Your van is your business lifeblood. It gets you to the job site. It transports your precious tools and products. That is why it is so important to protect it. Finding the right Van Insurance is not only a need by the law. It’s a very important business decision.

Your assets and livelihood are safeguarded by it. This guide will help you to go through everything. We will help you obtain the best van insurance quotes for your own specific needs. You’ll learn what to look for. And you’ll find out how you can save your money.

We know that insurance can appear to be complicated. There are many types and options of them. It can be overwhelming to start out; But don’t worry. That’s what we’re here for-tell you a little bit. We will make it simple and easy to get know. By the time you’re here, you’ll have some confidence. You will be ready to pick the perfect policy. Your business needs to have the right protection. Let’s make sure you get it.

Why Your Business Needs Specialized Van Insurance

You may be thinking, several really not just my personal car insurance? The answer is a big no. Personal Car Policies are not concentrated for business use. The use of your van for work is commercial activity. There are different risks that come with this. Insurers consider this another ball game. A claim on a personal policy could be denied. This would result in a huge bill for you.

Commercial vehicle insurance is meant for work. It is addressing the risks associated with your business. This may be carrying tools or delivering goods. It knows that your van is as hard-working as you are. It is a smart move to protect your investment with the right policy. It’s a basic concept of maintaining a successful and safe business. Think of it as insurance against your day to day operations.

Understanding the Core Types of Van Insurance

Before you begin the process of finding van insurance quotes you need to know what your options are. Your insurance policy will depend on the type of use you put to your van. This is most important factor for insurers. Let’s know about the major categories.

Carriage of Own Goods

This is the most common type of Van Insurance. It’s for professionals that bring their own tools and equipment. Think about plumbers, electricians, builders or florists. You are carrying stuff that you need for doing your job. You are not carrying goods for other people for a fee. If this sounds like you, this is most likely your category. It gives your business on the road protection. You also might want to consider the more professional liability insurance to cover your services.

Carriage for Hire or Reward

This one type of insurance is for delivery drivers. You use your van to transport for other people the goods which you get paid for. This includes couriers or furniture removal services. there are chances that you might make several stops in a day. The risk is taken to be more by the insurers. This is because you are in the road more. Also you are accountable for the things you are carrying. This policy correlates to that increased risk.

Haulage

Haulage is analogous to carriage for hire. However, it generally involves single drops deliveries. You may be transporting goods from one warehouse at one specific location. This is often over greater distances. The difference is subtle, but not lost on the insurance firms. Be sure to clarify what exactly your business model is. This is for safety so it’s sure that you get the correct coverage. An incorrect policy may cause your claim to be void.

“There’s risk involved in doing what you didn’t know how to do.”

– Warren Buffett

The Three Levels of Van Insurance Coverage

If you know your type of usage, you then select a level of cover. This is just like the case of personal car insurance. You have three main choices. Each of these provides some level of protection from the other.

Third-Party Only (TPO)

This is the most basic level of cover. It sometimes is the minimum that is required by law in many places. TPO covers harm done to other people that you are responsible for. It also includes their property as well as any injuries. It does not deal with any damage to your own van. Nor will it cover the theft of your van. While this is often the cheapest this offers very little protection for your business asset.

Third-Party, Fire, and Theft (TPFT)

This level is a step greater than TPO. It includes everything TPO covers. It also adds protection of your own van. Specifically, it insures you if your van is stolen. It also includes damage be it done by fire. This gives more peace of mind than basic TPO. It’s a standard choice of many as a middle ground means of powering the very common van. It is a balance between cost considered to essential protection.

Comprehensive Van Insurance

This is the best protection level that exists. It comprises everything of TPFT. It also covers damage to your own van being involved in an accident. This is true if the accident was your fault or not. Comprehensive cover provides you with the ultimate security. You know that your vehicle is equally protected in most situations. Surprisingly, it is not always the most expensive solution. Always compare quotes for all 3 levels. You may find a comprehensive commercial auto insurance is not as expensive as you think.

