Ever look at one of the insurance agency owners with their corner office and wonder what their take home pay really looks like? The question of how much do insurance agencies make is a common one, filled with images of high commissions and long-time wealth. But is that the reality?

After more than 10 years in and around the insurance world, I can tell you the answer is complicated. It’s a “yes, but…” situation. Yes, the opportunity to earn a lot of money is very real. But it’s not a golden ticket. It’s a business that was built on grit, relationships and smart financial management.

In this undisputed and complete guide, we’re going to have the curtains back. We’ll break down everything from the structures of the commission, to the costs of running these agencies, to the key differences between the models of the agencies. By the fleshy, you’ll have a crystal-clear picture of agency profitability as well as the life of a life insurance agent real life.

The Short Answer: A Look at the Numbers

Get Over the definitions to get to the point. The income of an insurance agency owner can vary from $50,000 annually in the early days, to well over $1,000,000 annually for a large agency that’s been established for a long time. That’s a massive range, right?

This wide spectrum is in line with national data. For example, the U.S. Bureau of Labor Statistics provides the median pay for insurance sales agents, but this number often combines new insurance sales agents with those that have been established and don’t accurately reflect what an insurance agency owner can earn.

That’s because an “insurance agency” is not one entity. It can be a one-man shop with a home office or a company with dozens of locations and dozens of employees. To really get a proper understanding of how much insurance agencies make, we have to dissect the finance anatomy of an insurance agency.

Deconstructing an Insurance Agency’s Revenue

An agency’s income is not like your average salary. It’s an actual flowing of money from various sources, mainly commissions. These can be put into two main categories every agent in the making needs to know.

First-Year Commissions: The Initial Payout

When a new policy is sold by an agent, the insurance company will pay him a percentage of the premium collected. It is this first-year commission. It’s the instant reward for their sales effort.

- Property & Casualty (P&C) Insurance: This is auto, home and business insurance. First year commissions are usually in the range of 10% to 20%.

- Life & Health (L&H) Insurance: So this is the point where you see the big numbers. First-year commissions on life insurance policies can be 80 percent to 120 percent of the first year’s premium. For instance, if the policy is sold for a $2,000 annual premium, he could get $1,600 or more in advance. This high commission structure is one of the greatest differentiators in trying to compare the choices between types of life policies.

This initial payout is very important for cash flow purposes, especially for newer agencies that are struggling to get off the ground.

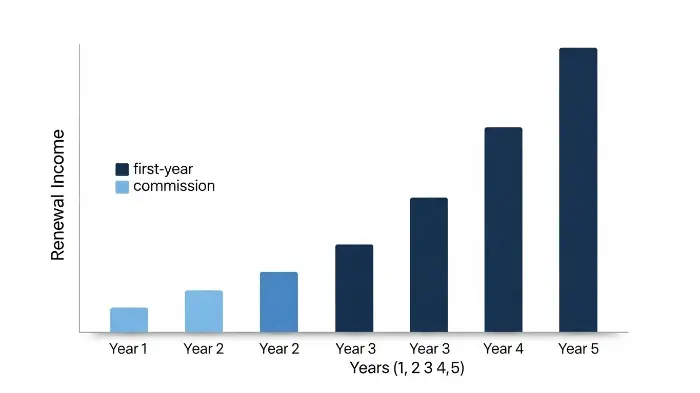

Renewal Commissions: The Key to Long-Term Profitability

This is the holy grail of insurance business. Renewal commissions: The commissions that an agency gets for every year that a client maintains their policy. While the percentage is less than the first year commission (often 2% to 15%), this is what creates sustainable and long-term wealth.

Think of it like this:

- Year 1: You sell 100 auto policies. You are paid a nice upfront commission.

- Year 2: You sell 100 more policies. You get the up front commission for those as well as the renewal commission from last year’s 100 policies.

- Year 3: You sell another 100 policies you now have renewals on 200 policies.

