Clear vision is something we take for granted by many of us. We use our eyes starting from the time we wake up in the morning. They help us work, learn and enjoy the beautiful moments in life. That is why it is of utmost importance to protect your eyesight. When it comes to vision coverage, we are sure you have heard about the VSP Vision Insurance. It is one of the biggest and most respected names in the industry. But is its reputation what makes it best for you and your family?

This is a guide that will provide you with a complete, in-depth look VSP. We will discuss its plans and countless advantages. We will also deconstruct its costs, network, and member-only perks. It is our hope to provide you with all the information you need.

You can then be smart and make a confident decision with regards to your eye care. We are going to go back to basics and cover things all the way down to the fine print, leaving no stone uncovered.

What Exactly Is VSP Vision Insurance?

Let’s start from the basics though. So, it is important to know what VSP Vision Insurance is and what it isn’t/would not be. It is not like your standard health insurance. Health insurance policies typically cover the issues related to the eyes from medical conditions. Think read infections, injuries or diseases such as glaucoma. Vision insurance, on the other hand, has to do with regular and preventive eye care.

It is aimed specifically at assisting with the costs for vision exams. It also helps to pay for corrective eyes. This includes eyeglasses as well as contact lenses. It’s a tool that is aimed at making good vision cheaper to maintain. Without this sort of coverage, these necessary costs can really add up rather quickly and can become a real monetary burden.

A Brief Look at VSP’s Not-for-Profit Mission

VSP is an acronym for Vision Service Plan. It was established in 1955 by a group of forward-thinking optometrists. Their goal was without complexity, but in a very powerful way. They wanted to be able to offer accessible, good quality eye care and affordable to more people. An integral part of VSP’s identity is the structure of a not-for-profit organization.

This isn’t just a label. It has a fundamental impact on how the company goes. As a non-profit, VSP returns their income into the system. This is the money that is used to improve benefits and services. It helps to keep costs down among its millions of members. It also enables VSP to help community outreach programs and fund the advancements of eye health and eye technology.

How Does VSP Insurance Work? A Step-by-Step Guide

The VSP insurance model is founded on its large network of providers. VSP creates contracts with an enormous amount of independent eye doctors. These professionals constitute the network of VSP providers. And when you become a VSP member, you have access to this entire network.

Let’s walk through a real experience:

- You enroll in a VSP plan.

- Exit refers to obtaining a local, in-network doctor.

- You Summer Annual WellVision Exam.

- When you visit the doctor at your appointment, you pay a slight, fixed amount (say, $15).

- You come out of the exam after all deciding you need new glasses.

- Your plan gives you an allowance say $175 for frames. You pick a pair that costs $200. You only pay the $25 difference.

- Cover plans with basic lenses are also included with your plan. You only pay more for special lens enhancements of your own choosing.

This simple model is very easy to use in order to budget for eye care. It’s often less complex than trying to navigate through some health insurance policies (as simple as a united healthcare insurance plan PPO plan).

“The only thing worse than being blind is seeing nothing but no vision.”

– Helen Keller

The Major Benefits of VSP Eye Insurance

So, why do so many individuals and employers take advantage of VSP? There are a number of good reasons for its popularity. The company has carefully developed a strong reputation over the decades. Let’s read in between the main advantages you’ll have as a VSP member.

An Unmatched Network of VSP Providers

One of VSP’s biggest assets is its provider network. It is arguably the biggest in the United States. For the members this means unparalleled flexibility and convenience. There’s a very durable chance you originate to have a highly-qualified VSP provider simply only minutes from your well being, in the home, or in the place of work. You may even find out that you have an existing eye doctor as a member of the VSP network.

This is a very large network that is made up mainly of independent, private practice optometrists. This helps you to develop a personal relationship with your doctor. You are not a mere fish in a big pool of retail stores.

It would be possible for you to pick up a doctor who is truly suited to your needs and ways of communicating. A robust provider network is a signature characteristic of any good plan, as well as is the case with a Humana Dental Insurance plan.

Comprehensive Coverage That Sees the Bigger Picture

VSP eye insurance plans are known to be very comprehensive in terms of coverage. Most of the standard plans cover the annual “WellVision Exam®.” This is so much beyond checking for a new prescription. It is a broad evaluation of your relative health of your eyes. During this exam, your doctor is also checking for preliminary indications about critical health problems.

