We all feel the pain. And that car insurance bill comes up. It always seems to go up. Lowering your Car Insurance Cost seems impossible. But there is more power than you think you have. It is a necessary expense to every driver. It is to protect you, your car and the other people.

And, the price can be huge. Many people just pay for the renewal. They don’t look for better alternatives. We are here to change that. You can find savings. You just have to know where to look for them. We are going to check 10 tips that work out. These tips will help you reduce your premiums.

You can get control over your policy. It starts with a slight knowledge. We will help you take you step by step through the process. Let’s find you cheap car insurance together. Thank you, your budget for this.

Understanding Your Current Car Insurance Cost

First, let’s look at your bill. What are you even paying for? The price of your car insurance price is not a random one. It is a complex calculation. Insurers use the term “risk assessment.” It’s their guess as to how likely you are to file a claim.

There are many ways that determine your final rate. Your location matters a lot. In most cities, higher rates exist. More cars, means more accidents. Your age and driving history is huge. Younger drivers are always more costly. The best friend that you have is a clean record. The car you drive is also key.

The average car insurance cost varies wildly. Your neighbor may pay twice as much as you do. Or they could pay half. This is why you need to compare so much. Your personal policy is not shared by anyone else on the planet. It is not like commercial auto insurance, which covers business vehicles.

Insurers even consider your credit score. This can be controversial. But statistics relate credit to claims. We will cover that later. For the moment, just know that there are a lot of things moving. Understanding both of them is the first step.

Tip 1: Shop Around and Compare Quotes

This is the more important tip. Never stay with one insurer out of loyalty. Loyalty may cost you hundreds of dollars. The insurance market is very competitive. It is necessary for you to make use of this. Get new car insurance quotes every year.

Or go shopping around every six months. It is free. It only takes a little time. You might be appalled at the differences. One company could quote you $150. Another might quote $250. This is with exact same coverage. Why does this happen?

Every company has an algorithm of its own. They view risk factors differently. One company might be my least favorite car model. Anther may be fond of your clean record. You will never know unless you ask. This is also true of other policies. It’s just as important to shop around for motorcycle insurance.

Do not be afraid to switch. It is a simple process. Most of the work is done by your new company. As part of this, they will confident your old policy will be cancelled. They will also receive refunds you are owed. It is your job to seek the best deal.

Tip 2: Increase Your Deductible

So here is a quick way to get a lower bill. Raise your deductible. The deductible are the things that you are first going to pay. You pay it ahead of time from insurance coming. For example, you have a $500-deductible. You get in an accident. The damage is $2,000. You pay $500. The insurer pays $1,500.

If you increase your deductible to $1000. Your premium will go down. This is because you are taking on more risk. The insurance company likes this. In return they will reward you with a less Car Insurance Cost.

But this tip has a big warning. The equivalent requirement is you must have the deductible saved. Keep this $1,000 with you in an emergency fund. You cannot pay the deductible? In that case, you are stuck. Getting your car fixed won’t be possible. So, be honest with yourself. Can it afford the higher deductible?

This is a personal choice. It is a trading place of risk and saving. An increased deductible is not everyone’s game. But it is a powerful tool. It is able to give you instant relief on your premium.

Low Deductible

High Deductible

Tip 3: Maintain a Good Driving Record

This seems obvious. But it is the foundation. A good driving record is key. It Is The Best Way To Get cheap car insurance. Insurers love safe drivers. They are less likely to cost the company money.

A single speeding ticket comes at a cost. It could pump another few hundred dollars. This increase can last up to 3 years. Now that one ticket you could be $600. Being in an “at-fault” accident is even worse. You can expect the rate of your rates to double overnight.

So, drive carefully. Obey the speed limit. Do not text and drive. Avoid all distractions. It is not just about safety. It is about your wallet. A clean record opens doors. It opens doors to best rates from all companies.

Some drivers require a special policy. Maybe you do have a gap in coverage. You may require a temporary car insurance for a short while. For even these, however, the record you are breaking recently matters. It is your greatest potential asset.

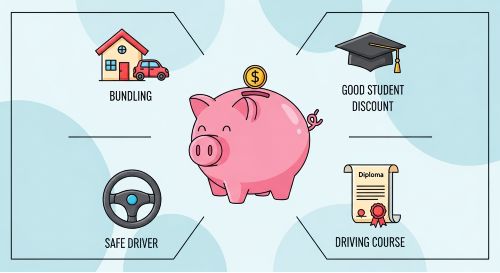

Tip 4: Leverage All Possible Discounts

Discounts are like money hidden. Nearly all insurance companies offer them. But they tend not to advertise them. You often have to ask. You should ask your agent. What are the Discounts I am Eligible for? You might be surprised.

