. For some businesses, other forms of protection are just as important; for example, knowing what professional liability insurance covers for a consultant or provider of services.

Your Deductible Amount

A deductible is something that you pay yourself before your building insurance sets in. For instance, if you have a $1000 deductible and you do $5000 worth damage, you would pay the $1000 first and the insurance company would pay for the remaining $4000.

- Higher Deductible = Lower Premium: The higher your deductible the greater the financial risk you are willing to take initially, the better deal you will get from insurance company in form of monthly or yearly premium.

A Deep Dive into Campervan Insurance Coverage Types

It’s important to understand your policy to understand how much is campervan insurance and what it is that you are paying for. Let’s take a look at the type of cover you will see used for camper van insurance quotes because this is very common.

- Liability Coverage: This is also compulsory in almost every state. It includes injury or damage to your body and property belonging to others you’ve injured in an accident that was caused by your fault. State minimums are often very low so most experts recommend carrying much higher minimums to protect your assets.

- Collision Coverage: This covers the repair or replacement of your own van if it’s hit by another vehicle or object (such as a tree or guardrail) in a collision caused by one of drivers or even by the driver himself.

- Comprehensive Coverage: This is your “everything else” protection. Covers damage that happens to your van that does not involve non-collision events. This includes theft, vandalism, fire, hail, flooding or hitting an animal. For van lifers, this coverage is a must.

- Uninsured/Underinsured Motorist Coverage: What Happens if Someone without Insurance (or not enough Insurance) Hits You? This coverage covers your medical bills and van repair. It’s a crucial safety net.

- Personal Effects Property (PEP): This is one of the most important add-on. This includes your personal belongings in the van – laptops, cameras, clothes, gear etc. Standard policies may only provide $1,000-$2,000 so you will likely need to purchase more. Some insurers cover contents to $100,000.

- Vacation Liability / Campsite Liability: This protects you from liability in the way that your van is parked and used as a temporary residence. If one of your guests trips on your awning and gets hurt, this coverage can kick in.

- Emergency Expense Coverage: If your van is damaged by an incident that is covered and it becomes unmanageable, this helps to pay for temporary accommodation, transport as well as food while the van is getting repaired.

- Roadside Assistance: A must have for any traveler. This includes towing, flat tire changes, jump starts, and fuel delivery perchance you get stranded. Look for a plan that offers towing services specifically for RVs as your van may not be defended with the standard towing services. The cost of providing this is usually minimal, especially compared to the specialized coverage required by other vehicles say when you need to get motorcycle insurance.

DIY Van Conversion Insurance

This is the big one. You’ve invested your heart, soul and savings into your dream van. Now, how do you insure something that did not roll off the factory floor? Getting DIY van conversion insurance is a tricky task, however, it is absolutely possible with the right strategy.

Insurers are afraid of self-builds because there’s no standardized “Blue Book” value and there’s no way they can insure the quality of the electrical or plumbing work. But don’t despair. Here is the sure-fire route to get your custom build covered.

1. Insure It During the Build Phase

While your van is just a cargo van, it’s relatively easy to insure. Get an ordinary commercial policy. This is for protection of the van itself in case it is stolen or involved in an accident during the building process. For someone running a small business, this is akin to finding the right commercial auto insurance to insure your work vehicles. This is your first step.

2. Document Everything

This is not optional. You have to make a detailed history of your build.

- Keep all receipts: Any screw, solar panel, wood etc.

- Take photos and videos: Document every stage of the build process.

- Make up a spreadsheet: Keep track of everything you spent, as well as how many hours you worked. This does prove the value you’ve added.

3. Get It Professionally Appraised

Once the conversion is done you need an independent and certified appraiser to measure its value. They will examine your documentation and inspect the van in order to offer you a “Stated Value” or “Agreed Value.” This document will be your proof to the insurance company.