VAN COVERAGE SPECIFICATIONS

Key Factors That Influence Your Van Insurance Quotes

There are many aspects to consider when calculating your premium that an insurance company will look at. Understanding these can help you to see ways of saving money. When you get van insurance quotes, the following information are important. Each of them helps to build a picture for your risk profile. Let’s examine the most important of them.

The Van Itself: Make, Model, and Age

The type of van that you drive is a huge factor. Newer, more powerful vans will often cost more to insure. They have a higher cost of repair/replacement. Their parts can also be very expensive. On the other hand, some of the newer vans have more sophisticated safety features. This is sometimes able to reduce your premium. If you are driving something unique you may even want to look into classic car insurance options although for work this is quite unusual.

Your Van’s Security Features

Insurers love security. A Van with factory fitted alarms and immobilizers is a good start. Adding some additional security can reduce your costs. This could include things such as trackers or slamlocks. These make your van a harder Manfred to steal. It indicates that you are an insurer with your house, meaning pro-active in regards to risk. This can result in a nice discount on your premium.

The Main Driver and Any Additional Drivers

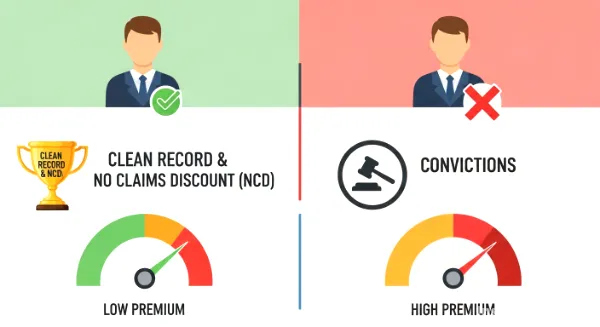

Your driving record is extremely important. A lengthy, clean driving record will ensure you pay less in premiums. Insurance companies are going to consider your age and experience. They will wander whether there are any previous claims or convictions. As the number of young or inexperienced drivers is added the cost increases. Be careful about whom you include in your policy. Sometimes a term life insurance vs. whole life insurance debate is simpler than named drivers decisions!

Your Business and How You Use the Van

Your profession matters. A builder who needs to park on-site has other risks from a courier with city traffic. Insurers do have information which jobs are riskier. How many miles you will put on in a year also plays a big part. The more you drive the higher the opportunity for an accident. Be honest, but be accurate. Leading by airing extra miles might lose you money.

Where Your Van Is Kept

Location, location, location. This is not only for real estate. Where you leave your van to park for the night is very important. A van which is kept in a locked garage is safest. Parking on a private driveway is the second best option. Leaving it on the street in an area with a lot of crime will increase your premium. This is an easy factor to control to some extent.

Your No-Claims Discount (NCD)

An example of a reward for safe driving would be a no-claims discount. For each year that you drive but do not make a claim, you get a discount. This amounts to as much as substantial saving. Some insurers offer the option of transferring NCD from a car policy. It’s always worth inquiring about this. The protection of your NCD can be a good investment in long term savings. Following simple tips for lowering your car insurance cost applies to vans, often.

A Step-by-Step Guide to Getting the Best Quotes

Now you understand what influences the price you have. It is time to start to shop around. Don’t just accept the first quote that you get. There can be a reasonable saving of a few hundred dollars if you put in a little effort here.

1. Gather All Your Information

Be prepared before you start. This will make the process far more easier. You will need:

- Van – details: Make, model, year, registration number.

- Driver Details: Name, age, driving license details and claims history for all drivers.

- Business Use: What you do and what you have.

- Mileage: Your best vision of annual mileage.

- Security: A list of all the security devices.

Being prepared with this will help you save your time. It ensures that every quote is accurate.

2. Compare Quotes from Multiple Sources

There are three main ways of getting van insurance quotes. Often the use of a mix of these methods is best.

