Welcome to your complete guide: We are here to get you through this jungle of obtaining the car insurance quotes. Getting your commercial abstracts is daunting. But, believe it or not, we guarantee that it’s not as difficult as you may perceive it. This guide, for instance, will help you to be a confident shopper. You will become educated in saving money.

Finding the proper car insurance is a big deal. It is a protection of you, your car and your money. As a result, you have to make a smart choice. We are going to deconstruct each and every single step. In short let’s get you on the road to savings.

Why You Must Compare Car Insurance Quotes

You might be thinking that this is so important, why? Can’t you just choose the first company you come across? You may indeed, but that is an expensive mistake. For this reason, let’s dive into the rest of the importance of comparing car insurance quotes for every driver. It’s the one best way to control your costs.

What Exactly is a Car Quote?

First of all, let’s clear what is a quote. A car quote is a quote of your premium. Specifically, it’s the price that an insurer offers for a policy. This price applies to your personal information. Therefore, you can consider it as an individual price tag.

However, a quote is not the end price. The final cost is determined following a complete review. This process becomes known as underwriting. Nevertheless, a quote generally is very close to the final price. As a result it’s a great tool for comparison.

The Legal Side of Car Insurance

In nearly all states, car insurance is required. In fact, you cannot legally drive without it. The government establishes minimum levels of coverage. These laws do of course provide protection to all those who are on the road. For instance, if you cause an accident your insurance is used to pay for the damages.

Without it, you are faced with huge fines. In addition, your license could be suspended. In some instances, you may even go to jail. Thus, it is a legal and financial requirement to get insured. It has you on the right side of the law.

How Comparing Car Insurance Online Unlocks Savings

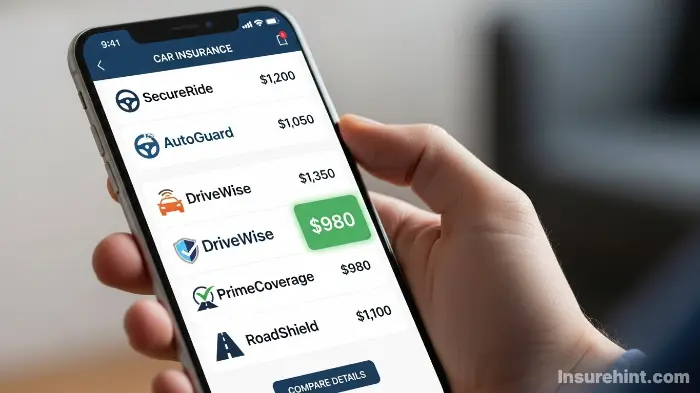

This is the most exciting part here. Insurance companies have different rates of what they rate as risk. For example, one company may view you as a high-risk driver while another may view you as perfectly safe. This is exactly the reason that prices vary so much.

By shopping for multiple insurance for the car, you can see these differences for yourself. Indeed you might find one company is 50% cheaper than another. This can save you hundreds and even thousands of dollars a year. One of the keys to the dishonest ads that dives often fall prey to is that it’s free to look, and the savings are real. This is why you have to compare car insurance.

“The bitterness of poor quality is long after remembered, the sweetness of low price is forgotten.”

– Benjamin Franklin

This quote is applicable to insurance in perfect form. You want a good price but you also need good quality coverage. After all, comparison of quotes helps you to attain the perfect balance of price and protection.

Getting Ready: Information for Accurate Car Quotes

Before you get on with getting your car insurance online, let’s get organized. You will need to give some specific information. Having it to hand also, after all, will help make the process much faster. Furthermore, it helps to ensure your quotes are on track.

Consider it as putting together of ingredients in a recipe. With all on the counter cooking is a breeze. So, let’s discuss the most important pieces of information that you will need to have handy.

Your Personal Details

Insurers need to know who it is they are covering. This is the most basic information that is required. Obviously, it can help them to determine your individual risk profile.

You will need to provide:

- Full Name and Address

- Date of Birth

- Driver’s License Number

- Marital Status

- Occupation

Your address for instance, telling them about local risks such as traffic and theft. Similarly, your age and occupation play its role in their calculations.

Your Vehicle’s Information

Then you need information about the car that you wish to be insured. The kinds of car you are driving greatly influences your rate. For example, a sports car is more expensive to insure than a family sedan is.

