You own your home. You are in charge of your castle, your ivory cave. But there is a ticking timebomb hidden beneath your feet. It’s your sewer line. If there is any break here, it will create a huge mess. Thus, it can also drain your bank account. This is when Sewer Line Insurance comes in. Which is what many homeowners do not think of. That is until a disaster strikes.

This guide will help you to decide whether is sewer line insurance worth it for you. We are going to learn about what is covered by it. We will also cover costs that are involved. At that point you can make an educated choice. It deals with safety of property and with yourself. For new entrepreneurs, it is important to be thinking about protection, and seeking affordable business insurance is a similar step that should be taken first to protect assets affordably.

The Unseen Problem Below Your Yard

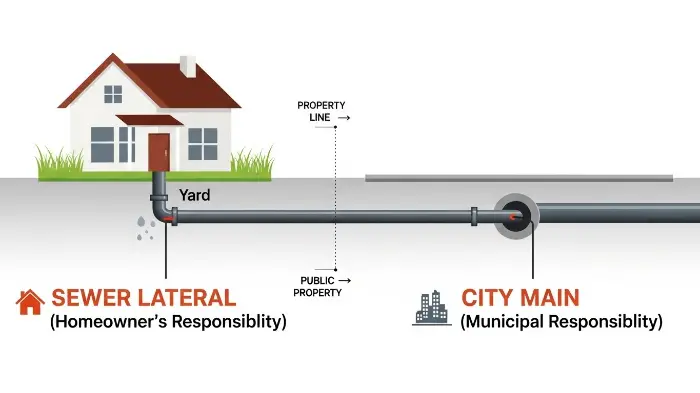

Most people never see their main sewer-line in their life. It is underground running from your house. It is connected with the main sewerage of the city. Or, it would lead to your septic tank. It is out of sight and hence it is often out of mind. However, this pipe works hard each and every day. It takes away all your wastewater. A problem here can a nightmare come true.

Why You Should Care Now

Imagine your toilets can not flush out. Or perhaps you see water coming out of your basement smelling pretty foul. Here are indications that there is huge sewer line problem. The repairs can be extremely costly. We are talking thousands or even tens of thousands of dollars. Therefore, it would be important to know your options in advance. This includes knowledge of potential solutions with insurance.

What Exactly is Sewer Line Insurance? A Deeper Look

But let’s break this down into very basic terms. One such insurance protection plan is Sewer Line Insurance. It helps to pay for the lack of your sewer line being repaired or replaced. This is the line coming from your home’s exterior to what is major public main. It’s not included in the traditional homeowners insurance. This is a very important distinction to understand.

Defining Your Responsibility: Where Your Line Begins and Ends

As a homeowner your responsibility is fairly obvious. You own the sewer lateral. This is the pipe that is located at your property. It is the plumbing of the home to interconnected to the sewer that is in your home. Any break, clog or failure on this line is up to you to deal with. The city is only responsible for the main line which typically lies under the street. This hole in the coverage is where a lot of homeowners receive a nasty surprise.

Why Standard Homeowners Insurance Usually Says “No”

You may consider that your homeowners policy has you covered. Unfortunately, it is not often the case. Standard policies typically cover out sewer line that are damaged. Why? They often have the perspective of a maintenance problem. Damage from wear and tear, rust, or roots of trees is not normally covered. Your policy may cover water backup within your home. But it won’t pay to dig up your yard and do any repairing of the pipe itself. Considering what is and isn’t included in normal policies is also critical when looking at something like the State Farm Life Insurance alterations for your family’s future.

Common Culprits: What Causes a Broken Sewer Line?

Don’t fifty-two or do over the problem of Sewer lines. They are caused by a variety of factors. Knowing these down can help you to even out your own level of dangerability. Furthermore, it helps you understand why you might be a good idea to have insurance.

The Silent Intruder: Are Tree Roots in Sewer Line Covered by Insurance?

Tree roots are a major cause of sewer lines damage. They seek out for water and nutrients. There can be no better source than your sewer line. The roots can find minute cracks in the pipes. Then, they force their way inside, enlarging in size over time. This can lead to blockages which break the pipe eventually.

Whether sewer lines with tree roots had been covered by insurance depends on the policy. Many specialized sewer lines insurance plans do cover this. However, a typical homeowner’s policy will almost certainly not.

“An Ounce of Prevention is Worth A Pound of Cure. This is particularly so for things we cannot see, such as the pipes underneath our houses.” – A Veteran Plumber

Age and Material Breakdown

Older houses tended to have older pipes. These may manufactured from clay or cast iron. Over decades these materials are degraded.