Directly from Insurers

You may go straight to the sites of big insurers. This can be time-consuming. However, some insurance companies do offer you deals you won’t get anywhere else. For example, a State Farm life insurance customer may realize a bundle discount because State Farm offers van coverage. It is worth checking almost a few big name.

Using Comparison Websites

Price comparison websites are highly useful. You enter your details once. They then expose you to scared quotes from dozens of insurers. This is the quickest method of viewing a vast range of prices. But be careful. The bargain is not always the best. Look crisis at details of policy.

Speaking with an Insurance Broker

A good insurance broker can make a good partner. They are experts in the field. They are able to give advice and access specialized policies. This is fabulous for businesses that have unique needs. A broker works for you not for the insurance company. They can help you find the right balance of cover and cost just like one may find United Healthcare insurance plans.

3. Read the Policy Details Carefully

The price is important. But it is the policy document that really matters. Look for the “policy excess.” This is the amount that you pay in regards to a claim. Higher the excess is, generally, the lesser is the premium. Just ensure that you can afford to pay it. Check for any exclusions. What is not covered? It pays to know this now so that you can avoid a nasty surprise later.

Smart Strategies to Lower Your Van Insurance Premiums

Everyone wants to save money. The good news is there are many ways you can reduce your Van Insurance costs. These tips can be the difference between a big difference to your bottom line. They are an important part of finding the affordable business insurance.

Pay for Your Policy Annually

Most insurers have a discount if you pay for your policy in one shot. It is comfortable to pay every month but there are often interest charges. If you are able to pay annually, you will almost always save money. It’s a good and simple cost-cutting measure.

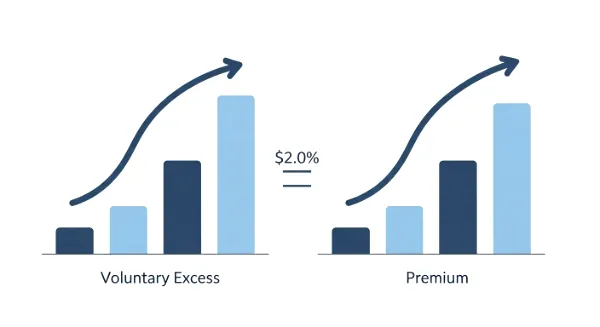

Increase Your Voluntary Excess

As we said the excess is your contribution to a claim. By consenting to a higher voluntary excess, you will be able to reduce your premium. You are taking more of the risk on yourself. If you have to make a claim only pick and amount you are comfortable paying. Do not make it so high as to make a claim unaffordable.

Choose the Right Van for the Job

When it is time to purchase a new van, consider insurance. Choose a van that is suitable for your requirements. A smaller van with a lower power engine will usually be cheaper to insure. Do a web search on its insurance group rating before you purchase. This information is easily available online from sources such as Thatcham Research.

Consider Telematics or “Black Box” Insurance

Telematics insurance is becoming more prevalent for vans. A small appliance is installed on your van. It keeps records of your driving habits. This includes your speed, braking and the times you are driving. Good, safe drivers are rewarded by lower insurance premiums. This can be a great option for new business or new young drivers. It proves you are a low risk driver. In some cases, you may even need temporary car insurance before you settle on a full-year telematics-sales-policy.

Limit the Number of Drivers

Each driver added to the policy influences the price. Don’t use the van appliance unless there is an absolute need. The addition of a young or inexperienced driver can bump the premium way up. If a driver has a poor history, it will cost you dearly. Keep your list of named drivers down to minimum.

“It’s better to prevent the cure by an ounce of prevention.”

– Benjamin Franklin

Essential Add-Ons for Your Van Insurance Policy

Your main Van Insurance policy is your base. But, you may need additional cover against total protection. These “add-ons” can be bought as an additional cost. In doing so, they plug the gaps in a standard policy.