There are various types of discounts. We will discuss the most common of them. See how many you can check off. Each one adds to your savings.

Bundling Discounts

This is a big one. Do you have any renters insurance or home insurance? Get it from the same company. This is called “bundling.” Insurers offer a huge discount. It can be 10% to 25%. Of course you can bundle other policies as well. You may be able to save money by combining auto with term life insurance, for example.

Good Student Discounts

Do you have a teen driver? Their rates are very high. But there is a way to help. If they get good grades (usually a “B” average use that to your insurer.) This can save you a lot. It shows that the student is responsible. Insurers like responsible people.

Safe Driver and Telematics Discounts

We discussed the premise of a clean record. This is the reward. If you go for 3-5 years without an accident, you get a discount. A number of companies have now offered telematics. This is a small device. Or it is an app on your phone. It monitors the habits of your driving. Hard braking is one of the behaviors it watches for. Speeding is also checked. If you drive safely, you are in for lower rates.

Defensive Driving Course Discounts

This is easy. Take a one-day course. It is usually online. It teaches methods of safe driving. When you have passed, you get a certificate. Send this to your insurer. It can give you a 5% or 10% discount. This is great for drivers who are older. It is also good for ticketed drivers.

Other Common Discounts

Do not stop there. Ask about more. Is it anti-theft devices features? That is a discount. Are you a member of an auto club? That is a discount. Do you drive less than 10,000 miles a year? That is some low mileage discount. Every little bit helps.

“A discount is a choice to spend your money on something else. Always take the discount.”

Tip 5: Improve Your Credit Score

This tip is surprising for many people. What are we saying about credit and driving? In most states, it makes all the difference in the world. Insurers use a “credit based insurance score.” This one is not your very main credit score. But it is based on it.

Why do they do this? Years of data show a pattern. People with less good credit score make more claims. People with better credit scores file fewer. Insurers consider this to be a risk factor. It is not about being personally. It is about statistics.

Good credit score indicates stability. It implies that you are a good manager of risk. Insurers like that. A poor score could increase your car insurance price. So, what can you do? You can work on your credit. This helps you whole life financially.

Pay all your bills on time. This is the biggest factor. Keep your credit card account balances low. Do not use open new accounts too quickly. To begin with, you can obtain your credit report free of charge. Check it for any errors. Certainly fixing errors can increase your score rapidly. This is a long-term strategy. But it has a huge payoff.

Tip 6: Choose Your Car Wisely

Your car has a huge impact. It is affecting your Car Insurance Cost. This begins before you purchase the car. That flashy red sports car? It will cost a fortune to insure. That safe, boring sedan? It will be much cheaper.

Insurers look at a number of things. How much does the car cost? A $50,000 car costs more to replace. So, insurance is higher. How much does it cost a case of repair? Luxury and foreign parts are expensive. This also raises your rates.

In addition, they look at safety ratings. Car that provide good protection to passengers get discount. They have fewer injury claims. Insurers are also interested in theft rates. Some cars get stolen more frequently. These cars will be more expensive to insure.

So, when you are out car shopping, think ahead. Get car insurance quotes before you buy. You may find that one car is $50 less a month. That is $600 a year. That is something which can change your whole budget. This is extremely different then classic car insurance, which has special rules. For someone who uses a vehicle on a daily basis, safety and repair costs are paramount.

How Car Type Affects Insurance Price

Family Minivan

(e.g., Honda Odyssey)

Standard Sedan

(e.g., Toyota Camry)

Large SUV

(e.g., Ford Explorer)

Luxury Sedan

(e.g., Mercedes E-Class)

Sports Car

(e.g., Ford Mustang GT)

Tip 7: Review and Adjust Your Coverage

Do you know what you have in your policy? Many people do not. They just renew it every year. This is a huge mistake. Your needs change. Your car gets older. The change is needed in your policy too.

You this look at your declaration page? This contains a list of all your coverages. Do you have an old car? Maybe it is paid off. Is it worth only $3,000? You may not even need to have collision or comprehensive coverage. These pay to fix your car.

Collision coverage is for accidents. Comprehensive is for theft, fire or weather. If you have an old car, this coverage may cost more than it is worth. The most that you can get is the value of the car. Do the math. If the coverage costs $300, and the car is worth $3000. It might be time to drop it.

Also, be aware of your liability levels. This is the part that is most important. It goes for damage that you cause to others. Do not go too low here. Medical bills are high. But you may be paying for more than you should. Go through your policy, you can go through a process like going through your Humana dental plans. You must check the details.