- Clay Pipes: These are brittle. They can easily cracked with the pressure of change of soil or tree roots.

- Cast Iron Pipes: Cast iron pipes have the ability to rust and corrode from the inside out. Eventually, they become thin and weak and collapse.

If your home was built before 1980 you have what is likely to older pipes. Your chances of a failure are much greater.

Shifting Soil and Ground Movement

The ground is not static. It is shifted, settled and moved in the course of time. This can occur because of heavy rains, freeze-thaw cycles or any construction in the immediate vicinity. This movement causes tremendous pressure on buried pipes. As a result, the pipes might crack, bend or get disconnected. This is a frequent reason for a broken sewer line covered by insurance policy under a separate policy.

Clogs from Grease, Debris, and Foreign Objects

You know what goes down your drain. Grease, fats and oils should never be poured down the drain. They solidify in the pipes causing stubborn clogs. In addition, flushing things like wipes (even “flushable” ones), paper towels or feminine hygiene products can lead to severe blockages. Over time these clogs can cause a pressure to build and River burst in the pipe.

Visualizing Potential Sewer Line Threats

This section helps you visualize the common risks to your underground pipes.

🔧 Common Sewer Line Threats

Tree Root Invasion

Roots seek water, infiltrating and crushing pipes. This is a leading cause of sewer line failure in older homes with large trees.

Pipe Aging & Corrosion

Older cast iron or clay pipes degrade over decades. They become brittle and can collapse without warning.

Ground Shifting

Freeze/thaw cycles and soil settlement put immense stress on pipes, causing cracks and misalignments.

Severe Blockages

Accumulated grease and improper disposals can create solid clogs, leading to pressure buildup and pipe bursts.

The Financial Blow: Uncovering the Real Cost of a Sewer Line Failure

The largest reason to consider sewer line insurance is the cost of repair. It is almost always more than what is expected by homeowners. Let’s put some of the potentially blooming expenses together.

A Breakdown of Repair Expenses

The itemized final bill is not a single item. It is a combination of a number of services.

- Diagnosis: First thing a plumber has to do is to be sure of the problem. This usually requires an inspection by a camera. They are used to feed a special camera down the line. This service alone can cost $300 – $1,000.

- Excavation: If the pipe requires replacement, they have to dig. Excavation is a time-consuming and costly endeavor. It is very easily several thousand dollars, depending on the depth of the pipe and the length of the pipe.

- Pipe Repair/Replacement: The actual pipe materials, human labours to correct or replace the portion adds to the cost. This may be another several thousand dollars.

- Restoration: Once the pipe has been taken care of, your yard is a mess. The expense of repairing your landscaping, driveway or walkway can be high. This is the part that is usually overlooked.

Traditional vs. Trenchless Repair Methods

Technology has afforded a less invasive choice. It is referred to as trenchless repair.

- Traditional Repair: This includes excavating a large trench along the whole of the failed pipe. It is destructive to your property, but sometimes you will need it. Costs can start from $5,000 and go up to $25,000 or more.

- Trenchless Repair: There are multiple methods available to fix the line using trenchless repair such as pipe lining or pipe bursting that eliminate the need for a large trench. They are less destructive but can actually be costly. You can expect to pay anywhere from $4000-$15,000.

No matter what the method, it’s a heavy cost. It is an expense that sewer line insurance is meant to counteract. Much like a good health insurance, such as a Humana Dental Insurance plan, that saves you from the unexpected dental bill, this insurance saves your property.

Diving into the Details: What Does Sewer Line Insurance Cover?

Not all policies are made equally. When you are looking at sewer line insurance coverage you have to read the fine print. Hard details such as these are important for understanding whether or not a policy might be right for you.

Covered Perils: What Is Typically Protected?

Ray Woodbridge, an American product manufacturer in the fur trenches industry, states that a good water and sewer line insurance policy will typically cover damage as a result of:

- Wear and tear

- Rust and corrosion

- Shifting soil

- Tree root intrusion

- Cracks, leaks, and breaks

- Pipe collapse

The policy should cover the cost to excavate and repair the pipe for repairing the pipe and returning your property to its previous state.

Common Exclusions: What Is Not Covered?

You will also have to know about exclusions. These are situations that the insurance company will not pay. Common exclusions include:

- Pre-existing conditions: Issues before you purchased the policy

- Negligence: Injury you caused by flushing things that you shouldn’t in the first place or failed to take care of an issue that you knew was there.

- Septic systems: Most policies will not cover an individual’s septic tank or drain field as insurance policies only cover the line to the city main.