Be ready with the following:

- Make, Model, and Year

- Vehicle Identification Number VIN

- Trim Level (e.g., LX, EX, Sport)

- Safety Equipment (Airbags, Anti-lock brakes)

- Anti-theft devices

The most subtle detail is the VIN. It provides the insurer with an able exact history and specs of your car. For the ones who have unique vehicles, understanding the specifics on classic car insurance is also vital.

Your Driving and Insurance History

The policy of honesty is the best here. Insurers will come cross-true to peruse your The record of driving. Therefore it’s better to be open about any underlying incidents in the past. Withholding information can definitely cause problems later on.

Prepare to share:

- Any accidents within the last 3-5 years.

- Any Traffic tickets or violation.

- Your previous insurance company, if you have one.

- Information about any other drivers that live in your house.

A good record of a clean one will certainly get you better rates. However, with a little bump in the road, you can find some cheap ones. Some even need temporary coverage, so having temporary car insurance learned may be very helpful in certain cases.

Decoding Your Car Insurance Quote: Understanding Coverage

Now we have come to the heart of your policy. It is really important to have an idea of the types of coverage when you are comparing insurance quotes. Choosing the right ones is what you need to protected. On the other hand, you can pick the wrong ones and dangerously exposed to. Let us demystify the commonly available ones.

Liability Coverage

Pays for the other person’s medical bills and vehicle repairs if you cause an accident. It’s required by law.

Collision Coverage

Pays to repair or replace your own car after an accident, regardless of who is at fault. It is an optional choice.

Comprehensive Coverage

Covers non-crash damage to your car. This includes theft, fire, vandalism, or storm damage.

Liability Coverage: The Foundation of Your Policy

Liability coverage is the part that’s called for by law. Above all else, it insures your assets. It includes Costs if you hurt someone or broke their things. It does not cover your own car or your own casualties and injuries.

It’s split into two parts:

- Bodily Injury Liability: This is what pays for the other party’s medical expenses.

- Property Damage Liability: This is to pay for repairing the other party’s car or property.

When you see things such as 25/50/25, that is the limits for this coverage. It’s often a smart thing to buy more than is required by the state. After all, medical bills and car repairs can be very expensive.

Collision and Comprehensive: Protecting Your Own Vehicle

These two coverages are often sold together. Basically, they are there to protect your actual car to be exact. They are usually optional unless of course you have a car loan. If you are financing or leasing your car, your lender will then require them.

Collision coverage is for crash related damage to your car. It pays out whether you hit another car or an object such as a pole. In this case, you will required to pay the deductible, first.

Comprehensive coverage is every other thing. Specifically, that includes damage from other things other than a collision. This includes theft, falling objects, fire and animal collisions. It also has a deductible. For businesses, a specific insurance policy is required for work vehicles, known as a commercial auto insurance.

Other Important Coverage Options to Consider

Beyond the main three, there are other add-ons that are very much worth having: These are able to add layers of financial safety. As a consequence, you will advised to take account of your personal needs when going through them.

- Uninsured/Underinsured Motorist (UM/UIM): This is so important. It covers you in case you are struck by a driver with no insurance or insufficient insurance.

- Medical Payments (MedPay) or Personal Injury Protection (PIP): These are to cover medical bills for you and your passengers rare who is at fault. Some states require PIP.

- Rental Reimbursement: This helps to pay for a rental car while yours is in at the shop from a covered claim.

- Roadside Assistance: This includes services such as roadside tow, flat tire change, and jump-start of the car.

Just like you consider the coverage of your car, it is a good idea to check out other policies. For instance, knowing your Humana dental insurance or United Healthcare insurance options will not only ensure that all is covered in your well-being.

The Hunt: How to Compare Car Insurance Quotes Effectively

You’re prepared. You understand the coverage. Now, it is time to start shopping. This is where you take your knowledge and put it into the practice. Luckily, there is a number of different ways that you can gather car insurance quotes. Each has its pros and cons.

Method 1: Visiting Direct Insurer Websites

You can proceed to the websites of the insurance companies directly. Think of brands such as Geico, Progressive or State Farm. Then, you process your information on each site individually.

The main being that are dealing directly with the source. There’s no middleman. However, this can be very time consuming. You have to fill in your information on each and every website. Subsequently, it makes it more difficult to be able to compare insurance quotes quickly.

Method 2: Using Online Comparison Tools

This is the most popular method of finding car insurance online. Comparison websites allow you to fill in one form. Then, they have quotes from several different insurers. This is, without a doubt, a huge time saver.