4. Re-title It as an RV/Motorhome

This is the key that opens up proper RV insurance. You have to go to your local DMV and change the vehicle’s title from a cargo van to a motorhome. The requirements for obtaining one vary by state, but you usually have to prove that it has some combination of the following:

- A sleeping area

- A cooking appliance

- A refrigerator

- A self-contained toilet

- Potable water supply

Check your state’s DMV website for the specific criteria. An excellent state specific resource of vehicle laws is the AAA Digest of Motor Laws.

5. Shop for a Stated Value RV Policy

With the help of your new RV title along with professional appraisal, it’s time to shops for the right insurance. You’re not asking for cargo van insurance anymore, you’re asking for Class B RV insurance with a “Stated Value.” Companies such as Progressive and Roamly and National General are more comfortable with well-documented DIY builds.

This process is more work but it’s the only way to get your entire investment (and not just the base van) protected. Finding the right policy is a detailed process that is similar to comparing the pros and cons of term life insurance vs. whole life insurance to secure your family’s future.

How to Get Cheap Campervan Insurance: 10 Actionable Tips

Everyone wants to save money. Luckily, there are so many ways to reduce your premium and not compromise your needed protection. Follow these tips to find cheap campervan insurance.

- Shop Around and Compare Quotes: This is the one most important way to save money. Don’t settle on the first offer you’re given. Get quotes for a minimum of 3-5 companies. Use on-line comparison tools; speak to agents that specialize with RVs.

- Increase Your Deductible: Imagine having a very good emergency fund, why not increase your deductible amount from $500 to $1000 or even $2000. This can deduct from your yearly premium 15-30%.

- Bundle Your Policies: Most of the major insurance companies offer some sort of multi-policy discount. If you can bundle your campervan insurance with your daily driver auto policy or home/renters insurance policy, then you can usually save 10-20%. This is one of the best tips for lowering your car insurance cost.

- Maintain a Good Driving Record: This is simple but powerful. Avoid accidents and Traffic Tickets. A clean record for 3-5 years is in the lowest risk category.

- Take a Defensive Driving Course: Many insurance companies offer a discount (5-10% in most cases) for taking an approved defensive driving course/ RV safety courses. Often the low cost of the course will pay for itself in the first year.

- Install Safety and Anti-Theft Devices: Tell your insurer about any safety features that you have. This includes GPS tracking, alarms and steering wheel locks and the modern versions of driver assist functionality.

- Choose the Right Coverage: Look at your policy every year. Do you really need $5000 in emergency expense coverage – if you have family around? Don’t pay for coverage you will not use, but do not skimp out on important things like liability and comprehensive.

- Improve Your Credit Score: If you live in a state where credit makes a difference to insurance rates, then work on improving your credit score. Over time paying bills on time and keeping credit card balances at a lower level can result in lower premiums.

- Ask About All Possible Discounts: You won’t get discounts if you don’t ask. Inquire about discounts for:

- Belonging to an RV club (good Sam or FMCA).

- Being a good student (if it applies).

- Being retired or a senior.

- Having a low annual mileage.

- Having no claims in your history.

- Pay Your Premium in Full: If possible to afford an annual or 6-month premium, pay your premium all at once at the start of the year. Most companies do impose administration fees for monthly instalment plans.

Comparing Top Campervan Insurance Providers

There is a larger and larger market for campervan insurance insurance and you don’t have to make do and beg. Some of the companies are traditional giants, and some are specialists. Here’s a look at a few top names.

- Progressive: One of the biggest RV insurers in the country. They have a reputation for being friendly to DIY conversions (if documented) as well as having a large array of discounts and coverages such as pet injury coverages.

- Roamly: Built by van lifers for van lifers. Roamly is unique as their policies explicitly state that it’s okay to rent out on your van on things like Outdoorsy without having to get a separate commercial policy. This is a huge benefit to many owners.

- Good Sam: Insurance agency affiliated with the Good Sam RV Club. They work with insurers such as National General and The Hartford to provide policies specifically for RVers with discounts for club members.

- National General: A big gun in the RV arena, with specialty full-timer policies and a wide range of coverage options. They can be a good choice for high value conversions often.