- Damage from earthquakes or floods: This is typically covered in separate out-of-the-book specific insurance policies.

It’s always a good idea to make sure that all these points are clarified before you buy a policy. Just like you would compare PPO and HMO plans with United Healthcare Insurance, you need to compare the specifics of each sewer line plan.

Understanding Deductibles and Coverage Limits

Like other insurance, these policies have deductibles and limits.

- Deductible: This is the out-of-pocket policy amount you will need to fund before your insurance will start reimbursing for the damages. It might be $250, $500, or more. An increased lower deductible often means an increased monthly premium.

- Coverage Limit: This is the maximum amount that the policy will compensate for one claim or yearly. A typical limit might be $10,000 or $15,000. Make sure that this limit is high enough to allow for a major repair in your area.

The Big Question: Is Sewer Line Insurance Worth It for You?

Now we are getting to the heart of the matter. You know the risks. You know the costs. So, is sewer line corporate insurance worth it? The answer is totally dependent upon your personal situation and how much of a risk you are willing to take.

The Case FOR Getting Sewer Line Insurance

There are strong arguments to made for getting this coverage.

- Peace of Mind: Knowing you are covered for the possibility of a big bill of $15,000 can help you sleep at night.

- Budget Protection: An explosion of soaring repair costs can destroy your budget. A low monthly premium is much easier to handle.

- Older Home: A pipe failure is much more likely with homes that are more than 30 years old.

- Large Trees: If your yard has some large, mature trees in your yard close to the sewer line then your chances of root intrusion are very high.

For many, the low price this way (often just $10-$20 a month) is a small price to pay for this kind of security. It’s a financial tool in that same way you might consider Term Life Insurance vs. Whole Life Insurance in order to protect your family.

“The wise man builds his house on rock. The wisest man also insures the plumbing.” – Modern Financial Proverb

The Case AGAINST Getting Sewer Line Insurance

On the flip side of the coin, though, it’s not going to be for everyone.

- Newer Home: If your home is new, and the pipes are made of modern day PVC, then the risk is very low for the next couple of decades.

- No Trees: If your property is void of large trees then you are eliminating one of the main risk factors.

- Sufficient Emergency Fund: If you possess a substantial emergency fund ($20,000+) and would rather “self-insure” then you may be able to avoid paying for the monthly premium altogether.

- Low Premiums vs. Potential Payout: You may be paying premiums for years and never access the policy. Some people would rather live by that chance. For those with unique and high-value assets, self insuring minor risks while securing specialized coverage, such as classic car insurance as to major risks can be a valid approach.

Your Personal Sewer Line Risk Assessment

Use this interactive-style checklist to gauge your personal risk level. The more checks you have, the more you should consider coverage.

Finding the Right Policy: How to Choose the Best Water and Sewer Line Insurance

If you have decided that the protection is worth it, then your next step is to find the right policy. You do have a few options to go in. The choice between the two is as important as the choice of commercial auto insurance for a business vehicle; the details make a difference.

Standalone Policies vs. Homeowners Endorsements

Two basic methods of coverage are possible:

- Endorsement (or Rider): This is an option on your current policy of homeowners insurance. It’s convenient as you deal with one company. It may also be cheaper. Ask your current insurance agent whether they carry this.

- Standalone Policy: This is a stand-alone policy that is independent of a third-party company. These companies specialize in the utility line coverage. Their policies may be more inclusive and have better limits. You will have another bill to pay, but you perhaps get better protection.

Researching Top Providers

A number of reputable companies provide this type of coverage. Some are big names in insurance while others are specialists. It is very important to make a comparison between them. Look at such companies as HomeServe, American Water Resources and others. Read customer reviews. Check their ratings on the Better Business Bureau. For more information on dealing with plumbing issues the Plumbing-Heating-Cooling Contractors Association has great resources for consumers.

Does State Farm Homeowners Cover Sewer Line Replacement?

This is an extremely common question. Generally, the answer is no, a standard State Farm homeowners insurance policy is not a policy of sewer line replacement due to wear, tear, or tree roots.

However there are State Farm and many other major insurers who do offer an endorsement for this. It may referred to as “Service Line Coverage” or something of that nature. So, although it is not covered by the base policy, often you can add on the protection. You have to be very specific and ask for and add this endorsement to your policy. It is not automatic.

Key Questions to Ask Before You Buy

When shopping out for a policy prepared. Have a list of questions to asked.

- What is the precise amount of coverage per incident?

- What is the limit of the annual coverage?

- What is the deductible?

- Does it provide for tree root intrusion?

- Does it cover pre-existing conditions where you did not know?