These tools are available to find prices quite efficiently side-by-side. They are great to get a broad view of the market. Also, you are able to quickly spot out the most competitive options. The most important thing that you can do is to use a reputable comparison site. Some sites may sell your data, thus you should be careful. For a detailed overview of one of the larger companies, our State Farm life insurance review provides some great insights.

Method 3: Consulting an Independent Insurance Agent

An independent agent is a professional who is licensed. They cooperate with several insurance companies. Furthermore, they can do the shopping in the market instead of you. This one can be a very good choice if you want to have some advice from experts.

An agent can cover the complicated details of coverage. They are also good to help you find discounts that you may not find. An agent’s expertise is particularly useful if you have a complex situation as in needing to have professional liability insurance for your work. The negative is they could be not every single company available.

“Price is what you pay. Value is what you get.”

– Warren Buffett

This is important in comparing quotes. In other words, don’t just look at the price. Look at the value. You have to make sure you are comparing the same coverage level. A low price quote with low liability limits is definitely not a good deal.

Making a True “Apples-to-Apples” Comparison of Insurance Quotes

This is the most important part of the process. In order to really compare your car insurance, you need to make sure that each quote has the exact same:

- Coverage Types: (Liability, collision, etc.)

- Coverage Limits: (e.g., $100,000/$300,000/$100,000)

- Deductibles: ($500 for collision and comprehensive, for example)

If a quote has one $1,000 deductible while a quote has a $250 deductible, the prices will be different for a good reason. Therefore you need to standardize these details across all quotes available in order to see which company is actually providing a better rate.

What Factors Drive Your Car Insurance Quotes Up or Down?

Ever wonder what is going on behind the curtain? Insurers use complex algorithms in order to come up with your car quotes. In essence what they try to do is predict the likelihood of you making a claim. Let’s Pull Back that Curtain, Se See the Baddest Factors.

Top Factors Influencing Your Insurance Rate

Your Location

Urban areas with more traffic and crime typically have higher rates than rural areas.

Age & Experience

Young, inexperienced drivers statistically have more accidents, leading to higher premiums.

Vehicle Type

Expensive, sporty cars cost more to insure than safe, reliable sedans due to repair costs.

Driving Record

A history of accidents or tickets is the strongest indicator of future risk, raising your rates.

Credit History

In most states, a better credit score is linked to fewer claims, resulting in lower premiums.

Coverage Choices

Higher liability limits and lower deductibles will increase your premium, but offer more protection.

Your Driving Record’s Impact on Your Car Quote

This is the most influential factor. A driving record that is clean is your golden ticket. This reflects well on you to insurers that you are a safe and responsible driver. On the other hand, a record showing accidents and tickets will raise red flags. It will, therefore, make your car insurance quotes much higher.

How Your Vehicle Choice Affects Your Insurance Quotes

The make and model of your vehicle make huge. Insurers in particular look at a couple of things. They verify the safety ratings of the car from sources such as National Highway Traffic Safety Administration (NHTSA). Also, they are taking into consideration the average cost of repairs.

Finally they look at statistics of thefts for that model. A cheap-to-fix car that is not easily stolen will have lower premiums. The same logic applies to other vehicles, making it important to do your research on the best rates to get motorcycle insurance if you own one.

Where You Live and Its Role in Car Insurance Quotes

ZIP CodeS coincidentally, your ZIP code makes a difference (big time). Insurances use location data to make a determination regarding risk. A thick urban area with high levels of traffic congestion and crime will result in higher premiums. On the other hand, an area that is usually quiet as being rural will mean lower rates. It has all to do with the number of claims in that particular geographic area.

Your Credit Score (In Most States)

This one stuns a lot of people. In the majority of states, insurance companies are allowed to use a credit based insurance score. It’s not your normal credit score but it has to do with it. Statistical data from organizations such as Insurance Information Institute (III) supports the correlation of credit history and the probability of a claim being filed. In fact, people with better credit scores make less claims. Therefore, a good credit history can result in substantial savings. Prohibited in California, Massachusetts and other states, in some cases even limited.

Your Age, Gender, and Marital Status

These demographic factors are also statistic based. Younger drivers, teenagers in particular, have much higher accident rates. As a result they pay the highest premiums. Rates usually begin declining by the time one reaches 25 years of age. Similarly, statistics show that married drivers tend to have fewer accidents than one do, which can then tame lead to a small discount.