Tip 8: Consider Usage-Based or Telematics Insurance

We said telematics for discounts. But there are companies that base your entire rate on it. This is known as Usage-Based Insurance (UBI). It is a “pay as you drive” model. It is a new method to obtain cheap car insurance.

This is ideal for some people. Do you work from home? Are you a retiree? Do you drive very little? UBI could save you a lot. Why should you pay the same as a long distance commuter?

Here is how it works. You plug in a device. Or you use a phone app. It tracks your mileage. This also monitors your driving habits. It measures hard braking. It notes late-night driving. Low mileage drivers can be the safest and get the best rates.

There is a trade-off. It is privacy. You are giving the insurer a lot of data. You have to be comfortable with that. But if you are a safe driver, then why not get paid for it? It can be a huge change from the old model. Link: Learn about telematics from Forbes.

“The future of insurance is personal. It’s moving from…

Tip 9: Ask About Group Insurance Plans

You may be able to get the discount. You just do not know it. Many large companies have group insurance. This is a special rate to their members. It is an advantage of being in the group.

Where can you find these? Start with your employer. Many major companies have a deal. They partner with an insurer. They have a group rate available for employees. Ask your HR department.

Also, look in professional associations. Are you a teacher? A nurse? An engineer? Your association may possibly have a plan. Alumni groups are another source. Your college wants to offer benefits. Car insurance is a common one.

This is like finding affordable business insurance. The group is a valid bargaining power. It is “strength in numbers.” The insurer offers a little discount. They do this to get access to thousands of new customers. It cannot hurt to ask.

Tip 10: Pay Your Premium in Full

This is a simple and instant saving. How do you pay your bill? Do you pay it every month? Stop and take a look at what you are saying. It is likely that you are paying an “installment fee.” This is a service charge. It can be $5 to $10 every month.

That does not sound like much. But $8 a month is $96 a year. That is almost $100 just to pay out monthly. Insurers love receiving their money up front. It is less work for them. It is less risk.

They will give you a discount. If possible, pay for six months. Or pay for the whole year. The discount is usually 5% to 10%. It is an easy win. You save on the fees. And you get a discount.

This requires having the cash at the ready. But it is a guaranteed return. This logic can be applied to many policies. It is true for professional liability insurance and others. Paying in full almost always saves money.

Bonus: Factors You Can’t (Easily) Change

We want to be complete. Some factors are out of place. It does you no harm to know what they are. This helps you to understand your Car Insurance Cost.

Your age is a big one. Drivers under 25 pay the most. Rates begin to decline after that. They are lowest in your 50s. Then they go back up for seniors drivers. You cannot change your age. You just have to wait.

Your location (ZIP code) is very large. If you live in a city that has a lot of theft, you’ve got a lot of theft. If you move to a rural area, then they drop. Moving is a big decision. You do not want to move simply for the sake of insurance. But be aware of the impact.

Even your gender may also play a part. Statistically, there are more crashes by young men. So, they pay more. This is changing. Some states have banned this. Providers such as State Farm and healthcare companies have to comply with state rules. It is like the pricing of United Healthcare plans by the region.

Conclusion: Take Control of Your Car Insurance Cost

Your Car Insurance Cost is not fixed. It is not a bill that you just have to accept. You have real power. You can make real changes. These changes will reduce your premiums. It all begins from being an active consumer.

Do not just renew. Shop around. Ask questions. Review your coverage. Use the tips we shared. Compare car insurance quotes every year. Ask for every discount. Drive safely. Be smart about your car.

A bit of effort may save you many hundreds. That is real money. It is money in your pocket. Not the insurer’s. Take an hour this weekend. Make a few calls. Get some online quotes. You will be very glad you did.

Frequently Asked Questions (FAQs)

The fastest way is to shop around. Get at least three new car insurance quotes. The second fastest way is to raise your deductible, but make sure you can afford to pay it.

You should shop for new quotes every 6 to 12 months. You should also shop any time you have a major life change, like moving, buying a new car, or adding a new driver.

Yes, most likely. A single ticket can increase your premium by 10% to 20%. This increase can last for three years, costing you a lot of money over time.

Usually, yes. The bundling discount is one of the biggest discounts available. However, you should still compare. Sometimes, two separate policies from two different companies can be cheaper.

In most states, yes. Insurers use a credit-based insurance score to predict risk. Improving your credit score can lead to a lower Car Insurance Cost over time.

![Compliant Drivers Program: Is It Legit for Driver Safety? [2025]](https://propinfo.site/wp-content/uploads/2025/12/Compliant-Drivers-Program-150x150.jpg)

Leave a Reply