Many systemic diseases can be found in the eyes. These include diabetes, high blood pressure and high cholesterol. The National Eye Institute (NEI) has ample available research that illustrates the relationship between eye health and overall wellness, which makes up the reason these exams are so important.

You can learn more about this connection at the NEI’s official Web site. In addition to the actual exam, there are generous allowances for glasses and contacts. Many plans also have the deep discounts on popular lens enhancement.

A Deeper Dive into Lens Enhancements

So that is a discussion of those enhancements to the lens. Your VSP plan often offers great savings on such upgrades which will help any individual with substantial improvement in vision and easiness. Common options include:

- Anti-Glare (AR) Coatings: These are used to reduce the reflections from the screen and headlights, which would cause people to see better and reduce the strain on their eyesight.

- Blue Light Filtering: A must have filtration for anyone who spends hours (and hours) looking at computers or phones. This helps in reducing digital eyestrain and can help improve the sleeping patterns.

- Scratch-Resistant Coatings: A must have to ensure you don’t have to spend money on new lenses every few days because you constantly scratch them.

- Progressive Lenses: If one is suffering from presbyopia, this no-line bifocals offer clear vision for all distances. VSP plans have a great benefit for these in many cases.

- Photochromic/Transitions® Lenses: Lenses that will get darkened automatically by the sunlight, which provide comfortable vision for indoor and outdoor.

Real, Tangible Cost Savings and Value

Let’s talk about the bottom line; money. High quality vision care is sometimes costlier than one might expect. A comprehensive eye exam will cost in excess of $200 alone, in some areas. A couple of neat glasses with modern lenses can easily cost $400 or more. VSP Vision Insurance is MSN’s attempt to make dent against these out-of-pocket costs.

By paying a predictable amount of money each month, you enjoy access to predictable and low copays and generous allowances. For many individuals/families, the savings reaped annually are far greater than the cost of the plan over the year. This is especially the case for anyone who needs vision correction. It gives financial predictability and peace of mind that’s much like having a good State Farm Life Insurance policy for the long term security of your family.

Your Vision Benefits at a Glance

Eye Exams

- Low, fixed copay

- Comprehensive WellVision Exam®

- Checks for prescription changes

- Screens for eye diseases

Frames & Lenses

- Generous frame allowance

- Covered-in-full lens options

- Discounts on lens enhancements

- Extra savings on select brands

Contact Lenses

- Allowance for contacts

- Copay for contact lens fitting

- Full coverage for some brands

- Mail-in rebates often available

Potential Drawbacks and Considerations

No insurance plan is a perfect fit for each and every person. While VSP has an impressive list of strengths, it’s fair and important to get a look at the potential downsides. Being aware of these limitations can contribute to making a fully-informed decision. This type of balanced evaluation is just as important as it is when you are looking at Term Life Insurance vs. Whole Life Insurance.

Limitations on Frames and Lenses

The allowance system is a great way to control costs, but the system is not without limits. VSP plans offer a set number of dollars for frames. If you fall in love with a high-end pair of designers that costs more than your allowance, then you are responsible for paying the difference. It is the same principle when it comes to advanced lens enhancements.

While your plan might cover your basic single vision lenses in full, new-fangled and greatest lens technology will add to your cost. Premium progressive lenses, highest quality high index materials or the top of the line coating are all additional costs that will be out-of-pocket. You have to read your plan details carefully in order to know exactly what is covered.

Out-of-Network Rules and Costs

What about your favorite doctor that you’ve worked with for years? You can still use your benefits, but it’s going to be a more expensive and complicated process. VSP’s out-of-network benefits are much less generous than those it offers in its network. Instead of a basic copay, you would have to pay your doctor in full when you get your service.

After this, you need to complete a form of claim that you send to VSP for reimbursement. VSP will then send you a check for an agreed upon smaller amount based on their out-of-network schedule. This process is more paperwork, more up-front cost, and less overall benefit. This is a common problem with the PPO vs. HMO-style plans.

Is It Always the Most Affordable Plan?

For most users, VSP provides invaluable value. However, it’s not always the outright cheapest option to go with on the market. Other companies that offer vision insurance might tempt you with lower monthly premiums. Be careful though, as some of these plans may have smaller provider networks, lower allowances or more restrictions. It’s always a trade-off.