Pro Tips: How to Lower Your Car Insurance Quotes

You don’t have to settle on the first price you are given. There are many things you can do to reduce your premium. These tips in particular can help you in finding much cheaper car quotes. Let’s dive into it: The best ways to save.

Discounts: Your Key to Cheaper Car Insurance Quotes

Insurers offer a huge menu of discounts. You just have to ask for them! Many are not automatic applications. Our guide on the top 10 tips for lowering your car insurance cost goes into great detail.

Common discounts include:

- Multi-Policy Discount: Bundle car and home or renters insurance.

- Good Student Discount: For young drivers who are good grade students.

- Safe Driver Discount: For having a clean record for a certain time period.

- Defensive Driving Course: Variables allow discount for an approved course.

- Low Mileage Discount: If you don’t drive Reynolds much.

Choose a Higher Deductible

Your deductible is what you are paying out-of-pocket before your insurance is activated. The higher the deductible, the greater the risk that you assume. In turn, the insurance company will provide you a cheaper premium.

For instance, increasing your particular deductible cost from $250 to $1,000 can save you 15% to 30% in premium fees. Just be sure you could stand to comfortably afford to pay that higher amount if you need to file a claim. Financial strategies can learned from other consumer information sources such as the Federal Trade Commission.

Maintain and Improve Your Credit

As we discussed in your credit have a big impact. Paying your bills on time also: and keeping your credit card balances low: can help raise your credit score. But after some time, this can contribute to stronger car insurance quotes. It’s a long-term strategy which definitely pays off.

Consider Usage-Based Insurance

Many companies now are offering telematics or usage-based insurance. These programs use a small device or a smartphone program using an app. In essence they monitor your actual driving habits, such as speed, braking and even time of day.

If you are a truly safe driver, this can result in big discounts. It gives the insurer the ability to base your rate on what you do in the real world, rather than what is even known statistically. However, risky driving could increase your rate potentially. All in all, this is a great option for people who drive safely. For some entrepreneurs, finding ways to save is critical and since that’s the case, finding affordable business insurance is a top priority.

Review Your Policy Annually

Don’t just set it and forget it. Your life changes, therefore your insurance requirements change. For this reason, you need to go over your policy every year before it is due for renewal. Did you change jobs and you have a shorter commute? Did some old ticket fall off your record?

The value of your car depreciates as well. Maybe you don’t need collision and comprehensive coverage for an older car. Shopping around for fresh car insurance quotes online each year is the method to always have the best rate.

It only takes a little time and can lead to a lot of money being saved. Similarly, it’s a good idea to periodically compare something like term life insurance vs. whole life insurance to make sure your financial plan is the best it can be.

Your Next Steps to Getting Insured

Now you are complete with all the knowledge you need. You know the jargon, the factors and strategies. It ultimately becomes the power of your hands to make the best deal possible. Getting car insurance quotes is your very first step and most important step.

Don’t procrastinate. The sooner you get on your comparison, the sooner you will get started saving money. Use this guide as your roadmap or direction. Remove Information, Coverage Decisions, Start Getting those Quotes.

You are in the driver’s seat as it relates to your financial protection. Take Control, be a smart shopper and have the peace of mind that comes with the right coverage at the right price. Happy driving!

Frequently Asked Questions (FAQs)

You should try to obtain at least three to five different car insurance quotes. This provides you with a good sample of the market and helps you find a adequate competitive price without be overwhelming.

No. When you get an insurance quote, therefore, insurers do a “soft pull” on your credit. This is different from the “hard pull” that is used for loans, and, therefore, does not affect your credit score.

It’s a good thing to annually shop for new car quotes when it is time for renewal. In addition, you should also shop around anytime you have a major life event, like you are moving, buying a new car, or getting married.

The quickest way is by using an online comparison website. You complete a single quote form and get multiple quotes in minutes, so it’s very efficient to compare car insurance from various providers.

Not necessarily. The cheapest quote could have very low coverage limits or an horrid customer service rating. For this reason, you should find a happy medium between price and the company’s reputation as well as the amount of coverage they’re getting.

![Compliant Drivers Program: Is It Legit for Driver Safety? [2025]](https://propinfo.site/wp-content/uploads/2025/12/Compliant-Drivers-Program-150x150.jpg)

Leave a Reply