- Who selects the contractor for repairs? Do I have a choice?

- Does coverage include excavation of to public sidewalk or roads if needed?

- Why a claim should raised and how is the claim raised?

Getting some concrete answers to these questions will help you to find the best water and sewer line insurance to get your needs met. Lowering insurance costs is a universal goal and the same principles of asking detailed questions can help you to discover tips for lowering your car insurance cost.

When Disaster Strikes: Your Action Plan for a Sewer Line Problem

Knowing the signs and having a plan aloud be a difference in a timeliness and money plan. If you think you have a sewer line problem, then it is necessary to act on it immediately.

Identifying the Telltale Signs of a Problem

Be on the lookout for these warning out of the following warning signs:

- Multiple slow draining pipes in your house.

- Gurgling sounds from your toilets or drains.

- Water backing up in your tubs/submersion basins, or showers.

- A foul/ sewer gas odour order inside your home or outside your home.

- Green spots in your yard, green as may be.

- A hole in a grass or under pavings.

If you recognize any of these then it is high time to call a professional plumber. Acting fast is the key, as is having temporary car insurance to have on hand for a short-term driving need.

The Claims Process: A Step-by-Step Process

If you have have sewer million line insurance and have a problem the following is just how the process works:

- Call a Plumber: One of the first calls to make is to a plumber to diagnose the issue. Some insurance companies will have a network of approved plumbers.

- Contact Your Insurer: As soon as the problem has been confirmed, give a call to your insurance company and open a claim. Before authorizing major work, do not authorize it without doing this.

- Documentation: The insurer will want the diagnosis of the plumber, including the footage of the camera inspection if possible. They will also need to know an estimate for the repair.

- Approval: The insurance company will examine the insurance claim. Once they approve they will authorize the repair work up to your coverage limit.

- Repair and Payment: The work get done. You pay your deductible. The direct payment to the contractor or reimbursement to the insurance company covers the remaining amount of the total price.

“In dealing with a home crisis, having a good plan, as well as good insurance, are your best ‘friends’.” – A Home Restoration Expert

For professionals that perform these diagnostic services, having their own protection, such as professional liability insurance, is equally important.

Working with Contractors

If you are hiring a contractor, make sure he is licensed and insured. Get in writing an estimate before any work to done. If there is an option in your insurance policy to select your own contractor, get two or three quotes at least. A good contractor will take care of the permits and make sure that the work is up to code with the local codes. To learn more about municipal codes and standards, the U.S. Environmental Protection Agency (EPA) has a great deal of information about wastewater management.

The Final Verdict on Sewer Line Protection

So, we go back to the original question: Is sewer line insurance worth it?

For homeowners wanting complete financial protection for older houses, mature trees or complete financial protection the answer is a resounding yes. The small amount of the monthly premium provides a buffer in case of a potentially catastrophic expense. It takes, in effect, what could only described as an unmanageable disaster: previously an unpredictable event: and turns it into something that is manageable and budgeted. It’s a special tool for a special and high cost risk much like motorcycle insurance is for riders.

For those with new homes and little in the way of risk factors, this may be less of a priority. However, even new home is not not immune against issues such as shifting soil or construction defects. For a better understanding of construction of a home, and possible problems, a source such as This Old House can be very enlightening.

At the end it all you are buying peace of mind. You are insuring against one of your biggest investments from a hidden but very real threat. Carefully evaluate your individual risk between these risk factors we have discussed. Then, you will be able to make an informed choice whether Sewer Line Insurance should be a worthy inclusion in your home protection plan in the year 2025 and beyond.

Frequently Answered Questions (FAQs)

On average, you can expect to pay anywhere between $7 and $20 a month. The cost will depend on the provider, where you live, how high the coverage limit will be and what your deductible is.

Yes, but be cautious. Most policies have a waiting period (e.g. 30 days) before coverage is to commence. Also, they will not be covering pre-existing conditions found during a home-inspection.

Many companies sell this coverage bundled. You can often purchase a combined water and sewer line insurance policy that will exist you both the incoming water line and the outgoing sewer line for just a bit more of a premium.

If the amount of repair bills come to $15,000 and your policy limit is $10,000, then the insurance company will cover up to $10,000 (which is minus your deductible). You would be responsible for repaying the remaining $5,000.

Generally, no. Most companies do not need an inspection to embark on a policy. However, they will not include any problems that were known or could have been reasonably detected prior to policy initiation.

![Compliant Drivers Program: Is It Legit for Driver Safety? [2025]](https://propinfo.site/wp-content/uploads/2025/12/Compliant-Drivers-Program-150x150.jpg)

Leave a Reply