This is the compounding effect by which agency owners develop a valuable “book of business.” It’s a powerful engine for predictable revenue that directly, if by the long haul impacts how much do insurance agencies make.

Contingency Bonuses and Profit Sharing

For well run agencies there’s another layer of income. Carriers tend to give annual bonuses to their top performing agencies. These are based on two important measures:

- Growth: How much new business did the agency write?

- Profitability (Loss Ratio): How profitable was the business for a carrier? Did the agency’s clients make fewer claims than would be expected?

These bonuses are potentially large, sometimes in the form of extra 10-20% of the total annual revenue for the agency. It’s the carrier’s way of saying “thank you” for taking them good profitable clients.

The Other Side of the Coin: Agency Expenses

Gross revenue is a vanity measure. Profit is sanity. Before an agency owner takes any single dollar home, he or she has to pay the bills. Understanding these costs are critical to figuring out how much do insurance agencies make in net profit.

Startup Costs vs. Ongoing Operational Costs

Getting started isn’t free. New agency owners are faced with a number of one-time costs:

- Licensing and legal fees.

- Office furniture and equipment.

- Initiative marketing and branding.

- Website development.

- Down payment on an office lease.

These first hurdles are common for any new venture and things such as the resources from the Small Business Administration (SBA) can be of invaluable use in planning your initial budget and business strategy. Once the doors are open, the monthly operational costs start kicking in. For every new venture, finding ways of managing startup costs is a good way to start with your path to long-term viability.

Common Monthly Expenses for an Insurance Agency

The monthly nut can be surprisingly high. Here’s a look at what a small-to-mid-sized agency might spend.

💼 Insurance Agency Operating Expenses

As you can see, the overhead burns up quickly. An agency taking in $30,000 a month in revenue and having $20,000 in expenses had a $10,000 profit before owner’s salary and taxes.

The Cost of People: Staff and Agent Commissions

Your biggest asset, as well as your biggest expense will be your team.

- Customer Service Representatives (CSRs): They are the backbone of the agency and every day deal with client requests, changes, and issue high retention rates. They are generally floored employees.

- Producers (Sales Agents): These are the hunters. They are normally remunerated with a reduced base salary on top of a large share of commission that is split on the business they write.

A smart agency owner knows that investing in good people pays dividends, but it’s a major line item that affects how much do insurance agencies make.

How Much Money Do Insurance Agencies Make? Captive vs. Independent Models

All agencies are not created equal. There is no bigger determinant of the amount of money he or she can make and the day-to-day operations of the business than the business model that an owner of a business chooses to use. Let’s examine the two paths in a major way.

The Captive Agent Model (e.g., State Farm, Allstate, Farmers)

A captive agent is one who works for a single insurance carrier. You are, in a way, a representative of the one brand.

Pros:

- Brand Recognition: You get to use a household name and that makes marketing easier.

- Training and Support: Captive carriers offer a great deal of training, and often, financial support at the outset of the venture.

- Lead Generation: Some carriers have leads that they give to their agents.

- Lower Overhead: the parent company can subsidize office expenses, marketing, or technology.

Cons:

- Lower Commissions: This is the real one. You give in support in exchange for a smaller piece of the pie.

- Limited Products: You can only sell the products your carrier offers. If they have un-competitive rates for a certain client, you have no other options.

- Less Ownership: You’re Building the Carrier’s Brand Not your own. Your book of business may not actually be your book of business to sell. When you look into options you’ll be working within this single-carrier framework.

The captive model is often a great starting point into the industry. The question of how much do insurance agencies make in this model is too often answered with “less per policy, but with more support to sell in volume.”

The Independent Agent Model

An independent agent is a real entrepreneur. They represent several insurance carriers and are able to shop around for the best coverage and price for their clients.

Pros:

- Higher Commissions: You have straight contracts with the carriers and maintain a much higher percentage of the commission.