Furthermore, if you are one of the fortunate few who rarely require vision correction, the monthly cost is not worth it. Someone experiencing perfect eyesight who would only need occasional eye examinations would be saving more by paying for the test exam itself. Just like when you are looking for tips on how to lower your car insurance cost, you have to weigh up the costs of the peskin(ment) to the actual benefits you expect to utilize.

“What an ounce of prevention is worth a pound of cure.”

– Benjamin Franklin

A Closer Look at VSP Plan Types

VSP has many different plans to suit many different needs. The specific details of your plan will depend a great deal on your method of enrollment. VSP insurance in most cases, most people obtain through their employer. However, there are also excellent individual plans available to freelancers, retired individuals or anyone whose employer doesn’t offer vision benefits.

VSP Individual Vision Plans

If you are self-employed or otherwise don’t have benefits for your job that include vision, don’t fret. You can buy a plan direct from VSP. These individual plans are offered in all 50 states. One of the advantages is that you can pursue enrolment online any time during the calendar year. There is no restrictive open enrollment period to be concerned about.

These plans are great for providing some needed eye care coverage. They are generally above nominal monthly premiums than group plans. This is due to the lack of employer contribution. However, they afford you with access to the same massive network of doctors. They provide a simple and direct method of securing coverage, and are often simpler than securing specialized professional liability insurance for your work.

Employer-Sponsored Group Plans

This is the most common method which people get their VSP Vision Insurance. Companies, both small and large, including both startups and major corporations, can provide VSP as a part of their benefit packages. Premiums are almost always lower than in a group setting. The employer may subsidize some portion of the cost. The risk is also spread over a large number of employees, and this has the effect of reducing the price for all.

Group plans are often very customizable. An employer can collaborate with VSP to select from tiers of a coverage. This gives them the ability to balance the cost of the plan to the level of benefits they wish to provide for their team. It’s a key part of putting together a competitive package as is finding cheap business insurance to protect the company.

Plan Comparison: Employer vs. Individual

Employer Group Plans

- Lower monthly premiums.

- Often subsidized by the company.

- Enrollment during specific periods.

- Potentially richer benefit options.

Individual & Family Plans

- Enroll anytime online.

- Higher monthly premiums.

- Generally not subsidized.

- Great for self-employed & retirees.

How Does VSP Vision Insurance Stack Up?

VSP is a giant in the vision care world but they are not the only players at the table. It is always a good idea to have a view on how a service is doing compared to its main competitors. This will provide you with a much broader vista on the market. Let’s see how VSP compares with the others that are more popular.

VSP vs. EyeMed

EyeMed is VSP’s largest and most direct rival. They operate in a very similar business model. Both companies have large provider networks. Both provide plans via employer and directly to individuals. For many people, the choice on which to go is the doctors.

Some eye doctors accept VSP. Some accept EyeMed. Accepting both is also done by some. The best choice for you may simply be based on which plan your preferred doctor takes. It is worth mentioning that EyeMed is owned by Luxottica. Luxottica also owns large retail chains, such as LensCrafters and Pearle Vision. This, in turn, can cause a level of deeper integration and special discounts to be offered at these particular retail locations.

VSP vs. Davis Vision

Davis Vision is another big nation wide competitor. It often boasts of a unique “fixed-price” model. With certain Davis Vision plans, you can have a complete pair of glasses out of a particular “collection” for the cost of your copay. This can be very appealing for very budget-conscious consumers who want no surprises.

However, Davis Vision’s provider network is usually smaller than VSP’s. Their exclusive frame collection may also be less eclectic in respect to style and choice. VSP’s allowance model provides you with greater freedom to select virtually any frame in the store. This flexibility is a huge plus for people who place importance in their choice, whether it is to insure their eyes or their prized car with classic car insurance.

Maximizing Your VSP Insurance Benefits

Once you’ve come to the decision of going to enroll in a VSP eye insurance plan, you want to get as much out of it as you can. A few light tips can assist you to make the most of your saving and benefit. It’s all about being part proactive member and informed member. You wouldn’t purchase motorcycle insurance and not know how to make a claim, right? The same logic applies here.

Find and Stick to In-Network VSP Providers

This is the most important step that you can carry out. Always use a doctor that is in your network. You can get a full are designated list of local VSP providers by taking the official “Find a Doctor” device at the vsp.com web site. Using and in-network doctor is the key to unlocking the cut your plan will give you. It makes sure that you pay the lowest possible copays and receive the highest possible allowances. It makes the entire process easier.