Goods in Transit Insurance

If you bring goods on behalf of other people, this is crucial. Standard commercial vehicle insurance covers your van. It does not cover the items that it contains. Goods in Transit insurance secures the property that you are transporting. The level of cover is adjustable. Make sure it is enough to cover the value of what you carry around.

Tool Insurance

For tradespeople, tools are their livelihood. A standard policy might provide an extremely small policy of cover for tools left in the van. Tool insurance offers specific insurance. It can insure them from theft or damage. Check the terms carefully. Some policies only protect tools if they are in a locked van. Others may require that they be removed overnight. The U.S. Small Business Administration often recommends to business that they catalog items that are valuable assets, such as tools.

Public Liability Insurance

This is a very essential cover for almost any business. What if by mistake you injure some member of the public? Or damage their property while doing their work? There is Public Liability insurance for the legal costs and compensation. Many clients will require that you have this before they hire you on. It is usually sold with Van Insurance.

Breakdown Cover

Getting stranded on the side of the road is a nightmare. It’s even worse when it is your work vehicle. It costs you time and money. Breakdown cover can guarantee that you can get help quickly. You can obtain the roadside help to get you going again. This add-on adds huge peace of mind at little cost. Some insurance plans, such as those offered by Humana dental insurance, demonstrate how special add-ons can be extremely important for peace of mind.

Legal Expenses Cover

If you are involved in an accident which was not your fault you may have some uninsured losses. This could be your policy excess or loss of earnings policy. Legal Expenses Cover can assist you in obtaining these expenses from the at fault party. It gives access to legal experts to fight your corner.

For a small fee, it can be a very precious safety net. It insures you from unanticipated legal bills. For example, if you have a high-performance car, you are aware of the complexities of legal issues related to your vehicle, much like and similar to motorcycle insurance. Legislation, legal cover, makes that easier.

Your Final Checklist for Van Insurance Success

We’ve covered a lot of ground. Finding out right Van Insurance is Big task. But you’ve been given the information now to do it right. You are good to go comparing van insurance quotes like a pro. This last checklist will take you part of the way.

- Assess Your Needs: What is the use of the business? What level of cover?

- Gather Your Docs: Have all your van and driver details ready.

- Shop Around: Get quotes about insurers, comparison sites and brokers.

- Compare Wisely: Don’t base a business solely on the price. Take a look at the excess and exclusions.

- Ask for Discounts: Inquire about security, annual payment and no claims.

- Consider Add-Ons: Do you need tool cover? Or goods in transit?

- Read the Fine Print: Before purchasing a policy, understand it.

Your van is More than a Vehicle. It’s one of your business’s success partners. Protecting it with the right business car insurance or van policy – One of the smartest insurance purchases you can make. It allows you to get on with your work knowing that you are covered if the worst happens. For other important safety information, you can always check information such as the National Highway Traffic Safety Administration.

Frequently Asked Questions (FAQs)

Van Insurance is a form of Commercial Vehicle Insurance. It has been designed for working purposes. It covers risks that personal car insurance does not such as carrying goods or tools for business purposes.

Most Van Insurance policies have an inclusion for social domestic and pleasure use. However, you would always want to check your policy details to be sure. Commuting to one place of work is normally covered too.

Yes, you must be truthful to all changes to your insurer. This includes things like roof rack, shelving or signwriting. Failure to declare them could have your policy shot invalid. Some changes may result in higher premiums, while others (such as security upgrades) may result in lower premiums.

It can be. Electric vans are often cheaper insurance groups. In addition, they have fewer complex parts than a diesel engine. However, their repair price can at times be higher. It’s best to get quotes for the both to see what’s more cost-effective to you.

If you make a claim in which you are at fault, you will generally lose some or all your no-claims discount at renewal. You can often pay a small extra fee to “protect” your NCD so that you can make one or two claims in a period without having your discount affected.

![Compliant Drivers Program: Is It Legit for Driver Safety? [2025]](https://propinfo.site/wp-content/uploads/2025/12/Compliant-Drivers-Program-150x150.jpg)

Leave a Reply