- Product Diversity: You can offer dozens of different carrier’s policies, and you always have a competitive option available. This is great for the client who is looking for anything from common health plans to more complicated commercial policies.

- True Business Ownership: You are developing your own brand as well as a saleable asset. So your book of business is your book.

- Flexibility: You are the boss. You are free to set yourself on your own hours, marketing strategies, and company culture.

Cons:

- Higher Startup Costs: You are liable for 100% of the startup and operational costs.

- No Brand Hand-Holding: You have to build your agency’s reputation from scratch.

- Getting Carrier Appointments: It can be difficult for a new independent agent to get contracts with top-tier carriers.

For independent agents, the sky is the limit. Their success or failure is totally up to their shoulders. This model usually contain the most high end answer to the question how much do insurance agencies make which holds true for the longer term purposes.

The Effect of Specialization on Agency Earnings

Generalist agencies are sometimes able to do well, but specialists often do better. Focusing on a specific niche enables an agency to become an agency of choice and often results in better referrals and higher profitability.

Property & Casualty (P&C) vs. Life & Health (L&H)

Most agencies specialize in one of these two general areas, but some agencies perform both.

- P&C Focused Agencies: These are high volume businesses. You have to sell a lot of auto, home and business policies to make a lot of money. Their ability to be successful is highly dependent on offering amazing service to retain clients. A good P&C agency can cover everything from standard auto insurance to specialized insurance coverage for a new motorcycle.

- L&H Focused Agencies: This is often a lower volume and high margin game. Selling one large life insurance policy will bring in more commission than 50 auto policies. It’s a more consultative sale aimed at financial planning and agents often support clients through different health plans. This specialization directly influences how much do insurance agencies make.

Niche Markets: The Way to Higher Margins

Driving up more anybody, you can so, just breakdown and it can be incredibly lucrative. An agency to become an expert in a particular industry or demographic is able to take command of such a market.

Examples of markets with profitability niches:

- High-Net-Worth Individuals: Offering complete insurance solution to rich families.

- Trucking Companies: A complicated field that needs expert knowledge of commercial vehicle policies.

- Restaurants and Bars: Needs unique knowledge of liquor liability and other unique risks.

- Hobbyist Vehicles: Enthusiastic owners can afford to spend money on knowledge. Agency can become the go-to place for the owners of unique and classic cars.

- Unique Situations: There are even agents who specialize in finding a solution to those who need short-term auto insurance coverage.

By specializing, you have less competition and more value proposition to offer the market which in turn will help you command more of it and, more importantly, more profit.

A Day in the Life of a Life Insurance Agent

But to really understand the “how” behind the money it’s important to have an understanding of the daily grind. The job of a life insurance agent, in particular, is a very unique combination of entrepreneurship, sales, and financial advising. It’s far from a typical 9-to-5 job.

A Typical Day Could Possibly Look Such:

- Morning (8:00 AM – 12:00 PM): Best prospecting time. The day begins with follow-up emails and phone calls towards potential clients, and networking via platforms, such as LinkedIn. The goal is to establish appointments. This is the “hunting” phase: no appointments, no sales.

- Mid-day (12:00 PM – 2:00 PM): This could be a networking lunch with a financial planner or CPA in order to develop relationships to generate referrals. Or it could be utilized for administrative work: preparing quotes, applications and underwriting requests.

- Afternoon (2:00 PM – 5:00 PM): Meeting with clients. This may be a virtual call or an in-person meeting to complete a needs analysis, provide a proposal, or finish an application.

- Evening (5:00 PM onwards): A very large number of client meetings occur after regular work hours to accommodate their schedules. This is a very important aspect to the life of a life insurance agent: flexibility is the name of the game.

It’s a career of tremendously high highs and low lows. The high of bringing a check with a death benefit through to a family in grief, knowing that you made a real difference, is profound. The “low” constant rejection and deals falling through can be demoralizing.