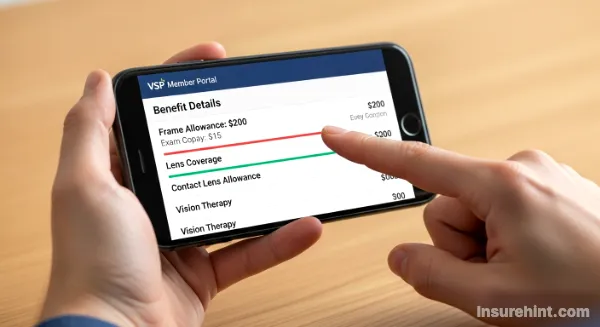

Understand Your Allowances and Frequencies

Take a few minutes and read your benefits summary. You usually will be able to find this on your VSP member portal online. Know how much you get to spend on frames and contacts. Also, look at how often you get benefits. Can you get new glasses for every 12 or 24 months? Knowing such details helps avoid unpleasant surprises at the checkout counter.

Don’t Forget the “Exclusive Member Extras”

Often that is not all that your VSP plan covers when it comes to examinations and glasses. VSP has a program called “Exclusive Member Extras.” This allows for further savings on top of your below regular plan benefits. For example, there are many plans that provide a 20 – 30% discount on a second pair of glasses.

This is perfect when you are interested in having a prescription pair of sunglasses or a pair backup sunglasses. You may also receive special rebates on select brands of contact lenses as well as substantial discounts on types of laser vision correction surgery such as LASIK. Don’t throw these valuable perks on the table. It is like having a temporary car insurance there just when you need it.

“The utmost wealth is health.”

– Virgil

The Verdict: Is VSP the Best Choice for You?

Having gone through all the details we are brought right back to our original important question. Is VSP Vision Insurance the right load choice for your personal eye care requirements? As is the case with most things in insurance, the honest answer is: it depends upon your particular situation.

For the vast majority of people, VSP is an excellent and highly recommended option. And its biggest network of providers, extensive coverage and stellar reputation make it a reliable and beneficial choice. If you wear glasses or contacts and want the freedom of choice from thousands of private doctors at VSP is very hard to beat. The value that the WellVision Exam alone offers with its potential to identify serious health problems is tremendous, as confirmed by health authorities, such as the American Academy of Ophthalmology.

When VSP Might Not Be the Best Fit

However, if your trustworthy eye doctor is one of the many eye doctor’s not in the VSP network, then surely you would want to look elsewhere. If your budget is really tight and a competitor is a lot lower in terms of the premium, that could be a more suitable match. This is particularly the case if you do not mind being restricted to a lesser choice of frames or providers. The key is to analyze your own needs just as you would if you were choosing between different types of commercial auto insurance for your fleet of business vehicles.

Ultimately, VSP has earned its place as a leader of the industry for a reason. It aims to have real and measurable value and allow millions of people to see clearly and be healthier. By knowing how does VSP insurance function, you can certainly make a decision on whether it’s the correct partner to accompany you on the almost snow journey for your own eye health in different ways.

Frequently Asked Questions (FAQs)

You can easily go on the official VSP website to search specific set of in-network doctors. They have a “Find a Doctor” tool where you can search by your name, city or zip code to see who is in your area.

Yes, Eyeconic.com is owned and operated by VSP. You can have your benefits tied directly to the website and take advantage of shopping for a huge selection of glasses and contacts online by using your in-network coverage.

VSP benefits normally do not roll over. If you don’t use your exam or materials allowance within your plan year (usually a 12-month period then you will unfortunately lose those for that period of time).

Generally, no. VSP Vision Insurance is intended for normal – preventive vision care. Medical problems related to eye care such as pink eye, glaucoma treatment or cataract surgery are usually covered under your regular health insurance plan.

This cost varies a great deal according to your plan. Employer sponsored plans can be on the lower end of $5-$15 a month. Individual plans you buy directly from VSP could cost $15 to $40 or more a month, depending upon how rich the coverage you desire.

![Compliant Drivers Program: Is It Legit for Driver Safety? [2025]](https://propinfo.site/wp-content/uploads/2025/12/Compliant-Drivers-Program-150x150.jpg)

Leave a Reply