- State Farm: Traditional insurer that has a huge network of agents. Many traditional insurers such as State Farm have strong RV policies. While they are a household name when it comes to selling auto and home, it’s worth noting the variety of what they have to offer, and that sometimes can be bundled. For example, it is not unusual for customers to shop their State Farm life insurance options simultaneously with the preparation of other types of long-term policies.

When you’re shopping, don’t look at just one thing – the price. Read some reviews, compare the coverage details. A great resource for this is The Zebra’s guide to RV insurance which is unbiased in comparison.

So, How Much Is Campervan Insurance for You, Really?

We’ve covered a lot of ground. We’ve looked at averages, factors which influence it and ways to save. But the final answer to the question of how much is campervan insurance is individual. It is a matter of having a unique combination of your van, your history, your location and your choice.

Let’s walk through a quick example.

Imagine you are Alex, a 38-year-old remote worker living full-time in a self-converted 2021 Ram ProMaster worth $80,000. Alex has a clean driving record, and travels about 15,000 miles a year traveling throughout the country.

- Policy Type: Full-Timers Policy.

- Key Coverages: High liability ($250k/$500k), collision and comprehensive with $1000 deductible, $20,000 personal effects & roadside assistance.

- Estimated Cost: Alex would probably be quoted $1,800 to $2,600 per year ($150 – $217/month).

For full-timers such as Alex, van insurance is only one part of the puzzle. You will also need to consider the coverage you have on the road – looking into plans such as United Healthcare insurance or the specific dental plans like Humana dental insurance that have networks all over the country. It’s all part of a secure mobile lifestyle.The process of getting quotes and comparing them is not so different from the diligence that may be required in looking for affordable business insurance – you must look through your risks and coverage needs carefully here.

“Your campervan is not just a car, it’s your home, your office and your ticket to freedom. Insuring it properly isn’t an expense – it’s an investment in your dream.” – An RV Insurance Specialist.

Conclusion: Your Roadmap to the Right Policy

Going on the van life journey is a fun adventure. Navigating the world of insurance may not look like a path to success but now you have a clear map. We’ve seen that the answer to how much is campervan insurance isn’t a number, but a range based on the basics of your campervan, your life and what type of cover you want.

The average cost of campervan insurance is between $800 and $2,500 a year. But you are not an average. You can gain control over this cost. By keeping your driving record clean, by selecting the appropriate deductible, by bundling your policies, and most importantly by getting a quote from several different sources, you will be able to find a policy that fits your budget. Whether you have a factory-built rig out there or our unique DIY van conversion, the right protection is out there.

Your adventure is waiting. Use this guide to obtain the peace of mind that you need. Take the time to get the right coverage and then you can actually focus on the road ahead. Finding the answer to the question of how much is campervan insurance is the final step before you can turn the key and hunt down that horizon.

Short Frequently Asked Questions (FAQ)

Yes, generally. Campervan insurance covers not only a standard car policy, but the living quarters and once again personal belongings and in many cases offers more liability limits. This comprehensive coverage does cause the campervan insurance cost to be slightly more expensive.

No, you should not. A personal auto policy is not intended to cover the custom conversion work, content of your van, and liability risks of that it is a living space. You must have a special RV/campervan policy.

Yes. To drive on the public roads of almost all states, you are legally required to have liability insurance. Plus, you’ll want comprehensive coverage to cover potential damage to your van from theft, weather or other damage while it is in storage.

Full time van lifers require a “Full-Timers Policy.” This provides wider scope of liability for the insurance which works like homeowner’s insurance and will ensure you have a cover even when parked. It also usually has increased limits for personal effects and emergency expenses. Look for providers who are well-versed in doing so such as National General or Roamly.

When at the build phase, you should have the base vehicle covered with a commercial auto policy. A form of temporary car insurance or commercial policy is used by some builders before it is re-titled as an RV. This is to protect the van itself from theft or damage before the conversion value has been added and officially appraised.

![Compliant Drivers Program: Is It Legit for Driver Safety? [2025]](https://propinfo.site/wp-content/uploads/2025/12/Compliant-Drivers-Program-150x150.jpg)

Leave a Reply