The Realistic Profit Margin for an Insurance Agency

So, what’s the bottom line? After all revenue is collected and all expenses are paid what percentage is left is left as profit for the owner? According to financial experts at Investopedia, a healthy profit margin for a service based small business can vary greatly but hitting a sustainable percentage is a key indicator of success.

- Years 1-3: Often an agency owner makes very little profit, or even loses money, as they invest so much in growing and building their first book of business.

- Years 4 – 7: As Renewal commissions build up and the agency gains traction, a profit margin of 10% to 20% is achievable.

- Established Agencies (8+ years): An established, well run agency can have a net profit margin of 20% to 35% or higher.

On $1,000,000 in gross revenue, the agency owner publishes 25% profit margin means $250,000 before gives personal income taxes. This journey helps to highlight that the life of a life insurance agent and agency owner is a marathon and not a sprint.

Factors That Determine the Amount Insurance Agencies Make

As we’ve seen, there are a lot of variables that are at play. You are seeking a ultimate breakdown, so these are the most critical factors that make up how much do insurance agencies make.

- Agency Model: Independent agents have a higher ceiling on earnings but carry all the risk.

- Book of Business: Size and more importantly retention rate of your existing client base is the number one driver of stable income.

- Product Mix: A good mix of P&C and L&H or specialization in some profitable niche will play a crucial role in increasing the revenue.

- Lead Generation: A predictable and scalable method for an agency to generate new leads will always have an advantage over an agency that generates only referrals.

- Location: An agency located in a high population and high income area has a larger number of potential clients.

- Staff & Producers: The quality of your staff directly affects growth while bringing client satisfaction.

- Expense Management: A lean, efficient operation will always be more profitable than a bloated one. Smart spending is key.

Ultimately, how much do Insurance agencies make boils down to running a tight ship and never losing their minds with regards to both sales and service.

Frequently Asked Questions (FAQs)

Most of the industry experts agree that it takes 3 to 5 years for a new insurance agency to become consistently profitable. The first few years are focused upon building a book of business with the growing renewals income often lagging behind as expenses.

A book of business is an assembly of all the policies an agency is in charge of. It’s the agency’s biggest asset. It’s usually worth between 1.5 and 2.5 times the amount of annual commission it renews. So, a publishing book with renewals of $200,000 per year could be valued at $300,000 to $500,000.

While in theory possible, it’s very hard to accomplish. The most common route is to work as a producer or CSR first, working at an existing agency for a few years. This way you can learn the business, become licensed and understand the business industry before you take on the risk of ownership.

In smaller agencies yes, the owner is almost always the top producer. In larger agencies the role of the owner is often transferred from selling to managing: hiring, training, setting strategy and carrier relationships. However, the vast majority of successful owners never lose their sales touch.

The greatest challenge is in balancing the “two headed monster”: of acquiring new customers and at the same time delivering great service to existing customers so the retention rate remains high. Neglecting either side can quickly sink an agency.

Conclusion: So, How Much Do They Really Make?

The road to a seven-figure insurance agency is paved with countless hours, smart investments and a complete focus on the client. The question, “how much do insurance agencies make?,” does not have a simple answer because the result of it is directly linked to the ambition and business acumen of the owner.

A new Captive agent may have difficulty clearing $60,000 in his or her first year, while an established independent agency owner could be making more than $500,000 out of a mature book of business. The key is in the fact that this is a long-term game. The real money isn’t in the quick and flashy first year’s commission, it’s in the slow and steady compounding power of the renewals.

It’s a business where you can create a true legacy and an income stream that can be relied upon, for the next few decades. But it requires patience and the unceasing desire to be successful.

How do you feel about the insurance industry? Vote your experience and comment or not comments below. Ultimately, understanding the variables is the first step to understanding how much do insurance agencies make.

![Compliant Drivers Program: Is It Legit for Driver Safety? [2025]](https://propinfo.site/wp-content/uploads/2025/12/Compliant-Drivers-Program-150x150.jpg)

Leave a Reply